This article was first posted in Outperforming the Market on June 16, 2023.

Today, in this article, I will be sharing my research findings and thoughts on a leading LiDAR player, Luminar Technologies (NASDAQ:LAZR). I am of the view that we are at an inflection point in the LiDAR industry as automotive players are increasingly making their strategic LiDAR sourcing decisions in the next one to two years, with many of them in the process of doing so. As I will elaborate below, I think that Luminar has one of the best product and software solutions portfolio in the industry, led by an owner-operator, and with a manufacturing strategy meant to have sufficient control and at the same time, enabling rapid scaling and cost efficiencies.

While this is my first Luminar article on Seeking Alpha, I have posted a deep dive research into LAZR stock in Outperforming the Market, where I go deeper into the customer order book, competitive landscape, financials and valuation of the company.

Apart from Luminar, I have also done extensive research on other LiDAR players, like Innoviz (INVZ), including a deep dive into the company in Outperforming the Market for those who are interested in the theme.

Let’s start off with a brief introduction into Luminar.

Brief introduction

Luminar was founded in 2012 by Austin Russell and Jason Eichenholz. Austin is currently the CEO of Luminar while Jason is serving as the company’s chief technology officer.

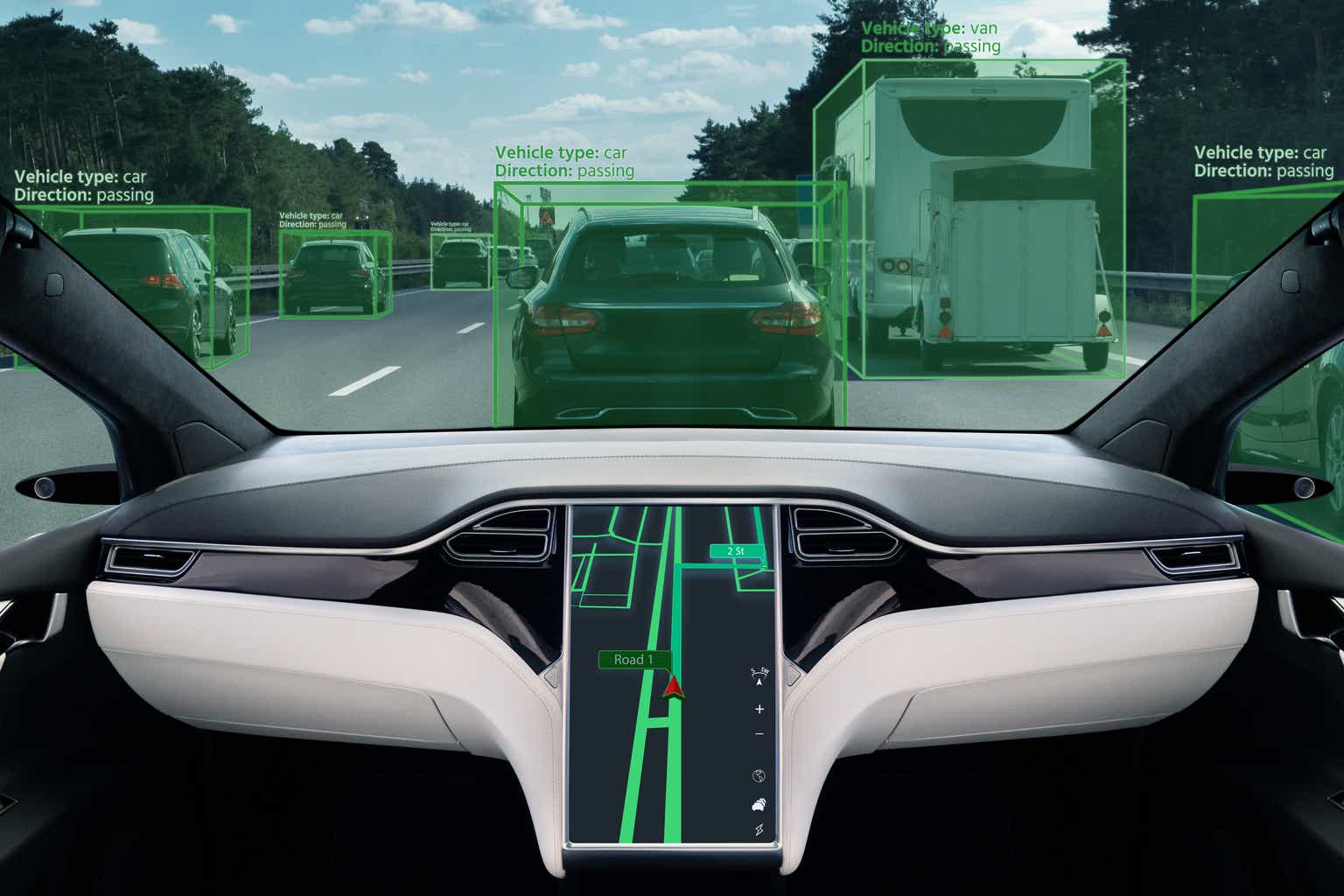

Its current portfolio includes both sensor hardware and perception and decision making software that was developed in-house, as well as a high definition 3D mapping engine for new levels of vehicle automation and better vehicle safety features.

Luminar has spent the last 10 years building its LiDAR, chip-level up, meeting the cost, performance, and safety requirements of its customers. At the end of the day, its products and solutions are meant to bring about next generation ADAS and highway autonomy for passenger and commercial vehicles.

Market opportunities

Similar to Innoviz, Luminar sees the near-term opportunities for the market being in the ADAS and highway autonomy space. This means that in the near-term, the opportunity will be to enhance, and not replace, the driver.

The level of automation ranges from L0, which means no driving automation, to L5, which means full driving automation. L1, L2 and L3 means driver assistance, partial driver automation and conditional driver automation respectively. The level of autonomy increases from L0 to L5, with the human fully responsible for all dynamic driving tasks in L0, while in L5, the automated driving system is the one that makes all the decisions for all dynamic driving tasks.

As such, the near-term business opportunities for LiDAR players like Luminar and Innoviz is in up to L3 today.

Luminar portfolio

Hardware

Luminar’s main product is its Iris LiDAR.

Luminar Iris LiDAR (Luminar)

The Iris LiDAR combines the laser transmitter and receiver to bring a 1550nm based LiDAR. This compares to a 950nm based LiDAR which Innoviz offers.

The Iris LiDAR offers a cost effective and automotive grade LiDAR solution that for Tier 1s and OEMs.

One thing that differentiates the Iris Lidar is that there are multiple components and solutions that are vertically integrated. The receiver, detector and laser solutions of Luminar’s Iris LiDAR is developed by its Advanced Technologies & Services segment companies. These companies include Freedom Photonics, Black Forest Engineering, and Optogration. Freedom Photonics is a manufacturer of unique and innovative photonic components, modules and subsystems, Black Forest Photonics provides full custom ASIC designs and services, providing Full Custom ASIC/ROIC Designs & Services and Optogration builds advanced Photodetectors. As a result of the internal development of these technologies, Luminar can then have an advantage in terms of controlling its own product roadmap and technological improvements.

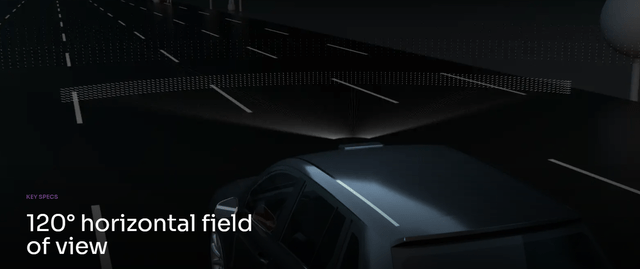

Some key metrics that differentiates Iris LiDAR sensors from other peers in the industry includes its dynamically configurable dual-axis scan sensors that can detect objects up to 600 metres away, over a horizontal field of view of 120° and a software configurable vertical field of view of up to 30°. This provides high point densities in excess of 200 points per square degree, thereby enabling long-range detection, tracking, and classification over the whole field of view. On top of that, Iris is able to meet the automotive reliability, cost, size, weight and power requirements.

Key specifications (Luminar)

Software

Luminar has its core sensor software, perception software and Sentinel under development today.

Luminar’s core sensor software helps its partners to integrate the LiDAR sensors and control and enrich the sensor data stream before perception processing.

Luminar’s perception software is meant to take the LiDAR point-cloud data and translate that into actionable information. This information is able to do things like classify static objects like pedestrians, vehicles, lane markings, amongst others. On top of that, through internal development of its perception software and also through the acquired assets of Civil Maps, Luminar is then able to use the point-cloud data to derive precise vehicle localization, which will then bring about continuous updates to a high definition map of a vehicle’s environment.

Luminar’s Sentinel is its full-stack software platform. Sentinel will enable Proactive Safety and highway autonomy for cars and commercial trucks.

Luminar’s software products are currently in the design and coding phase of development and has not yet reached technological feasibility as of the end of 2022.

Product development and technology

Luminar’s Iris LiDAR is expected to SOP in 2022, while its Iris+ is expected to SOP in 2025, with a next-generation LiDAR being under development at the moment.

Luminar product roadmap (Luminar IR)

Luminar’s Iris+ LiDAR was revealed recently, with capabilities including long-range validation facility that is more than 300 meters, a slimmer profile to its predecessor. It is said that Mercedes-Benz will be integrating Iris+ to its next generation vehicle lineup. As can be seen below, the incremental benefits of Iris+ over Iris LiDARs are shown below. The next-gen LiDAR is expected to use the technology from Seagate, which it recently acquired.

Iris+ benefits over predecessor (Luminar IR)

Management team

Another owner-operator

When I was researching about Luminar, its CEO and co-founder, Austin Russell really stood out.

At age 11, he developed his first visioning system “building prototype supercomputers and optoelectronic systems with real-world applications in mind”.

At age 12, he wrote his first patent application, and over the next four years worked on a host of photonics and imaging related technologies

At age 16, he then became an independent researcher at the Beckman Laser Institute.

And finally, at age 17, while he was at Stanford University, Austin Russell developed the idea for Luminar.

He then dropped out of college after he received a $100,000 Thiel Fellowship. This is a highly prestigious program funded by billionaire Peter Thiel to help nurture entrepreneurs.

On top of that, Austin Russell also became the youngest self-made billionaire at the age of 25 years old after Luminar went public.

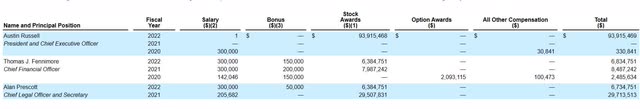

The other two key members of the management team includes Thomas Fennimore, Luminar’s Chief Financial Officer, and Alan Prescott, Luminar’s Chief Legal Officer.

Thomas has been with Luminar since 2020 and prior to that, he was the global head of automotive at Jefferies Group for 6 years, and before that spent 17 years at Goldman Sachs. Alan has been with Luminar since 2021 and he is an automotive and autonomous industry legal expert. Prior to joining Luminar, he was at Tesla, where he spent four years as its General Counsel and before that, he was at Uber.

Jason Eichenholz is the other co-founder of Luminar and he remains rather low profile. I could not find how many shares of Luminar does he currently own but he is still the Chief Technology Officer in Luminar today.

It is clear to me that Luminar’s co-founder and CEO is a very outstanding and competent individual in the space, and I like the quality of the management team, which is well poised for growth, in my view.

Strong alignment of interest with management

Before I begin delving into deeper aspects of Luminar’s investment case, it is pertinent for me to highlight the huge alignment of interest of the management team, particularly so for the CEO and co-founder, Austin Russell.

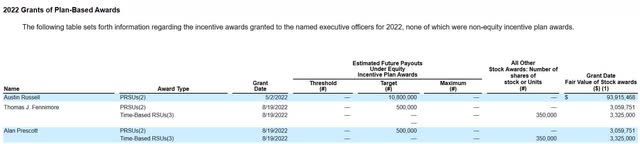

As can be seen below, since listing in late 2020, Austin has received $0 in salary and $1 in salary in 2021 and 2022 respectively. In turn, his compensation comes from stock awards worth about $94 million.

Luminar Executive Compensation (Luminar Proxy Statement)

However, these stock awards require several criteria to be met before they can be distributed to Austin, Thomas and Alan.

Equity incentive award (Luminar Proxy Statement)

Based on the proxy statement, it states that the stock awards will only vest if the operational milestone is met, and the service requirement and the stock price milestone is met.

Firstly, the easiest criteria to be met is the service requirement. The stock awards will vest in a certain percentage each year from the first year to the seventh year, with 10% vesting in the first year and 20% vesting in the seventh year.

Secondly, I am particularly interested in the stock price milestone because one-third will only vest if the share price goes higher than $50, another third will vest if the stock goes to $60 or more, and the last tranche will vest when the share price goes higher than $70.

Last but not the least, the operational milestone is met when at least one major program begins production.

Both the operational milestone and the share price milestone must be achieved before seven years after the stock awards vest.

As a result, Luminar needs to meet its operational and stock price milestone in the next five years or they will not achieve the targets needed to fully vest their stock awards.

Manufacturing strategy

Luminar sees its manufacturing processes and knowledge as a key differentiator for the company.

As I highlighted in the Innoviz deep dive, Innoviz employs a contract manufacturer strategy when it comes to manufacturing. Thus, Luminar is taking a slightly different approach, as I will highlight next.

Luminar designs and makes some components that it deems critical in-house. This includes its receiver ASIC and InGaAs photodiode. The company has an internal advanced manufacturing line in Florida that is meant for developing manufacturing and testing processes.

As a result of manufacturing in-house, Luminar faces challenges like supply chain disruptions, but at the same time, it is able to enhance the efficiency of its manufacturing process and have more control over it.

Luminar announced in 2021 that they have entered into series manufacturing partnerships with Celestica and Fabrinet. This will complement Luminar’s in-house advanced manufacturing facility mentioned above.

The company is currently in the middle of installing its high-volume series production facility in Mexico, which will be operated by Celestica. Production is expected to begin in the second half of 2023. Before that is up and running, Luminar is currently producing Iris LiDARs in an existing facility that is owned and operated by Celestica.

Conclusion

As I have stated in the beginning of the article, I am of the opinion that we are seeing the start of a strong period of growth in the LiDAR industry.

Automotive players are largely due to make their strategic sourcing decisions for their LiDARs in the next one to two years, with most of them going through rigorous testing and qualification before choosing their LiDAR supplier.

I think we can see that Luminar has one of the leading LiDAR product and software solutions in the market. At the same time, the company is focused on innovating and improving its technology with Iris+ and the development of its next-generation LiDAR under way. Also, Austin Russell, Luminar’s CEO and co-founder, really stood out to me given that he does not receive any salary and his compensation comes from stock awards that vest only if the stock price goes materially higher to $50 per share at least.

Lastly, its manufacturing strategy is one that is tailored to its business as it vertically integrates parts of its business which is deems as critical, while other components and parts of the business utilizes its manufacturing partner to enable scale and cost efficiencies.

Read the full article here