Investment Thesis

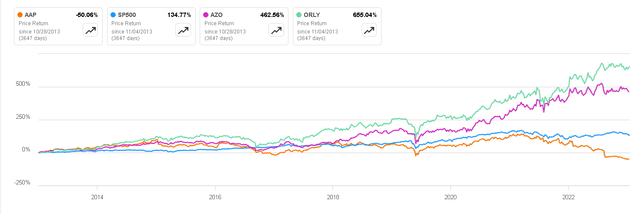

Advance Auto Parts (NYSE:AAP) shares have had a challenging decade when compared to the S&P 500, O’Reilly (ORLY), and AutoZone (AZO)—two of its biggest competitors that have enjoyed extraordinary performance during the same period.

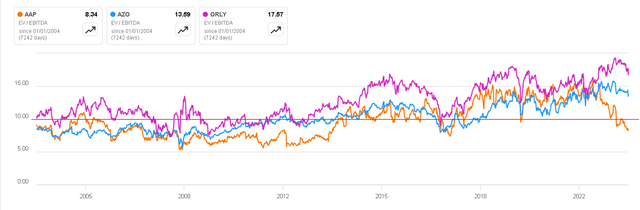

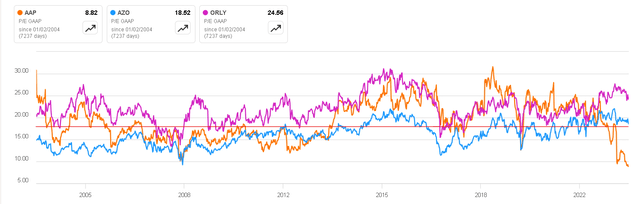

While it may appear very cheap when comparing its valuation ratios to those of its competitors, I believe this is justified. There are even scenarios where it could prove to be a bad investment, despite its seemingly low valuation.

In this article, I aim to share historical ratios that might provide insights into when the company’s decline began. I will also conduct a valuation to explain why I think there’s a scenario in which AAP could be a very poor investment.

Price Return vs Peers (Seeking Alpha)

Business Overview

Advance Auto Parts is an automotive aftermarket parts and accessories retailer in the United States. The company specializes in selling automotive parts, tools, and accessories for both professional mechanics and do-it-yourself (DIY) customers. They offer a wide range of products, including replacement parts, maintenance items, performance parts, and accessories for cars, trucks, and other vehicles.

Advance Auto Parts operates a network of retail stores, as well as an online e-commerce platform, making it convenient for customers to purchase automotive parts and accessories. The company provides services such as battery testing and installation, loaner tools, and other automotive solutions to cater to the needs of vehicle owners and repair enthusiasts.

While competitors like O’Reilly and AutoZone have demonstrated the resilience of this market with good margins during this time, it appears that this hasn’t held true for Advance Auto Parts, whose shares have declined by -35% in the last 10 years. Such underperformance cannot be a coincidence, so I would like to share this story based on what the numbers tell us.

The Story Told by Numbers

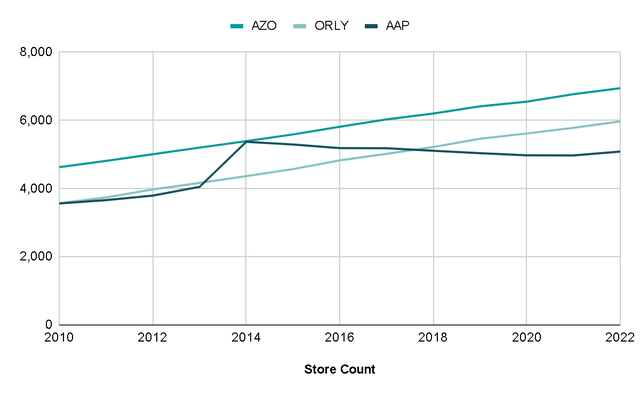

In 2010, AutoZone was already the auto parts retailer with the most stores. At that time, both O’Reilly and Advance Auto Parts had 3,500 stores, providing us with a perfect point of comparison for the decisions made and their subsequent effects.

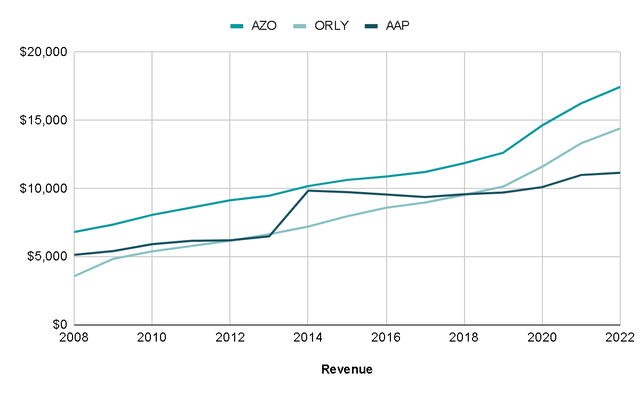

Right from the start, we can observe a significant increase in AAP’s store count in 2014 when they decided to expand through the massive acquisition of General Parts International, owner of Carquest and Worldpac brands, adding 1,300 stores to its portfolio. In contrast, O’Reilly and AutoZone chose a strategy of gradual, steady, and sustainable growth over time.

Author’s Representation

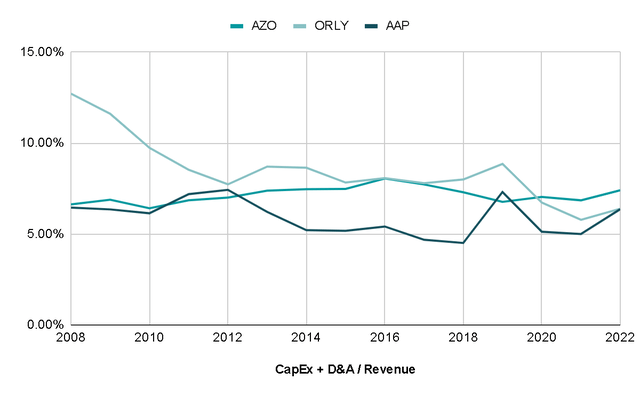

This significant acquisition led the company to halt its investments in strategically increasing the number of its stores and expanding distribution centers, while O’Reilly and AutoZone continued to invest in these areas. This can be observed in the percentage of CapEx that each company allocated in relation to their revenues, taking into account depreciation and amortization, which are incurred when a company invests in both tangible and intangible assets.

Before the 2014 acquisition, it was evident that ORLY recognized the importance of scale and was already allocating significantly more resources than its competitors. However, since 2014, AAP has been allocating approximately one-third fewer resources than both AZO and ORLY.

Author’s Representation

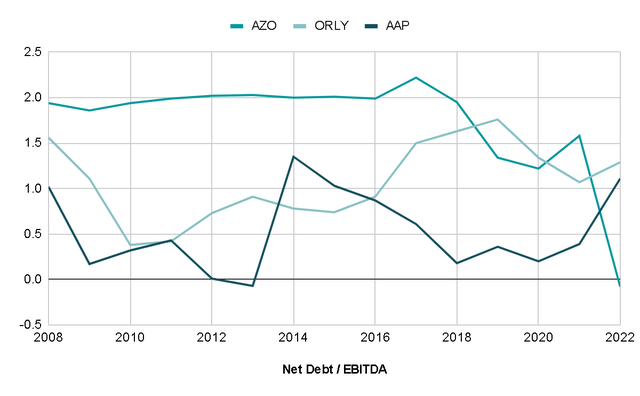

The explanation is straightforward: with the acquisition of General Parts International, AAP’s Net Debt/EBITDA ratio shifted from -0.07x (a better financial position than its competitors) to 1.35x. This compelled the company to prioritize debt reduction and focus its efforts on integrating the numerous stores and distribution centers. It was crucial to ensure that these new assets did not cannibalize the existing Advance Auto Parts brand assets, leading to unnecessary complexities.

Conversely, AutoZone and O’Reilly maintained higher debt ratios, which they used for intelligent and profitable growth, as we will later see in their Return on Invested Capital. Debt is not inherently bad as long as it is employed for productive purposes.

Author’s Representation

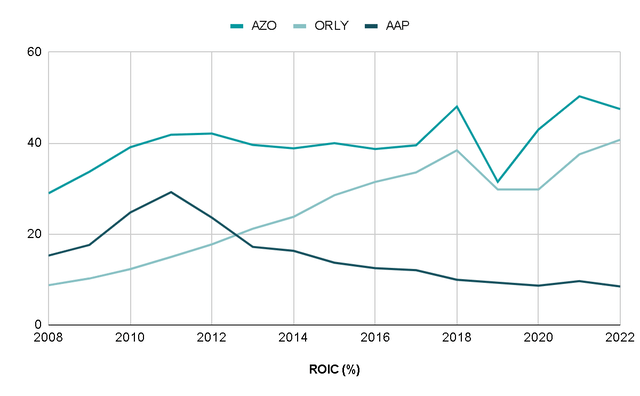

This graph illustrates the exact inflection point between O’Reilly and Advance Auto Parts. Both companies started with the same store count, and even AAP had higher revenue per store and returns on invested capital. However, after the 2014 acquisition, their ROICs followed entirely different trajectories.

The short-term mentality of rapid growth led AAP to an acquisition that proved challenging to integrate and ultimately unprofitable, as later evidenced by the ROIC. In contrast, O’Reilly focused on a strategy of slower, but better-planned and strategically located store openings, resulting in greater profitability.

Author’s Representation

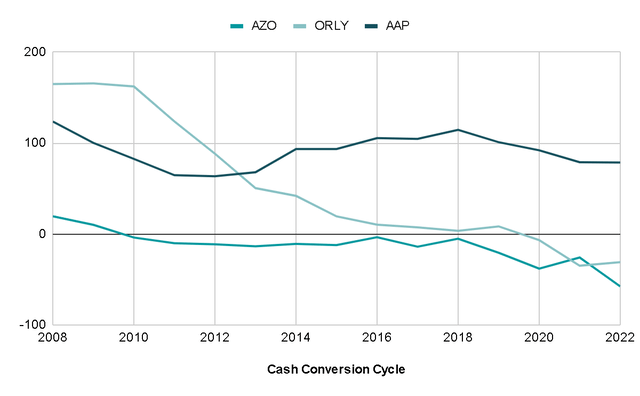

By prioritizing scale, both O’Reilly and AutoZone began to improve payment terms with their suppliers.

O’Reilly initially had a Cash Conversion Cycle greater than that of Advance Auto Parts, taking 165 days from when they paid their suppliers for inventory to when they received payment after the sale. However, O’Reilly has since shifted to charging 30 days ahead of when it pays its suppliers. In contrast, AAP still pays its suppliers 80 days ahead of what it collects.

Author’s Representation

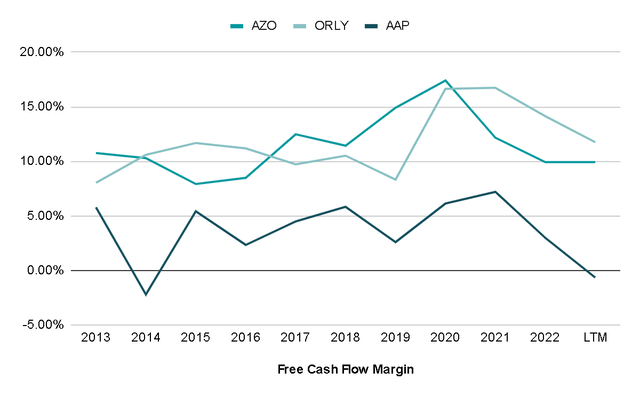

This situation has led Advance Auto Parts to have worse working capital and, consequently, lower free cash flow margins than its competitors since 2014.

This issue could be a significant obstacle for the company, as it cannot be resolved in the short term. To improve its payment conditions, enhance its margins, and make substantial investments in the business, it needs to attain the scale of O’Reilly and AutoZone. This, in turn, would lead to the improvement of its ROIC and the generation of value. However, it’s a long-term endeavor that cannot be accomplished within a year or two.

Additionally, this undertaking must be carried out while enduring the relentless price war imposed by O’Reilly and AutoZone.

Author’s Representation

Consequently, Advance Auto Parts transitioned from post-acquisition revenues that were 35% higher than O’Reilly’s to a current situation where they are 22% lower, accompanied by 900 less stores.

Author’s Representation

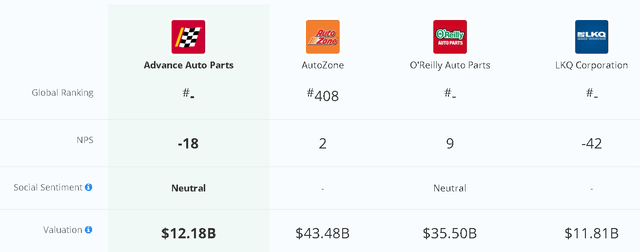

The final nail in the coffin for Advance Auto Parts is currently dealing with a worse perception from its customers. The Net Promoter Score, a data point from the Comparably website measuring whether customers would recommend a company, indicates that O’Reilly’s score is 9, AutoZone’s is 2, and Advance Auto Parts’ is -18.

In summary, the company has a smaller scale, worse margins, lower profitability, and possibly a poorer consumer perception, making the situation appear very challenging to reverse.

Net Promoter Score (Comparably)

Valuation

This year, the company provided guidance that suggests a 40% decrease in the EBIT margin, which would result in EBIT margins of 6% (while O’Reilly and AutoZone expect 20% margins) and a Free Cash Flow of between 1% and 2%. This shift is partly because the company is now aiming to compete on price, in what I believe is a desperate attempt to attract customers and boost sales. Once again, this strategy may not be the most advantageous choice, as it involves pursuing rapid growth at any cost, resorting to short-term measures instead of addressing the structural issues mentioned earlier in my view.

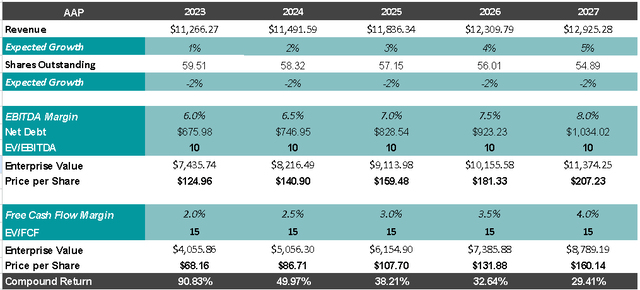

In any case, let’s maintain a positive perspective and assume that this strategy proves successful, gradually improving their growth, margins, and market multiples. Based on historical data, the market might assign them multiples of 10x EBITDA and 15x FCF. In this optimistic scenario, the company could indeed become an attractive investment, potentially offering annual returns of up to 30%.

Bull Case Valuation (Author’s Representation)

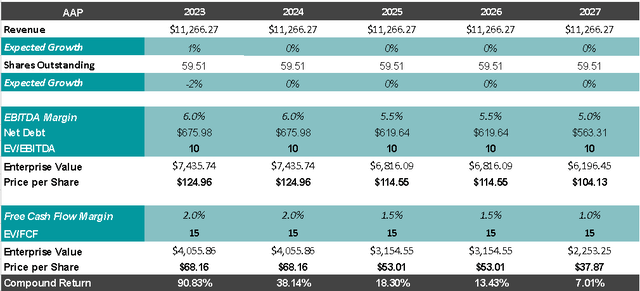

However, there exists another scenario where persistent price competition against industry giants like O’Reilly and AutoZone leads to a continual reduction in margins year after year. Moreover, the negative customer experiences could contribute to the idea that pricing alone is insufficient to justify purchasing from AAP, resulting in stagnant revenues.

In this scenario, we’ll assume the company retains average multiples, even though it would be reasonable for these multiples to decrease given the market’s diminishing faith in the company. In this case, the potential return would be unfavorable, at 7% annually for the next five years, despite the company’s current apparent cheapness, thanks to its LTM P/E ratio of 9x.

Bear Case Valuation (Author’s Representation) EV/EBITDA (Seeking Alpha) PER (Seeking Alpha)

Final Thoughts

Capitalism can be unforgiving, and a poor strategic move made in 2014 could indeed result in a decade of decline and the loss of competitive advantages.

The company may appear to be undervalued and have the potential for a great investment, but only if it can alter its recent trajectory, which seems to be leading more towards its demise in my opinion, no matter how dire that may sound.

Taking all of these considerations into account, my recommendation would be to ‘sell’ and watch this story from the outside. However, it’s worth noting that the company recently announced a change in CEO in August, and if this leads to a fundamental shift in the business, I might reconsider my assessment.

Read the full article here