Main Thesis / Background

The purpose of this article is to give my opinion on the current market environment, with a specific focus on some of the warning signs that I see brewing beneath the surface. On a macro-level, the US economy and jobs market has been resilient. This is good news and explains (and justifies) the strength we have seen in US equities. But my concerns going forward is that we are ripe for a bit of a correction – for a number of reasons – and investors do not appear to be pricing this in.

This is not related specifically to any one event. While developments in the Middle East have me very concerned, that is less as an investor and more as a humanitarian. With respect to equities, I think investors, analysts, and economists are simply too optimistic on what the forward environment is going to look like.

This has led to a decline in volatility, lots of corporate earnings upgrades, and expectations around interest rates in 2024. For the most part the market is predicting some favorable scenarios – and that drives my worry. I prefer to buy during times of turmoil and/or when everyone else is worried. By contrast, when I see too much optimism, I get cautious, and that precisely what I am witnessing now.

Volatility Has Been Low All Year

My first topic may seem a bit odd. It focuses on volatility, or lack thereof. This may strike readers as a positive. After all – who doesn’t like a calm market that rises consistently? I do – along with most people I would presume!

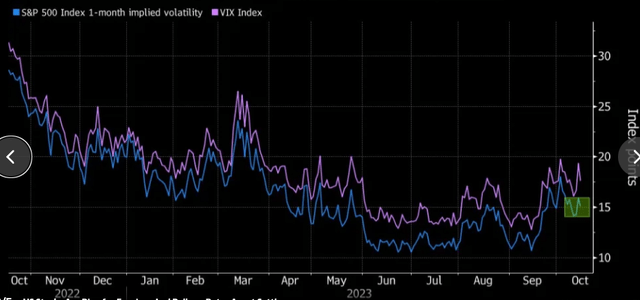

But the problem arises because markets do not stay calm forever. The last few years have taught even the most novice investor that. While we have seen a few upticks in volatility in 2023, levels are much lower than last year and have declined recently:

Volatility Index (S&P 500) (Bloomberg)

Again, this is “good” for the most part, but only as long as it lasts. That isn’t meant to be facetious but to suggest that higher levels of volatility are inevitable as a fact of life. And the currently low volatility environment poses risks going forward. It suggests a level of complacency that could react (or overreact) to any bad news in the days/weeks ahead.

For this reason alone I think it makes sense for investors to be cautious here. I am reluctant to add to my core positions in the major US indices unless there is a down day. Similarly, I continue to build on my defensive positions, including Utilities, Energy, and cash.

**I own the Vanguard S&P 500 (VOO), the SPDR Dow Jones Industrial Average ETF Trust (DIA), and the Invesco QQQ (QQQ). I will add to these funds on any down days or sell-offs. I have been, and will continue, to add to my positions in the Vanguard Utilities ETF (VPU) and the Vanguard Energy ETF (VDE).

Consumers Have To Get Used To An Old Normal

The next attribute has to do with the pinch on the US consumer. Households are certainly feeling the double-strain from both rising interest rates and inflation. The good news is the backstory is not too problematic because wages have been rising and unemployment has been low. This has allowed many families to stay ahead of the curve, supporting retail/consumer sectors.

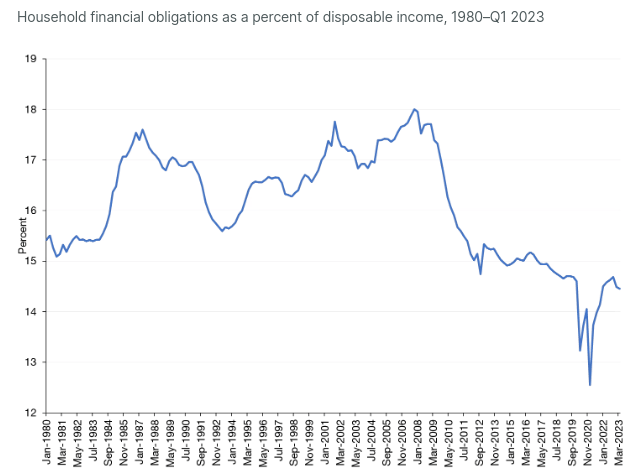

But the story isn’t all rosy. Household financial obligations are on the rise, there is no getting around it. And while obligations are lower than they are pre-Covid, we see that the strain on disposable income is clear:

Household Financial Obligations (As a % of Disposable Income) (St. Louis Fed)

Again, this isn’t meant to be alarmist. The employment story is fairly stable here at home and across much of the developed world. But we have to remember that this is a lagging indicator that is probably going to reflect further consumer challenges in the new year. New loans will be at the higher (prevailing) rates, so the cost of credit is only going to be higher in the short-term.

What I take away from this is that Americans had a bit of a reprieve from the pandemic due to lower prices, stimulus, and lower interest rates. But this was an anomaly – not the norm. While financial obligations are low on a historical basis, they are higher than they have been in the past few years. This means households are probably feeling the pain more than they would have in years past, and that is probably going to put a dent in consumer spending in the months ahead as people adjust.

Economists Think Rates Will Move Lower In 2024

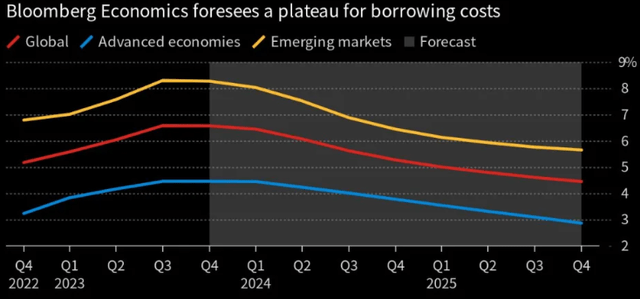

The next topic is the elephant in the world: interest rates. This has been a thorn in the side of investors in the past two years and the hope of many investors is that this will change in 2024. While it may just be wishful thinking, the consensus at this moment is clear – it is almost unanimous that the world will see interest rates decline over the next twelve months:

Interest Rate Expectations (Bloomberg)

To be fair, this very well could be the case. But in my view, that is a big “if”. The truth of it is that nobody knows for sure what the interest rate environment will be next year and I would rather plan for the worst – or at least more of the same – rather than banking on a sharp decline in domestic rates in 2024.

This touches on my concern. The market seems to be preparing itself for a lower rate world – not just in the USA – in 2024. And we should all know how wrong “the market” has been with respect to interest rates in the current calendar year. So why would I put a lot of trust in estimates for 2024 given this track record? Short answer: I wouldn’t.

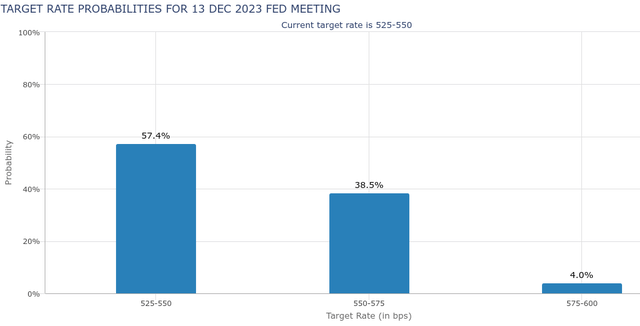

This is central to the title of this review and supports my general view of caution. The market is gearing up for a more favorable, lower rate year in 2024. If that doesn’t occur, I fear there could be a sharp, negative reaction. And the fact is the Fed has not yet signaled it is going to cut rates any time soon. Furthermore, futures data suggests an interest rate hike by year-end:

CME FedWatch Tool (CME Group)

This is where I diverge with the market for 2024. I don’t see a strong possibility of the Fed beginning to cut rates in early 2024 after putting in another hike in December – right before 2024 starts! It doesn’t make logical sense to me and I believe the forward outlook by many (with respect to interest rates) is too optimistic. With the S&P 500 moving inversely with yields, this is another focal point on why I am striking a cautionary tone.

Earnings Anticipated To Be Very Strong

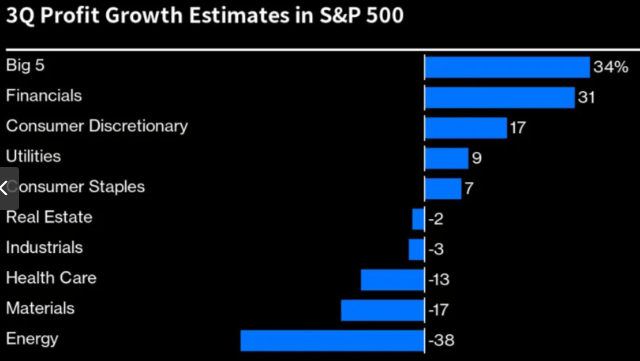

Another thing to keep in mind is that analysts are keeping stock prices elevated because they believe corporate earnings and profits are going to keep driving higher. This means that even though P/E ratios seem lofty, investors are banking on a higher “E” to bring down the ratio in the months ahead. For perspective, consider how optimistic investors are regarding a handful of sectors, especially big Tech which dominates the S&P 500:

Q3 Earnings Estimates (YOY Growth) (Yahoo Finance)

This ties back to the general premise of my article here. Stock prices are up and investors are counting on rising earnings to justify it. Can this happen? Of course – and quite frankly I hope it does.

But the opposite scenario could also occur, that earnings do not live up to the hype. If we had seen a market correction or elevated volatility, I wouldn’t be concerned. But given rising markets and depressed volatility, I am concerned that an earnings disappointment will have an out-sized impact. That poses a risk in the short-term.

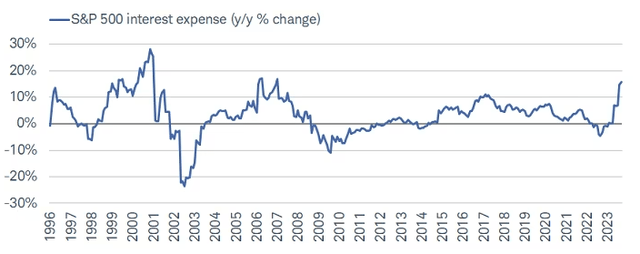

A key reason why I see analysts as being too generous with their forecasts is that interest rate expenses are not only pinching consumers, but businesses too. Interest expenses are on the rise and that is sure to put a dent in earnings, all other things being equal:

Interest Expense (S&P 500 average) (Charles Schwab)

The reason this is a headwind of note is that there could be an environment where higher interest expenses persist in to next year (as I discussed in the prior paragraph). That suggests earnings may be pressured now, and later.

How To Play It?

I am certainly one to advocate for locking in higher yields in this climate. Cash is paying a solid amount, and individual high grade bonds – from munis to corporates – offer some relative value. But there is also a good case for Energy and Utilities for diversification and for the defensive nature of both (Utilities given their stable revenue streams and Energy for its hedge against rising oil prices).

For those who want to take a more passive approach, there is some inherent value in the equal-weight S&P 500 index (as opposed to the more popular market cap index). The P/E for the index has been dropping swiftly and it is well below its 10-year average:

S&P P/E (equal-weight index) (Yahoo Finance)

This highlights a spot for investors who are worried with rising valuations in other corners of the market. This is personally a strategy I like to employ on a tactical basis. With equal-weight is under-priced, I buy, and vice-versa. I use the Invesco S&P 500 Equal Weight ETF (RSP) for this index, and suggest readers give it a look at this time.

Bottom-line

As stocks rise and analysts get blinded by potential good news, I take the opposite approach and get selective. I will let my positions in VOO and QQQ ride, and use this environment to be more tactical by adding to Utilities, Energy, Equal-weight, and cash.

I think there are enough headwinds that aren’t being fully counted that will have an impact on the major indices in the next few months. While I hope to be wrong, I am planning on being right, and I hope this review gives my followers some ideas on how to play any upcoming volatility and/or broader equity weakness.

Read the full article here