The economy has become an interesting economic puzzle. Historically reliable indicators of economic activity (Leading Indicators, Inverted Yield Curve, ISM mfg.) have clearly signaled a slowdown in the economy, revisiting levels historically reached in recessions. But the economy continues to wobble forward, creating jobs and maintaining historically low unemployment rates, all while inflation is high and the Fed is pounding financial markets with a 500-basis point rate hike.

NFIB’s Small Business Optimism Index (in its 50th year) is among those reliable indicators that signals a recession (or a meaningful slowdown). Chart 1 shows that the Index falls sharply before each recession and the recent decline looks like a repeat of past recession signals. The Index peaked in late 2020 at 104 and has declined to a low of 89.4 in May. On the way down, it dropped 9 points from October 2020 to January 2021, then recovered to 102.5 in June 2021, then pretty much straight down to its current low reading (89.4).

The record low for the Index of 79.7 occurred in April 1980 as the Fed was struggling with double digit inflation. The current reading is 9.7 points higher. The current economy is surprising forecasters with solid (but not great) job numbers each month. This was not the case in 1980. Currently, a net 19% of small business owners plan to hire and 44% have a job opening. In April 1980, a net -8% planned to hire and 16% had a job opening. The strong job market indicators provide support for the Index.

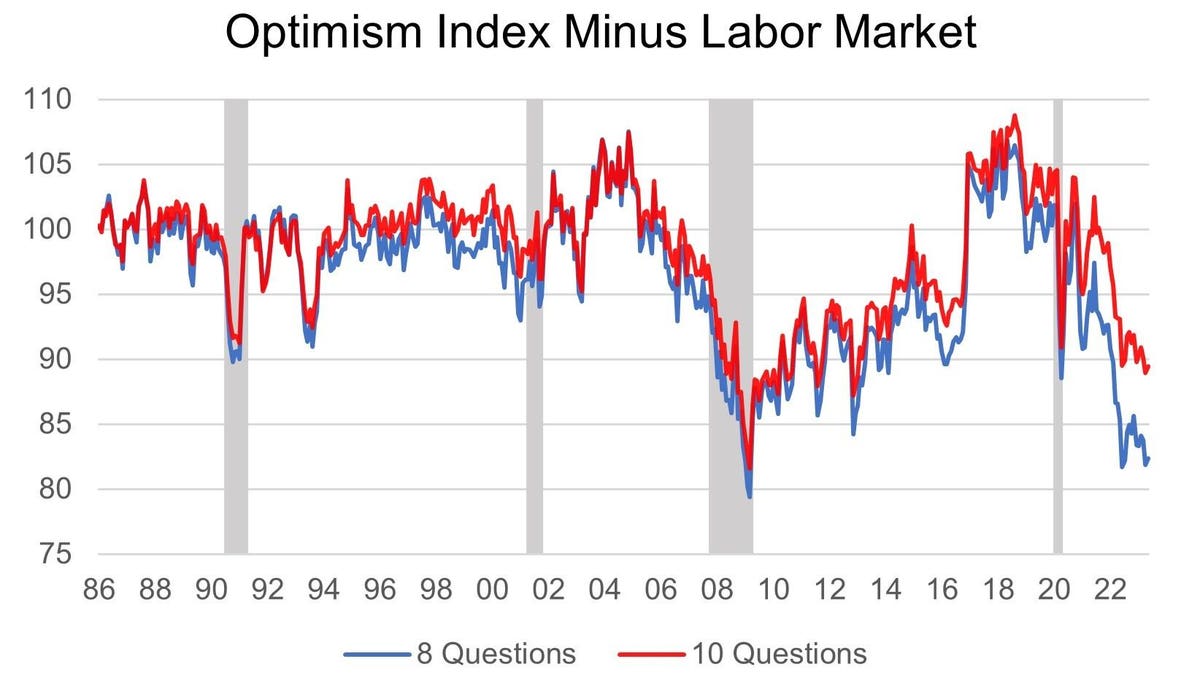

Chart 2 shows the current Index compared to an Index calculated leaving out the two labor market indicators. The two measures were closely correlated until 2021 when the Index sharply declined as most of its components and other leading indicators did. So, most components of the Index have been “in recession” for over a year, can we have an economic recession without rising unemployment? If the Fed were to reverse policy now, the economy might stop weakening (a soft landing of sorts). But inflation has not fallen nearly far enough to let the Fed ease up. Business owners are not raising prices as frequently, providing some relief on inflation, but the Fed will at least hold rates at current levels until official inflation measures show a continuation of decline. Currently, the inflation rate is more than twice the 2% target.

Read the full article here