The 10-year (US10Y) broke through 5% yield today, and it is making a lot of headlines. I was almost finished with this article about a long position in the iShares 7-10 Year Treasury Bond ETF (NASDAQ:IEF) and decided to finish it on the news. IEF is an exchange-traded fund, or ETF, that aims to track the investment results of the ICE® U.S. Treasury 7-10 Year Bond Index. As an ETF, it is a convenient and easy way for many people to trade for 10 years. The fund tends to maintain an effective duration of only 7.4 years. The shorter a strategy’s duration, the less sensitive it is to interest rates. A duration of around 7 means the fund should gain 7 if interest rates drop by 1% and the other way around.

I’ve been short bonds through IEF and iShares 20+ Year Treasury Bond ETF (TLT) for quite a while. I don’t write about it very often, and the latest public write-up goes back over a year. I’m actually still short both. It may seem peculiar that I’m writing in favor of IEF here, but there are a few reasons for that: 1) I’ve been shrinking my IEF short through the month and plan to close and reverse it if yields continue upwards; 2) I’ve been shrinking my TLT short as well though more slowly; 3) My short positions are financing long positions and I’d actually pay more in carry if I don’t sell long positions.

If you ask me, Fed Chair Powell has been nothing if not consistent. This whole tightening cycle he has said he’s going to raise and keep them up there until inflation is at 2%. Well, inflation isn’t at 2% yet. There is a lot of discussion about whether the economy is slowing down or not. However, there has been discussion all the way and it hasn’t slowed down.

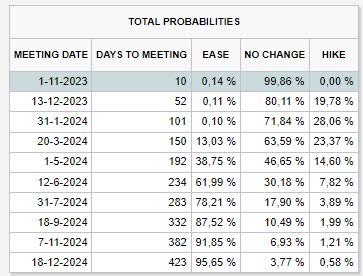

According to the CME watch tool, the Fed is almost surely going to keep rates as they are on 1-11-2023 and until the end of the year. It is hard for me to see the Fed ease before the end of the year until something really disastrous happens. We’ve already seen big bank earnings, and they weren’t disastrous. If banks aren’t blowing up, I’m unsure what could change the Fed’s course so quickly. Geopolitics seem unlikely to change the Fed’s course before the end of the year although it’s not impossible. The market seems to anticipate the Fed easing near the start or middle of 2024 already.

probability distribution CME rates tool (CME Fedwatch tool)

CME FedWatch Tool – CME Group.

However, the main reason I don’t want to short bonds anymore and see interesting positions that are tilted long is because we’ve arrived at much higher levels of yield now.

Today, we broke 5%. The fee of IEF is de minimus at 0.07%. But to short this ETF, I’m now paying up 5%. I’m on the hook for monthly payments of around $0.24 per share.

I can see the current trend continues. The IEF short has a lot of momentum, and more and more people are seeing yields rise even further, to levels that nobody would have believed two years ago. I’m not saying this isn’t possible.

If I take everything together, I’m just not so convinced anymore this is an asymmetric bet at all. What I did notice is that the expected volatility in bonds is fairly high.

A relatively straightforward and simple position to take advantage of A) decent yields of around 5%, B) decent expected volatility, and C) low probability of near-term easing, is to do a buy-write on the IEF. You can write IEF calls to December 15th at $1.33 per call. That’s effectively a 1.48% return with IEF at $89.47 per share. Meanwhile, you can expect one dividend of $0.24 until the 15th. I would say the expected yield on IEF is likely around 4.5% or so for a year. The expected annualized return is a bit higher in the near term, but the CME tool is heavily weighted towards easing later in 2024.

covered call option payoff (optionstrat)

To estimate the return of the above position, I assumed 50 days of generating a ~4.5% annualized return. I also assumed the call would expire worthless. In practice, things are likely to be a bit different. But if things go according to plan, this translates into a 2% return over ~50 days, or less than 2 months. Annualized, that’s a return of ~15%. That’s the best-case scenario, though. If IEF shoots up (rates unexpectedly fall a lot), you’re protected by the underlying. But you’re not participating in that upside, except for the premium and the yield. If IEF drops (rates continue to trend upwards), losses stem from the yield and the premium of the call sold. The position is at its worst when rates shoot up. But it would be less bad than a simple long bond position.

Read the full article here