Fintech Kaspi.kz is poised to become the first company from the Republic of Kazakhstan to list in the U.S. after the company filed for an IPO in late December.

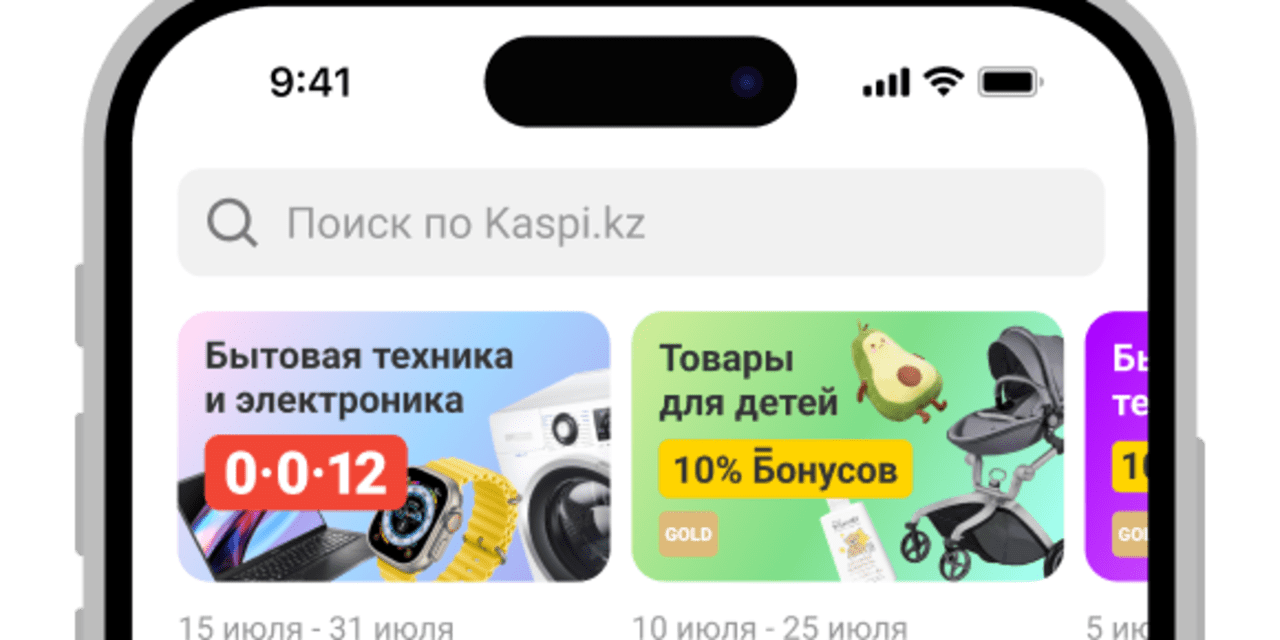

The company is parent to the Kaspi.kz Super App, which offers a range of financial services to customers via a single mobile app.

Kaspi.kz is profitable and already lists its stock on the London Stock Exchange, where it has a market capitalization of about $19 billion. It has now applied to list on Nasdaq, under the ticker “KSPI.”

The company

KSPI,

did not disclose how many shares it plans to offer in the U.S. deal, but said the price would likely be close to that of its London global depositary receipts, which closed Wednesday at about 79 pence.

“Being in Kazakhstan, we do not have the luxury of being able to rely on private equity or venture capital money to fund our operations and growth,” co-Founder and Chief Executive Mikheil Lomtadze wrote in a letter published along with the IPO documents.

“We’ve always had to stand on our own two feet. This meant growth and profitability from the beginning, not growth with the ever-shifting promise of making the business profitable at some future point. Profitability also means we generate cash, and this has allowed us to repurchase our GDRs, pay dividends, make acquisitions and invest in our long-term organic growth. This is not the norm and something I know our existing shareholders appreciate a lot,” he wrote.

Here are five things to know about Kaspi.kz ahead of its IPO.

It’s profitable and revenue is growing fast

Kaspi.kz had net income of $1.3 million in the first nine months of 2023, up from about $876,000 in the year-earlier period, according to its prospectus. Revenue rose to $2.8 million from about $1.9 million in the year-earlier period and was more than the $2.7 million generated for all of 2022.

The company had 13.5 million monthly average users as of Sept. 30, some 65% of whom use the app daily. The number of monthly transactions per active consumer stood at 68.

It pays a dividend — and plans to keep doing so

Unlike many early-stage companies that go public, Kaspi.kz pays a quarterly dividend and is planning to return at least 50% of net income calculated under IFRS standards to shareholders every year.

On Nov. 20, it paid a quarterly dividend of 850 Kazakhstani tenge, or $1.79 a share.

However, the company may reduce or even eliminate its dividend, it if needs the funds to finance new business initiatives or for other projects, the prospectus cautions.

It’s a Kazakh play for now—but it has growth ambitions

For now, Kaspi.kz operates mostly in Kazakhstan, where it combines a range of services and products across platforms that are all integrated into the app. The company has small operations in Ukraine and Azerbaijan.

The company’s payments platform allows consumers to pay merchants, pay household bills and make peer-to-peer payments. Merchants can accept payments online and in stores, issue and settle invoices, pay suppliers and monitor their turnover.

Its marketplace platform connects online and offline merchants with consumers and allows third-party merchants to sell directly to consumers. It also allows consumers to get delivery or in-store pickup and merchants to advertise and take advantage of a three-day national shopping day which is held twice a year.

The fintech platform offers buy-now-pay-later services, finance and savings products and loans, which are originated in less than six seconds.

The app is the most recognized one in Kazakhstan, according to the prospectus. With a population of about 20 million, Kazakhstan is the biggest economy measured by GDP in the Central Asian region with 2022 nominal GDP of about $220.6 billion, according to the World Bank.

“Over the long term, our ambition is to extend our geographical reach and profitably serve 100 million users, up from 13.5 million we currently serve,” says the prospectus.

It has credit, liquidity and market risk

Investing in Kaspi.kz is not without risk, however, as the prospectus makes clear. The company has credit risk, not least that its proprietary loan-approval models, while fast, may not capture a full picture of a consumer’s financial condition, particularly if they are taking other loans from other providers.

The company has liquidity risk if it fails to correctly match its assets and liabilities, and market risk in the form of interest rate movements, or in the event of a downturn in the broader financial markets.

Given the less developed state of the Kazakh insurance market, Kaspi.kz does not have the kind of insurance that’s more common in developed countries, such as business interruption or property insurance.

“In addition, as a result of our e-Grocery business, we may be exposed to liability claims in the event that the food and other products we sell cause injury or illness, for which we also do not have insurance,” says the prospectus.

Kazakhstan’s legal framework is evolving

As a company operating in a still-developing market, Kaspi.kz has other risks for investors to consider, such as a still-evolving legal and regulatory framework. Laws and rules may be amended in unpredictable ways and a shortage of court precedents may lead to inconsistent interpretations, says the prospectus.

“Emerging markets such as Kazakhstan are subject to greater risks than more developed markets, including significant legal, economic,

tax and political risks,’ it says.

Corruption is a risk. Kazakhstan was ranked 101 out of 180 countries in Transparency International’s 2022 Corruption Perceptions Index with a score of 36 out of 100, where 1 is the most corrupt score and 100 is the least corrupt.

Once the deal is completed, the company will continue to be controlled by its current principal shareholders, limiting the power of individual investors to influence decision-making.

Read the full article here