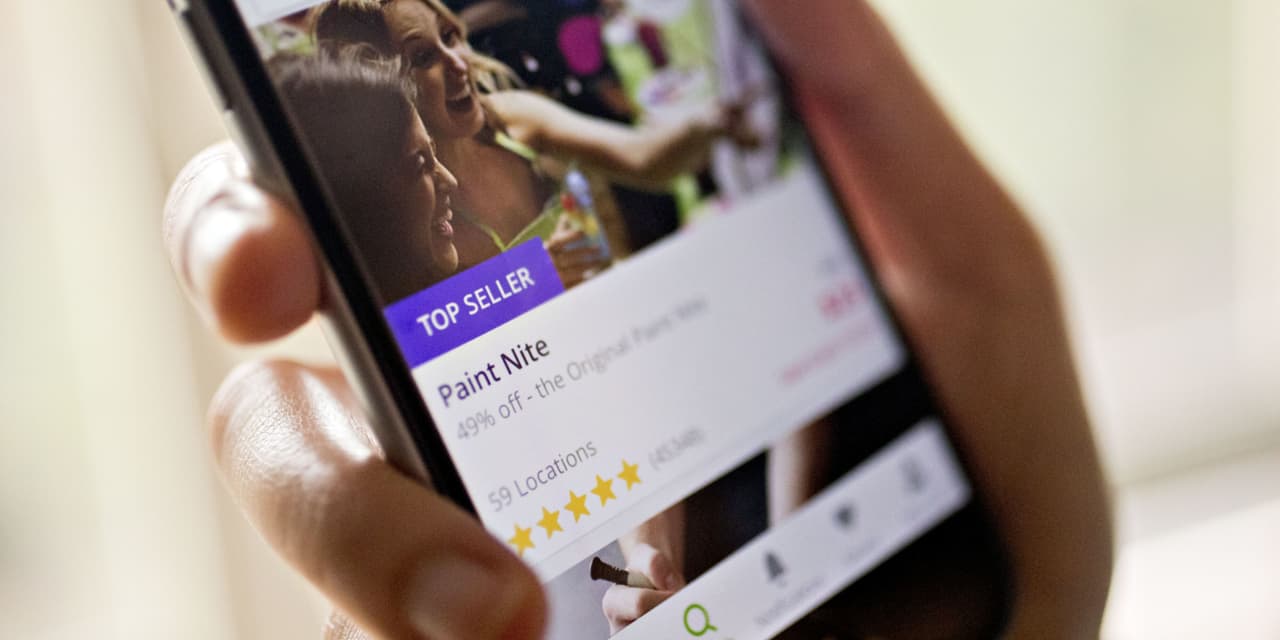

Groupon

may be a purveyor of coupons, but one activist investor says the company’s stock itself has been clipped, and is primed for a turnaround.

Windward Management unveiled an 8.9% stake in Groupon (ticker: GRPN) on Thursday, sending shares up 4.6%. The boost is sorely needed by longtime investors. While Groupon shares are up some 34% this year—trading around $11.65 apiece—the stock has plunged 99% since its public debut 12 years ago.

More recently, the stock has been challenged by the pandemic and postpandemic economies. Lockdowns meant people weren’t going out and, therefore, not in need of Groupon’s services. But on the flip side, the huge demand for services and activities postpandemic meant that businesses didn’t need to resort to deals to lure customers. In the face of persistent inflation, Windward is confident that Groupon can regain its stride, as customers will once again be in search of discounts.

Groupon declined to comment on the Windward stake.

Windward is also encouraged that Groupon got new leadership earlier this year, with Dusan Senkypl and Jiri Ponrt of Czech-based Pale Fire Capital taking the roles of interim CEO and chief financial officer, respectively. Pale Fire holds a 22% stake in Groupon, which under new management has started to revamp deals it offers in each region and has changed compensation for its sales force.

With economic conditions and new leadership as a tailwind, Windward sees Groupon stock hitting $55 over the next 12 months.

Write to Carleton English at [email protected]

Read the full article here