Here are some of the most notable stock movers on Monday.

Stock gainers:

MariaDB PLC shares

MRDB,

jumped 9% after venture capital group Runa Capital said Friday it had offered to buy the system software group for 56 cents a share in cash, representing a premium of around 24% based on the Sept. 13 closing price for MariaDB shares.

DoorDash Inc. shares

DASH,

were up 1.6% after Mizuho upgraded the stock to buy.

Iovance Biotherapeutics Inc.

IOVA,

shares jumped 16%. Shares of the biotechnology company were building on gains seen last Friday after the U.S. Food and Drug Administration agreed to expedite the remaining review of its Biologics License Application for lifileucel, a melanoma-treatment drug.

Stock decliners:

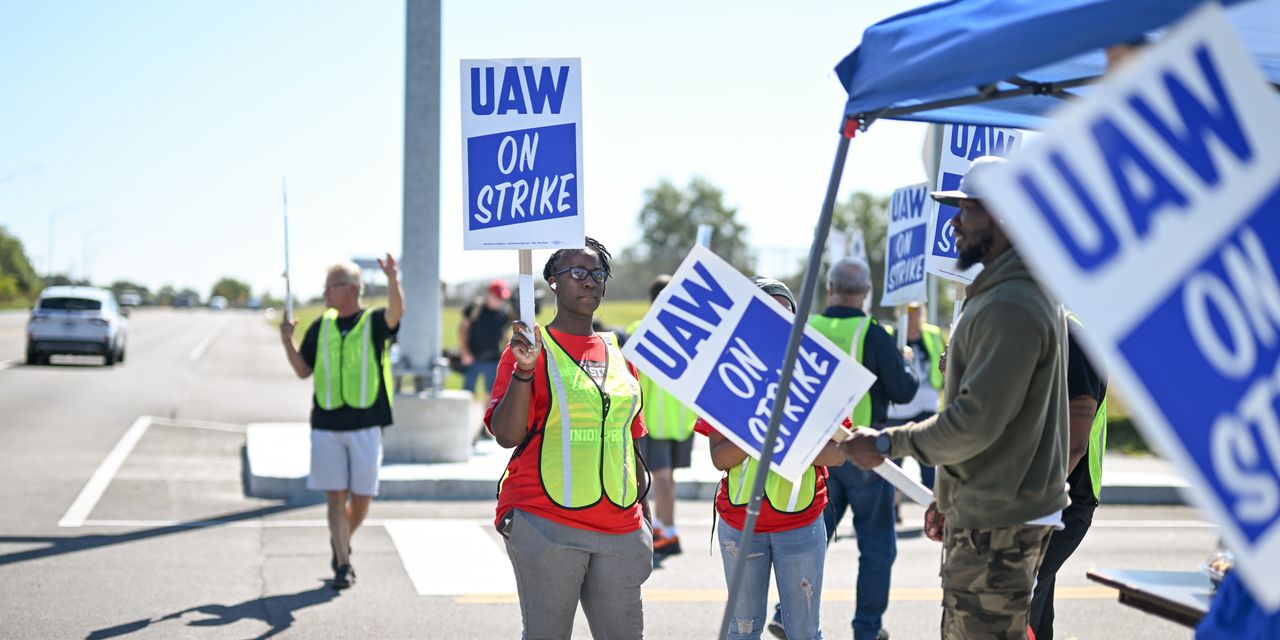

Shares of General Motors Co.

GM,

rfell 0.8% as investors continued to watch a standoff between that automaker and two others — Ford Motor Co.

F,

and Stellantis NV

STLA,

where workers at three plants have gone on strike. On Sunday, the president of the United Auto Workers (UAW) rejected Stellantis’s wage-hike offer of 21% with an immediate 10% increase at the time of approval. Ford was down 1.7% and Stellantis’ U.S.-based shares were down 1.6%.

Axcella Health Inc. shares

AXLA,

fell 8%. Shares slumped Friday after the biotech company announced plans for a 1-for-25 reverse stock split. The split, which will be effective Sept. 19, is intended to help the company regain Nasdaq compliance.

Dropbox Inc. shares

DBX,

were declining 1.1% after a downgrade at William Blair. Analyst Jason Ader cited “lackluster organic revenue growth prospects in 2024,” among other reasons for caution. He cut his rating to market perform from outperform.

Shares of NetApp Inc.

NTAP,

were off 2.5% after William Blair’s Ader downgraded that stock as well. Various factors “put in doubt the company’s ability to achieve sustained high-single-digit revenue growth,” he wrote, in moving to a market-perform rating from his prior bullish stance.

PayPal Holdings Inc.‘s stock

PYPL,

was off a1.5% after SVB MoffettNathanson analyst Lisa Ellis lowered her rating to market perform from outperform. “Looking forward, unfortunately, we expect PayPal’s gross-profit growth to remain lackluster,” Ellis wrote.

Arm Holdings Plc.’s stock

ARM,

fell 6%, after Bernstein, which didn’t help underwrite the company’s initial public offering last week, has already weighed in with a bearish rating on the stock.

Canopy Growth Corp.’s stock

CGC,

WEED,

fell 14%, after the Canadian cannabis company announced a private placement of up to $50 million as it again moves to boost liquidity. T

Read the full article here