The market has been kind to shipping company ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) this year as its stock price has plunged from a 52 week high of $29.38 all the way down to $9.17 as of yesterday’s close.

The shipping company lowered its expectations for 2023 adjusted EBITDA in the second quarter, implying a steep decline in free cash flow as well. The market now models a long earnings contraction for the shipping company which means that the dividend might not return for years.

Furthermore, growing container supply might result in a depression of freight rates for a longer period of time which in turn might lead to an ongoing re-rating of ZIM Integrated Shipping Services’ valuation multiple.

I am now a lot more pessimistic as to how long the earnings contraction will last and take responsibility by lowering my stock classification to Sell.

My Rating History

I have been a big fan of ZIM Integrated Shipping Services when it made a strong value proposition to stockholders, in no small part because of the company’s huge dividend pay-out.

My stock rating, before this article, was Hold. Recently, however, net losses have forced the shipping company to not pay a dividend and with the market now expecting a long earnings contraction, investors will likely have to wait years until the dividend comes back.

Furthermore, the company is burning through cash and might again have to lower its EBITDA guidance when it releases quarterly earnings for the last quarter.

Cash Drain Could Become A Problem Moving Forward

According to ZIM Integrated Shipping Services’ dividend policy, the company distributes 30-50% of annual net income as a dividend to shareholders, but the recent accumulation of losses has resulted in non-payment of a dividend and it could take years until the dividend gets paid again.

By now, the consensus pretty much is that investors will not get a dividend until the free cash flow and earnings situation at the shipping company improves drastically, something which might not happen for years.

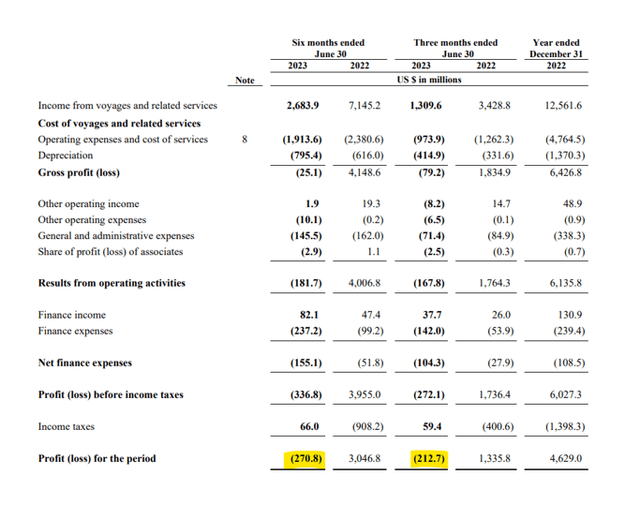

ZIM Integrated Shipping Services lost $213 million in the second quarter which brought total YTD losses to $271 million.

YTD Losses (ZIM Integrated Shipping Services)

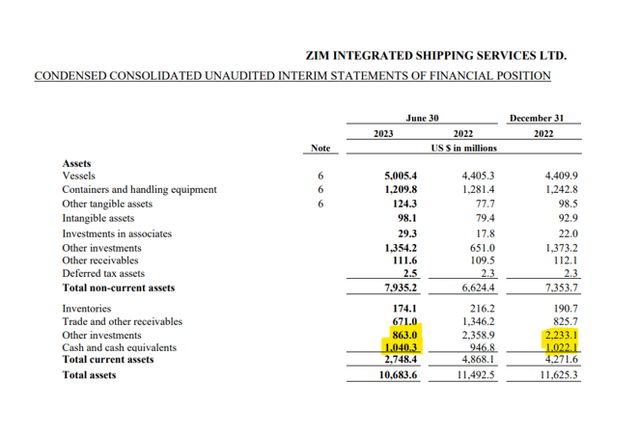

I am starting now to be a bit more concerned about the company’s cash levels which are rapidly depleting and which, in the past at least, have been cited, including by me, as a source of strength for the shipping company.

ZIM Integrated Shipping Services’ reported a net debt position of $1.6 billion in the second quarter and a net leverage ratio of 0.5x. However, at the end of last year, the company had a $269 million net cash position (0.0x net leverage ratio). The problem with this change in debt is that ZIM Integrated Shipping Services’ free cash flow has fallen off the cliff.

Positive free cash flow is naturally replenishing a company’s bank accounts and with free cash flow declining a scary 80% YoY in 2Q-23, I think ZIM Integrated Shipping Services is at the brink of having potentially to drastically increase its debt.

The absence of any real debt and strong free cash flow were good reasons to buy ZIM during the expansion, but the cash situation is unlikely to get better in the near term.

The company had $3.3 billion in cash at the end of 2022 and, at the end of the second quarter, had $1.9 billion in cash, reflecting a decline of $1.4 billion.

With the current rate of cash drain, ZIM Integrated Shipping Services might actually have to raise some money next year, or leverage up its balance sheet.

Cash Flows (ZIM Integrated Shipping Services)

Freight Rates Likely To Remain Pressured

Freight rates have come under considerable pressure in 2022 and 2023, primarily because of shrinking demand in the consumer sector. With consumer sentiment deteriorating and shipping volumes shrinking, the spot market has come under increasing pressure.

ZIM Integrated Shipping Services’ average freight rate, for instance, plunged to just $1,193 ($/TEU) in the second quarter, marking a sharp correction of 67% YoY.

Unfortunately, I don’t think the situation is getting much better and I was probably misguided in my earlier assessment that ZIM Integrated Shipping Services could see a short-lived recession and enjoy a quick rebound in freight rates.

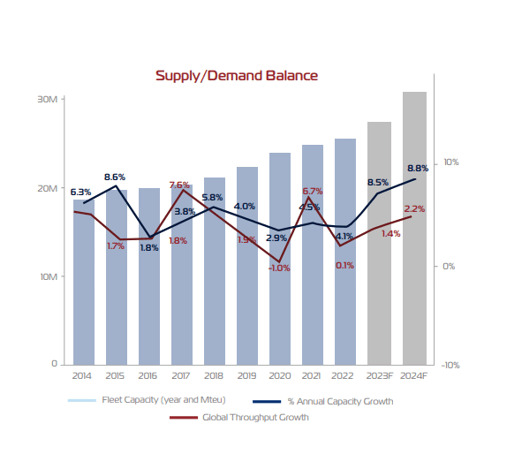

One aspect why I am less optimistic on ZIM Integrated Shipping Services is that the market continues to expect a glut of new supply for container ships which, in my view, will continue to suppress average freight rates way into 2024.

The following chart is reproduced from my last article, for convenience.

Container Ships Supply And Demand (ZIM Integrated Shipping Services)

Reduced Guidance For 2023 Adjusted EBITDA

ZIM Integrated Shipping Services expects to generate Adjusted EBITDA of $1.2 billion to $1.6 billion, down from a prior guidance of between $1.8 billion and $2.2 billion in Adjusted EBITDA. Given the poor state of the shipping industry, I would not be surprised to see yet another reduction in the profit outlook.

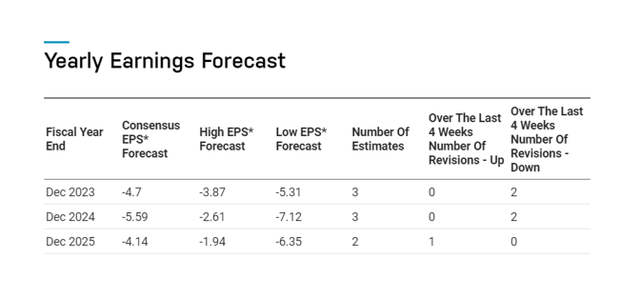

Multi-Year Earnings Recession Now Expected

The market now models a much deeper recession than it did in July which is when I presented my last outlook on the shipping company. The estimates also indicate that the recession will last longer and concerns over the general state of the economy should be taken seriously.

Cyclically-vulnerable shipping companies are at risk of a major earnings contraction and the market now sees 2024 to lead to even higher losses than are expected for 2023, and the situation is not anticipated to get much better in 2025 either.

Nasdaq Estimates For ZIM Integrated Shipping (Nasdaq)

Why ZIM Could See A Higher/Lower Valuation (Investment Risks)

Profit estimates are negative and an earnings multiple can’t be applied. The valuation ultimately depends on ZIM Integrated Shipping Services’ outlook for 2023, its cash drain in the third quarter and the company’s prospects for a free cash flow recovery.

If the outlook gets slashed again when the company presents for 3Q-23, I would say the valuation of ZIM Integrated Shipping Services is most likely headed for new lows. The most important metric to watch moving forward will be ZIM Integrated Shipping Services’ cash balance.

My Conclusion

ZIM Integrated Shipping Services was a popular income stock in 2021 and 2022 which is when the shipping company returned a boatload of cash to shareholders.

But two consecutive quarters of (growing) net losses have changed the picture quite a bit and the market now appears to model a steep recession that could last 1-3 years.

I am now much more concerned about ZIM Integrated Shipping Services’ cash drain as well as the length of the earnings contraction. As a consequence, investors must expect to see a much more leverage balance sheet moving forward. I am not willing to accept this risk and have sold out.

Read the full article here