Investment Thesis

I covered Zscaler, Inc. (NASDAQ:ZS) earlier in July, in which I covered ZS’s competitive position in the market. In this article, I will cover some recent developments, including the company’s recent results and Microsoft Corporation’s (MSFT) entry into the market. I firmly believe that Zscaler’s platform offers superior architecture and delivers better protection compared to other vendors’ solutions. ZS’s strength in cloud security, coupled with its product capabilities and ease of deployment, makes it well-suited for the evolving landscape of workload security. Although Microsoft’s entry into the market poses a threat to existing players, Zscaler’s network reliability and strong partner integration make it stand out from competitors. Hence, I remain bullish on the stock and maintain a buy rating on the stock.

4Q23 Results and Outlook

Zscaler has reported robust results for the fourth quarter of 2023, surpassing its billing guidance by 9%. The management’s projection for fiscal year 2024 billings is $2.54 billion, reflecting a 25% year-on-year increase, slightly exceeding the consensus estimate of $2.47 billion. Notably, the company experienced a record influx of new opportunities in its pipeline during Q4, indicating strong customer interest and the management is encountering fewer obstacles in closing deals. Consequently, I see minimal risks associated with the company’s guidance. One of the main factors contributing to the increase in billings for the quarter was the substantial number of new customers who committed over $1 million to Zscaler, with 49 such customers added (compared to 39 in Q4 2022). Additionally, the company now boasts 43 customers who have spent over $5 million.

In terms of their full-year guidance, Zscaler’s projections surpass market expectations in all key metrics. The company anticipates revenue in the range of $2.05 billion to $2.07 billion, slightly above the consensus estimate of $2.05 billion. Billings are expected to fall between $2.52 billion and $2.56 billion, exceeding the consensus estimate of $2.47 billion. Furthermore, the company projects an operating income ranging from $330 million to $340 million, translating to an operating margin of 16.3%, a notable expansion from the 14.9% seen in FY23. The Free Cash Flow margin is expected to be slightly above 20%, with capital expenditure being somewhat higher in FY24 compared to a high-single-digit percentage of revenue as seen previously, though still falling short of the consensus estimate of 22%. I continue to view Zscaler as a beneficiary of enterprise spending, high-priority CIO spending initiatives, and vendor consolidation as the company continues to balance growth and profitability into FY24. I still view Zscaler as well positioned to take share as enterprises pursue their network transformation journeys.

Microsoft’s SASE Push Not A Threat in the Near Term

Microsoft is continually expanding its presence in the cybersecurity market, an area that has shown more resilience this year compared to other segments of enterprise IT spending. On July 11th, Microsoft made an announcement about two new offerings, Microsoft Entra Internet Access, and Microsoft Entra Private Access, collectively known as Global Secure Access. These solutions are not yet widely available, but Microsoft customers have the option to preview them at a cost of $6 per user per month or $72 annually.

Microsoft’s move into the secure web gateway and broader Secure Access Service Edge (SASE) market highlights a potential challenge for specialized cybersecurity companies. Cloud infrastructure providers like Microsoft are now bundling security features alongside their core services, similar to how they provide databases and analytics. While Microsoft’s new products are likely to complement its existing endpoint security suite, their effectiveness may be somewhat limited, which could reduce immediate competition for cloud security vendors like Zscaler.

I anticipate that Microsoft’s new SASE offering will primarily target small and medium-sized businesses that predominantly use Microsoft products. While it does share some key features with Zscaler’s offering, such as a proxy-based architecture, it also has several limitations. One of the standout features of the Zscaler platform is its network reliability. Zscaler has implemented numerous redundancies in its network infrastructure to ensure continuous application access. In contrast, Microsoft Azure experienced several outages in 2023, including one in early June that resulted in blocked access to Azure, Outlook, and OneDrive web portals due to a Layer 7 DDoS attack. If a customer were using Microsoft’s SASE solution on Azure and Azure suffered an outage, they would be unable to access their applications. I believe that enterprises demand a very high level of availability, and given Microsoft’s recent outages, it may face challenges in penetrating the enterprise market.

Another significant advantage of the Zscaler platform is its integration with many endpoint security and identity vendors. Zscaler collaborates with major endpoint security vendors like CrowdStrike Holdings, Inc. (CRWD), SentinelOne, Inc. (S), VMware, Inc. (VMW), and others. When malware is detected, Zscaler shares threat intelligence with its partners, enabling companies like CrowdStrike to quarantine infected endpoints. Zscaler also integrates with numerous identity security vendors, including Okta and others. All these partners of Zscaler are best-in-class solutions, and interestingly, they compete with Microsoft. Consequently, I believe that Microsoft’s solution may lag behind Zscaler in terms of partner integration, a critical factor for enterprises.

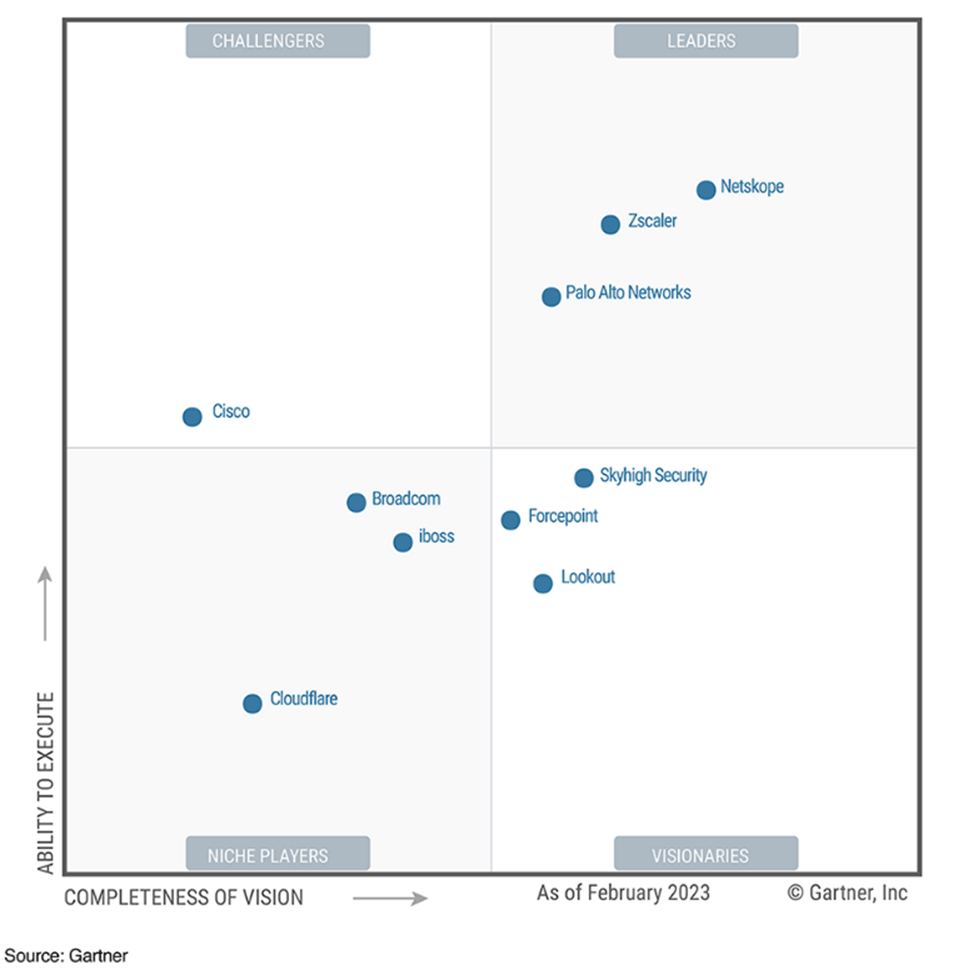

Gartner

Valuation

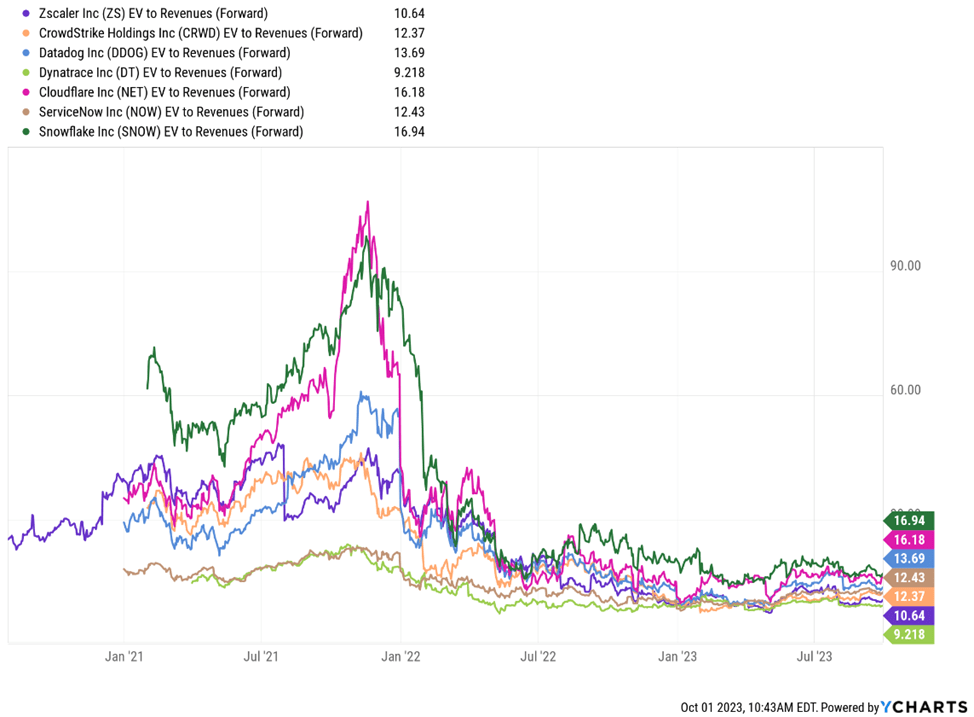

Zscaler has consistently exceeded consensus billings forecasts since the beginning of the pandemic. This demonstrates the company’s ability to effectively manage market’s expectations while also outperforming thanks to its favorable exposure to the expansion of distributed networks driven by the pandemic. I believe that there is still strong demand and anticipate that Zscaler will once again report results better than what the consensus expects. ZS is trading at 10.64x forward EV/Sales, at a discount to its peer group mean of 13.47x. I maintain my view that Zscaler is well-positioned to gain market share as businesses embark on network transformation journeys, which can re-iterate the company’s multiple upwards, which is why I maintain a buy rating on the stock.

Ycharts

Risks

I would be closely monitoring how ZS’s competitors, including Microsoft, are increasing their investments in the Secure Access Service Edge space. However, I believe that Microsoft might encounter more difficulties breaking into the Network Security market compared to its success in the endpoint and identity markets. Zscaler’s management sees Microsoft’s entry as validation of the value of the SSE market, but I believe Zscaler is in a particularly strong position in the large enterprise segment, with Microsoft’s disruption potential more likely in the lower-end market. Moreover, Zscaler has historically traded at a premium compared to its peers. I believe this premium is justified, given its momentum in the Secure Access Service Edge sector over the past few years, driven by enterprises’ rapid adoption of hybrid work environments. However, it’s important to note that the elevated valuation levels present a challenging risk-reward situation for the stock.

Conclusion

I firmly believe that Zscaler’s platform offers superior architecture and delivers better protection compared to other vendors’ solutions. Zscaler is known for its network reliability with redundancies ensuring continuous application access. In contrast, Microsoft Azure faced outages in 2023, raising concerns about its reliability. Zscaler’s integration with major endpoint security and identity vendors gives it an edge. It shares threat intelligence with partners like CrowdStrike, whereas Microsoft’s solution may lag behind in partner integration, a critical consideration for enterprises. Hence, I remain bullish on ZS and maintain my buy rating on the stock.

Read the full article here