The WisdomTree Japan Hedged Equity Fund ETF (NYSEARCA:DXJ) is a way to get Japan exposure while avoiding Yen exposure. We are actually bullish on the Yen, but we acknowledge that the market may actually favour the USD in the near and medium term. While DXJ will be unaffected on a direct basis by the Yen decline relative to the dollar, they will benefit on a business basis, because holdings do better when the Yen is cheaper. There are still risks for its holdings as it pertains to the credit environment, but the USD strength is a plus. We probably wouldn’t actually go long DXJ, also because we believe the rate regimes are not permanent, but ETF investors should take into account the puts and takes around the Yen decline for DXJ.

Quick DXJ Breakdown

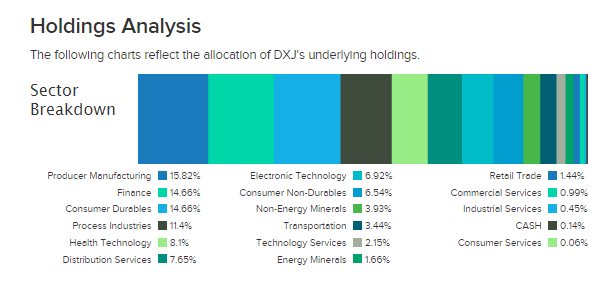

DXJ is a value-weighted exposure to the Japanese markets, so lots of financials, lots of consumer discretionary mainly being driven by automotive, and a lot of industrial exposures.

Sectors (ETFDB.com)

While having these exposures, the ETF is hedged so that declines in the Yen do not affect the stock price value of the stock holdings in USD terms, independent of the effects of Yen declines on the fundamental outlook of the holdings.

This is why the expense ratio is a little high at 0.48%, even though Japan is a liquid market and the DXJ theme is broad.

Yen Declines

The Yen declines are being driven by a couple of factors as of now, and weakness may persist into the medium term for a couple of reasons.

As of now, the Fed is appearing to be maintaining some hawkishness despite easing inflation, especially wholesale inflation which indicates less scary pricing spiral dynamics, that may lend strength to the USD. Higher rates plus decent inflation conditions could lead to USD strength, as it has from speculation so far.

We think these gains could continue as the debt ceiling issue develops. The USA’s hegemony depends probably in greatest part on the reserve currency status of the USD. A default would fully jeopardise that, and would without hyperbole be the end of the current world order. There is very little chance that those governing the US would allow that to happen. Some resolution will be found, and Biden cancelled his Asia trip to come home and try make sure that happens ASAP, since there isn’t much time left at all before the government needs to start cutting programmes to keep paying out lenders. An eventual resolution of the debt ceiling issue will restore some of the lost confidence in the USD.

Bottom Line

As the USD gains, Yen-denominated shares would decline in USD value, however DXJ hedges this. Meanwhile, Yen declines actually mean more Yen income for the holding companies, which are focused on consumer discretionary and industrial, with those markets being substantially export oriented for Japan. A weaker Yen means better competitive standing on international export markets – these products are cheaper for customers to import. The net effect as far as the Yen declines go will be positive for DXJ.

However, besides the fact that once inflation cools divergence between monetary policies should revert, DXJ does have an issue insofar the sources of demand for USD. Higher rates in the US will also mean weaker demand for credit-financed spending, including automotive and industrial. In Germany, we are already seeing recession due to falling industrial demand and production. The spending cycles by corporates are definitely coming down on the industrial side, which will pressure those export markets for Japan. On the other hand, China is at least recovering, so there is ambiguity here. However, automotive is still skating on the pent-up demand from the pandemic. Weaker credit conditions could mean this demand goes off a small cliff suddenly once pent-up demand is exhausted. Automotive still needs to take a hit and DXJ would not benefit from that.

Overall, DXJ is by no means a clear buy, although they have some favour in being positioned against what should be a strong USD over the next 6 months.

Read the full article here