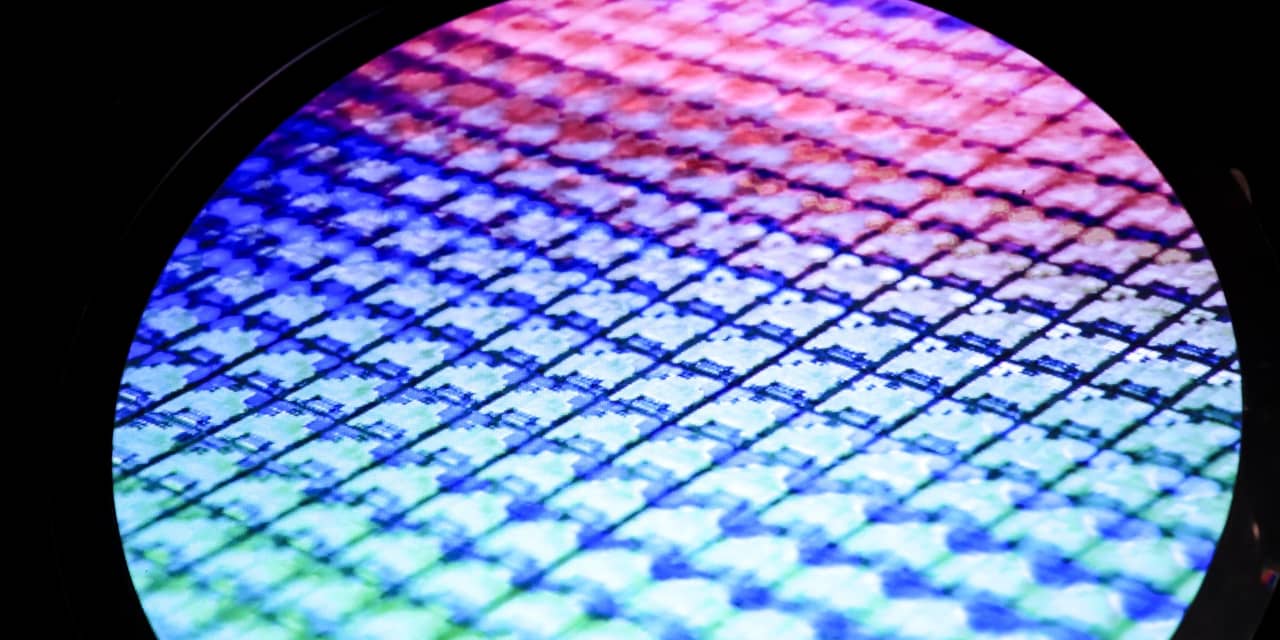

Taiwan Semiconductor Manufacturing’s latest monthly sales results suggest the company is tracking to a solid September quarter.

On Friday, the world’s largest third-party semiconductor chip manufacturer announced its sales numbers for August.

TSMC’s

(ticker: TSM) revenue for the month fell 13.5% from the prior year and rose 6.2% from July.

Wedbush analyst Matt Bryson said the results so far for TSMC’s third quarter—adding up July and August—add up to 69% of analyst expectations for the third quarter, which is slightly ahead of the five-year historical average of 66% for September quarters.

“We see TSMC’s result as a good start to the quarter,” he wrote.

TSMC dominates the market for high-end chips. It makes the main processors inside

Apple

(AAPL) iPhones,

Qualcomm

(QCOM) mobile chipsets, and processors made by Advanced Micro Devices (AMD). According to TrendForce, TSMC has about 60% market share of the third-party chip-manufacturing business, followed by

Samsung

at 12%.

Bryson expressed caution in reading too much into the August number, noting recent earnings reports from companies gave subdued guidance for the second half of the year for key tech markets. In July, TSMC lowered its financial guidance for the year, forecasting a decline of 10% year-over-year in revenue. Management at the time said it saw a worse-than-expected deterioration in demand outside of the robust AI chip market.

“We haven’t encountered any specific meaningful improvement in end-markets or with TSMC customers,” he wrote. “We don’t see any reason at this juncture to shift our expectations around TSMC’s [September] quarterly results.”

The analyst, however, reaffirmed his Positive rating for TSMC stock and reiterated his price forecast of 650 Taiwan dollars for each of TSMC’s Taiwan-traded shares, citing its strong leadership position over the long term. The target represents roughly 20% upside from current levels in TSMC’s American depositary receipts.

Write to Tae Kim at [email protected]

Read the full article here