Introduction

About two months ago, I wrote an article titled Adyen, Why I’m Buying With Both Hands. I put my money where my mouth is and I have done what I wrote in the title.

As I’m writing this article, on Thursday, Adyen’s (OTCPK:ADYEY) stock is down almost 8% and it was down 12% at a certain moment.

To the subscribers of my Investing Group, I wrote this about the stock slump this morning:

Adyen is selling off this morning on the Amsterdam Stock Exchange. Currently about -7%.

The reason is that Worldline announced its earnings and warned about a deterioration in Europe and the “termination of some of our specific merchants’ relationships”.

The market reacts to the first, thinking Adyen will see the same problem, but I wouldn’t be surprised if the second, much bigger issue for Worldline is that Adyen and others are taking over its customers. Worldline is a legacy player and Adyen has much stronger solutions.

Visa (V) reported its earnings yesterday. I didn’t think they were negative at all about Europe. A few quotes:

- “We have been building momentum in the business across Europe with a particular focus on the continent.”

- “Active cards across Continental Europe have grown nearly 50% since 2019.”

- “Payments volume growth rates were strong through the quarter in most major regions with Latin America, CEMEA and Europe ex-UK growing about 20% or more in constant dollars.”

- “We continued to see healthy travel volume levels in and out of LAC, Europe and CEMEA, ranging from 145% to 165% of 2019 levels.”

- “Outside of North America and Asia, if you look at Europe ex-UK, Latin America, CEMEA, most of these regions are growing at around 20% or more. So, we feel good about what’s happening there.”

To me, Worldline is using this argument to hide that it lost customers, maybe to Adyen. Worldline’s stock is down 50%.

But I want to remain very critical, even more so now that I have bought a substantial position. That’s why I wanted to write this article. In this article, I look at the bear cases and my own blind spots.

Before we go to the rest of the article, though, I want to explain the value proposition and the business model of Adyen once more.

The business model

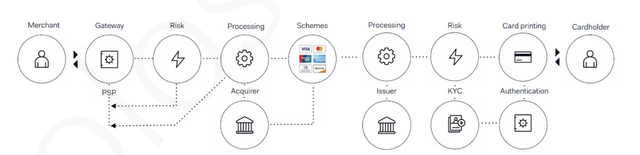

Let’s look at a company like Nike (NKE), one of Adyen’s customers. As you probably know, Nike sells products all around the world, both online and offline. Up to now, Nike’s POS (point-of-sale) system is using many different players.

Adyen

As you can see, this is a complex system. Nike’s payment system is all over the world and therefore, it uses dozens of different players for different parts of the payment process.

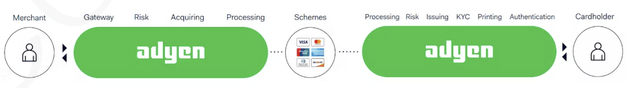

In comes Adyen to help Nike. This is how Nike’s payment process looks after it became an Adyen customer.

Adyen

As you see, the merchant and the cardholder are now connected through only Adyen and the schemes. I think you can imagine that Adyen will be cheaper for Nike if this can be done, especially because it can implement this worldwide. Instead of all the different parties, which all want their fee, Nike has only to work with one, Adyen.

That also means that Nike will channel more and more of its business to Adyen over time. New stores immediately implement Adyen’s POS, but older ones still have to switch. That’s why 80% of Adyen’s growth comes from existing customers who streamline their payment process.

On top of that, and also very important, in the first situation, without Adyen, it’s almost impossible for Nike to have an overview of its customers through payments. With Adyen, that is not only possible but easy and data-rich.

What you also shouldn’t underestimate is the different payment methods that are popular in different countries. If you are not Dutch, for example, you will probably never have heard of iDeal, but it has a market share of 70% for online payments in the Netherlands. There’s Alipay (BABA), Mercado Pago (MELI), and many other ways to pay around the world. For every method in every country, new intermediaries have to be set up. For Nike, it’s much easier to just go to Adyen, which has this set up already and Nike can just plug-and-play, as it were.

I hope you see the strength of Adyen’s business. It’s not just something that can be replaced easily once customers are on board, especially not because it’s more expensive than just staying with Adyen.

Avoiding biases

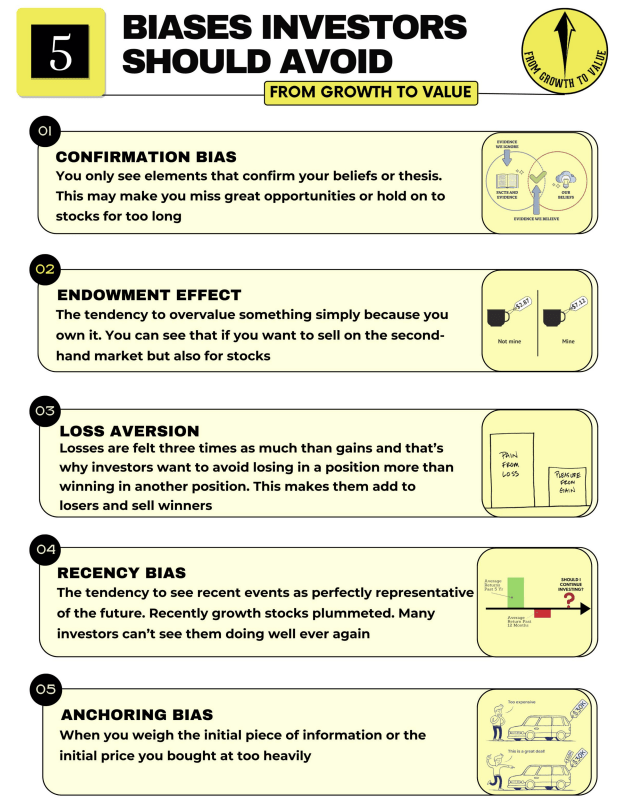

At the same time, as Adyen has become a much bigger position now, I don’t want to be a victim of some investment biases. There are several that could be working here.

Recently, I posted this on X (formerly Twitter):

Made by the author

1, 2, 3 and 5 may be applicable here, while many investors will struggle with 4. Their recency bias will let them think the stock can’t go up anymore. That’s what often happens: when a stock is up, people think it can’t go down. When it’s down, they think it can’t go up. That’s recency bias in full swing. I can say without blinking that I have no real problem with this bias when it comes to my own mindset.

I think that I have to be careful with the four other biases, though. And that’s the reason for this article. I want to be critical about Adyen before I add even more to my position. After all, I could be wrong, right?

1. Confirmation Bias

Confirmation bias means you only look at what you want to see, at what confirms your beliefs. Therefore, I want to look at the bearish arguments I have seen and weigh them.

* The stock price could go down more / don’t catch a falling knife: I can only agree that the stock price could drop more, but that is always the case for any investment. If you are a trader or a market timer, this is very important to you, but that’s not me. I invest and if my thesis plays out, I want to hold on as long as possible. I probably don’t need the money for the next 20 years.

In other words, this argument could be true, or not, but it’s of no value to me. If I think ADYEY’s stock could be worth $100 in, let’s say, 2035, why would I care if I bought at $9, $8 or at $7? It’s not that big of a difference. The most important thing is that the thesis plays out.

* Management will never hit their medium-term targets of 65% EBITDA margins

There is no way to know this for sure. What I did see, though, was that Adyen was very close to the long-term objective just before it started its investment round by hiring as many great tech people as possible.

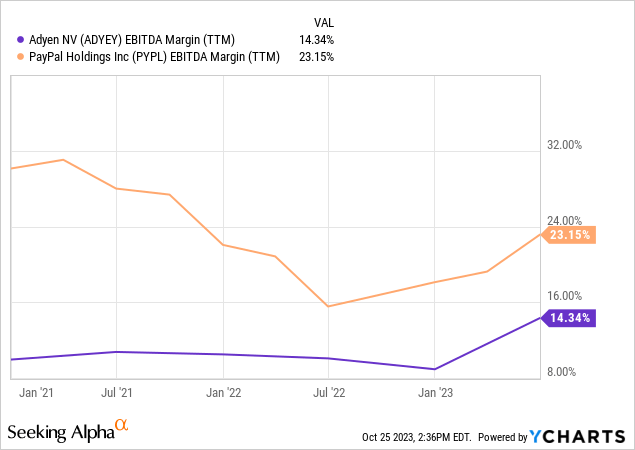

If you look at the automated numbers, you will not see this and EBITDA margins look low. That’s why some commented that PayPal (PYPL), for example, had higher EBITDA margins than Adyen.

The difference, though, is that until recently, Adyen reported gross revenue, while PayPal reported net revenue.

Both have to pay the schemes, like Visa (V) and Mastercard (MA). Paypal already took that money out in its revenue recognition. Adyen always had to report it including the money they had to pay to the schemes. That has changed for the last earnings. That’s also why the EBITDA margin for Adyen seems to go up. There is just one-half year in these trailing twelve months’ numbers, though. And in reality, EBITDA margins went down significantly because of the investments.

If you look on a net revenue basis, comparable to that of PayPal, Adyen’s EBITDA margins were around 60% before it started its investments or almost triple the margins of PayPal.

I’m human and that means I have biases. That’s why I asked this from my 90K+ X/Twitter followers:

x

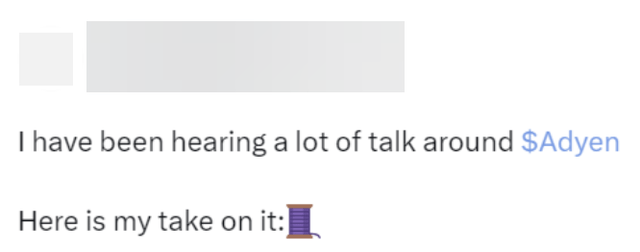

Misunderstandings about the revenue

I could have left these out, but I think they are essential. I see so many uninformed takes and I think this is a big part of why the stock is down so much. This is one.

X X

I see this so much! Let me be clear: “No, revenue is not down. It’s up 23%!” Adyen just changed the revenue recognition from gross to net. But it has always reported net revenue during the calls and in press releases.

Just 20 seconds to look at the company’s information would have been enough to see this, but no. And if you think this is just some random Fintwit investor, look at this. I blurred the name, as this is not about the person and I don’t want to harm this person. It’s just emblematic of the situation.

X

I want to show how many uninformed opinions are out there, and yes, that includes professionals. This is not the only professional who makes this mistake. I have seen multiple others.

And I have also seen them make other mistakes as well. They say: “Paypal is much cheaper and has higher margins.” Again, they just looked at their screeners, without checking the information in the earnings reports.

Things like these already explain a big part of the drop and the bearishness, in my opinion. Seconds after the earnings were released, the stock was already down 25%. Then you know that this has to do with quant bots. In 2020, the SEC issued a report that showed that bots do 78% of trading. I think this will only have increased since then.

The bots saw a big decrease in revenue, lower ROIC, and lower EBITDA that will have been enough for them to sell the stock. What you always see then is that people look for explanations, preferably as sophisticated as possible to look good, for why the stock is down so much. That triggers another selling gulf from momentum investors and frightened long-term investors.

More substantial bear cases

Of course, there were also some really good points. Every investment holds risks and we should be aware of them. So, let’s start with one of the best.

X

I’m not sure about this one. Just for context, Bookings Holdings (BKNG) started its own payments platform and already deals with 43% of the total traffic on that platform. But Booking is still named a big Adyen customer. Could it be that Adyen does (some of) the back office of this? I don’t know, to be honest. At least, Adyen handles all the rest of Booking’s payments. And I wouldn’t be surprised that Booking uses Adyen in the background for its own payments, at least to a certain extent. But that is impossible to know. If you happen to know an insider at Booking, you can always let us know in the comment section!

One of my many smart subscribers also shared a bearish argument after I asked:

Here is my bearish argument on Adyen: world central banks are slowly implementing digital currencies. Implications are actually unpredictable but in the worst case, everyone will have a digital wallet directly with FED, BCE etc. That move will make payment industries obsolete. Of course this is an exaggeration but maybe has something to do with the weakness in other company like PayPal and Block. What do you say about digital currency and Adyen?

I’m not sure if central digital currencies will be that popular. I have seen many people rallying against it because they don’t want a central authority following every single transaction. So, will it be popular? No idea. But let’s suppose it is.

Central digital currencies are a payment method and Adyen is really strong in integrating payment methods. So, even if Central Bank digital currencies became popular, Adyen could also integrate them for its customers so they can easily accept them. As Adyen is also very strong when it comes to regulation and banking charters, it may even benefit from a switch to digital currencies.

Let’s go to the next bear arguments.

X

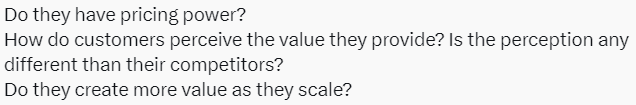

This chart says a lot about customers and how they perceive the value, I think.

BWG Strategy, through X

Adyen does have pricing power. Management has always stressed that the higher the complexity, the better for Adyen. It thrives on complexity and payments become much more complex, with much more cross-border, more customization, more hackers, more tech platforms, etc.

Only for the simplest of simple payments, in American e-commerce, some customers routed some payment traffic to competitors. They know in that one part of the payment traffic, quality is not that important because it is so simple.

Adyen says they have seen this in the past and that traffic is bound to come back. It will also hire more salespeople in the US.

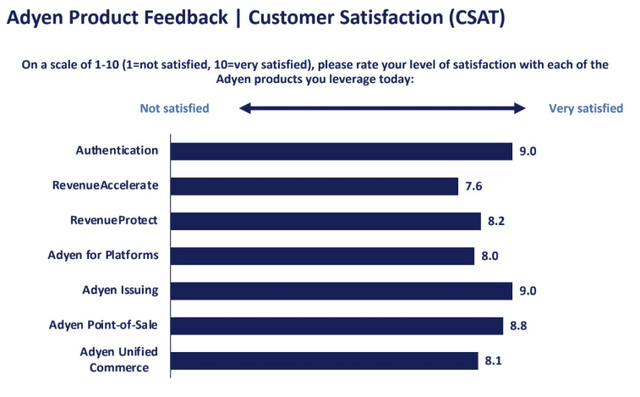

Do they create more value as they scale? For sure. Just look at this, for example. Even now, with the big investments, EBITDA is growing.

Now, to be fair, free cash flow went down because of the heavy investments, but I’m confident that will go back up once the investments stop. Officially, that’s in Q1 2024, but I wouldn’t be surprised to see Adyen announce earlier that they have everything they need, as the hiring went better than expected.

Adyen’s technological advantage

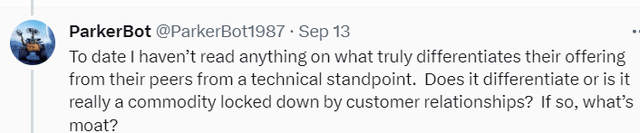

Here’s the next bear case already.

X

In short, Adyen is the only player that has not stitched together several solutions, which makes it the best and the cheapest to operate. They could undercut everyone on price if they wanted, but they think it would hurt their long-term value proposition, so they refuse to compete on price. We saw in the Nike example that Adyen can work as the only platform except for the schemes, and the railroads of payments (Visa, Mastercard…).

The payments industry is complex and evolves fast, but to my knowledge, Adyen is the only player so far who owns the full stack (except for the schemes they use). PayPal, for example, uses an outside bank, Bankcorp, to issue its cards. That makes things always more complicated and of lower quality. Everything that needs an extra connection is a potential weak point. There are always a few integration bugs that Adyen will be able to avoid because it has a single platform.

There are many more advantages Adyen has, like its banking licenses in the US, the UK and other countries, for example, although you could argue that’s not a technical feature.

Another technological advantage is that because the system was built from the ground up and Adyen has strong licenses or banking licenses in so many countries, it can deploy payments very fast. Netflix knows this, so when it wanted to expand to 43 countries simultaneously, the company asked Adyen to take care of the payments. For Adyen, this was a matter of weeks, while for its competitors, this would have taken years.

Harder to check, but I also hear from many specialists that no company comes close to Adyen’s approval rates without compromising on safety. There is no clear data, though, and therefore, almost every platform claims to have the highest safe approval rates. Several insiders working in e-commerce have said Adyen is the real leader, but again, I don’t have the numbers to back this up, just some anecdotal stories.

Intermediate conclusion

I think I did all I could here to tackle my confirmation bias. There are some arguments and we can’t know everything for sure, but what we can know looks really good for Adyen. I listened to all the bear arguments I could find, and none was convincing enough for me. But of course, in investing, it’s still about probabilities. Let’s go to the second bias, the endowment effect.

2. The Endowment Effect

The endowment effect means we overvalue something because we own it.

Made by the author

Of course, with Adyen being a big position, the endowment effect is very strong for me. At the same time, if the story changed fundamentally, I would sell or trim my position. I try to avoid the endowment effect by actively looking at the bear arguments and realizing that I have to sell when a company is just not living up to the expectations anymore. Up to now, that’s not the case for Adyen.

3. Loss Aversion

Made by the author

This is a very powerful one and, to be honest, one I have suffered from this in the past. I held on too long to positions, like Peloton (PTON), Teladoc (TDOC), and several others. They have been sold and I don’t want to make that mistake again. That’s why I pay much more attention to it.

Often, loss aversion is combined with confirmation bias. Because of the loss aversion instinct, you only look at the bull arguments. In this case, I looked at the bear cases intentionally.

For Adyen, I don’t see the degradation in quality that I should have seen for others in the past. So, adding to my position in the red here doesn’t feel like desperately clinging to a loser, to the contrary. It feels like adding to a future winner. I see the big stock drop as a temporary opportunity to accumulate shares.

The company had announced it would hire for the next phase of its growth. It does that in a time when everyone lays off people, which makes it much cheaper. To me, that looks like a fantastic countercyclical move. Of course, that has an impact on the immediate profitability results, just as the company announced. And Adyen has experience with this, as it scaled similarly in 2017. Indeed, the next phase of growth did indeed follow.

And yes, American e-commerce’s revenue was about 3% lower than expected. That’s about it when you look at the fundamentals and ignore the huge price drop. The rest are, so far (!) stories made up after the big drop. In investing, the stories follow the stock price.

4. Recency Bias

Made by the author

I think this is something many investors suffer from. They only remember the huge stock price drop and that colors everything. It’s like they are so frustrated that their minds can’t work anymore and they just want to smash things.

It’s the reverse of FOMO when stocks are near their peak. When stocks go up, many think they can only go up, when stocks go down, many think they can only continue to go down.

This is one I don’t have any trouble with, but if you do, try to fight it.

5. Anchoring Bias

Made by the author

Also a tough one for me. Because I investigate so much at the beginning before I pick a stock, it’s tough to weigh more recent information properly. Again, confirmation bias, which was not coincidently first in this list, is the way you rationalize this anchoring bias.

When you look at the price, you could say the same thing: because a stock has dropped significantly, doesn’t mean it’s cheap. If you think like that, that’s anchoring bias.

For Adyen, I don’t think I have an anchoring bias. Of course, often you can only know with 100% certainty in hindsight, but I have really made a big effort here to undercut my own assumptions, my own knowledge and my own biases.

Conclusion

I found it really important to write this article. I already started it a month ago, but I wanted to wait to take some distance to see if I would still feel the same when I looked at all the potential bear cases. And I do. I still see a lot of strength for Adyen. Not the stock, but the business. Of course, we will have to wait for results. Nobody can look into the future and that means I can be wrong. Sometimes, the market has a sharp eye for the future, but sometimes, it’s just plainly wrong. I think this is a case of the second, but it’s only certain in hindsight.

I think other people’s biases are stronger than mine in this case. I’m talking about recency bias and also apophenia, the bias to see too many parallels. They see all payments (Block, PayPal in particular) as the same. But that is simply not the case. If you look at the fundamentals, Adyen has far better profitability, growth, a stronger business model, easier scalability and is overall higher quality than the others.

That’s why I continue adding substantially to my position and bring down my average price. Could that be a mistake? Sure. Even the best investors make mistakes, let alone me. But from what I see, the probability that this is a temporary situation looks bigger than the probability that Adyen is a damaged company.

In the meantime, keep growing!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here