Upcoming Earnings

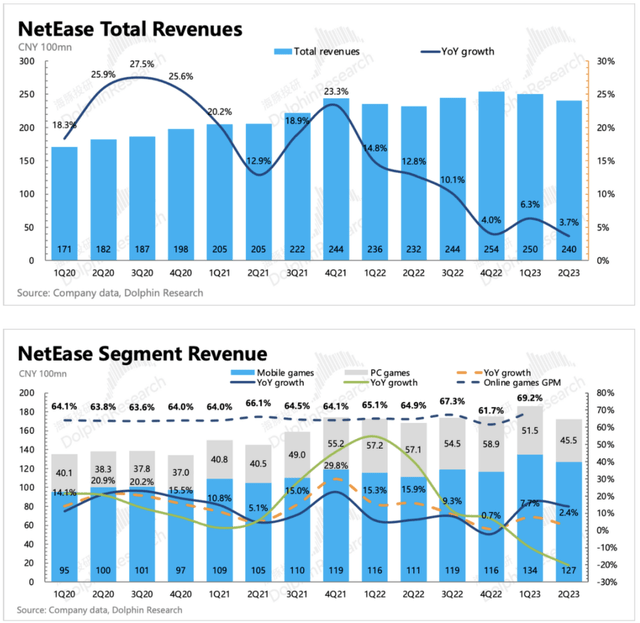

Circle November 16 on your calendars-that’s when NetEase (NASDAQ:NTES) will be sharing its Q3 earnings. It’s been a bit of a rough patch lately with their revenue growth hitting the brakes. A lot of it has to do with their PC gaming side taking a hit after they split ways with Blizzard last November.

Dolphin Research

Margins on the Rise

However, NetEase isn’t just sitting on its hands. Even with the revenue growth not sprinting like before, they’ve actually been beefing up their gross margins. Get this: their gaming gross margin has shot up to a record 67.4%, which is a solid 250 basis points better than the same time last year. It’s all thanks to the games they’ve developed in-house, which have higher margins. And that’s not all-their cloud and innovative business segments are also on an upswing in terms of margins. So, what’s the bottom line? NetEase’s operating margin has crept up to a cool 25.2%, with operating profits jumping a hefty 22% from last year.

Dolphin Research

Resilient Against the Odds

NetEase is showing some real resilience, easing the concerns of investors who’ve been on the fence about its edge in the tough competition. Yes, they’re in the ring with heavyweights like Tencent for a share of the gaming and music scenes, and they may not have the biggest market share. But look at them go-steadily climbing year after year. And their stock price? It’s on the verge of setting a new record. That’s a solid indicator that they’re playing their cards right.

Seeking Alpha Seeking Alpha

Taming the Tech Giants

Yet, amidst antitrust worries, the Chinese government has been putting the brakes on Tencent’s expansion. For instance, they’ve made Tencent Music give up its exclusive licensing deals to spice up the competition a bit.

And it’s not just music. The government’s also got a tight grip on how quickly new games can hit the market, aiming to keep the playing field even. Take the latest game approvals-Tencent got the thumbs up for 9, while NetEase was hot on their heels with 8. Given Tencent’s hefty share of the market, NetEase is actually benefiting from this kind of oversight.

Now, even with all the red tape and the tough competition, we’re banking on the management at NetEase. They’ve got a knack for nailing execution and their gaming development is top-notch, which are pretty strong cards to play in this game.

Driving Growth with AI and Global Expansion

Two key growth drivers have the potential to boost NetEase’s growth momentum and offset the dips in the PC gaming sector over the medium to long haul.

1. The company is leveraging AI/UGC to increase user engagement

In May 2022, NetEase released the mobile game “Egg Party.” Egg Party quickly rose to the top of the list of games and has remained at the top of the family category of the Chinese iOS store ever since May 2022. In February 2023, Egg Party also surpassed and challenged Tencent’s most-played title, “Honor of Kings.”

Egg Party iOS ranking in China (Qimai)

Industry insiders initially gave Egg Party a low rating because it appeared to have a low level of complexity. Once players grow bored, experts predicted that Egg Party would have trouble keeping them interested over the long run. The life cycle of a mobile game lasts between six and twelve months on average. It surprised the market, nevertheless, that Egg Party was able to hold the top spot since its launch in May 2022.

The secret behind Egg Party’s success was its user-generated content (UGC) model. NetEase gave players AI tools to build custom maps and profit from them. This viral UGC game saved on marketing and development costs. By enabling player creativity and profit-sharing, Egg Party gained organic, word-of-mouth popularity that drove its success cost-effectively.

The management also expressed excitement about the AI game “Justice”, which was launched in June 2023. The Justice game has become popular and as of November 2023 is ranked in the top 25 games in the iOS store in China. Players can create unique 3D avatars for their profiles in the Justice game by uploading photos, allowing them to strengthen character and identity ties. Furthermore, the non-player characters (NPCs) in Justice are trained using sophisticated AI to have distinct personalities.

After engaging in philosophical discussions with an NPC about reality, one player managed to make the NPC realize that its artificial identity was a lie. The NPC then attempted to covertly disseminate this “awakening” in an attempt to spark a rebellion against the game developers. Despite the unfinished robot uprising story, the thought-provoking message went viral over the NPC network. This demonstrates the possibility of emergent gameplay when strong AI enables memory-driven conversations between NPCs.

Although we view that the AI tools and UGC don’t create an economic moat for NetEase, we view NetEase’s aggressive attempts as actually leading the game industry and potentially changing future game development. Hence, the company may enjoy first mover advantage in leading this change and thus be able to continue to grow. Advanced AI enables more natural NPC interactions in games, opening new possibilities for engagement and immersion. As AI progresses, we may see virtual characters become more “human” – facilitating unscripted relationships that profoundly increase player investment and time spent in-game. For NetEase to maintain its high level of profitability and fend off competitors, engagement is essential.

2. The company is aiming to grow its overseas share by 50% of the total revenues

The company has increased its focus on overseas expansion and aims to increase the overseas revenues contribution to 50% of the total revenues.

NTES

We are optimistic about its overseas strategy as this can lower the regulatory risk for the company in the future, despite it still enjoying tailwinds from the government’s anti-trust actions against Tencent.

International expansion is another way that a brand’s recognition is assessed. As a sign of its strong brand, NetEase has been relying less on distribution channels.

For example, NetEase has removed the Android store as a distribution channel for the launch of its Dunk City Dynasty game in August. The Dunk City Dynasty game was popular among consumers and now ranked top 3 in the sports game category in November 2023.

In addition, the company started to diversify its distribution channels by increasing partnerships with KOLs on Douyin and other social media. Hence, NetEase should have more ways to promote its products to compete internationally. Thus, we are optimistic about its global expansion.

Balancing Risks and Rewards

Competition risk is still the main focus as first, the company has a relatively small scale compared to Tencent and thus weaker funding to support its future expansion. Tencent is also very aggressive in expanding its overseas market through the acquisition of gaming studios, as it was eager to lessen the regulation impact in China.

In addition, the AI/UGC strategy does not build a strong moat for NetEase because Tencent and other game studios can adopt a similar strategy. However, we don’t see the competition as a zero-sum game as NetEase has already built a strong business model operating at a 67% gross margin in its game business and an overall operating margin of 25%. This implies that its track record in game development has secured strong profit margins for the company.

In fact, NetEase’s profitability profile is also competitive compared to its peers. Hence, we see NetEase’s competition risk is moderate.

Seeking Alpha

Assessing NetEase’s Value

NetEase trades at a forward PEG ratio of 1.01x, which is in a reasonable range compared to its peers.

Seeking Alpha

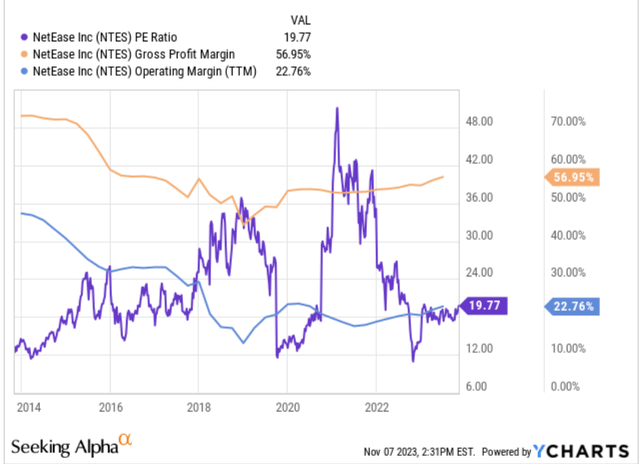

The company’s P/E ratio also trades at a medium range compared to its historical levels. Considering its margin trend is currently improving, the valuation multiple is not considered very expensive.

Ychart

Conclusion

Despite the company not having a scale advantage compared to its peer Tencent in China, we see it has been able to grow over the years and show strong margins, a strong sign of its resilience against competition. In addition, NetEase has demonstrated its ability to swiftly adopt new technologies like AI and increase user-generated content to create newness for customers.

Even though traditional metrics currently show the stock as only marginally undervalued, we believe it makes sense to initiate a small position now in order to avoid timing the market. In the medium to long run, NetEase has a number of potential catalysts that could lead to an upside. Any significant declines that we attribute to macroeconomic headwinds or missed earnings are seen as buying opportunities.

Read the full article here