Berkshire Hathaway has hit the trifecta.

The company’s shares hit a record high Tuesday, its market value topped $800 billion and its performance has moved above that of the

S&P 500

so far this year.

What’s impressive is that Berkshire Hathaway (ticker:

BRKb

) shares have rallied even though the company’s largest equity holding,

Apple

(AAPL), has been under pressure lately, falling more than 10% from its July peak to $175.

The two stocks had a pretty tight correlation for more than a year until recently even though Berkshire Hathaway’s Apple stake, now worth about $160 billion, is equivalent to just 20% of the market value of

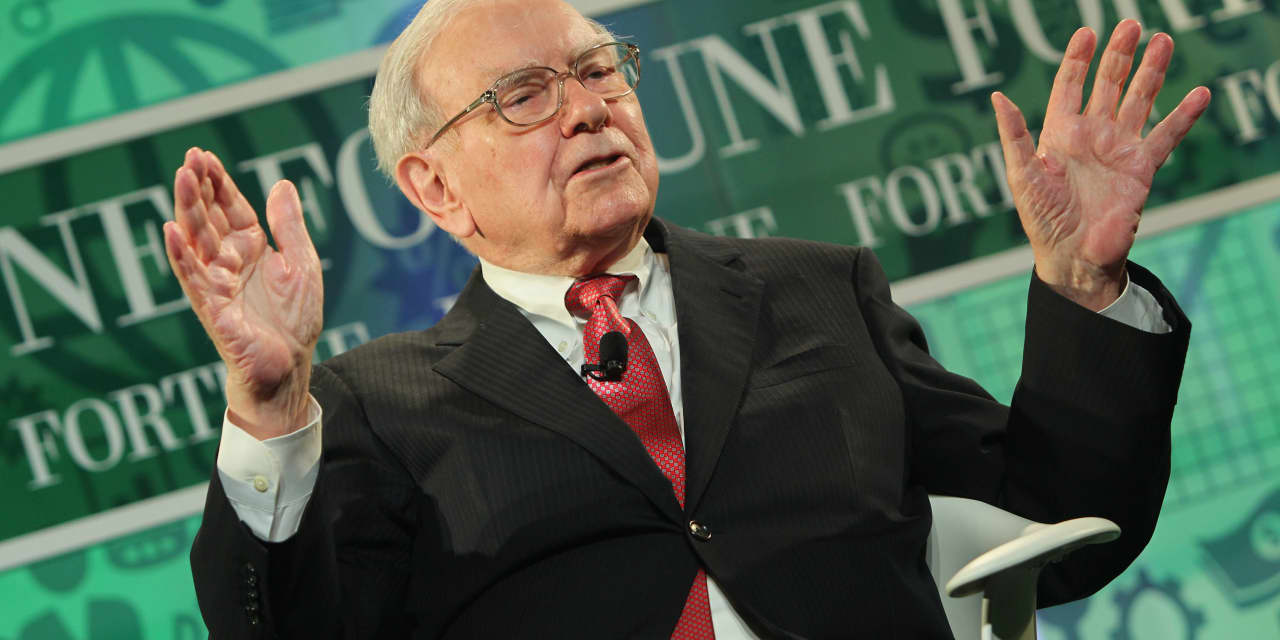

Warren Buffett

‘s company.

Berkshire Hathaway investors will be happy to know that the stock also recently pulled ahead of the S&P 500 for the latest five- and 10-year periods, as well. Ultimately, CEO Buffett and Vice Chairman

Charlie Munger

have said, investors should consider an S&P 500 index fund over Berkshire Hathaway if it can’t top the index over an extended period.

Berkshire Hathaway’s class A stock ended Tuesday at $557,415, up 0.4%, and the class B stock rose 0.3% to $367.78, as both set record intraday highs during the session. The class A stock was up another 0.3% to $559,174 in early trading Wednesday.

Berkshire Hathaway stock has been on a roll since mid-March, gaining 25%, and it was up 18.9% (based on class A shares) year to date through Tuesday, against 17.6% total return for the S&P 500. Berkshire has now returned 11.6% annually over the past five years, against 11% for the S&P 500, and shares have returned 12.6% yearly during the past 10 years, narrowly ahead of the index’s 12.5%.

Berkshire Hathaway’s slight edge over the index during the past 10 years and a somewhat wider advantage over the last 20 years (10.5% annualized against 9.7% for the S&P 500) show the difficulty in beating an index weighted heavily with top-performing tech stocks such as Apple,

Amazon.com

(AMZN), and

Alphabet

(GOOGL) even for someone of Buffett’s stature and experience.

It’s tough to know why Berkshire Hathaway has gotten a lift lately. Its short-term stock-price movements generally are hard to explain but over time, the shares have tracked book value and earnings. There has been no notable news since the company reported a better-than-expected second quarter after-tax operating profits of $10 billion, a record and up 6% from the year-earlier quarter. That report came in early August.

Berkshire Hathaway is benefiting from improved insurance underwriting results and higher interest income on its huge cash holdings of nearly $150 billion that are mostly invested in U.S. Treasury bills yielding more than 5%.

The equity portfolio, which totaled more than $375 billion on June 30, likely has declined in value so far this quarter due to the drop in Apple stock, which accounts for nearly half of its value. That might mean Berkshire Hathaway’s book value has changed little so far in the third quarter. Book value stood at roughly $373,000 per class A share at the end of June, Barron’s calculates.

Berkshire Hathaway stock now trades for 1.5 times book value, Barron’s estimates—the high end of its five-year range.The stock trades for 22 times projected 2023 operating earnings and 21 times estimated 2024 profits—in line with its five-year average, and a premium to the S&P 500 at around 19 times this year’s earnings.

There are only about a half dozen analysts that cover Berkshire Hathaway and only one tracked by Bloomberg, James Shanahan of Edward Jones, has a Buy rating. Brian Meredith of UBS, who isn’t included in the Bloomberg survey, is also bullish on Berkshire stock.

One issue is succession. Buffett turned 93 in late August and he will clearly be tough to follow given his manifold skills and towering reputation. His likely successor, Berkshire Hathaway Vice Chairman Greg Abel, who heads the company’s non-insurance operations, is well liked by many Berkshire Hathaway holders but has a lower profile in the broader investment community.

Buffett has said the stock would likely rise on the day after his death due to investor expectations of a corporate break-up—something he strongly opposes. That view is debatable given that he personifies Berkshire Hathaway, having built the company over nearly 60 years.

Berkshire Hathaway continues to pay no dividend, reflecting Buffett’s desire to retain profits for investment, and perhaps some tax aversion on his part. Even after giving away more than half his Berkshire Hathaway stock since 2006, Buffett still has a 15% stake worth about $120 billion—more than 99% of his net worth.

Berkshire Hathaway shares aren’t cheap but investors are gravitating to the stock apparently due to long-standing attributes. These include a Fort Knox balance sheet, diversified and growing earnings power, a powerhouse property and casualty-insurance franchise now benefiting from higher pricing and investment income, and what Wall Street calls “optionality” if Buffett can find an attractive “elephant-sized” acquisition for $50 billion to $100 billion that he has long sought.

Write to Andrew Bary at [email protected]

Read the full article here