Gold rose to another in a long series of record highs on August 20 when the December COMEX futures price (XAUUSD:CUR) reached $2,570.40 per ounce. Gold is now an official tenbagger since the 1999 $252.50 low.

A unique asset, gold is part commodity, part currency. Its historical volatility tends to be lower than that of other raw materials but higher than that of foreign exchange assets. Gold is the world’s oldest means of exchange and was money long before there were paper currencies.

The SPDR® Gold Shares ETF (NYSEARCA:GLD), introduced in 2004, was the first commodity ETF product and has been the most successful. As the ETF owns physical gold bullion, it does an excellent job tracking gold prices.

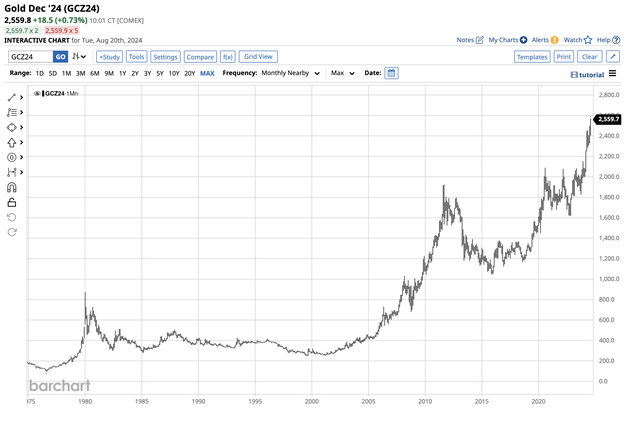

New highs in gold

In a bull market that is now twenty-five years old, gold continues to make new and higher highs.

Long-Term COMEX Gold Futures Chart (Barchart)

The long-term chart highlights that gold has not traded below $1,000 since 2009, under $1,500 since 2020, and below $2,000 since February 2024. The continuous gold futures contract eclipsed the $2,500 per ounce level in August 2024. Gold’s ascent has been a textbook bull market.

De-dollarization is bullish for gold

President Xi of China and Russian leader Vladimir Putin shook hands on a “no-limits” alliance in what was a watershed 2022 event. Russian troops marched into Ukraine less than one month later. U.S. and Western European sanctions on Russia caused Moscow to stabilize the economy through trade protocols with Beijing and other allies.

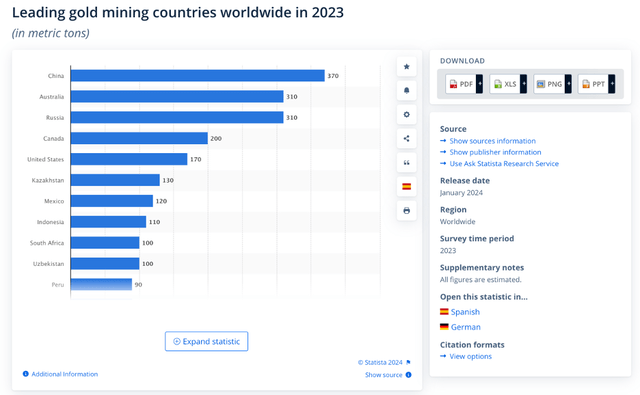

The U.S. dollar has been the world’s reserve currency over the past century, making the dollar the primary pricing mechanism for most commodities and cross-border transactions. The Chinese-Russian alliance and sanctions have caused a wave of international de-dollarization. As China, Russia, and their allies abandon the U.S. dollar for other payment vehicles, the dollar’s reserve currency role has diminished along with the effectiveness of sanctions. As the dollar’s role declines, gold’s value has increased, as gold is the world’s oldest means of exchange, and governments hold the precious metal as an integral part of foreign currency reserves. China and Russia are leading gold-producing countries.

The Leading Gold-Producing Countries in 2023 (Statista)

As the chart illustrates, China was the leading gold-producing country in 2023, with Russia tied with Australia for second place. With around 3,000 tons of annual production, China and Russia are responsible for around 22.7% of the world’s yearly output.

Meanwhile, in another move to increase de-dollarization, Saudi Arabia abandoned a 50-year petrodollar protocol that prices its oil output in U.S. dollars. The Saudis have been selling China crude oil for yuan payment, while India has purchased the energy commodity using rupees.

Central banks keep buying

Central banks own gold as a critical part of foreign currency reserves, validating gold’s role as a reserve asset. Since 2004, “The total quantity of gold held in central bank reserves has increased by almost 19% by weight.”

Meanwhile, the leading buyers have been Russia, China, India, and Turkey, the countries that are leading the de-dollarization. Moreover, since Russia and China are leading producers, they are likely vacuuming domestic production, increasing gold reserves even more than the official statistics show.

China and Russia have also been leading the development of a BRICS currency with some gold backing to challenge the dollar’s reserve currency position and offer an alternative to the U.S. currency.

As central banks, monetary authorities, and governments continue to build gold reserves, it sends a message to investors that gold needs to be an integral part of all investment portfolios.

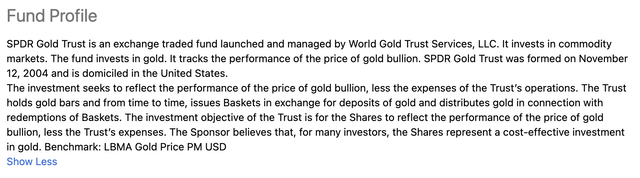

The GLD ETF is an excellent option for gold exposure

The most direct route for gold investment is the physical market for bars and coins. Governments tend to own physical London Good Delivery 400-ounce bars, each worth $1 million at $2,500 per ounce. The fund profile for the GLD ETF states:

Fund Profile for the GLD ETF Product (Seeking Alpha)

At $231.80 per share on August 20, GLD had $68.88 billion in assets under management. GLD trades an average of over seven million shares daily, making it a highly liquid ETF product. GLD holds all its assets in physical gold bullion in London, New York, and Zurich. GLD charges a 0.40% management fee.

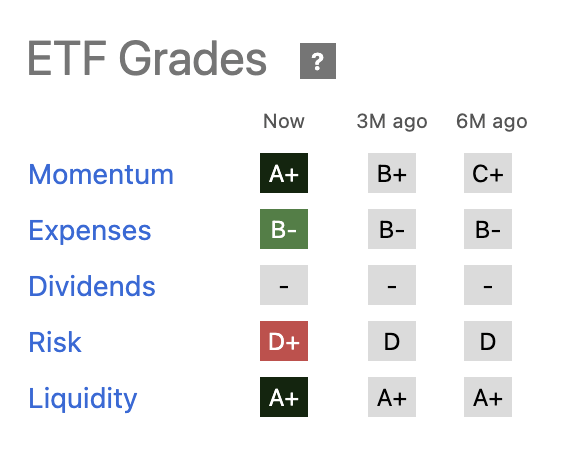

GLD Seeking Alpha ETF Grades (Seeking Alpha)

GLD gets high Seeking Alpha ETF grades. Momentum is at an A+ rating as the bull market continues to make higher record highs. Expenses at a B- reflect GLD’s 40 basis point per year expense ratio. The D+ in risk relates to the all-time high gold price that increases the odds of an eventual correction. GLD receives an A+ in liquidity as it is the commodity ETF with the most assets and volume.

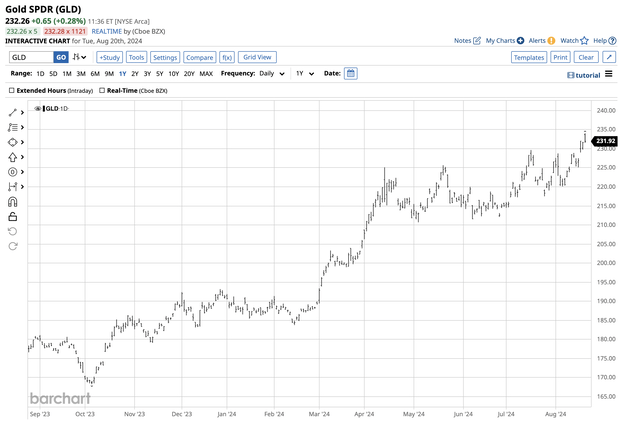

Gold’s latest rally took the futures 40.96% higher from $1,823.50 in October 2023 to $2,570.40 on August 20.

One-Year COMEX Gold Futures Chart (Barchart)

Over the same period, the GLD ETF rose 39% from $168.30 to $234.01 per share. Since the ETF only trades during U.S. stock market hours and gold trades around the clock, GLD can miss highs or lows occurring when the U.S. stock market is not operating.

Other factors supporting higher gold prices

Aside from the trend toward de-dollarization and central bank gold buying, the following factors favor a continuation of gold’s ascent to higher prices:

- The trend in any market is always your best friend. Gold’s trend has been higher for a quarter of a century, with every downside correction a golden buying opportunity.

- The U.S. debt is over $35 trillion and climbing, eroding the U.S. dollar’s value, which is bullish for gold.

- The geopolitical landscape remains a mess, with wars in Ukraine and the Middle East threatening world peace. Geopolitical turmoil tends to be bullish for gold.

- The U.S. election is fostering significant uncertainty about the future policy direction. Uncertainty causes a flight to quality, and gold is the world’s oldest asset and store of value.

Gold’s upside potential is a function of market sentiment and could reflect the decline of fiat currency values. The sky could be the limit for gold as commodity prices often rise to unreasonable, irrational, and illogical levels during bull markets that deft technical and fundamental supply and demand analysis. Gold is not a typical commodity, as it is a hybrid between a means of exchange or currency and a raw material. Therefore, its position as a unique asset has tempered its volatility, but the price continues to rise to new and higher highs.

The bottom line is we should respect gold’s trend, which remains bullish in early September 2024. However, even the most aggressive bull markets rarely move in straight lines. Gold could be overdue for a correction, which would be another buying opportunity if the quarter-of-a-century trend remains intact. Since 1999, buying every dip in gold has yielded golden returns.

Read the full article here