Most people don’t find investments appealing that have the perception of having finite upside. The best-performing stocks often rise consistently over a long-period of time, but don’t double overnight. Still, while experienced investors know that most investments won’t appreciate at more than 8-10% a year over the long term, many people like the idea that their stocks have unlimited potential.

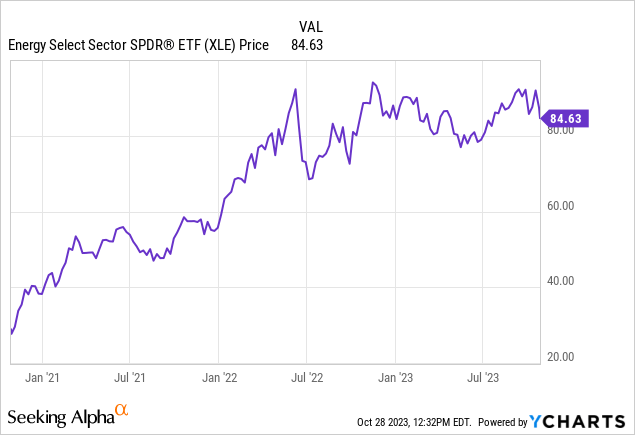

The energy sector has been one the best areas in the market for both growth and value investors to allocate capital over the last several years. Most oil and gas stocks consistently and significantly underperformed the benchmarks between 2016 and 2020, many oil and gas companies were cheap prior to the run-up in energy prices over the last three years. One of the most well-known energy funds is the Energy Select Sector SPDR Fund (NYSEARCA:XLE).

This exchange-traded fund has been one of the best-performing ETFs in the market over the last several years.

This energy fund has offered investors a total return of 232.34% since October of 2020, while the S&P 500 has offered investors total returns of 27% during this same time period.

I rated this fund a hold in May because of the prospect of a recession. I am now upgrading this fund to a buy. The price of oil should remain high for multiple reasons even if the economy continues to slow. Geopolitical risk, limited supply, and strong demand should continue to elevate prices. Most Western governments in the EU and the current administration in the US also remains committed to the green energy movement, there is not likely to be significant new drilling or exploration for oil and gas in Europe or the United States. Many oil companies are seeing record profits and free cash flow right now, this energy fund is well-positioned to offer strong income and solid capital gains for some time.

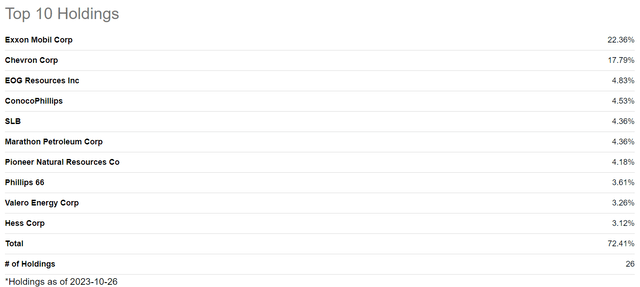

XLE is heavily concentrated fund with the two largest holdings being Exxon Mobil (XOM) and Chevron (CVX).

A list of XLE’s core holdings (Seeking Alpha)

The Energy Select Sector fund has $38.08 billion in assets under management, the expense ratio is .1%, and this ETF is 99.6% invested in energy stocks. The fund is weighted to energy stocks in the S&P 500, which is why the State Street fund has 40% of the ETF’s assets allocated to Chevron and Exxon-Mobil. This strategy has strengths and weaknesses, but these two companies have been some of the best-performing oil and gas stocks in both the energy sector and the overall market over the last three years. This ETF is also heavily concentrated on upstream energy companies, with the fund having lesser holdings in downstream refiners such as Valero (VLO) and Phillips 66 (PSX).

Predicting the price of any commodity in the near term is nearly impossible, but there are multiple reasons to believe crude prices should remain at high levels even if the economy enters a moderate recession. The recent conflict in the Middle East is not likely to end soon, Israel is determined to eliminate Hamas from Gaza, and the war between Russia and the Ukraine continues as well. The energy industry is also still recovering from an extended period of significant underinvestment from 2016 to 2020 when prices were often at low levels. Upstream investments in the energy sector have fallen from $700 billion a year in 2014, to between $370 billion to $400 billion today. The average decline rate per year globally of oil fields is also 6%. While the natural gas market remains weak in North America, but that fact has been well-known for some time and priced into markets.

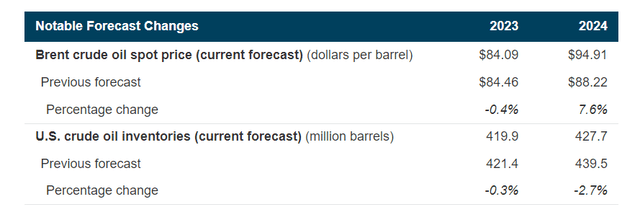

Most major energy producers also had record cash flow last year, oil prices are expected to remain high as well. Exxon Mobil had cash flow of $62.1 billion, an increase of 64% year-over-year, and Chevron reported record cash flow in 2022 of $49.6 billion. ConocoPhillips (COP) has also said the company expects to generate $115 billion in free cash flow over the next ten years, and those projections were based on a very conservative price of oil of $60 a barrel. The IAEA is also currently projecting Brent crude oil prices to average $84 dollars this year, and $94.91 in 2024.

A list of the IAEA’s projections for the oil market (IAEA)

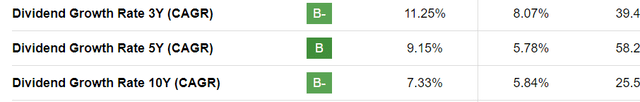

This fund has a history of strong dividend growth, and that fact should continue moving forward. The 5-year dividend growth of this fund is 8.09%, and the 10-year dividend growth of this fund is 9.22%.

A list of XLE’s recent dividend growth (Seeking Alpha)

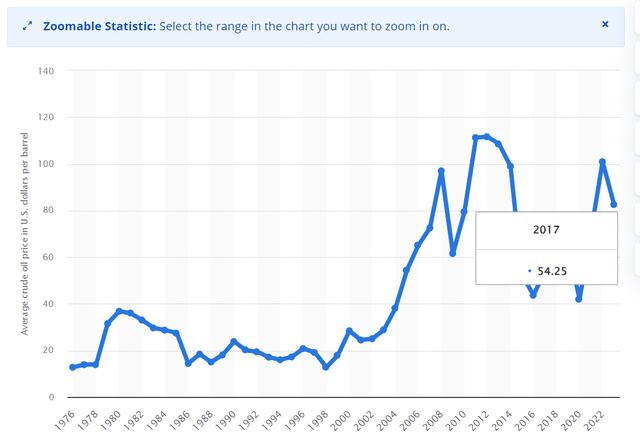

The average price of oil over the last 5 years has been nearly $72 a barrel, and consensus projections are for price this year and next to be 15-20% higher than those levels.

A chart of Brent Crude Oil Prices (Statista)

Most energy companies also have far stronger balance sheets now than in previous years too, since the strong recent cash flow they have generated has enabled these producers to pay down debt that was built up during Covid. In order for a dividend to double in six years using compounding returns, the rate of increase has to be just over 12% per year. With many leading energy companies having strong balance sheets, record-free cash flow, and management teams committed to maximizing shareholder returns with significant buybacks and dividend increases, that number should be achievable.

Predicting short-term price moves in any volatile market has minimal value, but forecasting prices ranges over a longer period of time by evaluating the fundamentals of an industry is important. The world needs oil and gas, that fact is not going to change. While energy companies were some of the worst performing stocks for some time, this sector is now well positioned to offer solid capital gains and impressive income over the long term.

Read the full article here