The stronger ADP National Employment Report for June, released a day before the non-farm payrolls report, confused markets. It smashed expectations by nearly double consensus estimates. In stark contrast, the NFP increase by 209,000 fell short of the 225,000 consensus. Traders will thrive from the market’s seesawing reaction to both reports.

Investors, who typically buy and hold, then sell when the investment is at full value, benefit from reviewing the jobs report in more detail. Readers will find trends in the job report. Later this month, the NFP will weigh on the Federal Reserve’s interest rate policy decision.

Unemployment Unchanged at 3.6%

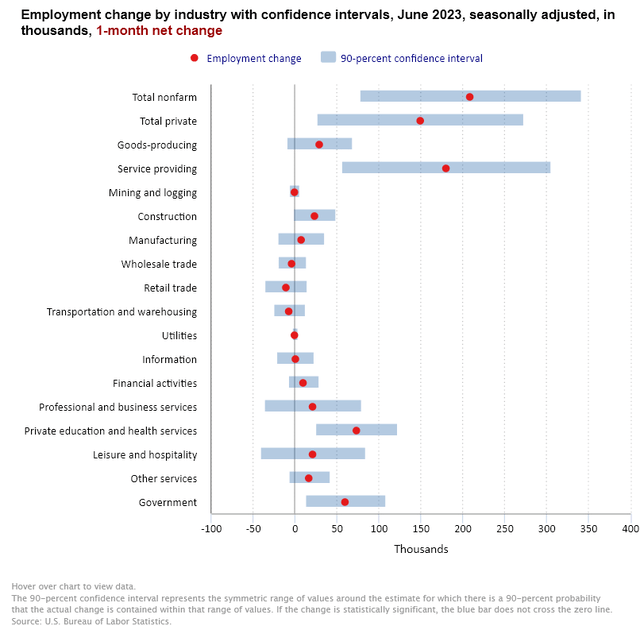

The Bureau of Labor Statistics reported that nonfarm payroll employment grew by 209,000 in June 2023. The unemployment rate was at 3.6%. The report highlighted the uptrend in job growth in government, healthcare, social assistance, and construction. Some readers would not appreciate the jump in government jobs. This increases the need to raise income taxes down the road, hurting disposable income. Still, jobs are growing faster in other areas on a month-over-month basis:

BLS

Job growth is strongest in service-providing industries. In addition, private education and health services and total private jobs outpaced government job growth.

Investors should expect continued spending from the Department of Defense. For example, Pratt & Whitney secured a $5.5 billion Air Force contract modification on July 3, 2023. Despite that, Raytheon Technologies (RTX) shares continued to trend lower. Markets are unwilling to pay more than $100 a share for RTX stock.

The Pentagon approved the sale of Lockheed Martin’s (LMT) F-35 fighter jets to the Czech Republic. The deal is worth up to $5.62 billion. LMT stock is stuck in a range of around $430-$460.

Readers might speculate that Ukraine’s counteroffensive will end its war with Russia. As the planning phase continues, this outcome will likely come later instead of sooner.

The BLS softened the increase of 60,000 government jobs by noting that government employment is below its pre-pandemic Feb. 2020 level by 161,000, or by 0.7%.

Health Care Job Growth

Healthcare added 41,000 jobs in the month. Hospitals added 15,000 jobs. Investors may not reliably correlate jobs in this sector to picking drug manufacturers, emerging biotechnology, or healthcare REITs. Most notably, pharmaceutical giant Pfizer (PFE) stock is below its pandemic high. It does not have tailwinds from COVID vaccines or antivirals to boost revenue. Instead, it’s acquiring companies to deepen its drug pipeline. Revenue acceleration from new products could take years to play out.

AbbVie (ABBV) is another giant. However, management cited an unexpected increase in IPR&D and milestone expenses. This will hurt its GAAP earnings per share by 15 cents.

Trading 40% lower in the last year, Medical Properties Trust (MPW), a healthcare facilities REIT, is on the mend. Its tenant, Prospect Medical, completed $375 million in financing. Prospect’s rental payment will alleviate fears of Medical Properties posting a revenue shortfall.

NFP Report Impact on Interest Rates

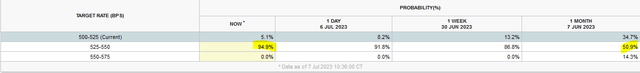

Strong job growth and moderate inflation rates are not enough to dissuade the Fed from raising interest rates this month. The CME FedWatch Tool indicated a 94.9% chance of the target rate at 525-550.

CME FedWatch

Will stock markets fall when money market funds pay up to 5.5% risk-free? These rates should discourage dividend income investors from buying companies whose stock yields less than 5.0% to 5.25% (current target rate). Still, tax rates on dividends in non-retirement accounts are lower than that paid on interest income. Additionally, stocks that rise will offer capital gains.

Investors who pick undervalued firms with generous dividend yields might outperform the markets. Altria (MO) bottomed below $44 and traded recently at $46.27. MO stock has a dividend yield of 8.16%. Verizon (VZ) traded as low as $33.72 before rebounding in the last month. Shares have a dividend that yields 7.03%.

AT&T (T) is an exception. While shares yield 6.99% in dividends, the chief financial officer warned that Q2 subscriber additions are likely to be below estimates. Elevated inflation hurts real income. Consumers may cut back on mobile services. This would lead to a price war among telecoms. The reduced free cash flow would at minimum prevent those firms from raising dividends or buying back shares.

Your Takeaway

The solid NFP report will give the Fed comfort in raising interest rates. It wants to slow the economy enough to lower inflation rates. With low unemployment, the job market is tight. Investors might want to lighten up on bond positions in a higher-rate environment.

Despite unfavorable valuations, the positive stock market sentiment shows no sign of reversing. The NFP report does not give a reason to sell in a panic just yet.

Read the full article here