VOC Energy Trust (NYSE:VOC) is an energy-related firm in the business of managing oil and gas properties with the intention of distributing net profit interest to trust unitholders. Given the nature of this business, units aren’t necessarily meant to be actively traded or used to seek capital gains; but rather, it should be held as an income vehicle. Using a PV model and constant future distributions, we can value VOC units at $11.62/unit. I provide VOC a HOLD recommendation.

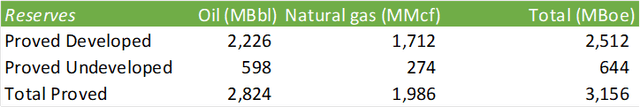

As of FY22, VOC’s assets include 81,095 gross acres located across Kansas and Texas with interests in 739 gross (454.6 net) producing wells. The trust is structured similar to a co-investment vehicle in which it has claims to 80% of production on assets with full intent to distribute profits net of expenses to trust unitholders. The duration of the trust is through the later of December 31, 2030, or the cumulative total production of 10.6mmBoe (8.5mmBoe attributable to the trust) and will result in the dissolution of units at the end of the term date. As of FY22, the trust has received payment for 6.5mmBoe, equivalent to 76% of the production duration. Reviewing their proved reserves as of FY22, the trust may be coming in short 944mBoe of the 10.6mmBoe target.

Corporate Reports

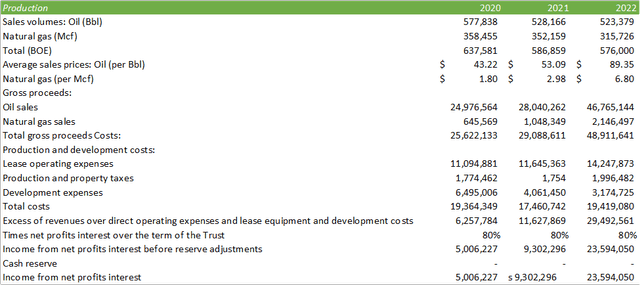

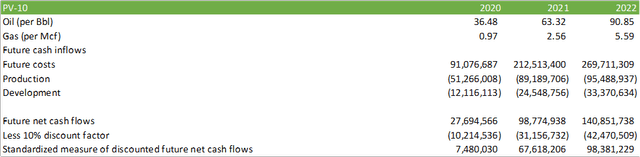

Owning units of this trust can be considered taking a long position in oil as cash distributions are dependent on the price of oil and natural gas at set terminal volumes. This means that net of lease and operating expenses, higher oil prices return more value to unitholders and vice versa.

Corporate Reports

In turn, higher oil prices will show greater value relating to future reserves.

Corporate Reports

Things to Take into Account Prior to Investment

The trust has a term date in which the trust will be dissolved and commence winding up of business at the later of December 31, 2030, or when production volumes reach 8.5mmBoe to the firm. There are some factors that may affect the dissolution of the trust prior to the term date, including if the trust sells the next profit interest, annual cash proceeds received by the trust attributable to the net profit interest are under $1mm for two consecutive years, a majority vote to dissolve the trust occurs, or a judicial dissolution of the trust occurs. Upon dissolution of the trust, VOC Energy Trust will sell the trust’s assets and distribute the net proceeds to unitholders.

The trust is set up in an amortizing fashion in which a portion of each distribution made is a return of capital and will be taxed more heavily in a taxable account. What this means is that between the cash distribution and the return of capital, the return of capital is categorized as taxable income by the IRS and may affect an investor’s reportable income if these units are held in a taxable account. Think of this like a co-invested closed-end fund or like a preferred share in which there is a term date imbedded for the entirety of capital invested plus distributions will be returned to the unitholder. The trust has 17mm units outstanding with the intent to distribute profits and return capital.

Details of Distribution

Because distributions are directly tied to the price per barrel of oil, distributions should be expected to be volatile over time. There are some analysts calling for oil to be priced in the mid-$80s-to-low-$90s/bbl throughout the duration of 2023. JPMorgan’s analyst suggests oil could hit $120/bbl through the next quarter. Goldman Sachs’s analyst is suggesting $100/bbl. Regardless of who is right or if oil prices remain in the present range, distributions should reflect the changes in oil prices, assuming similar operating and capital expenses. Assuming a constant dividend rate going forward, we can value units at $11.62 /unit assuming a 10% discount rate.

Read the full article here