Stock futures were slipping Friday following three days of losses for the

S&P 500

and four down days for the tech-heavy

Nasdaq Composite.

The question on investors’ minds Investors has been whether the Federal Reserve will keep interest rates higher for longer as the U.S. economy remains hot.

These stocks were poised to make moves Friday:

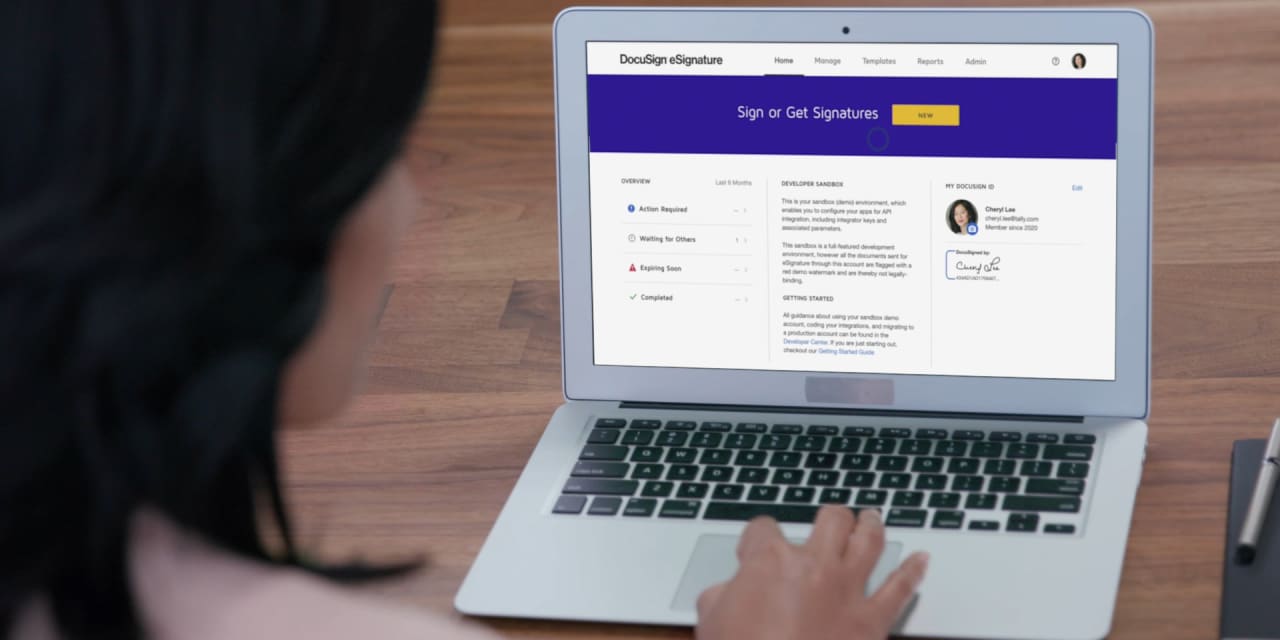

DocuSign

(DOCU) posted second-quarter adjusted earnings of 72 cents a share, higher than Wall Street expectations, and the e-signature company raised its revenue forecast for the fiscal year, saying it now expects revenue of between $2.73 billion and $2.74 billion. The stock was up 2.9% in premarket trading.

Apple

(AAPL) rose slightly in premarket trading following two days of losses for the iPhone maker after China banned the use of the device for central government officials at work. Since Tuesday, $189.8 billion has been shaved from Apple’s market value, leaving it at around $2.8 trillion.

Apple

is expected to launch the iPhone 15 next Tuesday.

Smartsheet

(SMAR) was rising 9% after the cloud work-management platform reported second-quarter adjusted earnings better than estimates and said it expects fiscal-year revenue of between $950 million and $953 million, higher than analysts’ estimates of $946 million.

First Solar

(FSLR) gained 2.2% to $184.50 in premarket trading after the stock was upgraded to Buy from Hold at

Deutsche Bank,

and the price target was raised to $235 from $220 following the company’s analyst day.

Adobe

(ADBE) was up 1.4% to $568.13 after shares of the software company were upgraded to Buy from Neutral at

Mizuho,

and the price target was boosted to $630 from $520.

Adobe

reports quarterly earnings on Sept. 14.

Guidewire Software

(GWRE), the insurance software provider, issued a forecast for fiscal 2024 revenue that was below analysts’ expectations. Guidewire said it expects revenue for the year ending next July of between $976 million and $986 million, below analysts’ estimates of about $989 million.

RH

(RH), the luxury furniture retailer once known as

Restoration Hardware,

posted better-than-expected second-quarter earnings and revenue, but CEO Gary Friedman said RH expects the luxury housing market and broader economy to “remain challenging throughout fiscal 2023 and into next year as mortgage rates continue to trend at 20-year highs and the current outlook is for rates to remain unchanged until the second quarter of 2024.” The stock tumbled 7.8%.

Planet Labs

(PL) said it expects fiscal-year revenue of $216 million to $223 million, down from its prior range of $225 million to $235 million. Shares of the satellite imagery provider fell 2.6%.

Grocer

Kroger

(KR) is scheduled to report quarterly earnings before the stock market opens Friday.

Write to Joe Woelfel at [email protected]

Read the full article here