A few days ago, I wrote an article titled “This REIT Myth MUST Be Debunked.” It was in response to someone’s comment that rising interest rates were rendering real estate investment trusts un-investable.

“When rates go up, so do rents… and more importantly, most REIT managers have been preparing for rising rates for quite some time. Just because rates moved so quickly is not the kiss of death. This myth MUST be debunked…”

The rest of the article did just that.

Overall, I think it was well received, but a few readers insisted I wasn’t seeing the full picture. One commented that “REITs are, in fact, highly levered,” even adding, “I challenge you to show that they are not.”

I hope said individual meant that dare because I’m officially taking it up.

Welcome to my second myth-debunking article in just a week.

The REIT sector isn’t overleveraged.

And I’m more than happy to prove it.

A Word of Caution About Commercial Real Estate in General

Despite the adamant argument I’m about to lay out for you about REITs not being overleveraged…

I do understand where the naysayers are coming from.

And if they’d just change their comments from REITs specifically to the larger commercial real estate (‘CRE’) category, I could grant them a whole lot more credit.

Take the Sept. 27 issue of CRE Daily. It mentioned “the imminent maturation of $1.5 trillion in commercial real estate debt between 2023 and 2025.”

Too many of the companies holding those loans already are struggling.

Many more are going to struggle further too, but not all. I can’t tell you the exact fraction off the top of my head. But I think it’s safe to assume the number is significant enough to report on without being catastrophic.

U.S. CRE is in store for noteworthy pain but not anything close to a total collapse. In which case, many of us will be operating in familiar territory.

If we survived 2008 and the stagnant years that followed, we can survive what’s up ahead.

Also worth pointing out – though not necessarily betting on – is H.R. 5580, a current House bill being considered. Recognizing the shaky ground that CRE rests on, four representatives have presented legislation that CRE Daily says seeks to:

“… reduce the tax burden on commercial real estate borrowers during loan modifications. This modification to Section 108(a)(1) of the tax code is designed to contribute to the stability of the post-pandemic commercial real estate market through the provision of tax reliefs in instances of debt restructuring.”

Can Congress come together on this?

Ultimately, I have no clue. I’m only pointing this out as a possibility.

Yet even if it isn’t, most real estate investment trusts (REITs) should be OK.

Here’s why…

To Each CRE Category Its Own

Again, commercial real estate is an enormous category that includes much more than REITs.

There are huge publicly traded and private companies that own and rent out CRE, mid-sized and smaller businesses, and countless individuals that operate an apartment building here or an office complex there.

Each category is navigating the post-pandemic burden differently. Likewise, apartment buildings and farmland operate under very different circumstances… as do big cities versus smaller cities versus suburbs… as does the West Coast vs. the Rust Belt vs. the Sun Belt.

I’m not here to tell you that office buildings everywhere are fine. Ask W. P. Carey (WPC) – see my latest article with more than 650 comments and counting.

But overall, research and reality are on REITs’ side. To quote Nareit’s “2023 Mid-Year Report”:

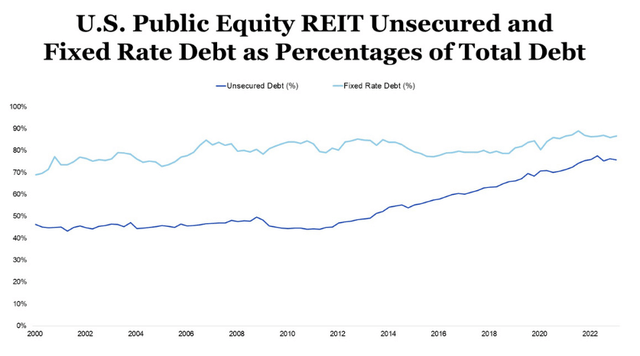

“… on average, equity REITs have maintained long-term, well-structured balance sheets with low leverage ratios, predominantly utilizing unsecured debt and fixed interest rates.”

Want the proof? Here’s one chart it included:

Nareit T-Tracker

It:

“… displays quarterly unsecured and fixed-rate debt as percentages of total debt for U.S. public equity REITs from the first quarter of 2000 to the first quarter of 2023. Equity REIT use of unsecured debt typically ranged between 45% and 50% of total debt prior to 2013. After that time, unsecured debt utilization grew consistently, reaching 76.0% of total debt in the first quarter of 2023.”

Moreover:

“REITs have also favored using fixed-rate debt. At the beginning of 2000, fixed-rate debt accounted for almost 70% of equity REIT total debt. By the first quarter of 2023, it comprised 87.0% of total debt, and the weighted average term to maturity for all REIT debt was nearly seven years. By focusing on unsecured, fixed rate, and longer-term debt, public equity REITs have limited their exposure to the challenges of the current mortgage market.”

As such, “their debt costs only increased marginally” comparatively speaking.

A Look at REITs’ Unsecured Debt Issuance

Let me sum up the previous information by reiterating that REITs are being punished for disconcerting conditions they’re well positioned to navigate.

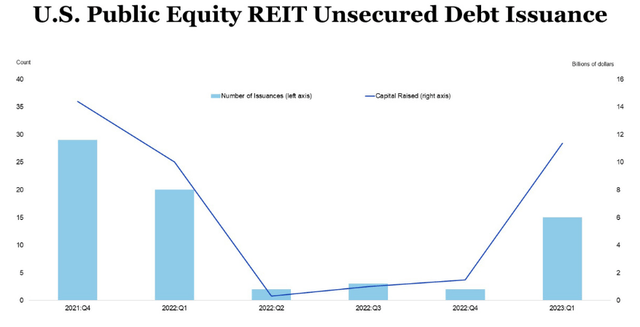

But we don’t have to stop there. Here’s another chart from Nareit’s mid-year report:

Nareit, S&P Global Market Intelligence

This one highlights both the number of issuances raised by equity REITs and the total capital they raised.

“With the rise in interest rates and debt costs in 2022, REITs acted rationally,” it writes. “Their unsecured debt issuance fell off precipitously.” This wasn’t because they were suddenly restricted by outside forces; they chose this course of action on their own.

But what about now? That report, after all, was from June. And a lot has happened since then.

So how about this from Cohen & Steers in late August: “Listed REITs are now in a position to provide liquidity to the broader commercial real estate market.” While it sees private property valuations declining “20%-25% in total this cycle – significantly more than the 10%-15% decline that has occurred in the last year,” it cites these reasons for REIT cheer:

- They “have strong balance sheets.”

- They entered the slowdown in “relatively healthy positions due to favorable supply/demand dynamics.”

- They “have access to diverse sources of capital.”

None of this could be true if leverage was an issue.

Go ahead and read the full report if you think I’m splicing and dicing from it. But I’m not. Cohen & Steers concluded the same thing about REITs going into September as Nareit reported in June.

The REIT category is in a good place no matter how you look at it.

Now that I’ve cleared up that myth, let me provide you with two REITs I’m buying as a result.

Agree Realty (NYSE:ADC)

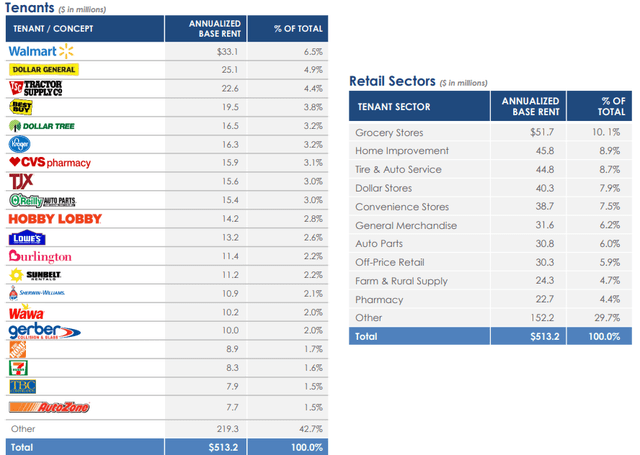

Agree Realty is a real estate investment trust (“REIT”) that acquires and owns commercial retail properties which are net-leased to retailers that primarily operate in industries which are insulated from recessions and e-commerce.

ADC’s largest retail sector is grocery stores, which makes up 10.1% of their annualized base rent (“ABR”), followed by home Improvement and tire and auto service, which makes up 8.9% and 8.7% of their ABR, respectively.

Agree Realty has a very strong tenant roster which includes well-established names such as Walmart, CVS Pharmacy, Kroger, Lowe’s, Home Depot and 7-Eleven.

Based on the percentage of ABR, the largest tenant is Walmart which makes up 6.5%, followed by Dollar General which makes up 4.9%, and Tractor Supply which makes up 4.4% of their ABR.

To highlight the quality of ADC’s tenants, as of their most recent update, 67.9% of their ABR was derived from tenants (or their parent company) that had an investment-grade credit rating.

As of the end of the second quarter, ADC’s portfolio consisted of more than 2,000 properties located across 49 states that had a weighted average remaining lease term of 8.6 years and were approximately 99.7% leased.

ADC – IR

When I look at the financial health of a company, I like to look at the level of debt as it compares to the company’s earnings or cash flow.

The net debt-to-EBITDA ratio works well to get an idea of how many years of EBITDA it would take to pay off all of the REIT’s debt.

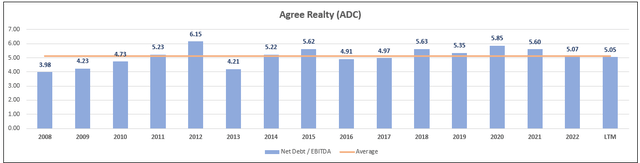

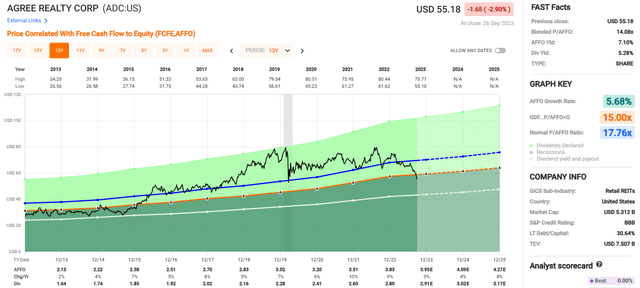

Since 2008 Agree Realty has averaged a net debt to EBITDA of 5.11x and for the last twelve months (“LTM”) they have been slightly below the average with a net debt to EBITDA of 5.05x.

Looking at this ratio over the years shows that ADC’s debt has remained stable in relation to their earnings.

TIKR.com (compiled by iREIT®)

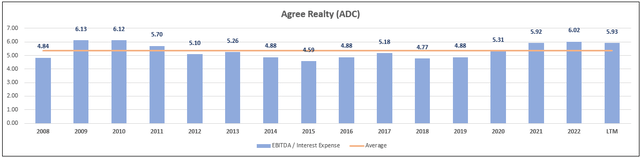

I also like to look at how many times over a REIT’s EBITDA can meet its annual debt obligations or cover its interest expense. ADC has averaged a EBITDA-to-interest expense ratio of 5.34x since 2008.

For the LTM this metric is slightly above the average at 5.93x, reflecting that Agree Realty’s EBITDA can cover its annual interest expense 5.93 times over.

Both the leverage ratio (net debt/EBITDA) and coverage ratio (EBITDA/interest expense) show that ADC has been able to successfully operate their business with similar levels of debt going back to the Great Recession of 2008-2009.

TIKR.com (compiled by iREIT®)

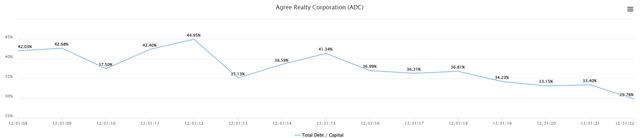

Finally, to get a good picture of a company’s capital structure I like to look at the REITs total debt as a percentage of their total capital.

This metric has become more conservative over the years with ADC’s total debt representing 42.03% of their total capital in 2008, compared to 2022 year-end when ADC’s total debt represented only 29.78% of their total capital.

TIKR.com

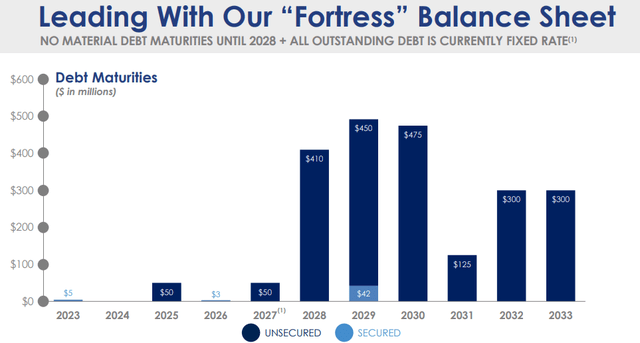

Agree Realty has an investment-grade balance sheet with a Baa1 credit rating from Moody’s and a BBB credit rating from S&P Global.

All of the debt is fixed rate, the vast majority of the debt is unsecured, and they have no significant debt maturities until 2028.

At the end of the second quarter ADC had total liquidity of $911.2 million which consisted of $12.2 million of cash, $202.0 million of outstanding forward equity, and $697.0 million available to them under their revolving credit facility.

Subsequent to the end of the second quarter, ADC closed a $350 million 5.5-year term loan which brings their total liquidity to approximately $1.3 billion.

ADC – IR

Agree Realty was founded in 1971 and went public in 1994 and has been acquiring and leasing commercial properties profitably over the years under multiple economic conditions including high interest rates and inflation.

They have grown their adjusted funds from operations (“AFFO”) each year since 2013 and have achieved a blended average AFFO growth rate of 5.68% since that time.

The stock pays a 5.28% dividend yield that is well covered with a 2022 year-end AFFO payout ratio of 73.24% and currently trades at a P/AFFO of 14.08x, compared to their 10-year average AFFO multiple of 17.76x.

We rate Agree Realty a Strong Buy.

FAST Graphs

VICI Properties (NYSE:VICI)

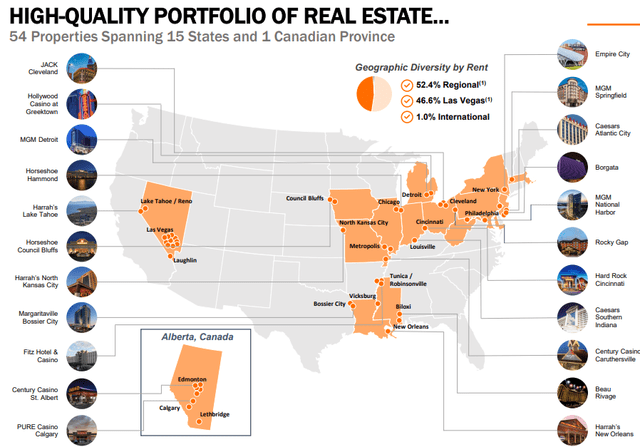

VICI is a triple-net REIT that invests in experiential real estate with a portfolio of leading gaming, hospitality, and entertainment destinations. Some of the more iconic properties in their portfolio include Caesars Palace Las Vegas, MGM Grand, and the Venetian Resort Las Vegas.

In total, VICI’s portfolio consists of 54 gaming facilities totaling approximately 124 million square feet which includes approximately 60,300 hotel rooms, around 500 retail outlets, and over 450 bars, restaurants, nightclubs, and sportsbooks.

In addition to their gaming properties, VICI also owns four championship golf courses as well as 33 acres of undeveloped land which sits next to the Las Vegas Strip.

VICI has high tenant concentration with a total of only 11 tenants and the company has a particularly high concentration in their top 2 tenants, Caesars and MGM Resorts, which make up 40% and 36% of their annual cash rent respectively.

Normally I’d be cautious about owning a REIT with such high tenant concentration, but the properties operated by Caesars and MGM Resorts are iconic and cannot be easily replaced or relocated.

In addition, the weighted average lease term (“WALT”) for Caesars is 32.1 years and the WALT for MGM Resorts is 51.8 years when including all tenant renewal options.

The duration of VICI’s lease terms should provide stable rent checks for years to come and should do well in a raising rate environment as 50% of VICI’s rent roll has CPI-linked escalation in 2023 and 96% of their rent roll is expected to have CPI-linked escalation by 2035.

VICI – IR

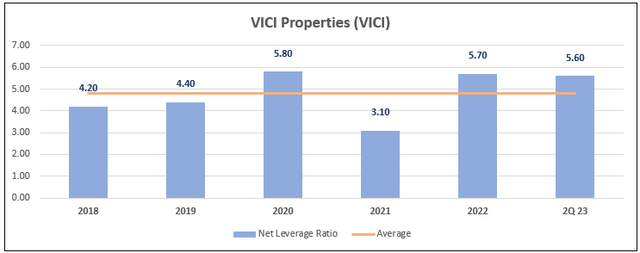

VICI went public in 2018 so we don’t have too many years to look at, but since the IPO the company has maintained a solid net leverage ratio (net debt / adjusted EBITDA) with the ratio ranging from as low as 3.1x in 2021 to as high as 5.8x in 2020.

As of the end of the second quarter, VICI’s net leverage ratio was reported at 5.6x, which is slightly above the average of 4.8x, but still well within reason and in line with many of its net-lease peers.

VICI – IR (compiled by iREIT®)

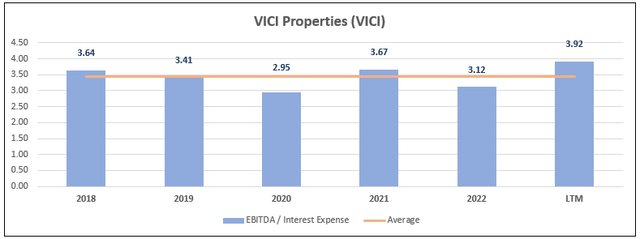

VICI also has maintained a stable coverage ratio with their EBITDA to interest expense ratio ranging from around 3x to almost 4x since 2018.

For the last 12 months, VICI’s EBITDA to interest expense ratio came in at 3.92x, which is slightly above their average of 3.45x and reflects that VICI can cover their annual interest expense almost four times over.

TIKR.com (compiled by iREIT®)

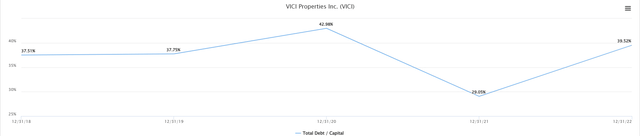

VICI has maintained a conservative capital structure with their total debt making up 37.51% of their capital in 2018 and their total debt making up 39.52% of their capital as of the end of 2022.

TIKR.com

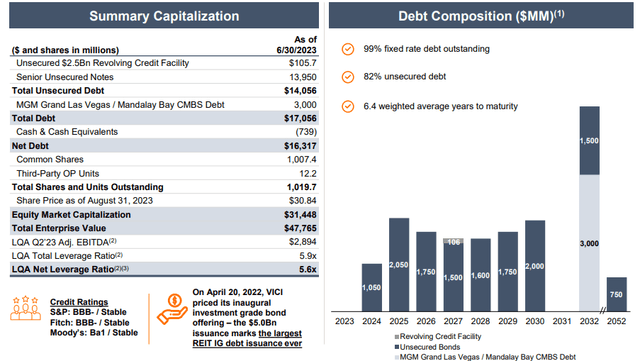

VICI has an investment-grade balance sheet with a BBB- credit rating from S&P Global. The company has a net leverage target of 5.0x to 5.5x and as previously mentioned, they are on track with their most recent net leverage ratio of 5.6x.

Their debt is 99% fixed rate and 82% unsecured with a weighted average term to maturity of 6.4 years and no debt maturities come due until 2024.

VICI – IR

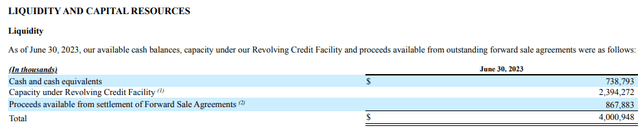

Plus they have a ton of dry powder with approximately $4.0 billion of total liquidity that consists of $738.8 million of cash and equivalents, $2.4 billion of availability under their revolving credit facility, and $867.9 million available from forward sale agreements.

VICI – IR

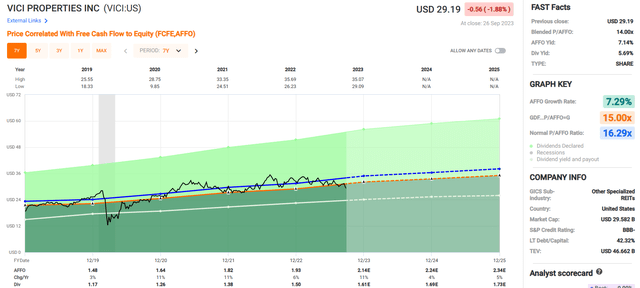

Since 2019 VICI has delivered an average AFFO growth rate of 7.29% and an average dividend growth rate of 10.80%.

The stock pays a 5.69% dividend yield that’s well covered with a 2022 year-end AFFO payout ratio of 77.72% and currently trades at a P/AFFO of 14.00x which compares favorably to their average AFFO multiple of 16.29x.

We rate VICI Properties a Buy.

FAST Graphs

Time is on my side… and yours too!

“Time is on your side when you own shares of superior companies.”

Peter Lynch

The debate rages on…

How much more pain is in the REIT sector?

If I knew the answer to that question, I would not be writing on Seeking Alpha.

Instead, I would be playing on the beach every day with my grandson, Asher.

Brad Thomas

Nonetheless, I’m thinking about Asher and my five children a lot, as I edge closer to the days that I can live off of my dividend income.

“The real key to making money in stocks is not to get scared out of them.”

Peter Lynch

I’m sure many REIT investors are becoming fearful, as they read headlines like “REITs are leveraged” or “run from REITs.”

Here’s how I see it…

We’re entering a new cycle, in which there will be a significant wealth transfer in commercial real estate.

It’s true, banks are pulling back…

And loan defaults are increasing…

And CRE valuations are declining…

Weaker hands will fold, creating once-in-a-lifetime opportunities for the dominant landlords to gain market share.

We’re seeing it already…

- Kimco (KIM) buys RPT Realty.

- Simon (SPG) buys Taubman.

- American Tower (AMT) buys CoreSite.

- KKR (KKR) buys CyrusOne.

- Realty Income (O) buys Vereit.

- Blackstone (BX) buys American Campus.

- Prologis (PLD) buys Duke Realty.

Now is not the time to be too cute.

Given the bargain basement valuations in the REIT sector, I’m laser-focused on blue-chip names like Agree and VICI.

Sooner or later, rates will pause… and eventually fall.

Again, I can’t tell you how long that window will stay open (I don’t have a crystal ball), which is why I’m nibbling weekly and keeping ample cash on hand.

Could Realty Income drop below $45?

Your guess is as good as mine.

If it does, I’m ready.

I do know that we’re living in a unique time in which you can purchase REITs at prices that we may never see again… in our lifetime.

I’m not only investing for my future, but for future generations (like Asher).

“People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare them out of the game.”

Peter Lynch

I hope you enjoyed this article, and I look forward to your comments below.

I’m always game for Debunking 3.0…

Happy REIT investing!

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here