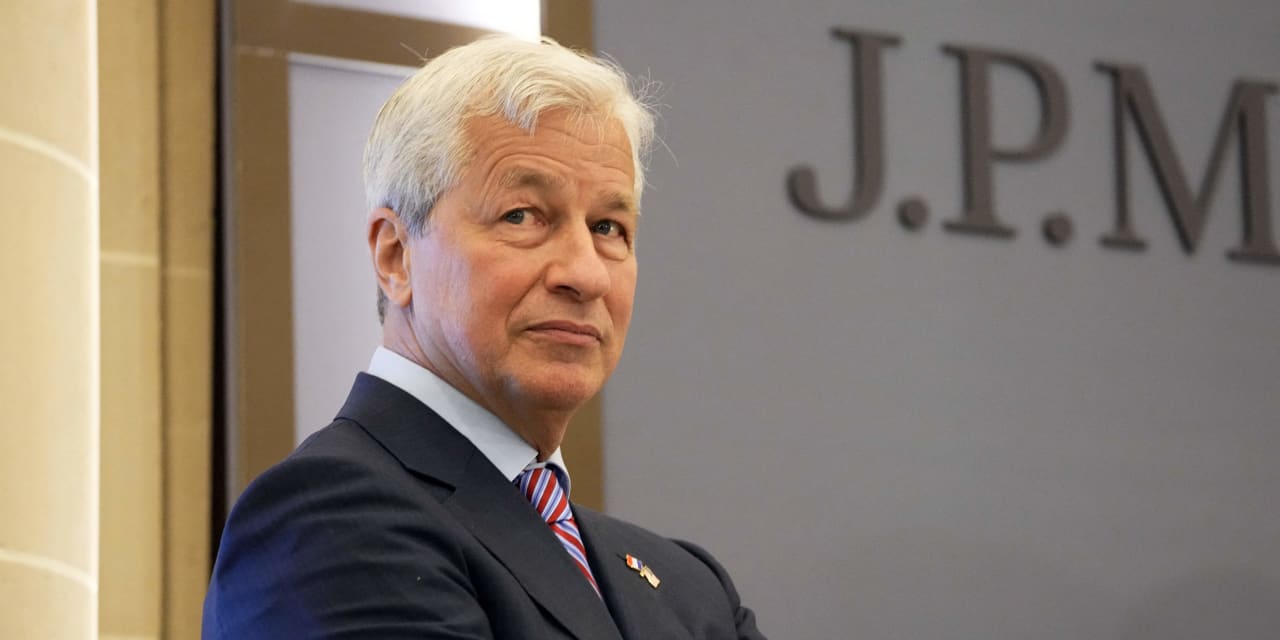

Investors need to be prepared for 7% interest rates and most of them aren’t. That’s the stark warning from

JPMorgan Chase

CEO Jamie Dimon over potential risks for the U.S. economy.

Dimon’s view comes as something of a surprise considering the Federal Reserve recently held interest rates steady at a range between 5.25% and 5.50% and most analysts expect only one more rate hike at most. However, the bank chief suggested current optimism might be based on a “sugar high” from monetary and fiscal stimulus and rates could need to go up further.

“Going from zero to 5% caught some people off guard, but no one would have taken 5% out of the realm of possibility. I am not sure if the world is prepared for 7%,” Dimon said in an interview with the Times of India.

Dimon said 7% interest rates were a worst-case scenario if stagflation—a situation of rising prices coupled with no or low economic growth—sets in.

“If they are going to have lower volumes and higher rates, there will be stress in the system. We urge our clients to be prepared for that kind of stress,” he said.

While Dimon is an outlier in his predictions of how high rates could be set to go, he is in line with a general market shift toward pricing in higher-for-longer rates following the Fed’s latest decision and economic projections.

Dimon gave the interview as he was visiting India after JPMorgan decided to add the country to its emerging-market government bond index. Dimon predicted the move would drive $25 billion of foreign bond purchases and encourage equity flows into India.

Write to Adam Clark at adam.clark@barrons.com

Read the full article here