The ZIM Investment Thesis Have Been Well Supported At $12s

We previously covered ZIM Integrated Shipping (NYSE:ZIM) in May 2023, discussing its mixed prospects then, due to the uncertain macroeconomic outlook, impacted TEU rates, and subsequent dividend cut.

Then again, we had iterated our warning that anyone expecting anything different from ZIM might have been misguided, since the container shipping industry had always been highly cyclical and therefore volatile.

With market analysts expecting a recession to occur in H2’23, we had also ended the article with caution, since Q2 might be similarly underwhelming, with things drastically worsening before improving.

For now, our suspicion has been proven, as ZIM lowers its FY2023 guidance, with adj EBITDA of $1.4B (-81.4% YoY) and adj EBIT loss of -$300M at the midpoint (-105.1% YoY). This is compared to the prior guidance of $2B (-73.4% YoY) and $300M (-95.1% YoY), respectively.

While the management opting to pre-release these numbers prior to its FQ2’23 earnings call on August 16, 2023, we believe this may be an attempt to manage Mr. Market’s expectations, in light of the underwhelming data from Drewry World Container Index.

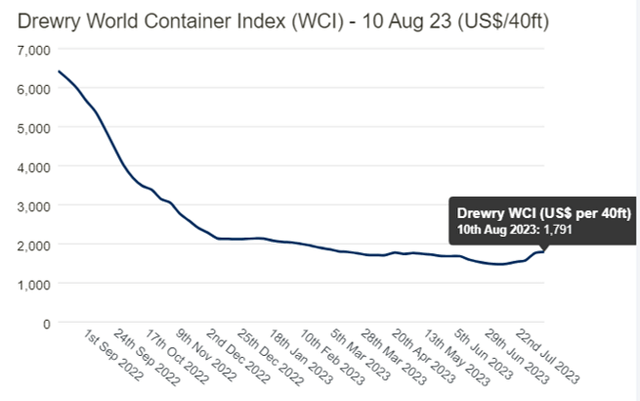

Drewry World Container Index

Drewry

For example, the index indicated further decline of TEU spot rates in Q2’23 to an average of $1.6K per 40ft container, down by -16.6% compared to the Q1’23 average of $1.92K.

However, the index has also suggested early market recovery in spot rates to $1.79K per 40ft container by August 10, 2023, up by +21.7% from the bottom of $1.47K on July 06, 2023, though still drastically down by -72.1% from $6.43K a year ago.

These numbers remain improved compared to the 2019 average of $1.42K as well, suggesting that ZIM’s prospects are only normalized to its pre-pandemic levels. Therefore, we believe its H2’23 TEU rates may improve from Q2 levels henceforth, assuming that spot rates stabilize.

For now, we applaud the management’s candid commentary about the uncertain recovery of the container freight rates/ volumes, since it paints the worst case scenario for its near term prospects.

This corroborates with our previous belief that things may get worse before they get better, with Maersk (OTCPK:AMKBY) iterating a similarly pessimistic sentiment in the recent FQ2’23 earnings call:

In logistics and services, the impact of this normalization process was felt stronger than we had anticipated, resulting in growth below our expectations and higher cost, a transitionary situation we are in the process of correcting… As we enter the second half of the year, we faced the challenge of reduced volume growth expectations combined with expected new vessel delivery and higher capacity in the market… We expect a continued subdued top line growth until these transitionary effects have fully played out. (Seeking Alpha)

So, Is ZIM Stock A Buy, Sell, or Hold?

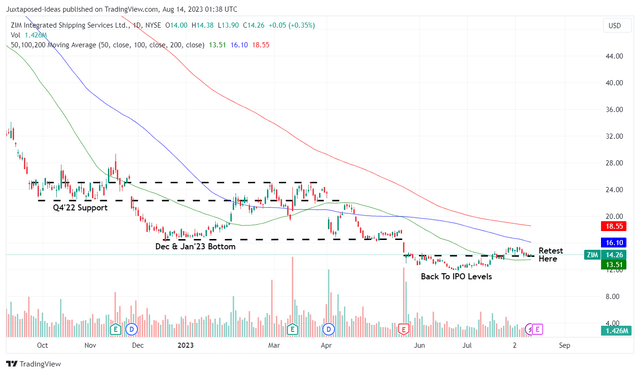

ZIM 1Y Stock Price

Trading View

For now, ZIM’s lowered FY2023 guidance is very telling that the great dividend suspension may last longer than expected, likely leaving its stock prices in the current limbo.

It is unsurprising that market analysts have already priced in a potential suspension of its dividends through FY2024, with things only alleviating by FY2025 with a dividend per share of $0.30.

Then again, despite the initial correction after the news release, ZIM stock had interestingly risen as the bulls swooped in, suggesting a tremendous support level at its IPO levels of between $11 and $12, with most of the pessimism previously baked-in already.

With the worst already here, any outperformance of its future results and/or a recovery in TEU rates may richly reward investors who have held on through the pessimism.

Due to these developments, we continue to rate the ZIM stock as a Buy, with a recommended entry point of $12 for the chance to dollar cost average.

Then again, with the push-pull factor of the MoM increase in the July 2023 CPI as the market analysts priced in zero rate hikes in the upcoming FOMC meeting, the stock is also only suitable for investors with deep understanding of cyclical stocks, the consequently variable dividend payouts, and patient investing trajectory.

In addition, with the hyper-pandemic profitability behind us, investors must calibrate their expectations toward a new normal in dividend payouts, with the stock likely to trade rangebound as how its peers have during the pre-pandemic period.

For now, we maintain our long-term view that ZIM’s prospects remain decent, due to the robust balance sheet and the ability to service its upcoming fleet deliveries through Q4’24. Until then, we believe that capital preservation remains key to its execution.

Read the full article here