Two major periods of inflation (late 1970s – early 1980s and 2020-2023) were both preceded by surges in government spending and regulation that were assisted by cheap financing facilitated by the Federal Reserve. Government outlays grew by 15% (annual rate) in 1974-1975, and by twice that in 2020-2021 (Covid), compared to an average increase of 8% over the 1973-2023 period). During those periods, small firms uncharacteristically raised prices at an accelerated rate and at increased frequency (Chart 1).

Although any firm, large or small, welcomes the opportunity to raise prices (and profits), that behavior is disciplined by competition and the impact of higher relative prices on customers’ willingness to buy. Large numbers of small firms don’t raise prices unless there is a cost side push (energy, input prices, minimum wages, regulations, etc.) that impacts most or all firms. On the positive side, strong consumer spending provides opportunities to raise prices with little fear that business will be lost to competitors or consumer resistance to higher prices. Supply chain shortages created strong upside pressures on prices of goods and a tight labor market pushed up the price of labor e.g., wages.

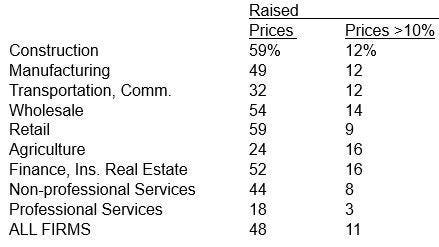

The most recent surge in prices started with 1% of all small firms raising prices over 10% in Q2 of 2020 to 20% of all small firms raising prices over 10% in Q2 of 2022, and that percent is still high at 11% raising in Q2 of 2023. The major driver of inflation in the early 1980s and recently has been the percent of owners raising prices by over 10%. The percent of owners raising prices more than 10% has declined by 10 percentage points but remains 11 points above its low in Q2 of 2020. Following closely, the percent raising selling prices between 5% and 10% also appears to have peaked, which it did not do until well after the 10%+ category peaked in the last inflationary episode. When so many firms are raising selling prices by percentages far above 2%, especially at double digit percentages, it is hard to get the overall inflation rate down to 2%, the Fed’s target. Price increases in the construction industry (59%) will take time to work its way into the CPI. Wholesale (54%) and retail (59%) increases appear quickly. High numbers in finance (52%) are mostly reports of higher interest rates on financial products (loans).

Interest rate and inflation measures in 1980 were much higher than today even though the price behavior on Main Street looks very similar. In the 1980s, after the first plunge in price hike activity, reports of higher prices leveled out at very high rates for a significant period before capitulating to Fed pressure. If this pattern repeats, the Fed will have to maintain consistently aggressive pressure on the economy to subdue the inflation rate.

Read the full article here