In a highly volatile market, some business sectors have a higher risk exposure. In the advent of another recession, discretionary spending may decrease. Non-essential industries like restaurants, department stores, and wellness centers may see softer demand. To manage revenues and stabilize expenses, they may have to cut back some expenses.

Yelp, Inc. (NYSE:YELP) may have to be more cautious as it may suffer from the negative spillovers of its customers and partners. It is challenging, given the evident cost pressures in 1Q 2023. Thankfully, inflation has started to cool down and relax, which may help improve pricing flexibility and cost management in the long run. Also, its financial positioning shows its capacity to cover its operations amidst headwinds. However, cash burns are high. The huge chunk of stock-based compensation is even more baffling. It comprises 16% of the operating expenses and a massive portion of cash flow from operations.

Meanwhile, the stock price remains sluggish as the downward pattern persists. It appears logical, given the decreasing book value of the company and market uncertainties. And while the decrease appears higher than it should, the stock-based compensation can erode actual investment returns.

Company Performance

As digital transformation peaks, more and more people and entrepreneurs meet online. Unsurprisingly, more business transactions are now done on the internet. One of the industries benefiting from this transition is advertising. Yelp, Inc., a platform that aims to highlight local businesses, took advantage of the situation. Its rebound and growth accelerated in the past two years, primarily due to pent-up demand. Yet, it faces challenges as skyrocketing prices affect its performance. They stayed evident at the start of the year, which we will try to discuss thoroughly.

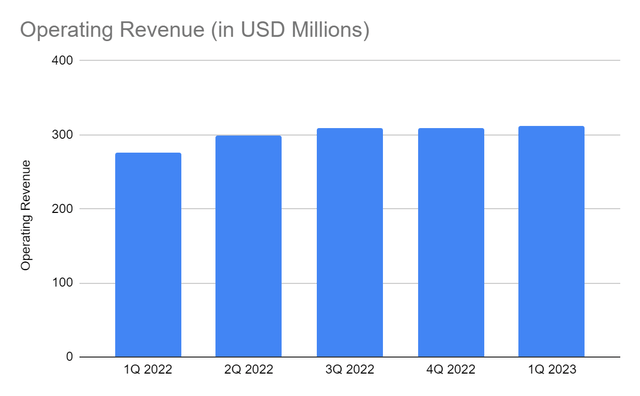

Its operating revenue reached $312.44 million, a 13% year-over-year increase. This double-digit growth was impressive amidst the strained consumption and tighter competition. According to its CEO, it was the sixth straight quarter of record revenues. We can attribute it to the advertising demand influx in the quarter. Indeed, its product strategy and launching of new product updates helped improve user experience. For instance, it launched a tool that allowed many entrepreneurs to identify their businesses as black-owned. It proved helpful in sustaining revenue growth. Politics and ideological differences aside, it captured the attention of many left-wing consumers. It also helped consumers connect with more local businesses and filter them according to their preferences.

Operating Revenue (YELP Report)

Aside from that, YELP remained a ubiquitous advertiser, allowing it to cater to more customers. Its popularity was instrumental in generating millions of users and reviews. But what worked best was its strategic pricing, which was suitable in a high-inflation environment. With that, it kept a solid customer base and deep ties with local businesses. Its efforts paid off, particularly in its services and restaurants segment, growing by 15% and 10%.

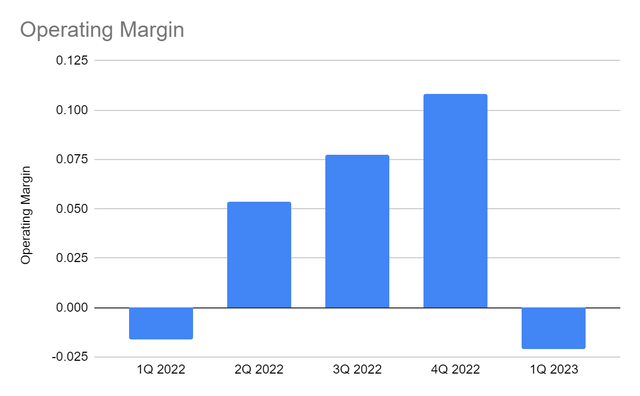

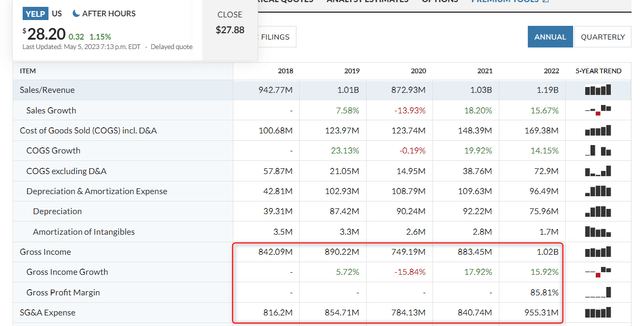

With regard to the business model, cost-per-click (CPC) has advantages for interactive media platforms like YELP. It is responsive with precise counts for a well-defined operating revenue per company. However, this business model can be less flexible during economic slowdowns. Since the cost per click is fixed, it may have a hard time coping with higher costs and expenses. It was exactly the problem it faced in 1Q as inflation increased cost pressures. SG&A expenses rose by 18% and easily overwhelmed revenue growth. With that, the operating margin dropped to -2%, the lowest in the past five quarters. Even worse, we did not see much improvement in margins since 2019. It remained flat at 4-5%, making its returns unexciting.

Operating Margin (YELP Report) Operating Margin (MarketWatch)

This year, Yelp may face the same problems as interest rate hikes affect consumer spending. Near-term expenses may still be high as they may still take time to adjust to macroeconomic changes. Even so, there are still opportunities to seize as inflation further relaxes. It can help the company utilize its operating capacity with improved flexibility. We will discuss it further in the next section.

Threats And Opportunities That May Affect Yelp, Inc.

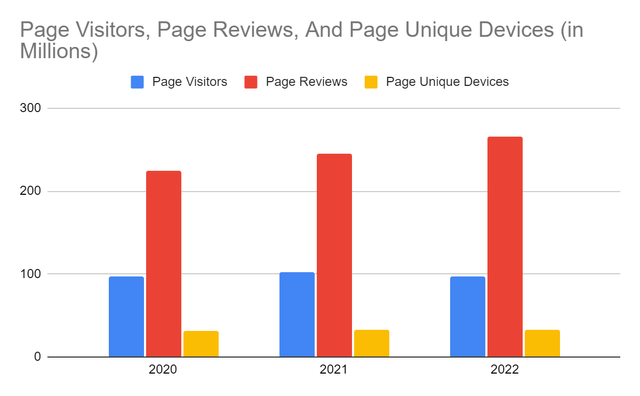

We already saw how Yelp, Inc. performed amidst market headwinds. Inflationary forces led to hammered margins. Despite this, it was impressive to see a continued inflow of customers and partners. However, YELP must not be too relaxed as market uncertainties remain prevalent. It may become unfavorable to its business model as the specter of another recession emerges. Aside from lower CPC flexibility, competition becomes tighter. It may intensify this quarter if consumer spending continues to decrease. Note that Yelp has been seeing a continued decrease in the number of page visitors in recent years. In 2022, the number of active visitors was 97.1 million versus 102.7 million in 2021. We can also attribute it to inflation that raised average prices. But the increasing competition and the controversy it faced before affected its consumer appeal. As we can see, page visitors and unique devices decreased, but page reviews increased.

Page Visitors, Page Reviews, Devices (YELP Report)

The consolation we have now is the continued decrease in inflation. From 9.1%, it is now only 5%, a 45% decrease. We can also see that the inflation decrease has accelerated since 4Q 2022. It was more visible in 1Q 2021. If it continues, it can partially offset the impact of another recession. For instance, YELP can manage its costs and expenses better to improve or at least stabilize margins.

The labor market transformation is an unexpected but potential growth driver for the company. In the US, 55% of companies have remote work flexibility. It may be lower than in Africa and Australia, but this percentage may increase. The same study shows 44% of employees and 51% of employers prefer hybrid working. This change may be helpful to YELP and other interactive media platforms. With more people having increased work flexibility, they may have more time to surf the internet. They may also have more time to relax and enjoy themselves in their favorite restaurants, salons, and health and wellness centers. This combination can increase the appeal of YELP a staple despite the higher competition. After weighing its risks and opportunities, I believe they will offset one another. Its performance may remain relatively flat.

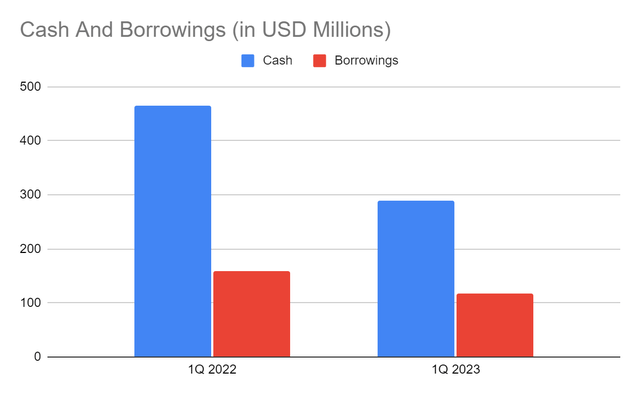

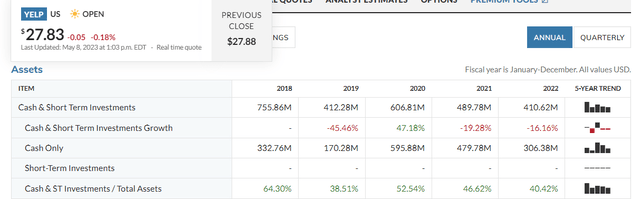

With regard to its financial positioning, YELP can still cover its operations. Its Balance Sheet shows it can navigate the challenging market landscape. Its cash remained adequate at $289 million, or 28% of the total assets. Also, it continues to deleverage, given the 26% decrease in borrowings. This aspect makes it a very liquid company. However, we must check the historical data where we can see its cash burns since 2018. If we get the cumulative change in cash, the company already let go $345 million. It is quite alarming since it is not a capital-intensive company. It uses more cash to sustain its operating capacity.

Cash And Equivalents And Borrowings (YELP Report) Cash And Equivalents (MarketWatch)

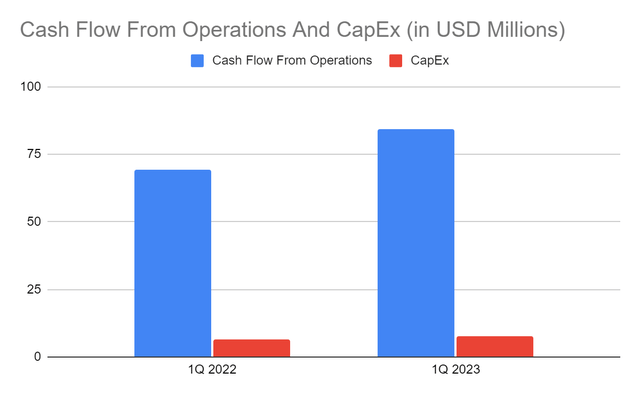

We can confirm it in the Cash Flow Statement since the cash flow from operations is way higher than CapEx. However, we can see increasing accounts payable the huge chunk of stock-based compensation is one of the concerns. While it makes the company appear more viable, it reduces the actual book value and shareholder value. Despite this, the company stays sustainable even if we deduct stock-based compensation. The company may still cover its operating capacity and borrowings while withstanding volatility. The only question is if it can use it to stabilize growth and balance it with margins.

Cash Flow From Operations And CapEx (YELP Report)

Stock Price Assessment

The stock price of Yelp, Inc. has been decreasing even before the pandemic. It rebounded from its lowest point, but it did not regain its value. At $27.88, the stock price is 6% lower than last year’s value. It is logical as its recent performance was not as impressive as in the previous quarters. But the actual decrease seems excessive. We can confirm it using the PB Ratio, given the current BVPS of 10.08 and PB Ratio of 2.74x. If we use the current BVPS and the average PB Ratio of 3.04x, the target price will be $30.98. Yet, the target price will only be $27.92 if we disregard stock-based compensation.

Meanwhile, Yelp, Inc. is not a dividend-paying stock. But it makes continued capital returns through share repurchases. However, it seems that its primary purpose is to cover dilution. As we can see, the cumulative EPS since 2019 was $1.25, but the actual gain was $0. Meanwhile, the average change in the stock price is -$1.7. It shows that while the stock price appears undervalued, gains remained stagnant. To assess the stock price better, we will use the DCF Model.

FCFF $92,983,000

Cash $289,298,000

Borrowings $117,207,000

Perpetual Growth Rate 4.4%

WACC 9.2% Common Shares Outstanding 69,821,000

Stock Price $27.88

Derived Value $29.26

The derived value also shows that the stock price is lower than the intrinsic value of the company. There may be a 5% upside in the next 12-18 months. However, the target price will decrease to $28.6 if we exclude stock-based compensation. While its potential undervaluation is evident, upside potential remains limited. Investors may have to think twice about purchasing its shares.

Bottomline

Yelp, Inc. maintains decent liquidity levels with its adequate cash reserves and stable borrowing levels. However, its growth potential remains limited, given the potential mild recession. We must also account for the tight competition and the controversies it has faced before. Over the years, we saw its revenue growth, but it did not help raise its margins. Its performance remained stagnant. And even if it remains liquid and sustainable, its book value continues to decrease. Unsurprisingly, the stock price also moves in a downward pattern. While it stays lower than the intrinsic value of the company, the upside potential remains low. The recommendation is that Yelp, Inc. is a sell.

Read the full article here