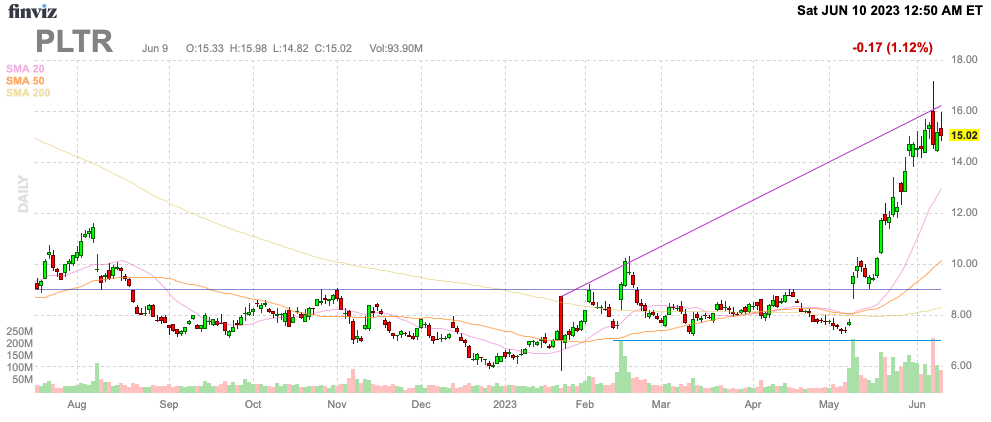

After a solid beat on Q1’23 earnings, Palantir Technologies (NYSE:PLTR) has soared in what wasn’t an overly impressive quarter. The company promoted a new Artificial Intelligence Platform (AIP) leading to what appears an irrational boost in the stock. My investment thesis is Bearish on the stock, especially after the recent double off the lows.

Source: Finviz

Artificial Rally

Palantir has seen the market cap rally back to over $32 billion. The company is only now releasing the new AIP platform to select customers. The system in essence super-charges a private enterprise network with large language models and empowers cutting-edge AI for defense and military organizations.

The market has seen the huge pop in sales at Nvidia (NVDA) and probably has extrapolated too much into the near-term business opportunities of Palantir. The chip company is selling the GPUs to develop and maintain the LLMs utilized by companies like Palantir implementing the technology into enterprise and government organizations, but this business is still in the early stages of ramping up.

On the Q1’23 earnings call, CEO Alex Karp made several statements like the following that unleashed the enthusiasm for the stock:

The issue of how do you have security, a data model or knowledge and wisdom that’s proprietary, interact with an external large language model or with generative AI is not new to Palantir, and that’s why we were able to launch our platform AIP so quickly, the demand for — of which is nothing I’ve ever seen in 20 years of being involved in Palantir.

The data security company didn’t actually report an overly impressive quarter. Palantir beat estimates with revenues growing 18%, but the company only reported a meager adjusted EPS of $0.05.

C3.ai (AI) reported a similar quarter where sales were tepid despite all of the promises of enterprise AI software demand surging. Palantir only reported 18% sales growth for Q1’23 and after the quarter analysts haven’t exactly hiked estimates for the years ahead.

The company is forecast to just grow sales 16% this year to $2.2 billion, due to Palantir only guiding to 12% growth in Q2. Sales aren’t even forecast to top 20% in the following 2 years, with a goal of just reaching $3.2 billion.

Source: Seeking Alpha

Analysts have already had a month to update sales estimates since Palantir reported Q1 results. Similar to C3.ai, the updates aren’t overly impressive for stocks soaring on supposed AI enterprise demand.

Even though Palantir only trades at $15, the stock is back to trading at early 2021 levels. Back then, the company was producing nearly 50% revenue growth and the market thought fast growth was sustainable.

The stock has clearly run ahead of reality in the short term.

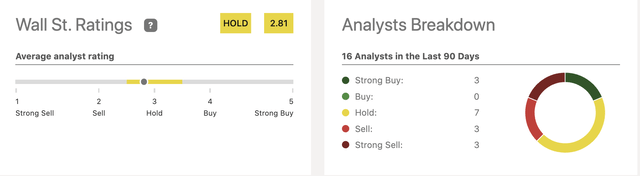

Analysts Oddly Bearish

The average analyst rating isn’t actually overly bullish on Palantir. The price target is just $9.54 in an odd scenario where the market is far more bullish on the stock than analysts predicting a 36% decline.

Source: Seeking Alpha

Unfortunately, the analysts appear logical on Palantir. The stock soared on the back of AI hype, though the contracts aren’t flowing through yet.

Even with Nvidia, analysts were at least as bullish on the stock as the market. Analyst estimates constantly rose along with the stock in the last 6+ months.

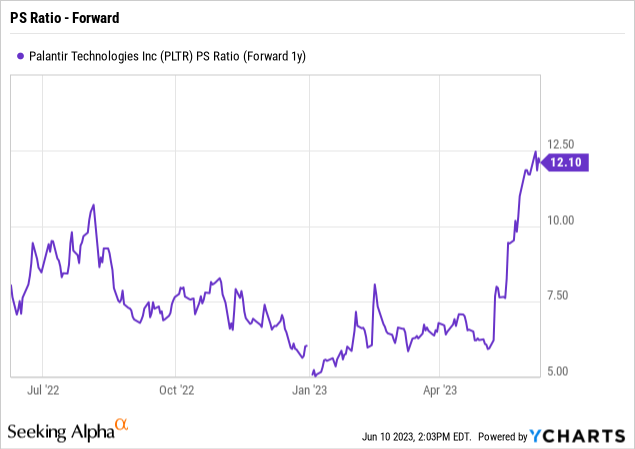

Palantir trades at 14x 2023 revenue targets, while the stock still trades at an aggressive forward P/S multiple of 12x 2024 targets of $2.6 billion. Virtually all of the rally in the last month is due to expansion of the P/S multiple, not due to higher revenue estimates.

The company has a solid cash balance of $2.9 billion along with positive free cash flows and adjusted profits. Unfortunately, though, Palantir only produces $530 million in quarterly revenues, reducing the amount of adjusted profits that can be achieved to even warrant a higher stock price.

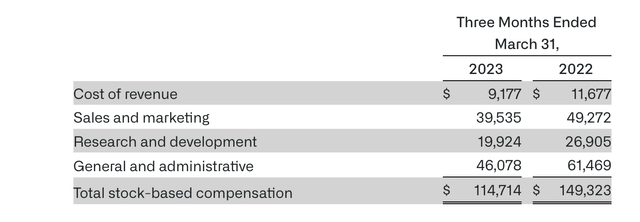

The company is already forecasting operating margins in the 24% range to produce the measly $0.05 quarterly EPS. Also, worth noting, the stock has 2.2 billion shares outstanding and the $114.7 million in stock-based compensation is contributing to the large share counts.

Source: Palantir Tech. Q1’23 earnings release

One of the prime mistakes made by investors is to see the above multiple as reasonable, but one has to remember that Palantir has to trade at a nearly 14x the forward P/S multiple in order for an investor to produce a 20% return.

Takeaway

The key investor takeaway is that Palantir has soared on AI hype. The company is definitely poised to benefit from AI demand in enterprises and military organizations, but the stock is now priced for perfection and enterprise AI software demand hasn’t actually flowed through to the results yet.

Investors should sell the rip and look to buy the tech titan on a sell-off to a more rational valuation.

Read the full article here