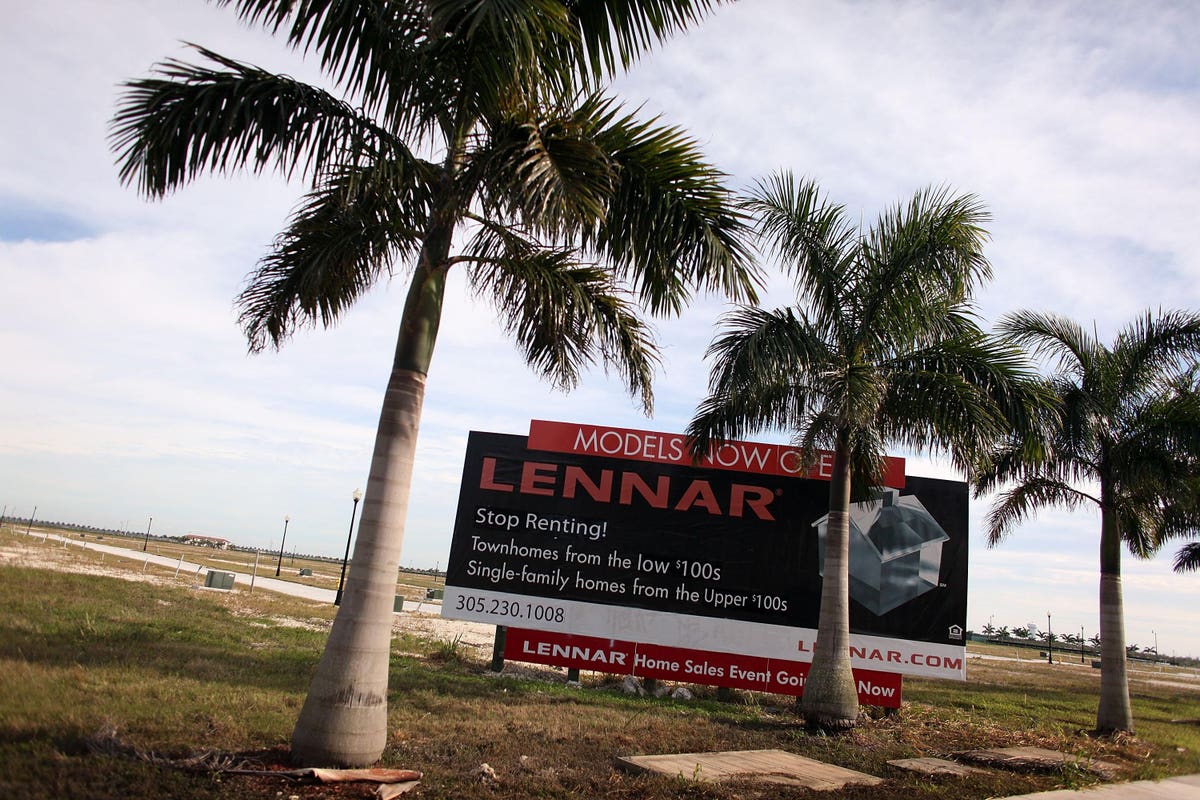

Lennar

LEN

Earnings Preview

The company is expected to report a gain of $3.47/share on $8.45 billion in revenue. Meanwhile, the so-called Whisper number is a gain of $3.61/share. The Whisper number is the Street’s unofficial view on earnings.

A Closer Look At The Fundamentals

Lennar enjoys a very attractive (and very low) price to earnings (P/E) ratio of 8 which is below the market and many other stocks. Return on Equity (ROE) has been double digits in each of the past four quarters which is also an attractive sign. Earnings have doubled since 2018 which is a very encouraging sign.

A Closer Look At The Technicals

Technically, the stock is acting great as it just hit a fresh all-time high. Homebuilders have acted very well this year thanks to a confluence of strong demand from consumers and low supply of homes. The stock is currently pulling back to digest the big move it had recently. The bulls want to see the stock gap up after earnings and the bears want to see it gap down.

Pay Attention To How The Stock Reacts To The News

From where I sit, the most important trait I look for during earnings season is how the market and a specific company reacts to the news. Remember, always keep your losses small and never argue with the tape.

Disclaimer: The stock has been featured in my FindLeadingStocks.com report.

Read the full article here