Meta Platforms, Inc. (NASDAQ:META) investors who stayed on the ride have likely been unable to catch their breath. CEO Mark Zuckerberg and his team gave more reasons for momentum investors to lift META higher.

Zuckerberg deepened his rivalry against Tesla (TSLA) CEO Elon Musk’s Twitter by launching Threads, which is undoubtedly a direct rival to Twitter’s existence. Zuckerberg also made no mistake about Meta’s threat, as he criticized Twitter’s inability to live up to its mission, as he articulated:

There should be a public conversations app with 1 billion-plus people on it. Twitter has had the opportunity to do this but hasn’t nailed it. Hopefully, we will. – Bloomberg

Musk has given Zuckerberg the strategic opportunity to attempt to take Twitter out of the game, given its recent struggles. Twitter has struggled with content moderation uncertainties and technical and accessibility issues as Musk attempts to remodel Twitter’s success. As such, I believe Meta likely saw the opening to consolidate its prowess in the social media space as it crawled out of the hole it fell into back in 2022.

Meta’s engagement has also continued to improve, regaining momentum against TikTok. In addition, Meta’s open-source approach in generative AI is expected to differentiate its ability to compete against Microsoft (MSFT) and Google (GOOGL), leveraging the open-source community to give it an edge. While still early, Meta’s approach holds promise. In addition, investors are likely anticipating the platform-wide launch of its generative AI products, further improving its engagement and monetization opportunities.

As such, it’s possible that Meta’s advances against Twitter and in the generative AI space could lead to further gains if its open-source development efforts could result in wider adoption and better performance against the proprietary models.

In addition, Apple’s (AAPL) decision to lower the first-year shipment estimates (due to supply chain technical challenges) for its Vision Pro device could lift the momentum in Meta’s Quest devices with the hype created at Apple’s recent WWDC in June.

META’s forward EBITDA multiple of 11.1x suggests that the market has likely not fully reflected these opportunities, as it remains well below its historical average (15.2x). In addition, the discount also likely reflects the market’s perception of the communications sector (XLC), which is still priced at a discount against its fair valuation.

The revised consensus estimates suggest that Meta could continue to post low-teens revenue growth in FY24 and FY25. Moreover, Meta is expected to regain operating leverage with a 20.4% increase in EBIT in 2024 after this year’s projected 31.5% increase. As such, Meta’s recovery in its operating performance should see a further boost in the second half, which I believe is what investors have tried to price in since META bottomed out late last year.

Therefore, I believe the critical question facing investors now is whether the price action suggests further gains are still possible if they missed adding earlier.

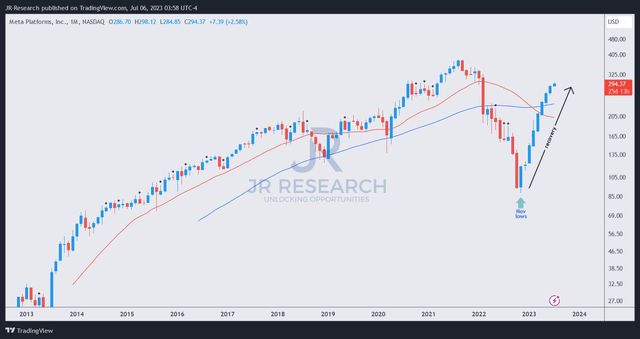

META price chart (monthly) (TradingView)

I gleaned that META’s price action demonstrates that it has regained its long-term uptrend bias after a stunning recovery that showed no clear sell signal. While a pullback is anticipated, it has not arrived, and even if it did, META is expected to continue on its long-term uptrend.

As seen above, with META buyers regaining control over its 50-month moving average (blue line), buying sentiments should be sustained further by momentum investors who missed buying its peak pessimism last year.

Therefore, I see increasingly lesser reasons to urge investors to continue staying on the sidelines, as META’s reasonable valuation and constructive price action indicate that it remains on track to continue on its long-term uptrend from here.

Rating: Buy (Revised from Hold).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Read the full article here