Summary

In my previous coverage on AdaptHealth (NASDAQ:AHCO), I advised a buy rating based on my anticipation of growth in the home medical equipment [HME] industry, which I believe would expand significantly. This growth is being fueled by factors like the aging population and the rising incidence of chronic diseases. These trends underscore the importance of companies like AHCO, which are positioned to supply top-notch medical equipment directly to patients in their homes.

I acknowledge that my previous buy rating was over bullish as management has cut the guidance by a big margin in 1Q23, which has since sent the stock down by 50%. However, I believe the sell down is overdone. This post is to provide an update on my thoughts on AHCO’S business moving forward after analyzing their second quarter performance and outlook, and why I am still reiterating a buy rating. AHCO reported impressive second quarter results, driven by strong performance in Sleep and Respiratory businesses. Year-over-year revenue grew from 5.4% in first quarter to 9% in current quarter, highlighting sustained growth. EBITDA margin also improved. The partnership with Humana is expected to drive future growth by expanding the customer base and focusing on value-based care. The diabetes segment is recovering, with Continuous Glucose Monitoring [CGM] growth outweighing pump challenges. Mr. Teufel’s appointment as CEO offers opportunities, despite a lawsuit with his former employer. Overall, AHCO seems poised for growth with positive trends in various areas.

Investment thesis

AHCO had an impressive second quarter performance, reporting revenues of $793 million and an EBITDA of $171 million, surpassing my expectations. This strong performance can be attributed to the excellent results in the Sleep and Respiratory businesses.

Next, let’s take a closer look by comparing AHCO’s performance in the current quarter with its performance in the previous one. In terms of year-over-year revenue growth, the first quarter saw a 5.4% increase, while the second quarter showed even stronger growth at 9%, indicating sustained growth for AHCO. Furthermore, when I consider EBITDA margins, the first quarter registered a margin of 19.76%, which is already quite robust. However, in the second quarter, AHCO improved its EBITDA margin to 22.25%, showcasing not only a strong EBITDA margin but also the company’s ability to enhance it. This highlights the resilience of AHCO’s EBITDA margin.

Looking ahead, I believe the collaboration with Humana is projected to propel future growth. AHCO’s partnership with Humana is expected to provide additional support to their already robust sleep, respiratory, and HME businesses. AHCO announced a contractual agreement with Humana to serve as a value-based provider of home medical equipment and supplies for Humana’s Medicare Advantage [MA] members. This agreement will address patients’ durable medical equipment [DME] requirements within the sleep, respiratory, and HME sectors.

This partnership is poised to drive future growth through several key mechanisms. Firstly, by partnering with Humana, AHCO gains access to a broader customer base consisting of Humana’s Medicare Advantage members. This expanded market reach provides AHCO with opportunities to offer their sleep, respiratory, and HME products and services to a larger audience, potentially increasing sales and revenue. Secondly, the agreement’s focus on value-based care means that AHCO will be incentivized to provide high-quality, cost-effective services. This not only benefits patients but also creates potential for increased bottom line as AHCO successfully manages its cost. Therefore, I expect sequential growth in revenue in the upcoming quarters as AHCO is poised to benefit from Humana.

Aside the partnership highlight, the diabetes division showed a modest recovery in the second quarter, following a disappointing first quarter primarily attributed to a sudden, unexpected shift to the pharmacy channel and challenges related to pump sales. In the second quarter, diabetes experienced a 2% growth, driven by a 13% year-over-year increase in the CGM patient count, although this was slightly offset by the ongoing pump-related challenges. Management expects these pump-related challenges to persist until the end of 2023 and potentially improve in 2024. Nevertheless, management anticipates that the growth in CGM patient numbers will outpace the pump-related challenges, leading to a gradual increase in diabetes performance for the remainder of 2023.

According to management’s perspective, it appears that the challenges previously faced by the diabetes segment are gradually diminishing. Consequently, I anticipate that the diabetes segment will start making a positive contribution to AHCO’s overall revenue growth in the forthcoming quarters.

CEO Appointment Brings Opportunities Amid Legal Matter

The appointment of Mr. Crispin Teufel as the new CEO, bringing significant experience from a prominent competitor, creates an excellent opportunity for gaining momentum in the second half of the year as I look ahead to 2024.

Nevertheless, it’s important to take note of an ongoing lawsuit involving Mr. Teufel and his former employer, Lincare, which is under the ownership of Linde Group, a major player in the DME industry. While investors are understandably enthusiastic about Mr. Teufel’s appointment, given his prior role as the CEO of AHCO’s largest competitor and the wealth of experience he brings, there are short-term concerns related to this legal matter.

However, I consider this issue more as a short-term challenge rather than a significant negative development. The reason for this perspective is that the lawsuit revolves around claims that Mr. Teufel possesses confidential information that Linde Group does not want AHCO to access.

It’s essential to emphasize that Mr. Teufel’s contract with AHCO explicitly prohibits the utilization of any confidential or proprietary information owned by Lincare/Linde in his role as the CEO of AHCO. Therefore, the risk of Mr. Teufel being prevented from joining AHCO is deemed low. Therefore, I do not expect any valuation contraction given this fact.

Valuation

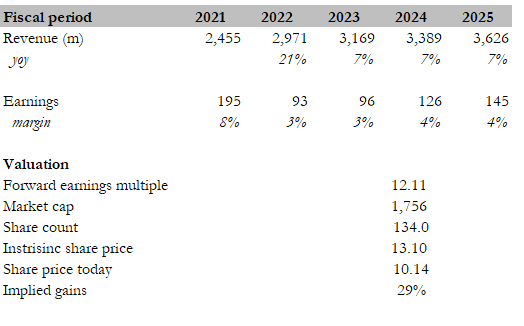

I believe that AHCO’s fair value, as per my DCF model, is $13.11. AHCO’s robust second quarter results, improved performance compared to the previous quarter, partnership with Humana, enhanced diabetes business segment, and the appointment of a new CEO with significant industry experience all indicate a promising future for the company. My model assumes a conservative 7% growth rate in FY25, with an earnings margin of 4%. This aligns with the consensus estimate of 7%.

When considering peers such as Cardinal Health and Henry Schein, AHCO appears favorable. Peers have a median forward earnings multiple of 12.47x. AHCO’s earnings margin stands at 3.13%, higher than the peers’ median of 2.61%. AHCO’s NTM consensus revenue growth aligns with peers at 8%. Overall, AHCO appears to be in good standing compared to its peers.

Valuing AHCO at its current forward Price/Earnings of 12.11, which is consistent with peers, I maintain my buy recommendation. Unlike previously, the grow expectation is much lower which I believe AHCO is able to achieve.

Own calculation

Risk

Dependence on Key Contracts is a downside risk that AHCO faces. AHCO’s partnerships and contracts, such as its agreement with Humana, are vital for its growth. Any issues or terminations in these agreements can have a significant impact on revenue.

If the new CEO is prevented from joining AHCO, it could have a substantial impact on the company’s valuation. The market holds high expectations for this new CEO’s appointment due to his expertise and experience.

Conclusion

In summary, AHCO is poised for a promising future with several key developments in its favor. The partnership with Humana holds the potential to significantly boost AHCO’s growth trajectory. This agreement not only expands AHCO’s customer base but also incentivizes the delivery of high-quality, cost-effective services, positioning the company for sequential revenue growth in the upcoming quarters.

Read the full article here