An ETF linked to generative AI seems like a smart way to diversify investment in one of the most important megatrends of this and the coming years. That’s why I was intrigued by Roundhill Generative AI & Technology ETF (NYSEARCA:CHAT), but my curiosity quickly turned into disappointment.

This ETF has only one strength: the companies it invests in are mostly tech giants, which have almost always been a good long-term investment – regardless of cycles of euphoria and panic – and which an investor might very well want in their portfolio for reasons completely unrelated to generative artificial intelligence.

From every other perspective, I wouldn’t buy this ETF, especially if my goal was to expose myself to generative AI. In this analysis, I outline the three main reasons not to buy CHAT.

1. Not a true generative AI-linked ETF

When I invest in a sectorial ETF, I expect the companies that the fund invests in to be highly exposed to that specific sector. In the case of CHAT, most of the portfolio is invested in companies that are not yet in the generative AI market or owe a minimal part of their results to it:

- Alphabet (GOOG) (GOOGL – 8.60%) – Currently a major loser in the whole generative AI affair. They rushed the release of their own AI so as not to leave the market exclusively in Microsoft’s (MSFT) hands, failing to make an impact so far. Google Cloud could benefit from the generative AI boom but represents just 10% of the group’s revenue, so 90% of CHAT’s position does not depend on actual performance in the field of artificial intelligence. Moreover, that 10% of revenue coming from Google Cloud is only marginally related to generative AI;

- Baidu (BIDU – 5.60%) – The company announced that it will “soon” launch its Ernie 3.5, a generative AI that could even outperform ChatGPT in some key areas. We don’t even know for sure when it will be launched, how it will be monetized, and whether it will truly be a quality product with a broad user base. For now, we only have management promises;

- Adobe (ADBE – 5.44%) – Adobe has integrated AI into some of its tools, particularly gaining success with Photoshop where it can save user time. That said, the company is in no way an AI company: even eBay (EBAY) is testing generative AI to write product descriptions, but these are just features. The core business is not tied to AI, which, on products other than Photoshop, finds very limited use.

- Marvell Technology (MRVL- 3.94%) – The company stated it expects to double its AI-related revenues in 2023, but has never officially declared what percentage of its revenues are tied to artificial intelligence. Furthermore, the “data center” segment represented 33% of the last quarter’s revenues against 35% of the previous quarter and 44% of the previous year, so it doesn’t seem that generative AI weighs heavily on the company’s financials;

- Meta (META- 3.90%) – A company that is not yet generating a single dollar from generative AI and only has ongoing research projects. One of these is Voicebox, for speech generation, and the other is AudioCraft for music and sounds. It seems quite clear that the company’s future depends more on its social media, advertisers, and investment in the metaverse than on generative AI.

The discussion could continue for most of the ETF’s portfolio, so I will simply say that if there were a serious sector membership criterion – for example, generating at least 15% of revenue from generative AI and associated products – very few companies would remain on the list: depending on where the bar is set, they would be Nvidia (NVDA), Microsoft, Iflytek, Sensetime, and C3.ai (AI). Together, they represent about 25% of CHAT’s holdings (the exact weight varies daily).

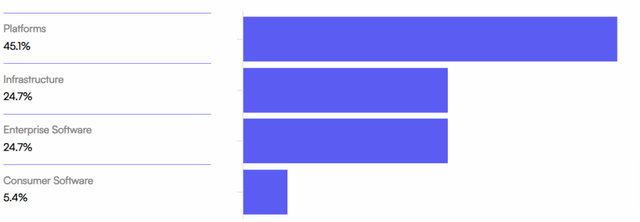

Theme relevance within CHAT’s holdings (Roundhill Investments)

2. The expense ratio is high

CHAT’s expense ratio is 0.75%, which is justified by the fact that it is an actively managed ETF. Considering that QQQ is an excellent alternative with an expense ratio of 0.20%, the cost is quite high. All the companies that are part of QQQ can benefit from generative AI, even if only through the increased productivity of their employees, and most of the companies that are part of CHAT are also present in the Invesco ETF.

Moreover, considering that there are very few companies heavily exposed to generative AI, as I specified in the previous paragraph, an even less expensive solution – and more focused on the goal of exposing oneself to generative AI – might simply be to manually buy those stocks.

3. The track record is not good

It seems that Roundhill Investments aims to create ETFs linked to the sector generating hype at a given time, regardless of the investment’s merit. Some of the company’s most famous ETFs are:

- MEME – An ETF that invests in meme stocks (but curiously not in GameStop). Since its inception on August 12, 2021, it has achieved a performance of -52.78%;

- WEED – ETF related to cannabis, launched on April 20, 2022, which has lost 70.87% of its value since then;

- DEEP – An ETF that invests in deep value companies, launched on September 23, 2014. From that time until today, it has recorded a performance of +6.31%, while the S&P 500 Pure Value Index has had a performance of +42% over the same period;

- NERD – This was hard to get wrong, being a fund linked to the world of video games: one of the segments that has performed best in recent years. Despite this, the fund has achieved a performance of +1.76% between its launch on June 4, 2019, and today.

It would be interesting to do the calculations also taking into account management costs, but this would only worsen already negative results. Although past performance is not indicative of future results, my lack of confidence in actively managed funds is certainly not comforted by the results Roundhill has achieved in recent years.

Conclusions and final thoughts

Today, it’s not even possible to create a true ETF linked to generative AI that can simultaneously maintain a diversified portfolio and ensure that all the companies the fund invests in derive a significant portion of their revenues from this technology in my opinion. For this reason, there are no real alternatives to CHAT to compare against.

Generative AI, like the internet and the computer before it, is having and will increasingly have an impact on all companies. Even the local restaurant, if it hasn’t already, will start using ChatGPT to write dish descriptions on the menu or to find inspiration for new desserts in my view. This doesn’t make it an AI-company, but it exemplifies the real impact we can expect from generative AI: a generalized increase in productivity.

Clearly, it’s easy to think that tech companies, having more use cases available, will particularly benefit from this new technology. For this reason, QQQ or any other well-diversified tech-sector ETF, with a low expense ratio, can expose investors to the growth of generative AI. All this without having risk solely in companies like Nvidia, which, although experiencing a revenue boom thanks to AI, have also skyrocketed in the stock market perhaps beyond justification in my view.

Read the full article here