With the S&P 500 hovering around 12-month highs despite macro jitters, a common question investors are asking is: is it too late to get in on the rally? For me, the answer is no, but the key is careful stock picking. I continue to advise investors to go against the grain and buy out-of-favor tech stocks (as in, avoid the latest AI craze).

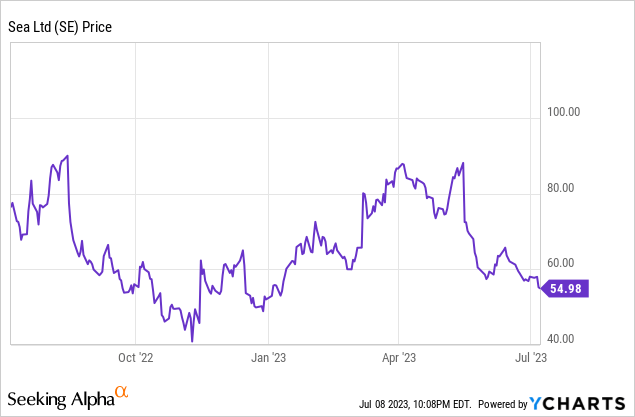

Sea (NYSE:SE), in particular, is an international tech giant that has fallen sharply out of favor recently. A one-time market darling, the so-called “Amazon of Southeast Asia” has seen a massive correction since May (despite most other tech stocks rallying sharply since then), giving back all of its year to date gains.

In spite of risks, the Sea bull case remains vibrant

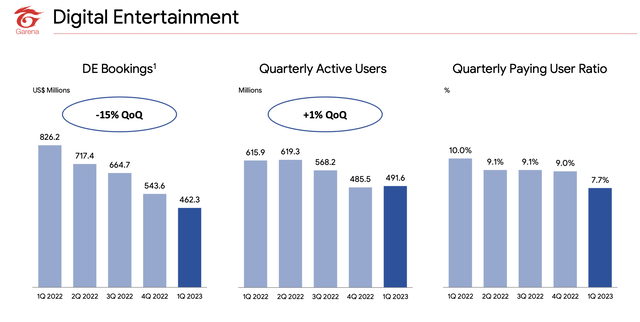

Pessimism for Sea can be summed up by one main driver: a sharp contraction in activity for Garena, the company’s gaming division. Sea’s video gaming business was a major highlight during the pandemic, when bored teenagers sunk millions into in-game purchases and the company’s ratio of paying users hit all-time highs. Now, not only are active users across the company’s games down, but the propensity to spend for in-game content is also waning.

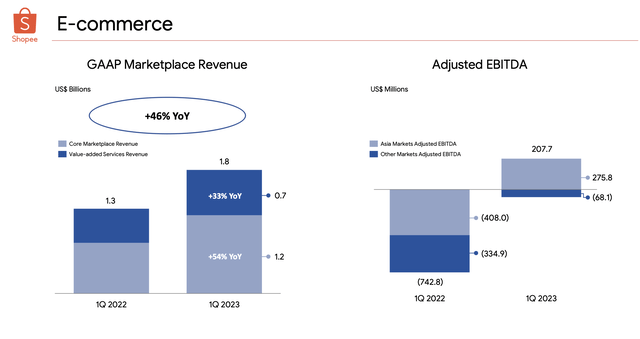

At the same time, the slowdown in gaming is being offset by huge growth in the company’s e-commerce arm, Shoppee. During the pandemic, I was largely bullish on Sea for one simple reason: losses in the fast-growing e-commerce division were effectively being subsidized by big profits in gaming. So now, even though we’re disappointed by the declining paid user trends in gaming, we’re also encouraged by the fact that Sea is no longer heavily dependent on gaming profitability now that e-commerce has scaled to profitability in its own right.

We also have to recognize that the gaming world is highly seasonal and fad-based. Sea’s Free Fire had its moment of glory, but the cast of popular online games is a rotating sphere (League of Legends, DOTA, Fortnite, Warcraft, and others are constantly jockeying for position with users’ limited time). In other words, soft trends now do not necessarily mean Garena will be in the hole forever.

When we step back from near-term noise, here are what I believe to be the core components of the bull case for Sea:

- Sea operates in the attractive “tiger economies” with secular multi-year growth tailwinds. Serving the fast-growing economies of Southeast Asia (Singapore, Indonesia, Philippines, Malaysia, etcetera). Outside of its home country of Singapore, Sea benefits from rapidly modernizing infrastructure and a burgeoning middle class. It’s not ludicrous comparing an investment in Sea to an early bet on Alibaba (BABA) and JD.com (JD) in China.

- Sea operates a conglomeration of attractive, profitable businesses. The company’s gaming, e-commerce, and digital payments business serve a wide net of customers, and are now each profitable in their own right – giving the company plenty of growth catalysts to capture more share in Southeast Asia. These subsidiaries, particularly the more nascent payments business, enjoy synergies and cross-sell opportunities with each other.

- Incredibly well capitalized. Sea has more than $8 billion of cash and investments on its balance sheet (for sizing, that is approximately a year’s worth of opex for the company) to continue investing in growth and potentially acquire new platforms.

From a valuation standpoint: at current share prices near $55, Sea trades at a market cap of $31.16 billion. After netting off the $8.15 billion of cash and $3.46 billion of convertible debt and borrowings on its most recent balance sheet, the company’s resulting enterprise value is $26.47 billion.

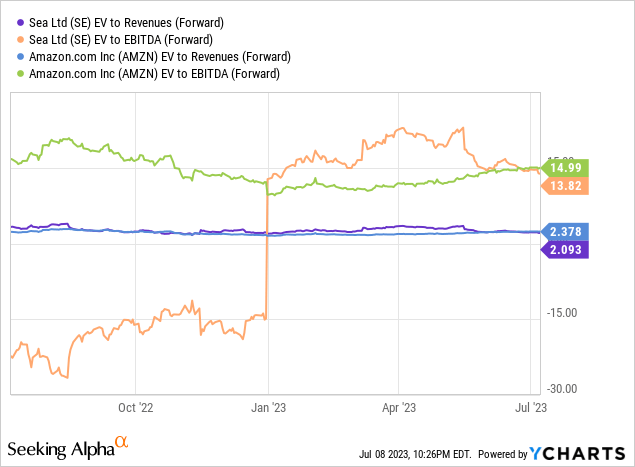

Meanwhile, for fiscal year FY24, Wall Street consensus is expecting Sea to generate $15.27 billion in revenue, representing 15% y/y growth (data from Yahoo Finance). This puts Sea’s valuation at 1.7x EV/FY24 revenue. And if we conservatively assume that Sea’s 17% adjusted EBITDA margin in its most recent quarter holds into next year, Sea’s adjusted EBITDA in FY24 would be roughly $2.59 billion and its multiple clocks in at 10.2x EV/FY24 adjusted EBITDA.

I find it encouraging that Sea’s forward multiples are fairly closely in-line with Amazon (AMZN), despite the former’s more nascent growth potential:

The bottom line here: it’s a great time to be bullish on Sea while the market is looking the other way.

Q1 download

Let’s now go through the highlights of Sea’s most recent quarterly results, starting with the trends in the gaming division:

Sea gaming (Sea Q1 earnings deck)

Bookings in the gaming division fell -15% sequentially and -44% y/y to $462.3 million. Revenue of $539.7 million, meanwhile, fell -51% y/y. The shortfall of bookings to revenue indicates that the company is “using up” deferred revenue balances (which in gaming represents in-game purchases that don’t get recognized as revenue until players actually consume the items) and that revenue deceleration is likely to continue.

Quarterly active users grew 1% sequentially (adding ~6 million net-new players), but declined -20% y/y. The biggest hit, however, was to the paid player ratio, which fell 130bps sequentially and 230bps y/y to just 7.7%. This is lower than pandemic-era ratios in the 8-10% range, but in-line with early 2019 levels, indicating that the business isn’t necessarily collapsing – it’s just normalizing in a post-pandemic world where gamers are back to schools and offices.

Forrest Li, the company’s CEO, noted on the Q1 earnings call that user engagement trends improved somewhat after the quarter closed in April:

As previously shared, Garena, continued to focus on improving gameplay and creating a stronger community for our games first and foremost. While there was some weakening in monetization, mainly as a result of a lower paying user ratio, we saw some initial signs of improvement in our quarterly active user base, which increased from $485 million last quarter to $492 million in the first quarter.

In April, we also observed positive user trends with Free Fire achieving a new peak in monthly active users in the last eight months period. While we are mindful of seasonality impacts, we’re pleased to see this as a positive sign for Free Fire, which remains one of the largest mobile games in the world. We will continue to monitor closely for trends going forward. As we strengthen our efforts in enhancing gameplay and user engagement, we have received positive responses from our user community on a number of initiatives we launched to make the game experience smoother.

This initiative include game package size optimization and the gameplay like reduction with an emphasis on devices commonly used in our markets. Our users have indicated that these recent changes are highly responsive to their feedback and shared that they are enjoying a better gameplay experience as a result.”

The company is also planning a big new title release in the “next coming months”, an open-world survival game called Undawn, that may help to lift the gaming division’s fortunes.

The big highlight in the quarter, of course, was e-commerce performance. Revenue grew 46% y/y to $1.8 billion, while profitability improved from a prior-year loss of -$743 million to an adjusted EBITDA profit of $208 million:

Sea e-commerce (Sea Q1 earnings deck)

Several highlights here include a sharp 77% reduction in contribution margin loss per order in the company’s expansion market of Brazil, as well as a widening of the company’s distribution network in Indonesia (a vast country of thousands of islands, and the bulk of Shopee’s customer base).

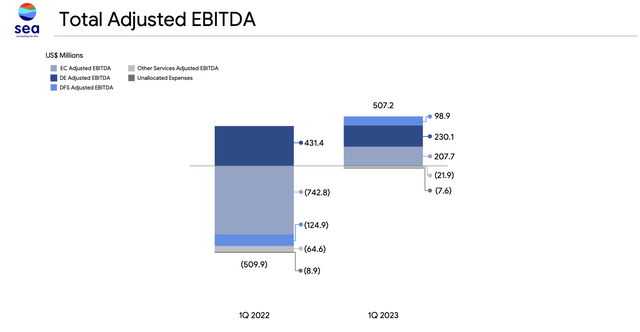

Thanks to the turnaround in e-commerce profitability, total company adjusted EBITDA soared to $507.2 million, a 17% margin; versus a -$509.9 million loss, or a -18% margin, in the year-ago quarter.

Sea company adjusted EBITDA (Sea Q1 earnings deck)

Key takeaways

In my view, it’s far too early to sour on Sea. Improving gaming trends in April plus the hope from a new title launch, plus a massive turnaround in e-commerce profitability, are huge catalysts for a rebound here. If you haven’t invested in Sea until now, this is a great time to do so.

Read the full article here