Written by Nick Ackerman, co-produced by Stanford Chemist.

Columbia Seligman Premium Technology Growth Fund (NYSE:STK) has been having a solid year of performance in rebounding after it faced the 2022 tech-driven sell-off. The fund’s share price started to get out ahead of the actual NAV performance; this has more recently changed as market volatility has started to pick up more recently.

This provides a more attractive entry level for the fund, but patient investors may wait for a discount to appear. That’s why it remains a ‘Hold’ today. We last touched on STK in 2020, and I felt like it was a hold at that time, too, due to the premium. It coincidentally traded around the same premium as it does now. A discount doesn’t happen often, but it has happened historically. The fund is worth revisiting today for those who are already holding a position.

The Basics

- 1-Year Z-score: -1.69.

- Discount/Premium: +2.02%.

- Distribution Yield: 6.79%.

- Expense Ratio: 1.13%.

- Leverage: N/A.

- Managed Assets: $440.26 million.

- Structure: Perpetual.

STK’s investment objective is to “target long-term capital appreciation and current income.” To achieve this, they will invest in a “portfolio of technology stocks” while also incorporating an “option overlay strategy designed to mitigate downside volatility and generate income.”

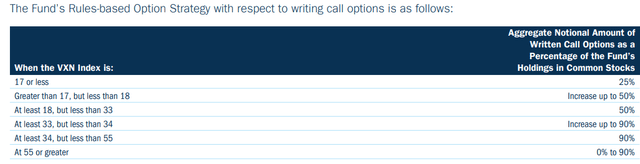

The fund’s options writing strategy generally focuses on writing calls against the NASDAQ 100 Index or its ETF equivalent at a 25 to 90% overwrite. This flexibility allows them to be more or less defensive, given the environment.

That being said, it is a rules-based approach and not an entirely actively managed part of their strategy, as is the case with some of their peers. The options strategy allocation involves where the CBOE NASDAQ-100 Volatility Index is trading. Higher volatility means they’ll get more defensive, and lower volatility means a lower sleeve will be overwritten.

STK Rules-Based Options (Columbia Threadneedle)

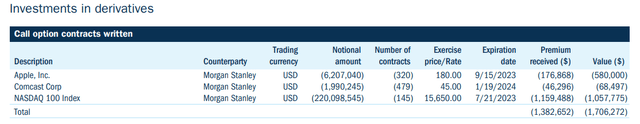

Additionally, in their last semi-annual report, it looks like they had also been writing covered calls. This was to a much small extent.

STK Options Written (Columbia Threadneedle)

Performance – Premium Cools Off

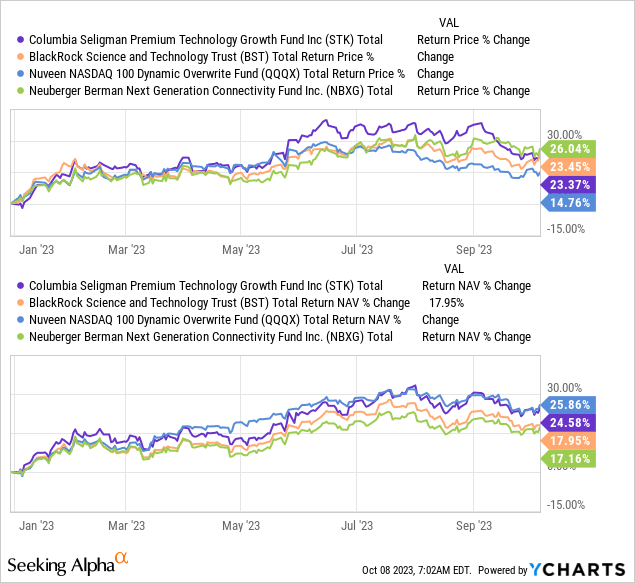

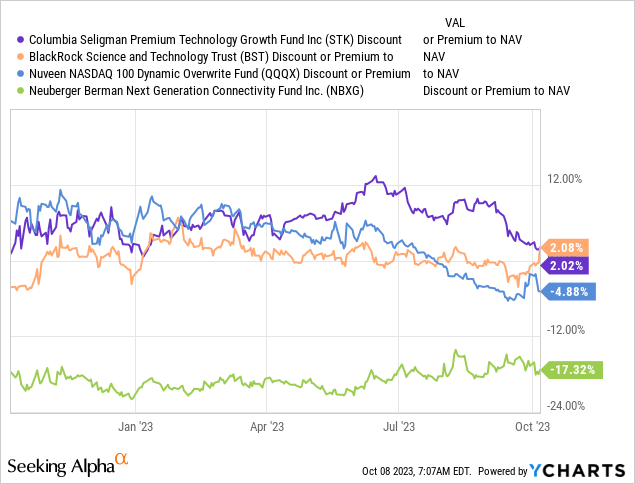

Some appropriate comparisons could be the BlackRock Science and Technology Trust (BST), Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX) and Neuberger Berman Next Generation Connectivity Fund (NBXG). These are funds that are mostly tilted towards larger-cap holdings and also implement a call-writing options strategy to generate premiums and dampen volatility a touch.

As tech has been recovering meaningfully this year, all of these funds have been enjoying some strong gains. STK is the second-best performing on a total NAV return basis YTD.

YCharts

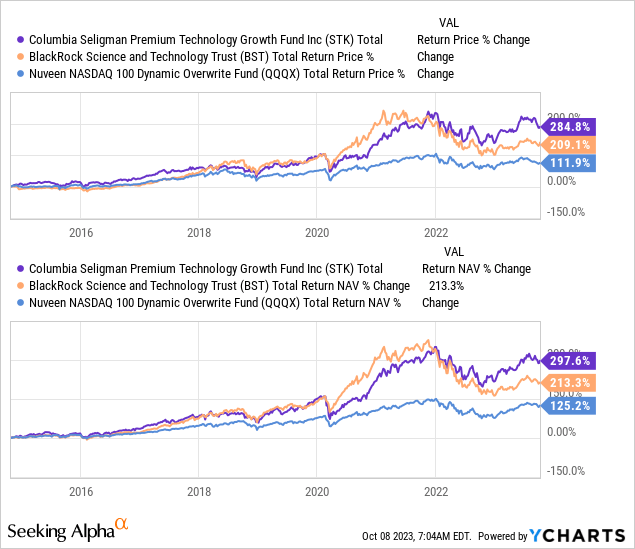

NBXG launched in mid-2021, so if we drop that fund, we can look at a comparison over the longer term. In this case, STK has come out ahead as it took over the lead from BST. BST performed exceptionally well coming out of 2020 as they shifted more towards speculative growth names and shifted a bit away from the large-cap focus. That eventually came back to bite them, as those are the exact names that took the heaviest hits through 2022. In this case, both STK and BST had beaten out QQQX by a significant margin.

YCharts

My main point to bring up the difference in performance here isn’t that STK is going to keep winning going forward but to make a point that diversification matters. Even within the tech space with comparable funds, they aren’t necessarily going to perform exactly the same. There will be overlap, but as the performance shows us, they aren’t going to be exactly the same. We don’t know which fund will perform best in any given period, so taking a more diversified approach can be beneficial.

For an investor who is looking to outperform the market or whatever benchmark they are chasing, that often means diversification isn’t a good thing to have, as it leads to reasonable returns but not outperformance. However, you probably wouldn’t be looking at call-writing funds in the first place, so these are certainly more geared toward income investors who might want a little side of growth potential.

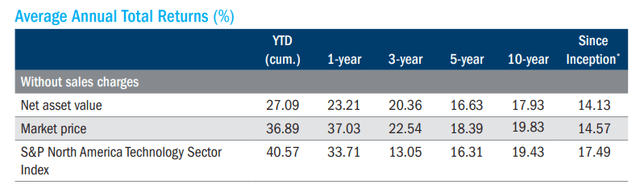

This can be highlighted in the longer term, where, on an annualized basis, STK has provided lower returns than its non-call-writing benchmark. When a fund is writing calls, it can cap the upside potential in a strong bull market. Of course, portfolio positioning will have played a role in this outcome, as well as having an expense ratio. These were still fairly solid returns if compared to the broader market. This is through the period ending June 30, 2023.

STK Annualized Results (Columbia Threadneedle)

At this point in time, NBXG actually offers the best discount on an absolute basis.

YCharts

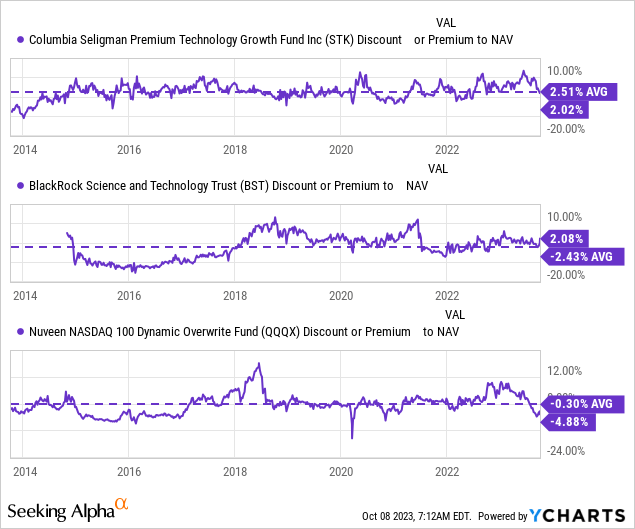

However, in terms of historical levels, on a relative basis, the winners here would be STK and QQQX, as they are trading below their historical averages. That’s what makes STK an interesting choice at this time, at least for investors who might want to look to start an initial position.

This lower valuation is coming after STK recently touched its all-time high premium. So, if you believe that momentum will bring it lower, then being patient here or accepting that you may get an opportunity to average down would be a good approach.

YCharts

Distribution – Ideal Policy?

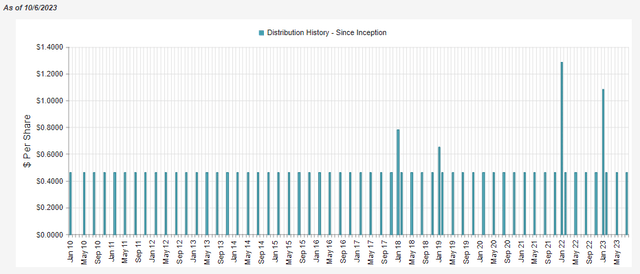

STK appears to have a fairly ideal distribution policy, and it is one that more funds should probably start to put into place as we move into an uncertain environment. Higher payouts are fun, but not when they aren’t sustainable long term, and they have to turn around and be cut.

Investors never remember the raises, but they most definitely remember cuts!

STK appears to have provided a stable quarterly distribution rate, and when the market really takes off in their sector, they provide substantial special distributions. These large year-end distributions are often required due to being regulated investment companies (“RICs”), as RICs are required to pay out the majority of their earnings to investors or pay excise taxes.

STK Distribution History (CEFConnect)

The steady distribution plays perfectly into the mentality of most income investors; at a current annualized NAV distribution rate of 6.92%, they aren’t looking at an excessive or unsustainable rate. Though, due to the fund’s slight premium, it does mean that the actual distribution yield for shareholders is a touch less at 6.79%.

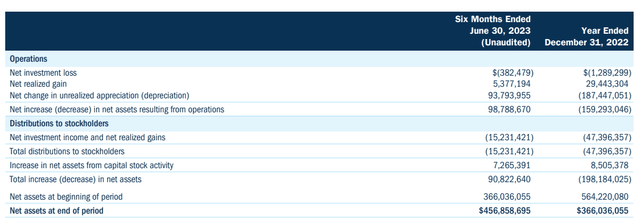

At the end of the day, however, STK is still an equity-focused fund and will rely heavily on capital gains to fund its distribution. In fact, as is the case with most tech-oriented funds, the fund will rely entirely on capital gains to fund the distribution as they have a net investment loss instead of a net investment income.

STK Semi-Annual Report (Columbia Threadneedle)

NII is simply dividends and interest received minus expenses the fund pays. The fund receives very little in the way of dividends as it is holding growth investments that have better uses for cash rather than paying it to shareholders. Thus, reinvesting in their businesses potentially provides a better chance at share price appreciation and gains that STK can realize to pay out to investors.

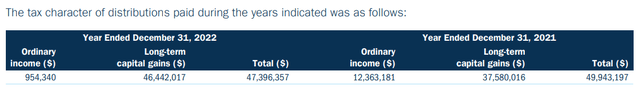

For tax purposes, the fund has mostly followed along similarly as being classified largely as long-term capital gains. However, some ordinary income shows up as well.

STK Distribution Tax Classifications (Columbia Threadneedle)

STK’s Portfolio

STK has run a pretty boring portfolio for the last couple of years. The portfolio turnover rate, as of their last six-month report, came in at only 7%. That’s actually running at a trend higher than last year, where the turnover came to 9% for the entirety of the twelve-month period. Though in prior years, such as 2020, we saw turnover ramp up to come in at 32%.

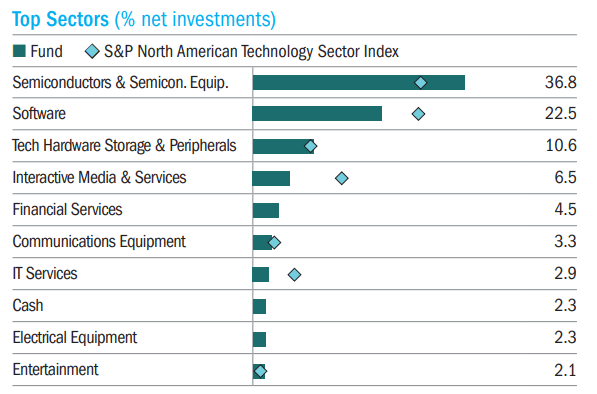

The fund was last positioned where they were overweight in semiconductors and underweight in software and interactive media relative to its benchmark. We saw in the above performance this led to a fairly sharp departure from the benchmark performance on a YTD basis.

STK Top Sector Allocation (Columbia Threadneedle)

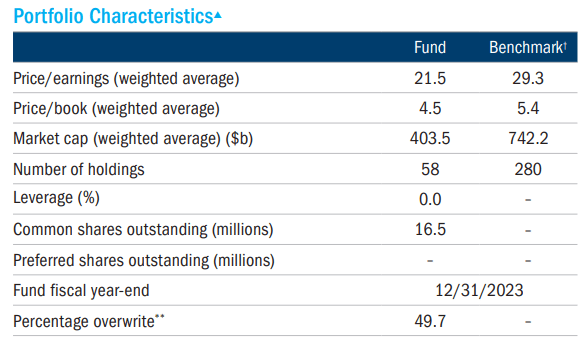

That being said, STK is also positioned with a more ‘value-oriented’ growth approach. It’s a bit of an oxymoron, but in terms of P/E and P/B, we are seeing that the fund is positioned in relatively cheaper investments compared to its benchmark. Notably, the fund is also investing in companies with relatively lower market caps but are still massive companies nonetheless.

STK Portfolio Stats (Columbia Threadneedle)

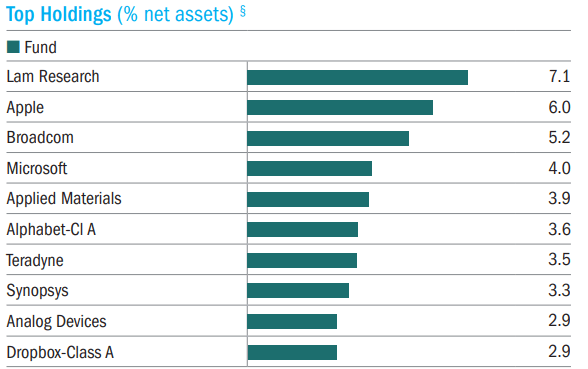

The fund also holds a relatively narrow basket of investments compared to its benchmark. The largest of these is Lam Research (LRCX), a semiconductor materials and equipment company. They don’t make the chips; they make the equipment that is sent to companies that make the chips.

STK Top Ten Holdings (Columbia Threadneedle)

I have not covered STK since July 2020. However, at that time, they were overweight semiconductors as well relative to their benchmark but in line with software weighting. So, the overweight semiconductor sector has remained, and that’s probably helped by the fact that they had been holding LRCX as the largest position for over three years.

That also includes holding Broadcom (AVGO) as the fund’s third-largest position as it is now, too. AVGO is a semiconductor company as well. As is Teradyne (TER) and Applied Materials (AMAT). TER was a portfolio position three years ago, but AMAT not being a top position. Instead, three years ago, Marvell Technology (MRVL) and Micron (MU) were top ten holdings from the semiconductor industry. MRVL is still a holding but at a smaller weighting, while MU has been removed from the portfolio

Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOG) (GOOGL) were included as top ten positions as well previously as they are now. These are more of your standard tech holdings that are seemingly required to be included in any tech-related fund.

Conclusion

STK’s premium has come down from its all-time high levels as volatility has moved back into the markets. This creates an opportunity for an investor to potentially initiate a position. However, more patient investors may wait for an even better entry at a discount – while rare, it happens occasionally. If volatility continues higher, the likelihood of that occurring could also increase as well.

Read the full article here