Advance Auto Parts (NYSE:AAP) surprised the market Thursday with another soft earnings report and big cut to its full-year 2024 guidance. Back in February, I warned that it was too early to buy into the company’s projected turnaround.

AAP stock is a classic bull and bear debate. Activist investors see the potential in the company with its massive store base, well-known brand, and currently depressed valuation. In theory, if Advance Auto Parts can increase its profit margins to somewhat closer to its primary industry peers, the stock could be a huge compounder from today’s level.

However, it’s been hard to buy into the bullish argument simply because there hasn’t been any tangible reflection of that margin story playing out. If anything, these Q2 results were another step in the wrong direction.

The following two tables explain the market’s reaction perfectly.

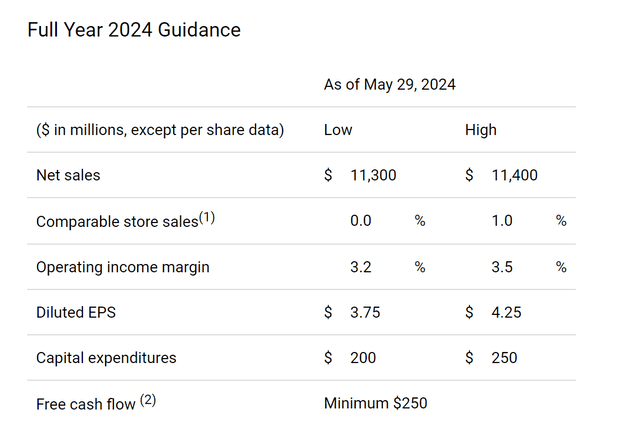

Here was Advance Auto Part’s full-year guidance as of May 29, 2024, following its Q1 report.

AAP full-year guidance as of May (Press release)

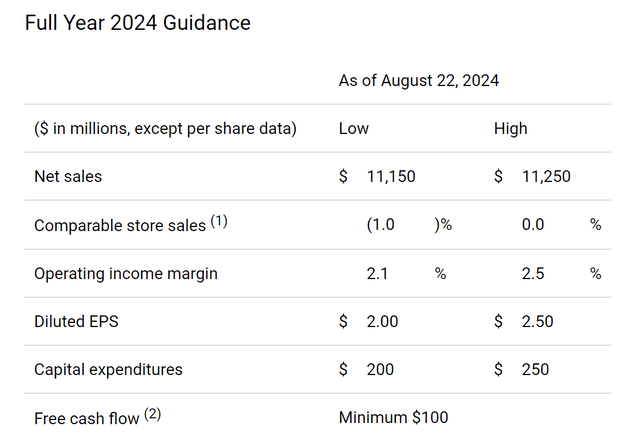

And here it is again today, following this latest downward revision:

AAP full-year guidance as of now (Press release)

What all changed?

Things aren’t too bad on the top-line. They only trimmed about $150 million off the revenue estimate for the year, and comparable store sales are still going to be roughly around flat year-over-year.

Where the turnaround story lost all its appeal, however, was on profit margins. The company reduced its operating margin guidance for the year from 3.35% at the midpoint in Q1 to just 2.3% now. This sort of reduction in margins has a huge effect on overall profitability when starting off a low base. That shows up in the diluted EPS guidance, which plunged from a prior $4.00 midpoint estimate as of Q1 to just $2.25 at the midpoint now. Also of concern, the company reduced its guided minimum free cash flow for the year by more than 50%.

These sorts of results are hard to explain. Advance Auto Parts is supposed to be laser-focused on cutting costs and improving business efficiency at the moment. And yet, despite top-line revenues being around flat, somehow margins keep dropping.

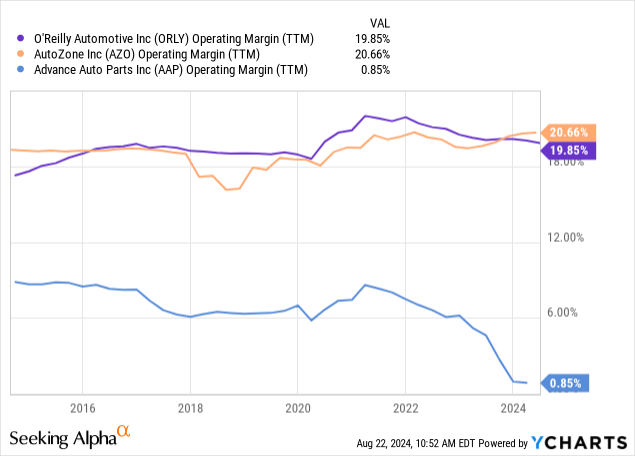

The contrast becomes especially stark when comparing to rivals O’Reilly Automotive (ORLY) and AutoZone (AZO). Just look at their operating margins over the past decade, respectively:

Advance Auto Parts had always run well behind its peers. You could argue some of that was structural due to the store mix between domestic and international, the wholesale business, or other such factors. That said, Advanced Auto Parts’ margins plunged from their usual 6-8% range to barely positive whatsoever at the same time that AutoZone and O’Reilly are reporting largely steady results.

As such, I find it hard to accept the excuse that it’s simply the macroeconomic climate or weak consumer spending to blame.

WorldPac Sale: Cash Is Nice, But Raises Long-Term Strategic Questions

In addition to the company’s earnings and guidance cut, Advance Auto Parts announced another big piece of news. After months of shopping its WorldPac asset, it successfully found a buyer for this business. Private equity firm Carlyle Group will be acquiring WorldPac for $1.5 billion, with Advance Auto Parts expected to receive $1.2 billion of that in net proceeds after taxes and transaction fees.

WorldPac, for those unfamiliar, is Advance Auto Parts’ Carquest division, which it acquired back in 2014. WorldPac, in turn, was a successor of a firm named Imported Parts and Accessories, which should give a sense of the overall business model. Namely, the focus is on parts for imported specialty vehicles, such as higher-end European and Asian vehicle models.

In theory, WorldPac should be an excellent business. The product mix is meaningfully different from what is found in a mainline AAP or rival store, and the harder-to-find goods should face less competition and have more consistent profit margins.

That said, from my understanding, Advance Auto Parts did not have particular skill in managing the wholesale side of the business, and it really struggled to integrate WorldPac into the company’s broader IT, supply chain and distribution systems. Some of this integration was finally occurring at meaningful scale around the year 2020, but the onset of the pandemic complicated matters and as AAP’s broader fortunes dipped, it apparently became easier to sell off WorldPac rather than continue trying to make it work within the broader business.

My guess is this is the sort of business where private equity can make immediate improvements. There is so much going on at Advance Auto Parts right now that management simply might not have the bandwidth to try to improve the situation at WorldPac at the same time.

Reportedly, WorldPac generated $2.1 billion of revenues and around $100 million of EBITDA over the past 12 months, so on that basis, Advance Auto Parts appears to be getting reasonable compensation for this asset. However, I wonder what EBITDA would have looked like for this business before Advance Auto Parts’ recent operational downturn. I didn’t see EBITDA broken out for WorldPac in prior AAP 10-K filings so I can’t comment on whether the reported $100 million runrate figure is a normal reflection of its core profitability or not. All that said, if I had to guess, Carlyle is getting a good deal here and they’ll be able to flip WorldPac at a significantly higher price a few years from now. I’d also note that one activist investor had previously suggested WorldPac was worth $1.8 billion as part of their upside case, so this outcome falls a bit short of that.

What can Advance Auto Parts do with the cash it will be getting? It had $479 million of cash on hand as of its Q2 report, which might sound like a decent amount. But much of the balance sheet is tied up in inventories, specifically it has $4.9 billion on-hand as of last report. With retail, especially in higher value goods, you need a solid chunk of working capital to keep the gears turning. I’d also note that by divesting WorldPac, this will reduce the amount of inventory they have to hold at stores to a meaningful degree, further freeing up some pressure on the balance sheet.

Advance Auto Parts does have $1.8 billion of long-term debt as of the latest report and $2.2 billion in noncurrent lease liabilities.

I highlight that to point out that the firm’s current $3 billion market cap is not in a deep value territory on any sort of liquidation or net asset value basis. The cash injection from the WorldPac sale is helpful, but the company still needs to turn the core retail business around to make the stock work from today’s levels.

The Bottom Line

I’m simply not sure we could have confidence in the turnaround story at this point. The company’s top priorities are seemingly in improving profit margins, cutting costs, and simplifying the business right now. Yet the results we see of that are top- and bottom-line results much worse than their direct peers.

It makes you wonder what would happen if the economy does go into a recession. If AutoZone and O’Reilly start posting negative year-over-year comps, as could easily happen in a broader downturn, what would happen to Advance’s already lackluster results? As we saw with this latest quarterly guidance update, a small change in the topline outlook led to a roughly 40% decline in expected earnings per share and even more than that on cash flows. That’s not a comfortable place for a significantly levered retailer that is already warning that it sees signs of increasing customer reluctance to spend money at the moment.

People are going to look at the $2.25 of midpoint estimated earnings for the year and say AAP stock looks expensive here around $50, as it is 22x estimated forward earnings. That’s not how I’d think about it though, as that $2.25 is very much a number that is in motion.

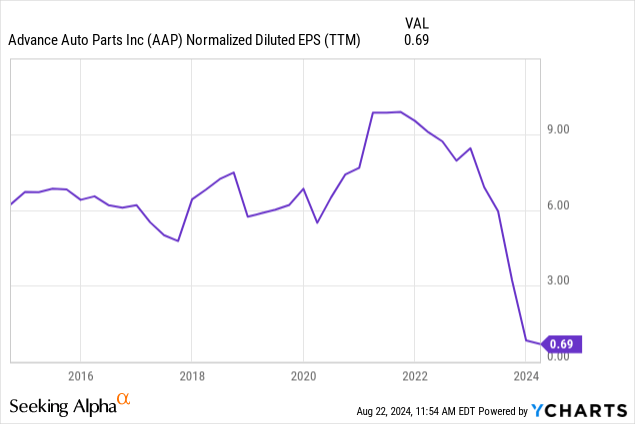

In the bigger picture, can the company return to prior levels of profitability (minus the foregone earnings from WorldPac)?

I don’t think the 2021 levels of earnings were sustainable, but you could make a reasonable case for getting back to, say, $5/share of earnings making shares reasonably attractive (though not dirt cheap) at today’s levels.

There are several activist investors involved. Perhaps bringing in different management or some other strategic actions could get things revving again.

On the other hand, AAP has underperformed AutoZone and O’Reilly for quite a while and you could argue that actions such as its seeming mismanagement of the WorldPac acquisition speak to a weaker overall corporate culture. In any case, with profit margins continuing to plunge despite the company being in cost cutting mode, I can’t get excited here. Retail is a tough business, and that’s especially true when your profit margins are far below your direct peers and you are seeing further erosion in performance heading into a potential economic downturn.

Read the full article here