Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

The Chevrolet Silverado has been one of America’s most popular pick-up trucks since it was launched almost three decades ago. But the iconic vehicle could now become one of the biggest victims of Donald Trump’s trade war.

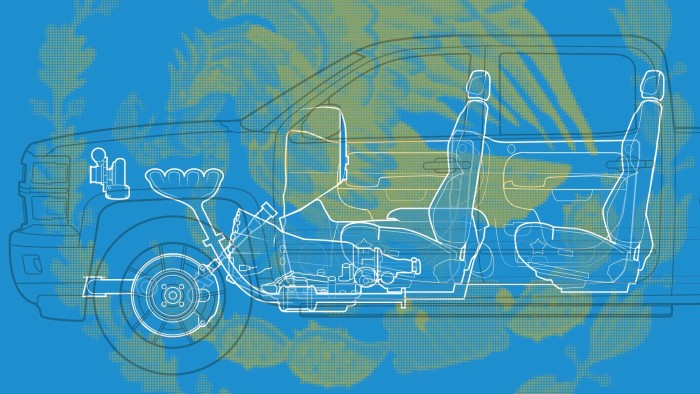

The high-margin General Motors model, which costs roughly $40,000-$70,000, relies on one of the most complex, international and interconnected automotive supply chains, making it particularly vulnerable to the US president’s threat to impose 25 per cent tariffs on Canada and Mexico.

Of the 673,000 Silverados produced last year, 31 per cent were built at GM’s factory in the Mexican city of Silao and 20 per cent at its plant in Oshawa, Canada.

But even for the roughly half manufactured at three US plants in Michigan and Indiana, it is likely that the power steering and door trim panels were built in Mexico; the rear lighting in Canada; the airbag module in Germany; and the centre stack display in Japan, according to S&P Global Mobility data.

GM has been preparing for tariffs since Trump’s election, chief financial officer Paul Jacobson told an investor conference last month.

The carmaker has shifted some production and reduced inventory at plants outside the US by nearly a third “because the last thing you want is a bunch of finished inventory that . . . suddenly became 25 per cent more expensive just with the passage of time”.

If the tariffs become permanent, he said, the company would need to consider whether to relocate plants. But with the current uncertainty, GM cannot spend billions “whipsawing the business back and forth”.

Data compiled by Export Genius shows that key components in Silverados are heavily dependent on parts imported from Mexico. The country’s exports of parts for the vehicle were worth almost $30bn last year, with braking systems alone accounting for $4.3bn.

Trump threatened tariffs on Mexico and Canada in early February, then announced a 30-day reprieve hours before they were due to take effect — but he vowed on Thursday to press ahead from March 4. The upheaval will be worse if the levies expand to goods imported from the EU and the rest of the world.

The big fear within the industry is that Trump will impose blanket tariffs without mechanisms that are usually in place to mitigate their impact, such as duty drawback programmes through which the levies can eventually be refunded if imported goods are subsequently re-exported.

“This is not a trade action. This is border security negotiation,” said Dan Hearsch, Americas leader of the automotive and industrial practice at consultancy AlixPartners, referring to Trump’s argument that he was imposing tariffs in response to the flow of illegal immigrants and drugs across the Mexican and Canadian borders. “It’s one big hammer so that’s the challenge.”

Mike Wall, executive director of automotive analysis at S&P Global Mobility, said companies were doing “a deep dive” in the supply chain to identify choke points. “If they can and wherever they can, they will try to shift some of that sourcing,” he added.

But a shift in manufacturing from Mexico to the US would take time and be expensive, while the higher price of labour would raise the costs of production.

Ford chief executive Jim Farley has warned that “billions of dollars in industry profits” could be wiped out if there were protracted tariffs on imports from Mexico and Canada.

John Elkann, chair of Chrysler owner Stellantis, this week called on Trump to keep goods from Mexico and Canada tariff-free. Instead, he urged the US to close what he described as a “loophole that currently allows approximately 4mn vehicles into the country” with no US content requirement, as is the case with cars made in Japan and South Korea.

Willebaldo Gómez Zuppa, an economics professor at the National Autonomous University of Mexico and a researcher at the country’s Center for Labor Research and Trade Union Consulting, said tariffs would raise the price of vehicles such as the Silverado, hurting demand — and may even exacerbate the problem of immigration.

Highly paid workers at GM’s Silao plant earned $5.50 an hour, Gómez Zuppa said. But the company cited the threat of tariffs last month when it rebuffed a proposal from the labour union at the plant to raise wages.

Tariffs “will change the course of integration that the three countries have been on since 1994”, he said.

GM, Ford and Stellantis operate their Mexican factories in regions from which there has already been significant migration, he added.

“In the case that these companies are closed, and they move on, it will impact the whole regional labour market, and therefore we have forecast that migrations from that region will increase,” he said.

Read the full article here