Summary

Airtel Africa (OTCPK:AAFRF) is a Sub-Saharan telecom operator with a large market share lead in many of its markets. AAFRF, in particular, has expanded its 4G coverage to support the growth of the mobile data market. Readers may find my previous coverage via this link. My previous rating was a buy as I believed the price action (27% drop) was excessive back then and that AAFRF is a beneficiary of Foreign Currency Policy change over the long term as currency becomes more stable over time. I am reiterating my buy rating that AAFRF will be able to continue riding on the secular tailwind in Africa in terms of mobile data penetration increasing. While valuation has reached my expected figure (9x forward PE), I do see positive catalysts that could drive valuation higher, thereby increasing the upside potential.

Financials / Valuation

Revenues and EBITDA for the AAFRF group grew by 20% and 23% y/y in constant currency, respectively, in 1Q24. The growth was fueled by the company’s continued dedication to streamlining operations and the success of the company’s strategy across markets. As I expected, the devaluation in Nigeria had a small effect on reported revenues and EBITDA but, it did, however, caused a US$471mn non-operating FX loss that was reflected in the finance cost line item. AAFRF’s strong growth in constant currency terms shows that, despite some challenges, the organization is on the right track.

In terms of valuation, my model assumptions remain the same as before. I still believe the stock is worth around 150 pence. I think the market is coming to terms with my expectations that the new foreign currency policy in Nigeria was not as bad as it seems, given that multiple (forward PE) has rerated back to near 9x (which is what I modeled). However, I think there is a chance for AAFRF to now trade higher than 9x forward PE (its historical average) given the Nigerian currency is now much more stable, which could eliminate the FX risk that investors dislike. As AAFRF continues to deleverage its balance sheet and grow its business, I expect a higher multiple to be attached, driving a price target that is higher than my expected 150 pence.

Comments

AAFRF remains, in my opinion, advantageously positioned to benefit from the structural growth trends existing in its African markets. As the mobile penetration rate rises to reach global levels, I anticipate that the rise in subscriber penetration will follow suit. The expansion of smartphone availability should boost data consumption, which is good news for AAFRF. Thus, I anticipate that data services will continue to play a significant role in the top-line growth of AAFRF over the next few years.

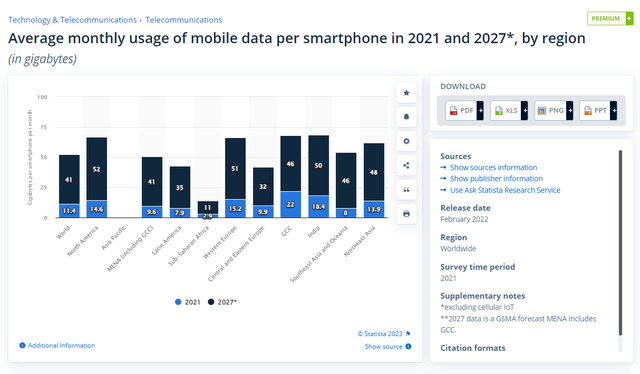

According to the recent reported data, quarterly growth in mobile services has been in the high single digits, with data revenues driving most of this expansion. The latter is the result of rising data consumption and a larger subscriber base caused by rising demand for data services and falling smartphone prices. Although data usage has been growing at a double-digit rate in the AAFRF footprint, I believe there is still a lot of room for expansion because the average per-customer usage is still lower than in other regions (refer to Statista chart below). In addition, I’ve noticed that AAFRF has put a lot of effort into investing in a 4G network rollout across its footprint, with the result that as of 1Q24, all sites in Nigeria and 90.4% of sites in East Africa were offering 4G services, respectively. With increased penetration over the next two years, I anticipate mobile data revenues to continue growing at their historical rate.

AAFRF’s continued emphasis on network enhancement and rollout across markets, combined with its extensive presence across the continent, leaves it in excellent position to capitalize on growth tailwinds over the medium to long term, in my opinion.

Statista

I believe that mobile money, in addition to data, has been crucial to Airtel’s success. Because so many Nigerians lack access to traditional banking services, and because smartphone penetration is expected to rise, I think the country presents a compelling growth story for mobile money. Increased consumer education about mobile money services and broader efforts to raise awareness of the importance of financial inclusion should help this sector expand. My belief that mobile money will continue to be a growth driver as adoption improves over time is supported by the fact that, as of FY23, only two of 14 markets have achieved a high mobile money penetration rate. In addition, I point out that mobile money accounted for about 15% of Airtel’s total revenues as of 1Q24, a figure that I expect to rise as the Nigerian mobile money opportunity materializes and adoption rates increase.

Risks

The economic prospects of the countries in which AAFRF operates have a significant impact on how well it does in those countries’ markets. Negative effects on operational performance may result from weaker-than-expected growth or higher-than-expected inflation pressuring household incomes.

Conclusion

In conclusion, I reiterate a long position on AAFRF. AAFRF’s resilient financial performance, with significant revenue and EBITDA growth, demonstrates effective operational strategies. While valuation aligns with expectations, potential catalysts could drive higher valuation, especially considering improved currency stability. The company’s strategic focus on data services, aided by smartphone adoption, should continue to sustain top-line growth. Mobile money also offers substantial growth prospects, particularly in Nigeria, where financial inclusion efforts align with rising smartphone penetration. With AAFRF’s network enhancements and market presence, it’s poised to benefit from African growth trends over the medium to long term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here