Introduction

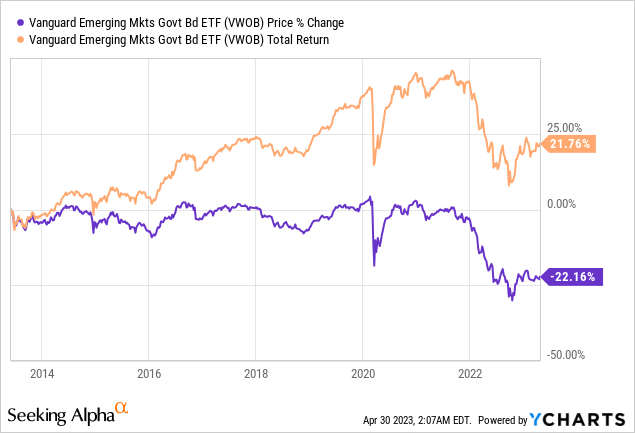

Prices of emerging market bonds have fallen significantly since the beginning of 2022. Is 2023 a good time to own emerging market bonds? In this article, we will analyze Vanguard Emerging Markets Government Bond Index Fund ETF Shares (NASDAQ:VWOB) and provide our recommendation.

ETF Overview

VWOB invests in government bonds in the emerging markets. The fund consists of a combination of investment grade and non-investment grade government bonds. As the Federal Reserve’s rate hike cycle gradually comes to an end in the first half of 2023, liquidity risks in these emerging markets have been reduced. However, the global economy may head for a recession in the second half of 2023. This may cause the prices of emerging market bonds to drop significantly. Therefore, we recommend investors to wait on the sidelines or own U.S. treasury funds instead.

YCharts

ETF Analysis

VWOB underperformed U.S. treasuries since 2022

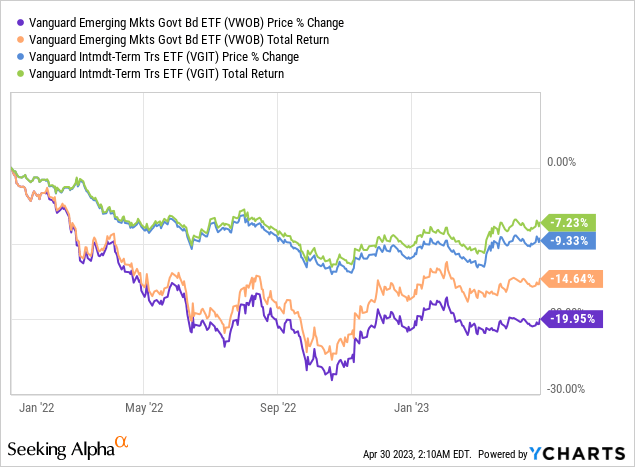

Emerging market bonds have not performed well last year. VWOB is not without exception. In fact, VWOB has delivered a negative total return of 14.6% since the beginning of 2022. As can be seen from the chart below, VWOB’s total return of negative 14.6% was much lower than the negative 7.2% total return of Vanguard Intermediate-Term Treasury ETF (VGIT). This difference is primarily due to the Federal Reserve’s aggressive rate hike last year. The aggressive rate hike has resulted in a strong U.S. dollar last year. As a result, many money flow out of these emerging market bonds back to the U.S. Therefore, emerging markets bonds have generally underperformed as they suffered from both liquidity issue and rate increase.

YCharts

Credit quality is a concern, but fortunately the Federal Reserve’s rate hike cycle is likely coming to an end

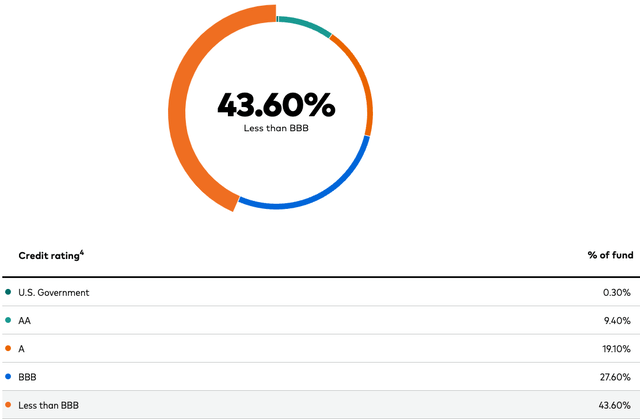

VWOB not only invests in investment-grade government bonds, it also invests in non-investment grade government bonds. As can be seen from the chart below, bonds with credit ratings less than BBB represent 43.6% of its total portfolio. These bonds include emerging countries that have a past history of credit defaults. For examples, Argentina, which represent about 2% of VWOB’s portfolio have had credit defaults in the past. Turkey, which represent about 7.2% of VWOB’s portfolio is also at risk as the country faces extremely high inflation that is currently well above 50%.

Vanguard Website

Fortunately, the Federal Reserve’s aggressive rate hike is likely coming to an end. We expect one or two more rate hikes of 25 basis points each in the next few months. This means that the strong U.S. dollar we have experienced in 2022 is likely coming to an end very soon. As the U.S. dollar weakens, liquidity pressure will be alleviated, and the risk of defaulting will likely be reduced.

A negative spike is likely to occur especially if a global recession occurs

Does this mean that this is a good time to own VWOB? We don’t think so. Here is our reason. We believe last year’s aggressive rate hikes by the Federal Reserves and most central banks in the world will eventually trigger a global recession. This has not yet happened because it normally takes 6~12 months for the monetary policy to see its effect on the broader economy. Therefore, we expect a recession to occur in the second half of 2023 or perhaps in early 2024. In an economic recession, the equity market will almost always decline. In the bond market, bonds with poor credit ratings will also experience significant decline.

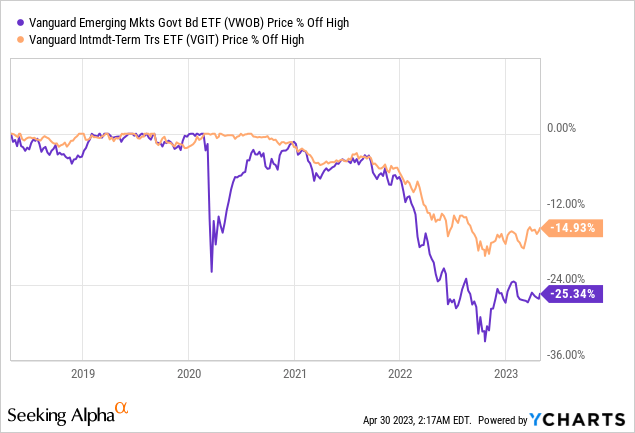

We can observe this from past history. As the chart below shows, VWOB’s fund price suffers a decline over 20% in the recession triggered by the pandemic in 2020. This is because non-investment grade bonds are considered as risky assets. Even less risky investment grade bonds suffer some losses as well. As the economy heads to a recession, the best type of bond to own is actually the U.S. treasury. This is because U.S. treasury is often considered as a risk-free asset. As can be seen from the chart below, U.S. treasury bond such as VGIT suffered no loss at all during the 2020 recession. Therefore, we think investors should consider owning U.S. treasury funds such as VGIT instead of VWOB.

YCharts

Investor Takeaway

As we have discussed in our article, we do not think VWOB is a good fund to own right now. As the economy eventually heads for a recession, investors should consider owning U.S. treasury funds instead as they provide better downside protection than emerging market bonds.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Read the full article here