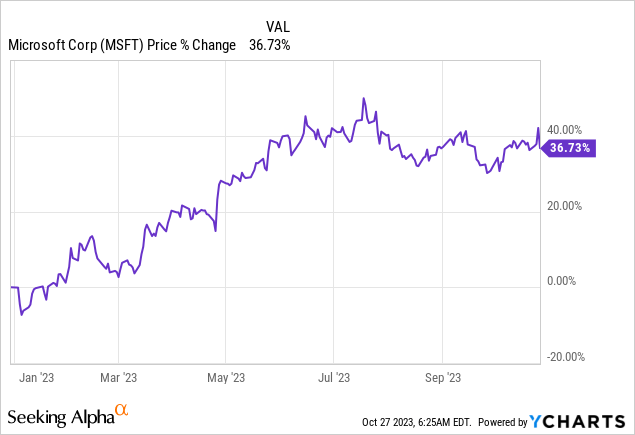

Shares of Microsoft (NASDAQ:MSFT) soared 3% immediately (but later dropped) after the technology company presented better-than-expected results for its first fiscal quarter of FY 2024. Microsoft beat expectations, on both the top and bottom line, due to a strong showing of the Cloud business which continued to generate double-digit top line growth. Microsoft also diverged from Alphabet (GOOG) in terms of Cloud performance in the last quarter and Microsoft may be the better bet on Cloud growth going forward as well.

On the other hand, Google has a serious valuation advantage compared to Microsoft. While Google was disappointed with a slowdown in Cloud-specific growth, the company saw a strong rebound in digital advertising spending. Microsoft, however, remains a strong Cloud growth investment… although shares are not cheap!

Previous rating

My rating on Microsoft was strong buy after the technology company submitted a robust earnings sheet for the second quarter, in July, due to a reacceleration of revenue growth: Microsoft: Buy The Dip.

Additional reasons to consider buying Microsoft, despite an elevated valuation multiplier factor, are that the company managed to grow its free cash flow margin to a massive 36.6% in FQ1 and the company is returning a ton of this free cash flow to shareholders through buybacks and dividends. Microsoft’s Cloud growth is also diverging from Google’s Cloud growth, indicating that Microsoft’s enterprise Cloud offering is perceived as stronger. The strength in Cloud as well as return to positive growth in the Personal Computing businesses will be discussed in this update.

Additional note: the third-quarter reference in this article relates to Microsoft’s fiscal quarter of FY 2024.

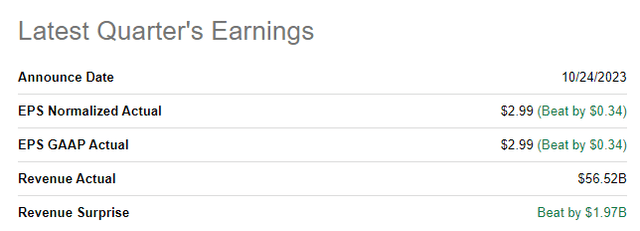

Microsoft beat top and bottom line FQ1 estimates

The driving force behind significant earnings and top line outperformance was the Cloud segment which is benefiting from increasing customer adoption, especially of Microsoft’s AI/Cloud-supported corporate solutions. Microsoft’s top line came in at $56.5B, beating the average prediction by a massive $1.97B… while adjusted EPS of $2.99 was $0.34 per share better than the consensus estimate.

Source: Seeking Alpha

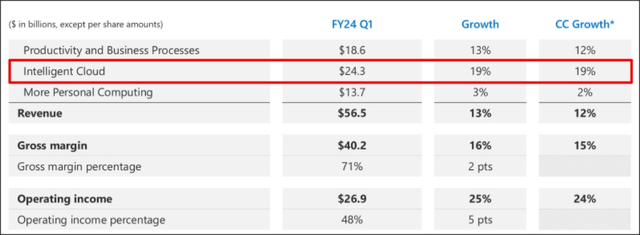

Personal Computing back to positive growth, Intelligent Cloud drives Microsoft’s performance

Microsoft benefited in the third quarter from a strong performance in the Cloud business while the Personal Computing business continued to recover. Total revenues were up 13% year over year and FQ1 was the third consecutive quarter of a top line acceleration.

Personal Computing, which includes Windows OEM and hardware revenues, saw a 3% top line increase, after posting a 4% top line decline in the last quarter. Windows OEM revenues, which depend on hardware sales, were up 4% year over year and it showed that the situation in the hardware market has improved considerably in the last three quarters.

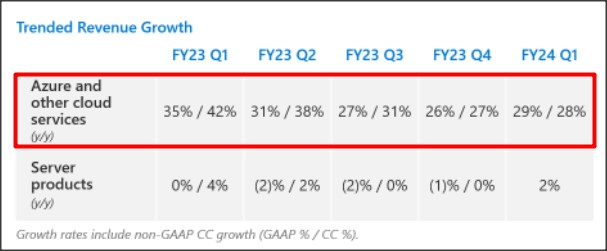

While the Personal Computing business stabilized, Azure remained a growth machine for Microsoft and it showed stronger growth than Google Cloud. Microsoft’s Intelligent Cloud segment generated 19% year-over-year growth, and Azure, Microsoft’s Cloud platform, saw 29% year-over-year growth.

Source: Microsoft

Microsoft’s Azure growth accelerated quarter over quarter from 26% to 29%, showing 3 PP growth. Google saw decelerating Cloud segment growth which declined from 28% in Q2’23 to 22% in Q3’23, so Microsoft’s Cloud business clearly developed much better. The acceleration of growth is due to Microsoft’s AI products that are integrated into its Cloud offering as well as strong enterprise customer adoption of such AI products.

Source: Microsoft

Microsoft remains a solid free cash flow play

Microsoft is not a bargain and this is because the technology company is a true free cash flow champion with tons of free cash flow available for buybacks and investments, like the one made into ChatGPT-creator OpenAI.

Microsoft generated $20.7B in free cash flow on revenues of $56.5B which calculates to an impressive free cash flow margin of 36.6%, implying an 8% year-over-year free cash flow margin expansion. In other words, Microsoft is generating more free cash flow now per dollar generated in revenues than in last year’s FQ1.

|

$billions |

FQ1’24 |

FQ4’23 |

FQ3’23 |

FQ2’23 |

FQ1’23 |

Y/Y Growth |

|

Revenues |

$56,517 |

$56,189 |

$52,857 |

$52,747 |

$50,122 |

13% |

|

Cash Flow From Operating Activities |

$30,583 |

$28,770 |

$24,441 |

$11,173 |

$23,198 |

32% |

|

Capital Expenditures |

($9,917) |

($8,943) |

($6,607) |

($6,274) |

($6,283) |

58% |

|

Free Cash Flow |

$20,666 |

$19,827 |

$17,834 |

$4,899 |

$16,915 |

22% |

|

Free Cash Flow Margin |

36.6% |

35.3% |

33.7% |

9.3% |

33.7% |

8% |

(Source: Author)

Of the $20.7B in free cash flow, Microsoft returned $9.1B to shareholders ($3.6B as stock buybacks and $5.6B in dividends) in the third quarter which calculates to a free cash flow return percentage of 44%.

Microsoft vs. Google valuation, growth potential, FV estimate

Microsoft is not trading at a low free cash flow/earnings multiplier factor and the company’s strong enterprise positioning in Cloud is the reason for this.

From a strategic point of view, I prefer Microsoft as a segment-specific Cloud growth play which is seeing a strong top line expansion, driven by Cloud product offerings. While Microsoft’s Cloud business is growing faster than Google’s, Microsoft Cloud’s potential is much more expensive than Google’s as well.

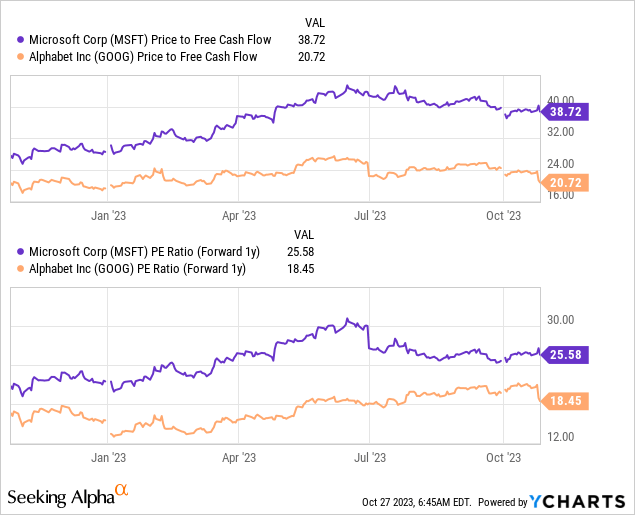

Microsoft is trading at a P/FCF ratio of 38.7X compared to a 20.7X P/FCF ratio for Google… and Google has seen a strong rebound in top line growth (+11% Y/Y in Q3’23) as well in Q3’23, attributable to a spending recovery in the digital advertising business. Based off of earnings, Google is also cheaper than Microsoft and I consider GOOG to represent deep value for investors.

I see a fair value for Microsoft, given its enormous free cash flow strength and high FCF return percentage, at about 30X forward earnings. This is not a low earnings multiplier factor, but it would more accurately reflect the core strength of enterprise, in my opinion. With EPS expectations of $12.84 per share (estimated for FY 2024), shares of Microsoft would be more fairly valued at $385, leading to potential upside of 17%.

I justify a 30X earnings multiplier also with Microsoft’s AI opportunity in Azure. Microsoft has said that it plans to integrate artificial intelligence solutions into the entire tech stack in order to drive enterprise productivity and Azure AI adoption could boost the firm’s top line and EPS growth going forward. Also, Research company Gartner said in October that global PC shipments declined 9% in the third quarter — after declining 17% in Q2’23 — and that device sales could see the beginning of a recovery in Q4’23. This would imply favorable tailwinds for Microsoft’s Personal Computing business as well.

Risks with Microsoft

Given the high valuation factor that Microsoft is trading at, the biggest risk is a slowdown in Microsoft’s Cloud business as well as a downturn in free cash flow growth. From a valuation perspective, I believe Google has less risk than Microsoft, because of the much lower FCF valuation multiplier factor. What would change my mind about Microsoft is if the firm saw deteriorating Cloud growth as well as lower free cash flow margins.

Final thoughts

Microsoft executed very well in the third quarter in terms of revenue and free cash flow and all these results were driven chiefly by Microsoft’s strong position in the Cloud segment, which benefits from increasing product uptake as well as AI products. Microsoft’s and Google’s Cloud growth diverged, too: Microsoft’s Azure top line growth accelerated in the last quarter (+3 PP) while Google’s growth slowed 6 PP.

The Personal Computing segment also posted its first positive top line growth rate this year, indicating that the market situation in hardware/device sales is also improving. While shares of Microsoft are not cheap, especially not relative to Google’s, I believe Microsoft is executing its Cloud strategy very well and I confirm my strong buy rating following the FQ1’24 earnings report!

Read the full article here