Recession Sledding

On top of mind for a lot of investors is the possibility of recession later this year or next. I think it’s roughly a 50-50 shot, and if it does happen, we will see it begin Q4 2023 – Q2 2024. Right now, it’s hard to look at a jobs report or JOLTS and think that a recession is coming. We just got Q1 GDP, and real personal consumption grew at a brisk 3.7% QoQ annualized clip despite still-high inflation, the fastest since Q2 2021. You have to squint very hard to see a recession among the current data, but it is strange times.

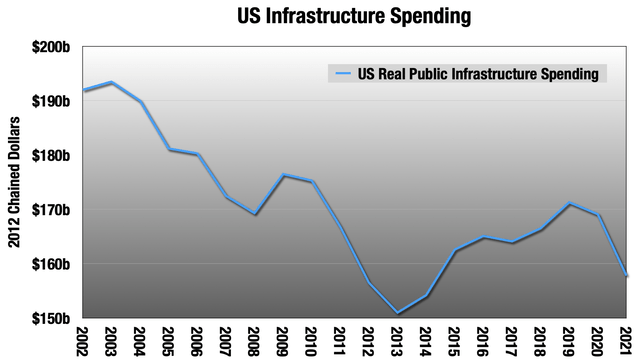

That last paragraph implies a ton of macro uncertainty going forward. But one thing that is certain is that the Federal government is going to double their contribution to infrastructure spending over five years, totaling $1.2 trillion. The first year of grants are already out to state and local agencies beginning last fall. That money is slowly working its way through the system, and will begin hitting construction and engineering backlogs in Q3 or Q4 this year.

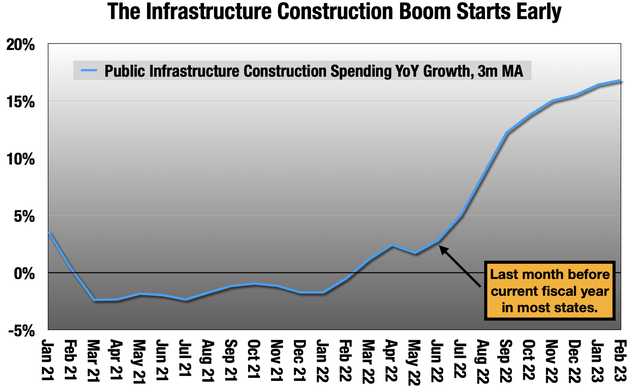

But the party is getting started early. In 2020 and 2021, state and local governments, where almost all the spending actually happens, banked nearly a quarter trillion dollars in unexpected surplus. Many states passed infrastructure bills of their own in 2021, and we are already seeing the effects of those bills:

Transportation, power, waste/sewer, water, conservation/development (Census Bureau)

Moreover, projects that were delayed in 2020-2021 are now moving forward. So we see infrastructure construction spending up 17% YoY already, and the Federal money has not even hit that chart yet. This is a multiyear public infrastructure construction boom that began last July when the current fiscal year began in most states.

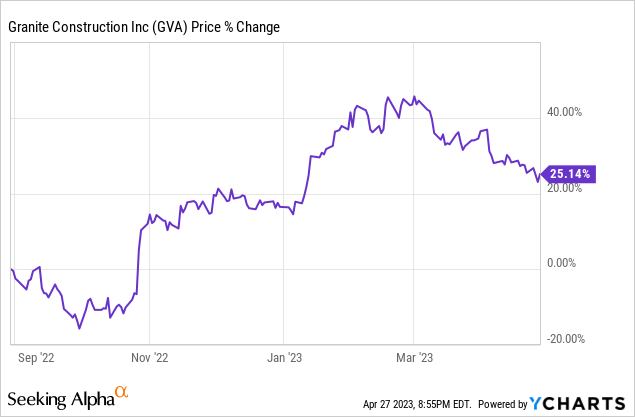

I last wrote about this in August 2022 regarding the top pick in Long View Capital’s Infrastructure Portfolio, Granite Construction (GVA). Since then, Granite and several others in that top group have had a nice run off this first wave of state spending.

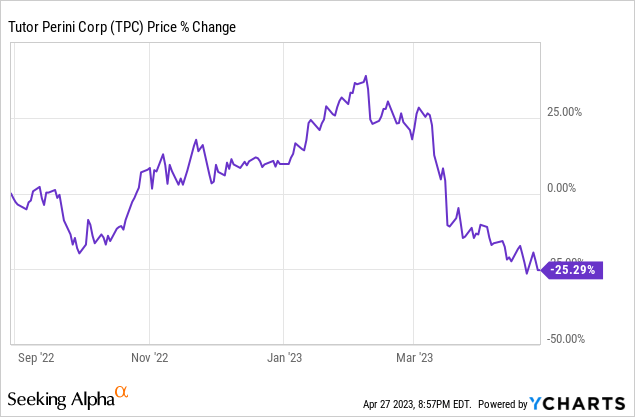

Another of the top picks in infrastructure is Tutor Perini (NYSE:TPC). They have gone the opposite way since then.

Tutor is in the same business as Granite, but you would never know it from those charts. Tutor Perini is worth more dead than alive, so let’s start there.

Worth More Dead Than Alive

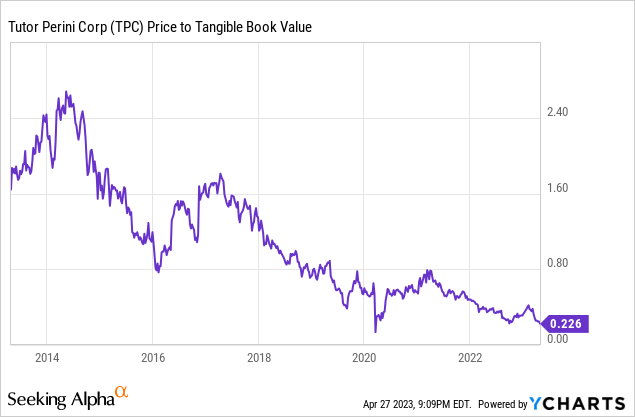

Tutor is trading at less than a quarter of its tangible book value, though that has changed a little since the December report, and I’ll get to that in a moment. I have a much more conservative calculation that excludes all non-current assets I call “liquidation value,” and it is trading at 54% of that as I type this. Why is that?

So now we should talk about Tutor’s reputation in the business, because they have one. They like to bid on large, flashy projects with big price tags. They are known for aggressive bidding and charging for overages, and this usually works out for them, like a recent $222 million airport project win. They are disliked by competitors and subcontractors because of all this.

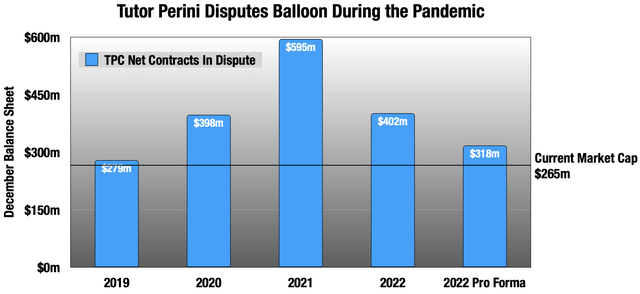

The construction business is much more professional than it once was, but it is still a little rough-and-tumble. Overage disputes are very common, but Tutor has raised it to sort of an art form, with special receivables accounting for it on their balance sheet. With all the delays induced by the pandemic, these disputes ballooned in 2020 and 2021, and pushed these tactics to their limits.

TPC annual reports

They spent a lot of 2022 cleaning this up, and taking a lot of non-cash charges. You will notice the column to the right, “2022 Pro Forma”. This is the December balance sheet modified for a recent judgement that went against Tutor and a $84 million charge with it. So you understand how convoluted these things are, this was a dispute regarding a project that completed in 2018. This was a NY/NJ Port Authority mixed use bus station renovation, but Tutor’s contract was with an LLC set up by the Port Authority for the project. The LLC declared bankruptcy in 2019 to get out of the dispute (it’s why they have the LLC legal structure in the first place). The triggering event for the $84 million charge was Tutor’s loss on appeal that their bankruptcy claim should be treated as a secured claim. $29 million will be treated as a secured claim, and the front of the line for recovery in liquidation, but the rest will likely never get recovered, and thus the charge.

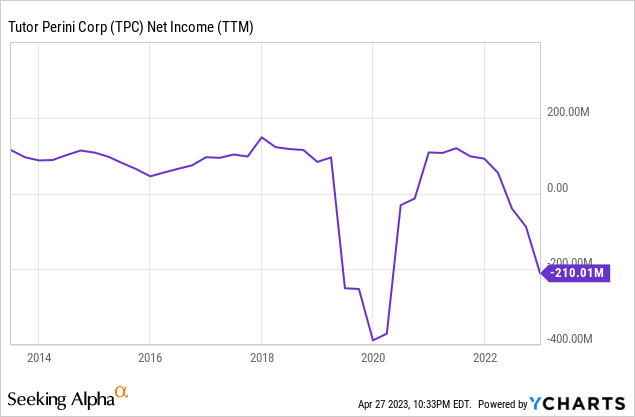

So it’s that big blob of disputed claims, still in excess of market cap after this charge, with very uncertain outcomes that has driven Tutor’s price down. It already destroyed the 2022 operating statement, and there are fears it may be coming for 2023 now.

(Tutor had record positive cash flow in 2022 of $207 million, as all of the negative net income was non-cash charges.)

Tutor had been projecting a small profit in 2023, weighted towards the back of the year, and this may have wiped that out. Is there more coming?

It has gone so far that even if they get $0 recovered on net and take another $318 million in charges, they would still be trading at 43% of tangible book value.

They are worth more dead than alive. But they are alive, and there are a host of opportunities in front of them.

Opportunities

Tutor and Granite overlap a lot, but there are important differences. Tutor also has a large building segment, like the aforementioned bus station, and also a lot of flashy work on the Vegas strip. The other big way they differ is that Granite likes to bid on lots of small projects that turn around relatively quickly, while Tutor likes the big budget affairs.

But one thing they have in common is the range of opportunities on the horizon, even before the Federal money gets digested by the states. Because there were very few big projects bidding out in 2020-2022, Tutor’s backlog shrank significantly, by 30% since 2019, now at $7.9 billion. But there are an unusually large number of big projects that are in their wheelhouse bidding in 2023, together worth about $12 billion in contracts. That will likely accelerate in 2024 and 2025 as the states digest the 2022 and 2023 Federal grants, $480 billion for the two years. The 2022 grants are out, and the 2023 grants will go out beginning in October.

Puts and Takes

Infrastructure construction is a beat up business.

Transportation, power, waste/sewer, water, conservation/development (BEA)

The last infrastructure boom ended about 20 years ago, right when this data set from BEA begins. The US has underinvested in infrastructure for a couple of decades, and the companies in this group have really felt it, essentially missing out entirely on the longest bull market ever. But as we possibly move into recession, this group will now outperform from the hundreds of billions coming down the road, whether or not a recession comes. Many in the group are already on the move, like Granite.

But Tutor is an exception because of the troubles outlined. On the one hand, there remains headline risk. They are going to post negative net income in Q1 off this most recent charge, though I will be watching cash flow more closely. They may withdraw their profit guidance for 2023. There may be more non-cash charges coming, coupled with partial cash recoveries. Interest in them has waned significantly; only two analysts dialed into their most recent earnings call in March, neither from a big bank.

But the range of opportunities ahead of them this year and in the next 5-8 years is extraordinary. A recession will dampen some of the money coming from state coffers, but the Federal money will keep coming every year through 2026. Given Tutor’s market cap, I view them as a potential multibagger over several years.

A Final Warning

A final warning about the construction business generally, and this applies particularly to Tutor because of their penchant for large projects. The advantage of the Granite strategy of many small projects is that there is a relatively short cycle from bidding to payment on these things. There tends to be fewer long delays and cost overruns. But even for them, their quarterly financials are very noisy, with a lot of up and down that evens out over time. I prefer TTM metrics in the construction business to get a good sense of what is happening. But because of the large projects they work on, Tutor’s quarterly financials are particularly noisy. In general, it’s best not to focus too much on a single quarter, good or bad.

Read the full article here