Inflation broke out in 2020, along the energy front line. When Covid entered the fray, shortages and supply channels became major players, hitting especially hard in goods prices and construction costs. Chickens got the flu and workers got sick or isolated to avoid illness. Chips were scarce (not potato) as were the goods they were critical for including cars and appliances. Solving some supply side issues eased the pressure on stuff but shifted the pressure to the services sector where labor remains in short supply and labor costs rise in response. Increases in supply have resolved most of the goods price inflation, but labor supply is still below 2020 levels and labor force participation has stalled. This is where inflation gets sticky, prices of goods, oil, etc. vary with supply and high prices encourage increases in supply to resolve price pressures. However, this is not the case for labor at the moment. Compensation has increased substantially, but not as fast as inflation taxed gains away. Real wages have declined about half a percent over the past 12 months and total employment is still below 2020 levels.

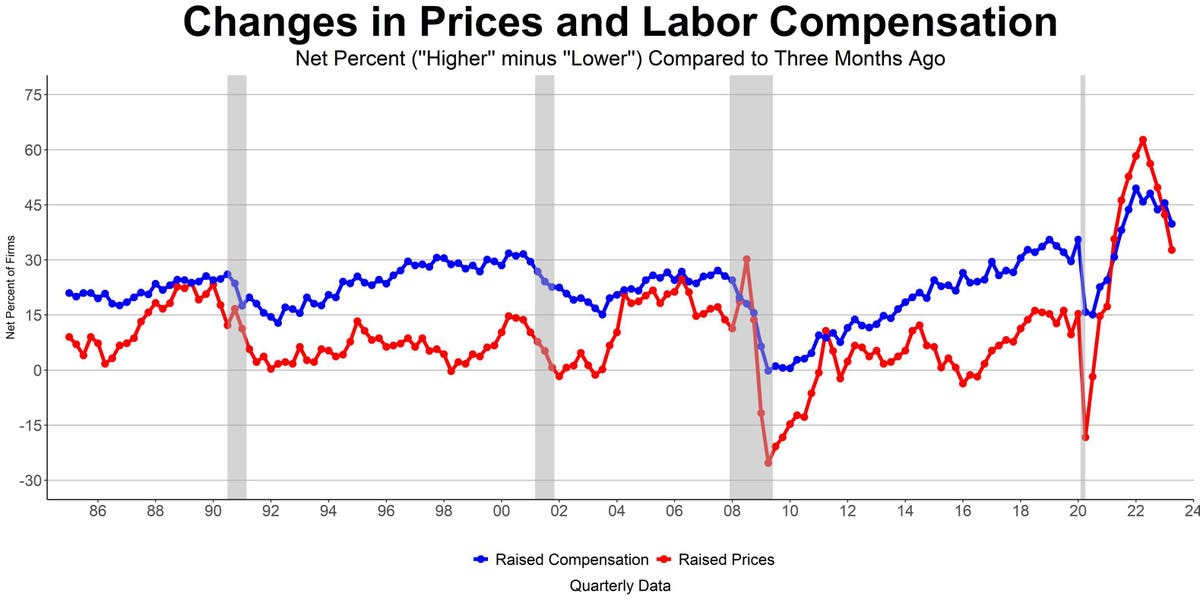

So, on Main Street, owners continue to fight skirmishes with selective supply chain problems. In February 2023, 87% of small business owners reported supply chain problems, 20% of those citing it as “significant.” However, input costs are easing – except for labor (the largest cost for most small, labor-intensive firms). The net percent of firms raising selling prices has declined from its recent peak of 65% in May 2022, to 33% April of this year, a decline of 32 percentage points in 11 months (Chart 1). Reports of raising compensation declined from its January 2022 peak of 50% to 40% in April, a reduction of only 10 percentage points. Plans to raise prices surrendered 30 points in the last 11 months while compensation plans gave up 11 points since its peak in October 2021. The cost of new workers may fall in a weak market, but wages currently paid to existing workers will not. Sticky. Historically, major reductions in labor cost are almost always accomplished by firing workers as in a recession. Few workers volunteer for a pay cut, instead lower pay generally comes in the form of termination and then finding a new job at a lower pay.

Economic forces do not evenly impact firms geographically. The California economy is very different from that in Ohio or New York. Reports of price hikes were highest in New England at 59% and lowest in the Pacific region at 38%, 21 percentage points lower. Industry concentrations might explain some of this, with 59% of construction firms reporting higher selling prices compared to just 18% in Professional Services. Industrial activity does not occur evenly across states. Firms in agriculture continue to lead the price cutting parade with 34% reporting price reductions (market prices for produce get set daily).

Changes in the percent of firms raising or cutting prices are a good predictor of inflation. Data collected in the first month of each quarter accurately anticipates the reported inflation for the quarter. Overall, it appears that inflation pressures are easing as fewer firms raise their prices. Labor costs are also easing, as fewer owners report raising compensation, but not as fast as price cuts. This will make inflation “sticky.”

Read the full article here