Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

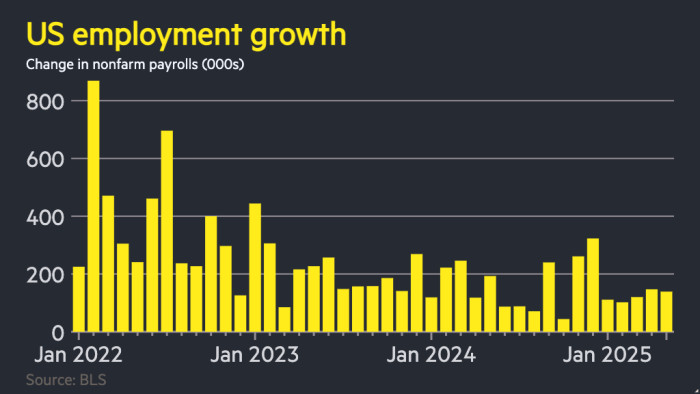

The US economy added 139,000 jobs in May, beating expectations but still signalling that the labour market in the world’s biggest economy is weakening as official data for earlier in the year were revised lower.

Friday’s figures from the Bureau of Labor Statistics were below the downwardly revised 147,000 posts added in April but above the 126,000 predicted by economists polled by Bloomberg.

The unemployment rate held steady at 4.2 per cent.

The BLS also revised down the March figures, bringing the average jobs gains this year through May to 124,000, compared with 168,000 in 2024.

“The headline beat isn’t nearly as impressive as it appears at first glance,” said Thomas Simons at US investment bank Jefferies, noting the revisions. “Job growth has clearly shifted into a lower trajectory.”

Marc Giannoni, chief US economist at Barclays, added: “We expect more slowing over the course of the year.”

The weaker numbers will pile additional pressure on Donald Trump as he contends with voter frustration over the economy. On Tuesday, after separate data pointed to lacklustre private-sector hiring, the US president lashed out at Federal Reserve chair Jay Powell, calling on him to lower interest rates.

Treasury yields rose after the data was released as traders marginally scaled back expectations for interest rate cuts this year. Futures markets are now pricing in a small chance that the Fed could cut rates just one more time this year, although two reductions remains their central expectation.

“For the Fed this means they are on hold for a while,” said Giannoni. “The latest employment report does not give them any reason to be alarmed.”

S&P 500 futures extended gains, trading 0.8 per cent higher.

Friday’s statistics were dragged down by a continued slide in the number of government jobs amid a cost-cutting effort by the so-called Department of Government Efficiency, led until last week by billionaire Elon Musk.

Musk and Trump’s relationship erupted into acrimony this week after the tech executive left his role and blasted the president’s signature tax bill as “a disgusting abomination” that would swell US debt.

But Doge’s efficiency drive has already led to the loss of 59,000 federal government workers since January, according to the BLS. That has been offset slightly by a rise in hiring in the leisure and hospitality sectors.

The OECD warned this week that the global economy was heading into its weakest period of growth since the Covid-19 pandemic as Trump’s trade war weighs on the world’s top economies.

Read the full article here