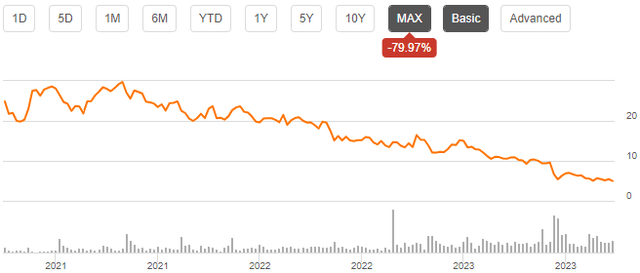

Leslie’s (NASDAQ:LESL) sells pool accessories in the United States. The company had an IPO in 2020, after which the stock has been on a slow and steady decline as the pandemic-boosted financials have turned into decreasing earnings. In my opinion, investors’ visibility into Leslie’s long-term growth is quite limited at the moment; I would wait for a few quarters to see the company’s growth ability as year-over-year comparison figures normalize.

The Company & Stock

Leslie’s sells pool supplies digitally and through small brick-and-mortar stores. The company’s sold products include a range of pool chemicals, pool covers, pumps, filters, accessories, as well as hot tub & spa products. The pool supplies market saw a significant boost during the Covid pandemic, as individuals’ use of personal pools rose because of closedowns. Leslie’s saw the boosted market as an opportunistic point in time to become a publicly traded company.

Leslie’s had an IPO in late 2020. After the stock began trading in November of 2020, the price has fallen into a fifth of the close on the first day of trading with:

Stock Chart From IPO (Seeking Alpha)

Financials

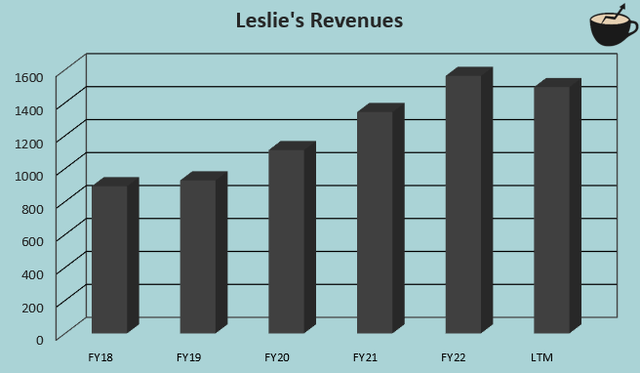

The company’s quarterly data begins from FY2018. Investors have a limited visibility into Leslie’s pre-pandemic performance, clouding visibility into the company’s sustainable growth level and margins. In the company’s public financial history, the company has achieved a good amount of growth with a compounded annualized growth of 11.5% from FY18 to LTM figures as of Q3/FY2023. Some of the growth has been due to cash acquisitions made mostly in FY2022 with an amount of $108 million in the year. Despite the acquisitions, Leslie’s revenues have decreased so far in FY2023:

Author’s Calculation Using Seeking Alpha Data

As the pandemic-boosted market has subsided, investors have a better view into Leslie’s sustainable revenues. I still believe that the company’s long-term growth rate is mostly unknown. Before the pandemic, Leslie’s achieved a growth of 4.0% from FY2018 to FY2019. As Leslie’s will soon start having year-over-year comparison numbers that have been achieved in a more normal market environment, investors should see a more clear long-term growth rate in the coming quarters.

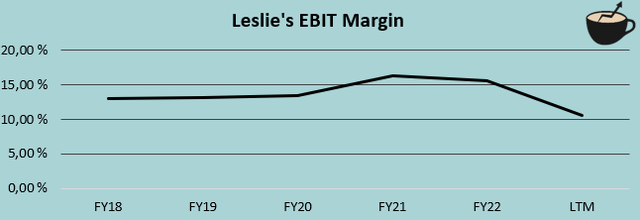

Leslie’s has achieved a stable EBIT margin, although the margin was somewhat higher in FY2021 and FY2022 as a result of the heightened market. From FY2018 to FY2022, the average EBIT margin was 14.3%, when in FY2021 and FY2022 the margin was 16.4% and 15.6% respectively. Currently, the trailing margin stands at 10.6%. The current margin is partly due to a poor weather and an increased consumer price sensitivity according to the company’s Q3 presentation.

Author’s Calculation Using Seeking Alpha Data

To finance the company’s acquisitions and overall operations, Leslie’s has drawn a large amount of long-term debt on its balance sheet. Currently, the long-term debt balance adds up to $814 million, of which $8 million is in the current portion. With trailing twelve months’ figures, Leslie’s interest expenses cover around 36% of the company’s operating income – I believe that the amount is still manageable, although the net debt is almost as large as Leslie’s market capitalization of $916 million at the time of writing.

Valuation

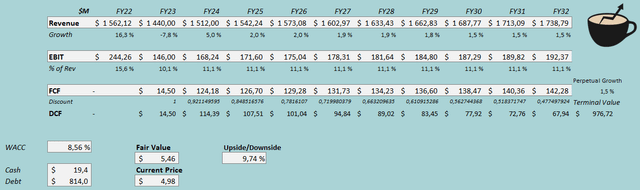

To evaluate a rough fair value for Leslie’s stock, I constructed a discounted cash flow model. In the model, I estimate Leslie’s to hit its FY2023 revenue guidance with a revenue decrease of -7.8%. After FY2023, I estimate the market conditions to normalize with a 5% rebound in revenues. After the year, I believe that Leslie’s organic growth catalysts are quite poor – I estimate a growth of 2% from FY2025 forward, that starts to slow down into a perpetual growth rate of 1.5%.

For Leslie’s EBIT margin, I estimate a figure of 10.1% for FY2023, 5.5 percentage points below FY2022 as the market has gone from heightened to a weak one. From FY2024 forward, I estimate a stable EBIT margin of 11.1%, one percentage point above the FY2023 estimate. The estimated margin is below Leslie’s achieved average, but I believe that the company needs to prove a better margin again before I’d be comfortable with estimating one. The mentioned estimates along with a weighted average cost of capital of 8.56% craft the following DCF model with a fair value estimate of $5.46, around 10% above the price at the time of writing:

DCF Model (Author’s Calculation)

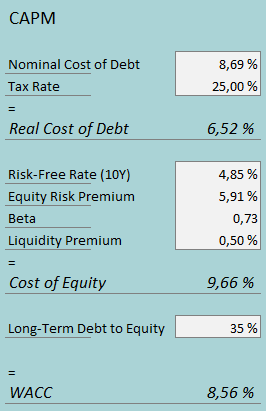

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, Leslie’s had $17.7 million in interest expenses. With the company’s current interest-bearing debts, Leslie’s interest rate comes up to an annualized figure of 8.69%. The company leverages a high amount of debt in its financing – I estimate a long-term debt-to-equity ratio of 35%.

The risk-free rate of 4.85% on the cost of equity side is the United States’ 10-year bond yield, which is a figure that I see as representative for the purpose. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate made in July for the US. Yahoo Finance estimates Leslie’s beta at 0.73. I see pool-related accessories as a mostly discretionary product, that could see a larger fluctuation correlated to the macroeconomy than Yahoo Finance’s low beta estimates. The low beta could be a result of the pandemic – the stock market as a whole had a negative correlation to the pandemic, but pool accessories’ demand saw a positive correlation. As Leslie’s IPO’d during the pandemic, the external pandemic factor could be the reason for the beta figure. For the moment being, I don’t see a better way to estimate Leslie’s beta though – in the estimates, I keep the beta of 0.73, although I recognize that the beta could be significantly higher in the future. Finally, I add a liquidity premium of 0.5% into the cost of equity, crafting the figure at 9.66% and the WACC at 8.56%.

Takeaway

In the next few quarters, I believe that investors will have better visibility into Leslie’s future growth pace. Looking at the company’s financial history, Leslie’s organic performance seems to have been quite poor when excluding the pandemic-boosted market in FY2021 and FY2022. At the moment, Leslie’s stock seems to be priced for quite low growth and a margin that’s fairly below Leslie’s historical margins. For the time being, I believe that these estimates are a good starting point; at the moment, I believe that a hold rating is justified.

Read the full article here