Launched by State Street Global Advisors and managed by SSGA Funds Management, Inc., the SPDR S&P Transportation ETF (NYSEARCA:XTN) invests in stocks of companies in the United States transportation industry. Companies within this portfolio range across a variety of sub-industries, including air freight and logistics, airlines, airport services, highways and rail tracks, marine, railroads, and trucking. The fund invests in a total of 49 growth and value stocks across diverse market capitalizations and aims to track the performance and provide similar returns to the S&P Transportation Select Industry Index using a representative sampling technique.

Holding Analysis

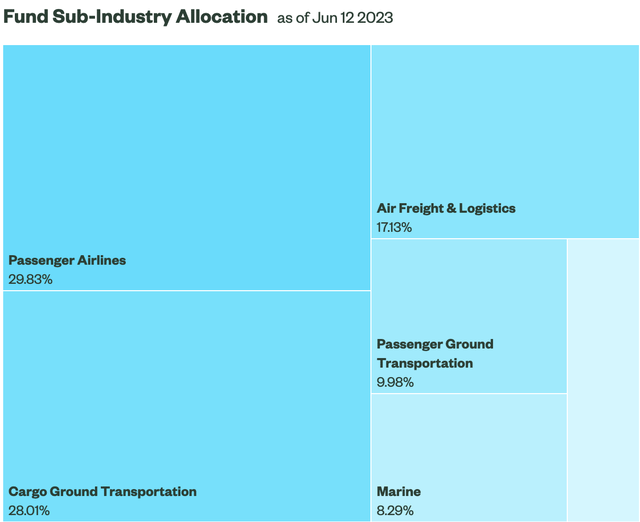

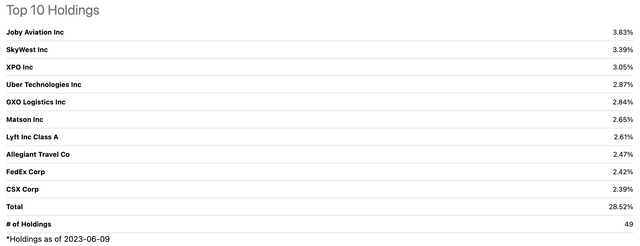

XTN primarily focuses on 6 sub-sectors within the transportation industry, including Passenger Airlines, Cargo Ground Transportation, Air Freight and Logistics, Passenger Ground Transportation, Marine, and Rail Transportation. The fund allocates the most weight to Passenger Airlines and Cargo Ground Transportation, each accounting for nearly 30% of the fund’s weight. Furthermore, XTN employs an equal-weighted approach in allocating weights to its portfolio companies. The fund invests in a total of 49 small-cap and mid-cap transportation companies, and its top 10 holdings range between weights of 2% to 3%, with no holding exceeding 4%. The top 10 holdings constitute slightly less than 30% of the entire portfolio.

State Street Global Advisors Seeking Alpha

Strengths

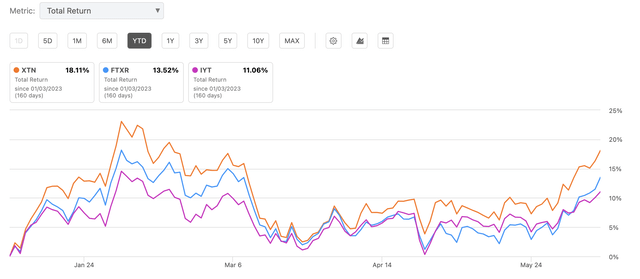

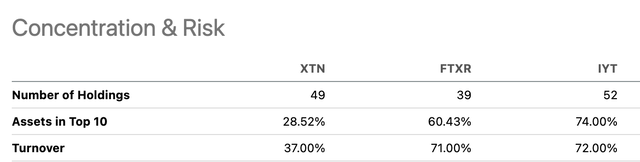

XTN’s key strength and differentiator is its equal-weighted approach in weighting its stocks. Several of XTN’s closest peers and competitors have a heavy skew towards the top holdings of their portfolios. Take FTXR and IYT, for example, their top 10 holdings constitute 60% and 74%, respectively, of their entire portfolios. Meanwhile, XTN’s top 10 holdings only represent 28% of the fund’s portfolio. XTN is by far the most diversified and has the most exposure to small-cap companies among the three. This allows for less concentration risk in an otherwise very concentrated transportation sector. If we look at the Total Return of XTN and its two closest peers, FTXR and IYT, XTN has consistently outperformed both other funds throughout 2023. This outperformance can likely be a result of XTN’s more diversified portfolio, which can help the fund navigate market volatility and capitalize on the growth of smaller companies within various sub-sectors of transportation.

Seeking Alpha

Moreover, when looking at XTN’s risk profile compared to FTXR and IYT, XTN has a significantly lower turnover rate than both of its peer funds. At 37%, it is just slightly over half the turnover rate of both FTXR and IYT. XTN’s lower turnover rate may be another advantage of the fund’s equal-weighted approach. Higher turnover rates, as seen in FTXR and IYT, may suggest a more active management style, which can potentially result in higher transaction costs due to frequent buying and selling. This can ultimately negatively affect the fund’s capital appreciation. On the other hand, XTN’s lower turnover rate may suggest a more passive management strategy, which makes sense considering its equal weighting approach, as rebalances are primarily made to maintain equal weights. This may be more attractive to investors who seek a steadier, risk-averse ETF that has lower costs. Moreover, XTN’s expense ratio of 0.35% is lower than both FTXR and IYT.

Seeking Alpha

Weaknesses

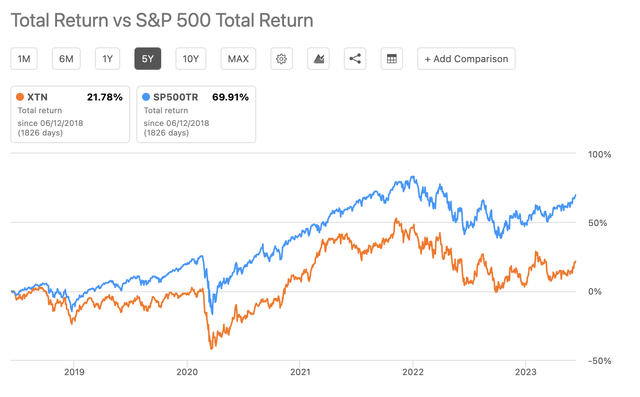

In the past 5 years, XTN has consistently underperformed the S&P 500. Despite this, the fund has closely followed trends, mirroring every peak and trough seen in the S&P 500. In 2019, the fund performed very similarly, but as the years progressed, the gap has only become wider. The S&P 500 is a capitalization-weighted index with a large allocation for high-growth industries like tech and healthcare, while XTN is a sector-specific fund which may not have benefited as much from the high growth of these sectors that have largely propelled growth in the S&P 500. This suggests that while sector-specific funds like transportation may not necessarily belong to a high-growth industry, they do exhibit a consistent correlation with broader market movements, making them sensitive to overall macroeconomic conditions.

Seeking Alpha

Opportunities

As mentioned earlier, XTN focuses extensively on the Passenger Airlines sector, with nearly 30% of its portfolio in companies in this sector. This sector experienced its worst-ever down cycle from 2020-2022, but forecasts for 2023 are showing signs of growth and recovery. Climate change and environmental considerations have become focal points for many industries, and airlines are no exception. Initiatives prioritizing greener practices in aviation are gaining traction, a trend that’s reflected in consumer sentiments as well. A survey conducted by McKinsey reported that among 5,500 travelers, 40% are willing to pay at least 2% more for a carbon-neutral flight. Moreover, nearly $15 billion a year is spent on efficiency-related research and development. Overall, the shift towards environmental sustainability could present significant growth opportunities for airlines that adapt to this trend.

Threats

Similar to the fund’s focus on Passenger Airlines, the fund also focuses nearly 30% on Cargo Ground Transportation. However, this industry may not be set for nearly as much growth as Passenger Airlines. The main challenge to the Cargo Ground Transportation sector is that rising fuel costs and driver shortages may limit growth in the trucking industry. According to the American Trucking Association, the industry could see a shortage of 160,000 truck drivers by 2030. The ATA also estimates that the number of truck drivers will reduce from 78,000 in 2022 to 64,000 in 2023, a nearly 20% decrease in one year. The trucking industry is the most reliable source of freight transportation in the US, and this shortage can significantly hinder growth in the Cargo Ground Transportation industry, and ultimately, this ETF.

Conclusion

The fund’s equal-weighted approach and diversified holdings may help it reduce concentration risk as well as market volatility better than its peers like FTXR and IYT. This also contributes to the fund’s lower turnover rate, making it more attractive to investors who seek a stable fund with exposure to the transportation sector. However, its sector-specific focus may limit its growth compared to other high-growth industries like tech and healthcare. The fund has historically trailed the S&P 500 despite closely following its general trends. Moreover, there are promising opportunities for the Airlines sector with a growing shift towards sustainability, but this is balanced out by some potential headwinds associated with the trucking industry. In this regard, I rate XTN a Hold.

Read the full article here