Introduction

At Microcap Review, we like to write about micro-cap stocks on SA, and today I’m taking a look at Total Energy Services (TSX:TOT:CA) (OTCPK:TOTZF). It’s a Canadian energy services company that has been shifting its business to the USA and I think it looks undervalued considering it’s trading at below 0.7x tangible book value. In addition, the company has a strong balance sheet, and it seems that 2023 is likely to be a good year, and I think that EBITDA could remain above C$150 million ($114 million). My rating on the stock is a speculative buy. Let’s review.

Overview of the business and financials

Total Energy Services was founded in 1996 and is involved in the provision of contract drilling services (through Savanna Drilling), contract well servicing (through Savanna Well Servicing), rental and transportation of equipment used in energy operations (through Total Oilfield Rentals), and fabrication, sale, rental and servicing of equipment for oil and gas processing (through Spectrum Process Systems) and gas compression (through Bidell Gas Compression). These are the four business lines of Total Energy Services and the company has operations in Canada, the USA, and Australia. As of March 2023, Savanna Drilling operated a total fleet of 94 drilling rigs, of which 76 were located in Canada, 13 were situated in the USA, and 6 were located in Australia (see page 14 here). Savanna Well Servicing, in turn, operated a total fleet of 56 well servicing rigs across western Canada, 11 in the USA, and 12 in Australia as of March. Total Oilfield Rentals has a network of 12 locations in western Canada and 3 in the USA, and it had a fleet of 70 heavy trucks and 9,455 pieces of major rental equipment as of the end of Q1 2023. And finally, Spectrum Process Systems, and Bidell Gas Compression had two production facilities with an area of 324,000 square feet, 13 branch locations, and 55,200 horsepower of compression in its rental fleet across western Canada and the USA at the end of March.

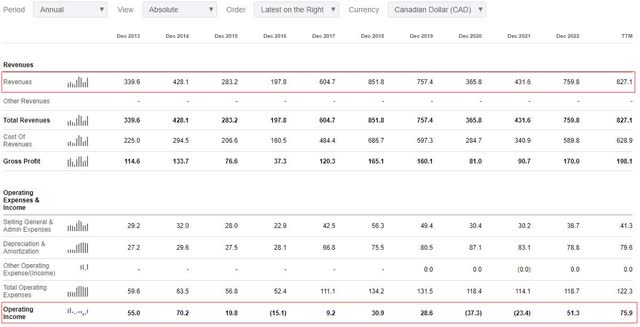

Looking at the financial performance of Total Energy Services over the past decade, we can see that this is a cyclical business that thrives during periods of high oil and gas prices but usually goes into the red during periods of low energy prices, e.g. 2020 and 2021 during the COVID-19 lockdowns.

Seeking Alpha

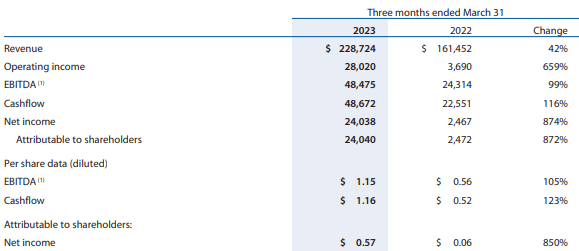

Turning our attention to the Q1 2023 financial results, revenues rose by 41.7% to C$228.7 million ($173.8 million) and EBITDA soared by 99.4% to C$48.5 million ($36.8 million) as strong drilling activity across North America led to high demand for the company’s services across all four business lines.

Total Energy Services

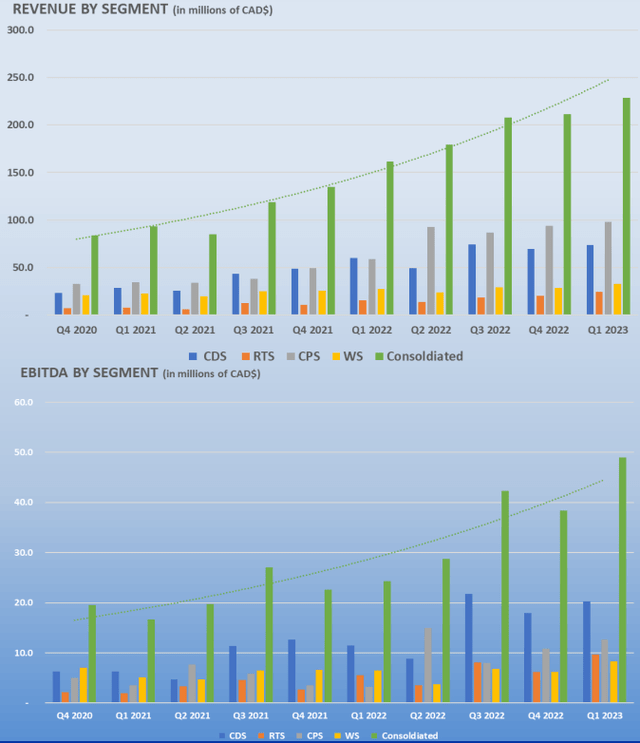

Compression and Process Servicing accounted for about 43% of revenues, followed by Contract Drilling Services at 32%, Well Servicing at 14%, and Rentals and Transportation Services at 11%.

Total Energy Services

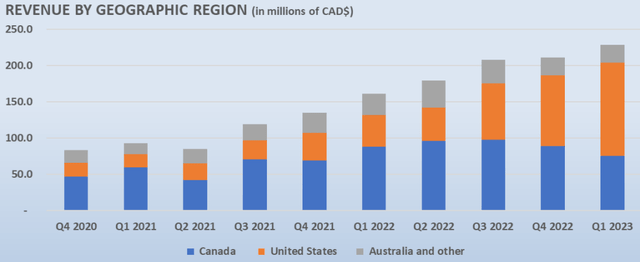

In addition, the USA accounted for the majority of revenues (56%) for the second consecutive quarter as Total Energy Services has been focusing on expanding its operations in this market over the past few years. In my view, this is a positive development as it limits the impact of seasonality in Canada on the business. You see, ground conditions affect the ability of the company to move heavy equipment, and many secondary roads in the country are not an option during the so-called spring break-up period when melting snow and frost causes the ground to become soft and muddy. Usually, the period from late March through May is the slowest period in Canada for Total Energy Services.

Total Energy Services

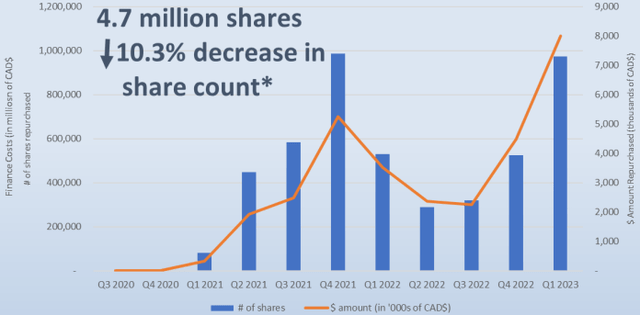

Total Energy Services used its strong Q1 2023 cashflow to fund C$30.3 million ($23.1 million) of CAPEX, reduce bank debt by C$5.5 million ($4.2 million) and buy back 975,000 shares (about 2.3% of the share capital) for about C$8 million.

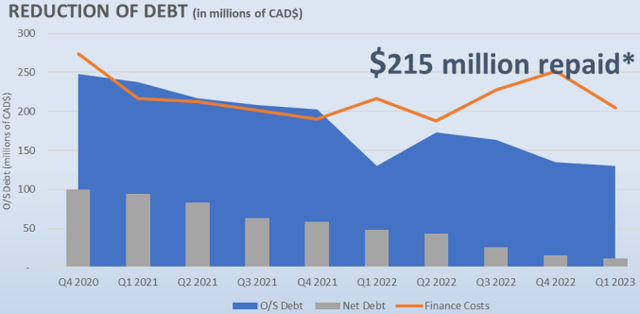

Turning our attention to the balance sheet, I think the situation looks good as the tangible equity value per share stood at C$13.09 ($9.95) as of March 2023 while net debt was reduced to just C$11.4 million ($8.7 million).

Total Energy Services

Looking at what to expect in the future, with crude oil prices near $70 per barrel, I expect drilling activity in the USA and Canada to remain stable over the remainder of 2023 which should enable Total Energy Services to generate EBITDA and cashflow of over C$150 million ($114 million) each (TTM cashflow is C$156.9 million ($119.3 million) while EBITDA is C$155.5 million($118.2 million)). The company has a CAPEX budget of C$66.1 million ($50.2 million) for 2023, which includes C$25.6 million ($19.5 million) of growth capital. Considering CAPEX in the first quarter of the year came in at C$30.3 million ($23 million), there are about just C$35.8 million ($27.2 million) left for the remainder of the year. Total Energy Services should thus have significant funds which it can use to further reduce debt, repurchase shares, and potentially increase the dividend over the coming months. At the moment, the company has a quarterly dividend of C$0.08 ($0.06) per share, and it has decreased the share count by 10.3% over the past two years.

Total Energy Services

In my view, share buybacks and strong results over the next few quarters could push the share price close to the tangible equity value per share by the end of the year.

Looking at the risks for the bull case, I think that the major one is I could be overestimating the resilience of drilling activity in North America over the course of the coming months. If oil prices continue falling, demand for the services of Total Energy Services could decrease significantly over the coming months which would limit its cashflow and thus decrease the funds available for share buybacks and debt reduction. In addition, investors should keep in mind that this is a thinly traded stock, with a daily trading volume rarely exceeding 50,000 shares on the TSX. The situation on the US OTC is even worse with the daily trading volume often being below 1,000 shares. In view of this, there could be significant share price volatility, and it could be challenging to exit a large position.

Investor takeaway

Total Energy Services started 2023 on a strong note as decent drilling activity in North America boosted demand for the services of all of its business lines. With almost half of CAPEX budgeted for the year spent in Q1, I expect the company to invest a significant amount of its cashflow over the next quarters in share buybacks and dividends. Coupled with potentially continued strong financial results over the coming months, this should act as a catalyst for the share price to move closer to the tangible equity value per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here