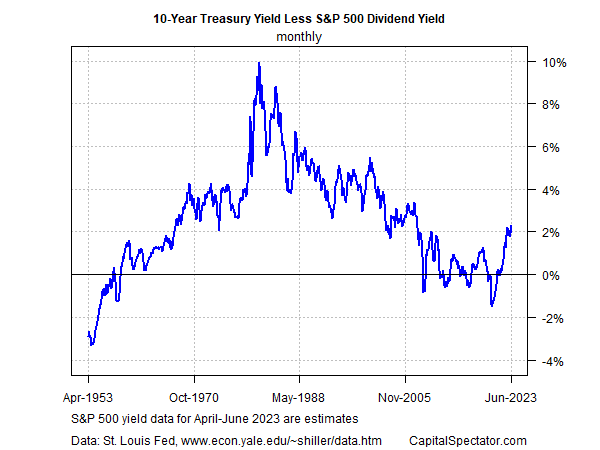

There are many factors to consider for choosing how to weigh stocks and bonds in an investment portfolio, and relative yield is on the shortlist. By that standard, the recent surge in the 10-Year Treasury yield vs. the dividend payout rate for US equities (S&P 500) looks attractive, at least compared to recent history.

The current US Treasury yield is 3.72% (June 15), which is close to the highest level since 2007. Thanks to the Federal Reserve’s interest rate hikes over the past 15 months, bond yields, in general, have surged. As a result, fixed-income securities are much more competitive vs. stocks these days compared with the period before the Fed hikes began in March 2022.

Estimating total returns for equities is tricky, of course, because dividend yield is paired with expectations for capital gains (and losses). The former is straightforward, the latter more dependent on forecasting, which comes with all the usual caveats.

In short, looking at stocks purely in terms of dividend yield is incomplete. Nonetheless, focusing on the equity market’s payout rate is a good place to start because it’s a relatively reliable measure of what you’ll earn from dividends. Projecting capital gains and losses, by comparison, is considerably more speculative, particularly in the short term.

With that in mind, the estimated S&P 500 dividend yield is currently 1.54%, based on data from Yale Professor Robert Shiller and multpl.com. That’s near the lowest level for the past 20-plus years. Compared with the 10-year Note’s 3.72%, relative value skews in favor of the Treasury Note, at least compared to recent years.

The chart below makes this clear. The 10-year less S&P 500 yield spread is currently an estimated 2.29 percentage points – the highest since 2007.

The premium for the 10-year Note looks less compelling if we factor in inflation and, if you’re so inclined, a rosy forecast for the stock market for the ten-year outlook. Nonetheless, there’s no getting around the simple fact that the recent jump in interest rates has lifted the relative allure of the benchmark Treasury Note by more than a trivial degree. This could be wiped out in real terms if inflation stays elevated or accelerates further. But if you’re in the camp that inflation is headed lower, the yield advantage for the 10-year Treasury looks all the better.

But real-world portfolio design is more complicated than simply comparing yields. Deciding how to select weights for stocks and bonds varies depending on an investor’s risk tolerance, expectations, and other factors. But generically speaking, the 10-year Treasury Note is at its most competitive against the S&P 500 in 16 years. That alone isn’t a green light to load up on bonds and dump stocks, but it’s one more factor in favor of tilting toward bonds, especially if they’ve fallen in your portfolio recently from strategic target allocations.

Stocks will likely outperform bonds in the long run, and so to some extent, the analysis above is of limited value to investors with sufficient lengthy time horizons. But in the shorter run – the next 10 years, for instance – the relatively wide yield spread in favor of the 10-year Note is a new development that deserves a fresh look for your asset allocation calculus.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here