Energy Transfer (NYSE:ET) announced a minimal increase in its dividend, to the tune of $0.0025 / quarter. That represents an approximately 1% increase in the company’s dividend. As we’ll see throughout this article, Energy Transfer is an interesting dichotomy between management that wants its own way and a market that disagrees, which will continue to put pressure on its shareholder returns.

Energy Transfer’s Punishment

Let’s go back in time. Before the early-2016 crude oil crash. Midstream stocks were having a great time. Interest rates were low and there weren’t a bunch of high-yield options to invest in. Midstream companies were viewed as a high-yield investment, but incredibly low-risk in an environment that has historically been quite volatile.

Additionally, their growth opportunities were endless. Shale oil was booming, and along with it, so too was U.S. exports and volumes. It was a big undertaking to build a pipeline, and these companies were building multi-decade incredibly tough to replace assets. The demand for their assets and equities was so high companies could use equity to grow.

Eventually the market soured. It pushed down equity prices making issuing equity to grow untenable. So what was cut first for these companies with capital obligations? Dividends. Income investors fled. Equity prices were pushed down substantially, the view of low risk investing was gone, and the companies were forced to change the model.

Energy Transfer, with some of the highest dividends and biggest growth plans, was punished much more than other companies. At one point, whether the company would survive was put into question. It’s since passed that, for now, but the company was punished for those prior decisions.

Energy Transfer Developments

So what’s the company doing now? It’s making the same decisions.

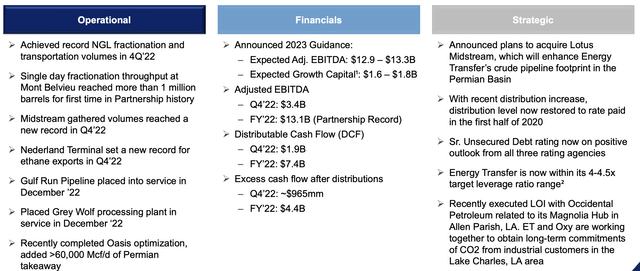

Energy Transfer Investor Presentation

The company has ramped up its growth capital to a 2023 expectation of $1.7 billion. That’s immense. The company’s DCF is expected to be $7.4 billion, so it can comfortably afford that growth capital. The company is at its target ratio of $40-45 billion in debt so it’s not committing to reducing that further and we instead expect it to commit to shareholder returns and capital spend.

However, once again the company is making some of the same mistakes:

- It’s keeping its debt high. That’s especially tough in a market with higher interest rates. With $40+ billion in debt a 2.5% move in the yield could have a 15% impact on FCF. With interest rates going from 0% to 5% over the past several years, that’s a massive risk.

- The company is spending on growth capital before fixing its balance sheet. Dividends are being raised. Growth capital continues to have high returns. There are numerous opportunities. However, especially when governments are pushing against fossil fuels, it’s a risky long-term strategy.

- Focus on what drives shareholder returns. If you have a 10% dividend yield, a higher dividend yield won’t drive more returns, companies are giving you a discount because they don’t see those returns as sustainable. Buy back shares to save on dividends, or reduce debt, both are more important.

Our View

Energy Transfer has management we’re not a fan of. The company is primarily owned by the Warren family, with a focus on dividends, and growth in the industry. The company has continued to generate massive cash flow for investors. However, times are changing, and the company isn’t adapting, which could hurt its long-term prospects.

Right now, the company’s 2023 guidance is for $7.4 billion in FCF. That’s an FCF yield of almost 20%. The company is paying just over half of that as dividends. For now it’s holding onto cash, it’s said that its debt levels are near where it expects and we don’t expect that to change as the company’s growth capital increases EBITDA.

We’d like to see the company focus on share repurchases and diversifying its growth capital to alternative energy sources. In the meantime however, we still recommend investing in the company given its dividend yield and ability to continue driving shareholder returns. Investors can keep their dividend and invest that in numerous opportunities.

Thesis Risk

The largest risk to our thesis here is management. As discussed above, even with our view of downsides, the company has strong cash flow. Incredibly strong cash flow. Management, however, has a history of poor investments that we expect will continue. We expect that that could lead to poor shareholder returns.

Conclusion

Energy Transfer has a management team we don’t like. The company’s focus on another mediocre dividend increase, despite its overall impressive dividend, and its aversion to reducing its debt highlight this. The strong long-term insider ownership supports dividend over anything else. The company was burned by the same thing before.

It doesn’t matter if one thing (growth capital) for example generates the theoretical highest returns if your investors disagree and hurt your future investment opportunities. We recommend investing in Energy Transfer stock for its ability to continue driving returns, however, we also recommend staying cautious and being patient.

Read the full article here