Overview

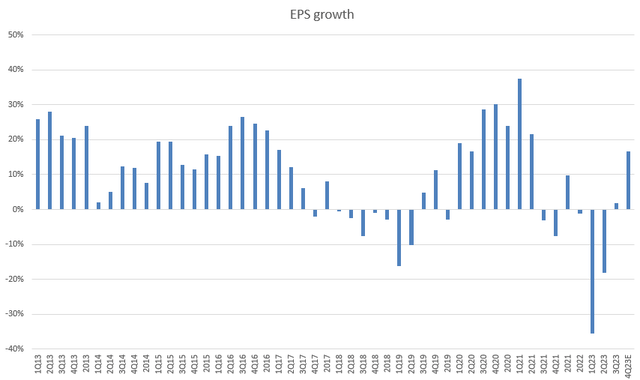

My recommendation for Equifax (NYSE:EFX) is a hold rating as there is a lot of uncertainty in the near term (4Q23), which makes me stay on the sidelines and await a clearer outlook for the business. Note that I previously rated a hold rating for EFX due to my pessimism about the business’s ability to grow 4Q23 EPS by more than 30%, especially given the headwinds the business is facing and its historical EPS performance.

Recent results & updates

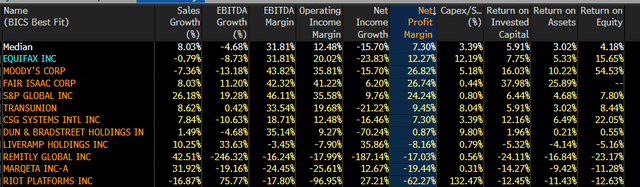

EFX reported 3Q23 revenue growth of 6% to $1.32 billion, 80bps below consensus growth forecast of 6.8%. The revenue experienced a growth of 6.5% on an FX neutral basis, which was slightly lower than the midpoint of the management’s projected growth of 7%. Regarding the various segments, the revenue of US Information Solutions experienced a growth of 7%. This growth can be attributed to an increase of 11% in Online Information Systems. However, there was a decline of 15% in Mortgage Solutions and a decline of 1% in Financial Marketing Services. The international revenue experienced a 12% year-on-year organic growth, comprising a 2% increase in Asia Pacific, a 2% decrease in Europe, a substantial 62% growth in Latin America, and a stable performance in Canada. Regarding Equifax Workforce Solutions, the company experienced a 3% increase in revenue. This growth can be attributed to a 1% rise in Verification Services and a notable 13% expansion in Employer Services. Non-mortgage revenue as a whole increased by 7% y/y CC. The profit lines were negatively impacted due to a revenue performance that fell short of expectations, resulting in disappointment. The expansion of EBITDA margins by 60 basis points to 33.1% can be attributed to the cost savings resulting from the implementation of the cloud spending reduction plan in 2023, as well as the margin expansion in EWS. However, it is important to note that this figure falls short of the consensus estimate of 33.6%. This deviation is primarily due to the negative impact of declining mortgage margins on overall profitability. EPS also came in modestly below consensus of $1.78.

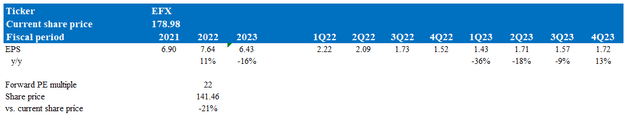

As anticipated, the challenge of achieving the previous fiscal year guidance remains formidable, prompting management to revise the guidance once more. This time, the reduction is more substantial, amounting to -$45 million, resulting in a revised range of $5.25 – $5.26 billion, compared to the previous range of $5.27 – $5.33 billion. Similarly, the EPS guidance has been adjusted from $6.85-7.10 to $6.62-6.72. The revision of organic growth guidance for revenue was substantial, with a decrease from the initial range of 2.5% – 3.7% to a range of 1% – 1.5%. This revision represents a significant adjustment of almost 200 basis points. Management has also indicated that the projected revenue for the fourth quarter is estimated to be between $1.3 billion and $1.32 billion, while the projected EPS range from $1.72 to $1.82. These figures suggest a 17% growth in EPS at the midpoint of the range. Now, this is a much more realistic growth target when compared to history.

Author’s valuation model

I believe revision in expectation is the right thing to do, but this is not enough to convince me that the business and stock will be able to achieve it. The performance of EFX in the third quarter of 2023 indicates a potentially unfavorable outlook characterized by a significant level of uncertainty. For instance, the revenue generated from mortgages in the United States, accounting for 19% of the overall revenue, experienced an 8% year-on-year decline in the third quarter. I expect this trend will further deteriorate in the upcoming quarter(s), as management has projected a 34% decrease in mortgage inquiries within the industry for the year 2023. It should be noted that the current revision represents a downward adjustment of 300 basis points from the previously projected negative 31% expectations. This significant decrease in expectations reflects a highly pessimistic outlook, in my opinion.

A further headwind for EFX is the fact that mortgage originators within EWS are in-sourcing manual verifications, which are more expensive and have a smaller margin at EFX than instant verifications. Importantly, the business is currently experiencing credit origination challenges in the subprime auto sector amid a period of increasing interest rates. While management has asserted that increased rates have not had a significant impact on prime and near-prime auto and card origination volumes, it is important to acknowledge the potential risk that higher rates could eventually exert downward pressure on these volumes.

Therefore, it is my belief that the level of uncertainty in the near term remains significantly elevated, and there exists a considerable probability for interest rates to continue their upward trajectory. This, in turn, will have a further effect on EFX. I would not be surprised if EFX fails to meet the revision guidance, which will likely send the stock down even further.

Valuation and risk

Author’s valuation model

According to my model, EFX is valued at $159, representing a 11% decrease. This target price is based on my EPS assumption of $1.72, which is the low end of management guidance. As I mentioned above, the elevated uncertainty in the near term makes it hard to forecast what is going to happen in 4Q23. There is a good chance for EPS performance to be worse than guided, but I am using the management-guided range as a benchmark.

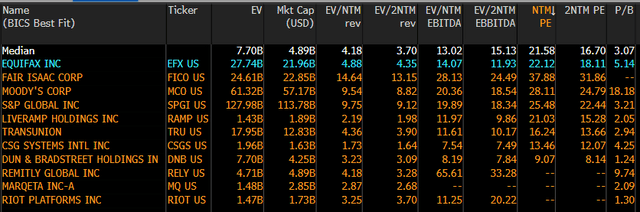

EFX is now trading at 22x forward earnings, which is a modest premium to peers’ valuation of 21.5x forward earnings. I note that the downward valuation rerating was due to the peer multiples rerating downward as well. If EFX manages to meet guidance, I expect this multiple to stay flat in the near term; however, any miss in guidance should send valuation rerating further downwards.

Bloomberg

Bloomberg

Summary

I am maintaining a hold rating for EFX, primarily due to heightened uncertainty in the near term, particularly in 4Q23. EFX’s outlook is further clouded by the substantial decline in mortgage revenue and the risk of rising interest rates impacting the subprime auto sector. There is considerable doubt about whether EFX can even achieve the revised guidance. The high degree of uncertainty complicates forecasting, making it challenging to predict 4Q23 results. Failure to meet guidance could lead to further valuation downgrades.

Read the full article here