Receive free US-China relations updates

We’ll send you a myFT Daily Digest email rounding up the latest US-China relations news every morning.

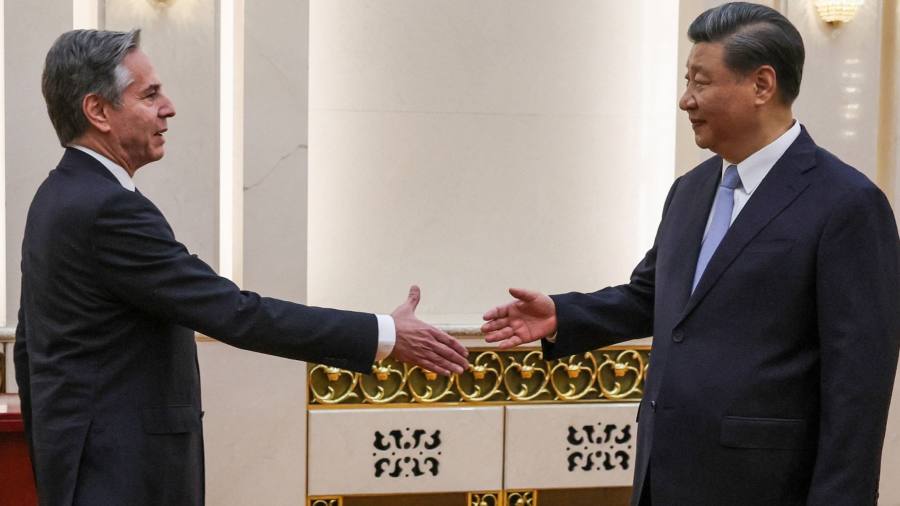

The visit this week by Antony Blinken to China, the first by a US secretary of state to Beijing since 2018, represented an important moment for the world’s most fateful bilateral relationship. But although his talks yielded claims of “progress”, incidents that have followed it serve to underline that the US-China rivalry remains unchecked.

The initial soundings out of Beijing were fairly positive. Xi Jinping, China’s leader, declared that the two sides “made progress and reached agreement on some specific issues”. Blinken’s five and a half-hour meeting with Qin Gang, China’s foreign minister, produced similarly upbeat readouts, with Qin saying Beijing was committed to a stable and predictable relationship. Blinken stressed the importance of “maintaining open channels of communication”.

Such statements reflected the desire to stabilise the relationship after the US shot down an alleged Chinese spy balloon that flew over American airspace in February. US diplomatic efforts have included a secret visit to China in May by Bill Burns, CIA director.

But since Blinken’s visit, several signs suggest that mutual suspicion remains undiminished. China responded with outrage after Joe Biden, the US president, called Xi a “dictator” shortly after Blinken left Beijing. Biden’s words were “extremely absurd and irresponsible”, China’s foreign ministry said. Blinken, for his part, raised concerns even before leaving Beijing about alleged Chinese electronic spying facilities in Cuba.

These signals point to the extreme difficulties managing a relationship bedevilled by strategic competition over Taiwan, which China regards as part of its territory, and the Ukraine war, a theatre in which Beijing’s support for its “strategic partner” Russia puts it on the opposite side to the US-led Nato. So how should China and the US seek to prevent their relationship from further deteriorating in a way that could risk a horrific superpower conflict?

The answers require honest appraisals, transparency from both sides and, where possible, a readiness to prize any small wins that can be made. In the first instance, Washington and Beijing should be clear that their main aim now is to prevent a bad relationship from becoming a catastrophic one — which means, quite simply, avoiding war.

If there is an upside to the absence of bilateral trust, it is that both the US and China have an opportunity to recognise how dangerous their rivalry has become. The main task in this regard is for both sides to communicate clearly their strategic and military red lines.

In the economic realm, the US should be much clearer about its “de-risking” strategy towards China. The Biden administration talks of a “small-yard, high-fence” policy in restricting trade and investment in sensitive areas — limiting the extent of such restrictions, but trying make them watertight. The difficulty is that many technologies have both civilian and military uses, and Beijing sees such efforts as aimed simply at holding back its development.

The White House ought to publish a clear and comprehensive list of technologies to which it wants to restrict China’s access. Beijing is likely to denounce such a list but the removal of ambiguity will over time allow both sides to readjust.

China and the US should not lose sight of the efficacy of “small wins”. There is, for instance, no humane reason for China to resist helping to restrict the trafficking in fentanyl and its precursors to the US, where fentanyl overdoses are a prime cause of untimely death.

Blinken’s visit may not have yielded much in itself. But the fact it took place at all should be a starting point for renewed efforts by Washington and Beijing to stabilise a relationship that has been dangerously unravelling.

Read the full article here