Thesis Summary

In my last article on Altria (NYSE:MO), which was over three years ago, I discussed the idea that, under the right circumstances, Altria could make you a millionaire by 2030, which back then was a 10-year time horizon.

After three years, I must admit the stock has not performed as well as I expected, but total returns have still kept up with the broader market.

The recent post-earnings sell-off offers a great entry point. While there are certainly some lurking concerns, MO is still an excellent hold for income investors.

I have adjusted the calculations I made three years ago, and while they are not as bullish, Altria can still provide above-market returns over the next decade in my opinion.

Earnings Review

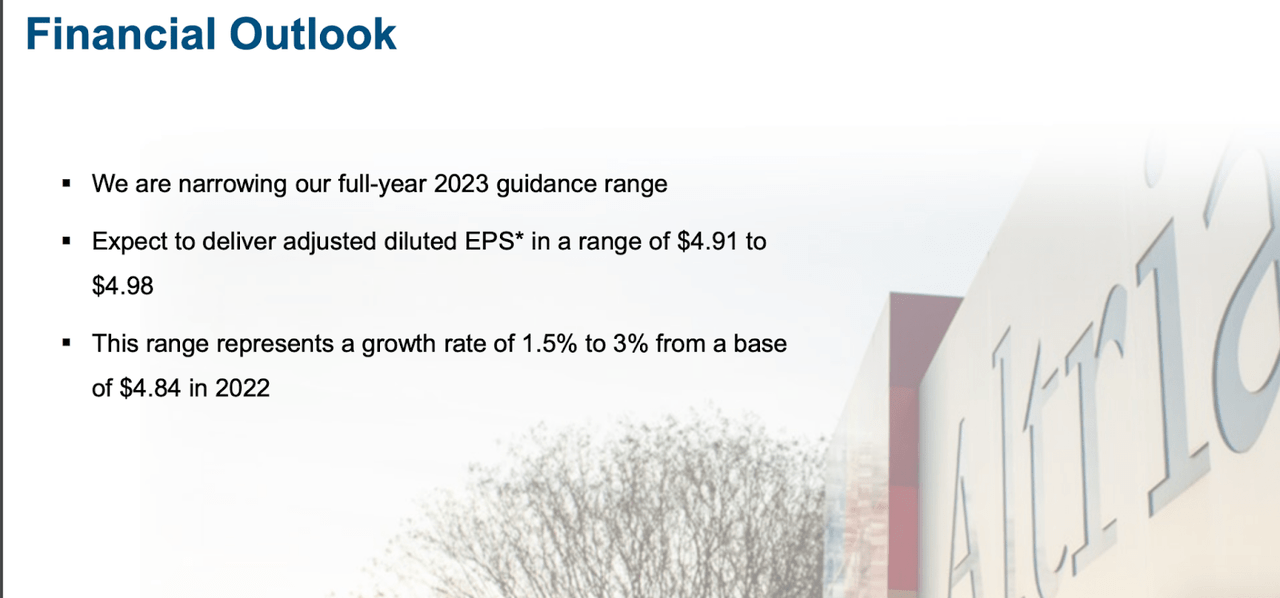

Altria missed on both earnings and revenue in the last quarter, prompting a swift sell-off of over 8% following the release. The company not only underperformed in this quarter but also “narrowed” its guidance for the full year, which actually means lowered.

Financial Outlook (Investor Presentation)

With that said, let’s look at how each of the segments performed for the quarter:

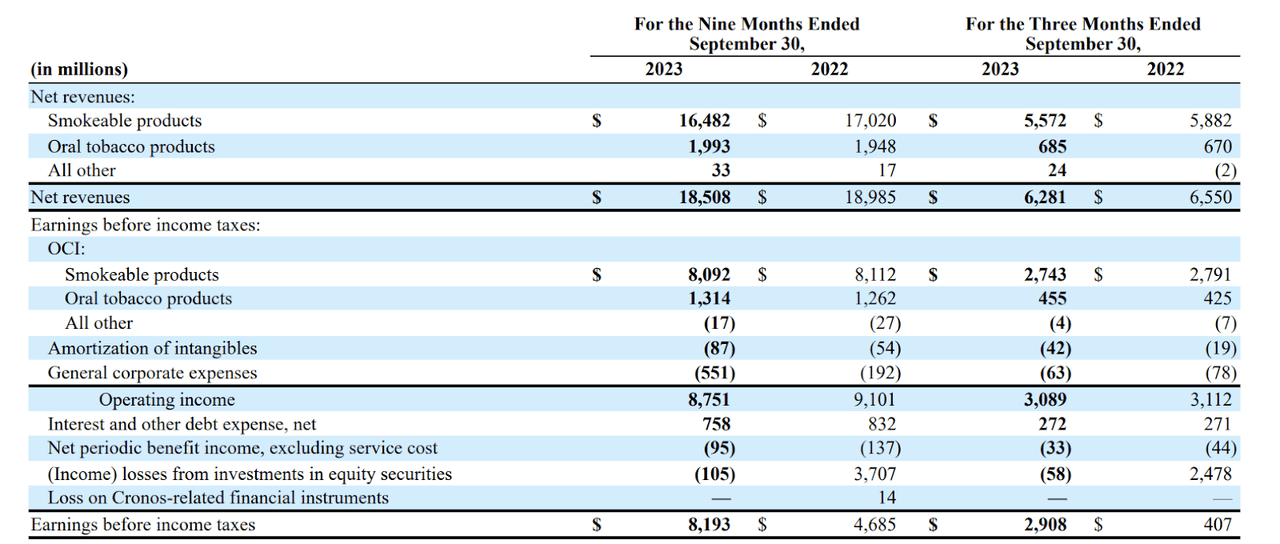

Altria Revenues (10-Q)

Smokeable products reported $5.572 million in revenues, down 5.2% YoY. Meanwhile, Oral Tobacco products actually grew around 2% YoY, contributing $685 million in revenues.

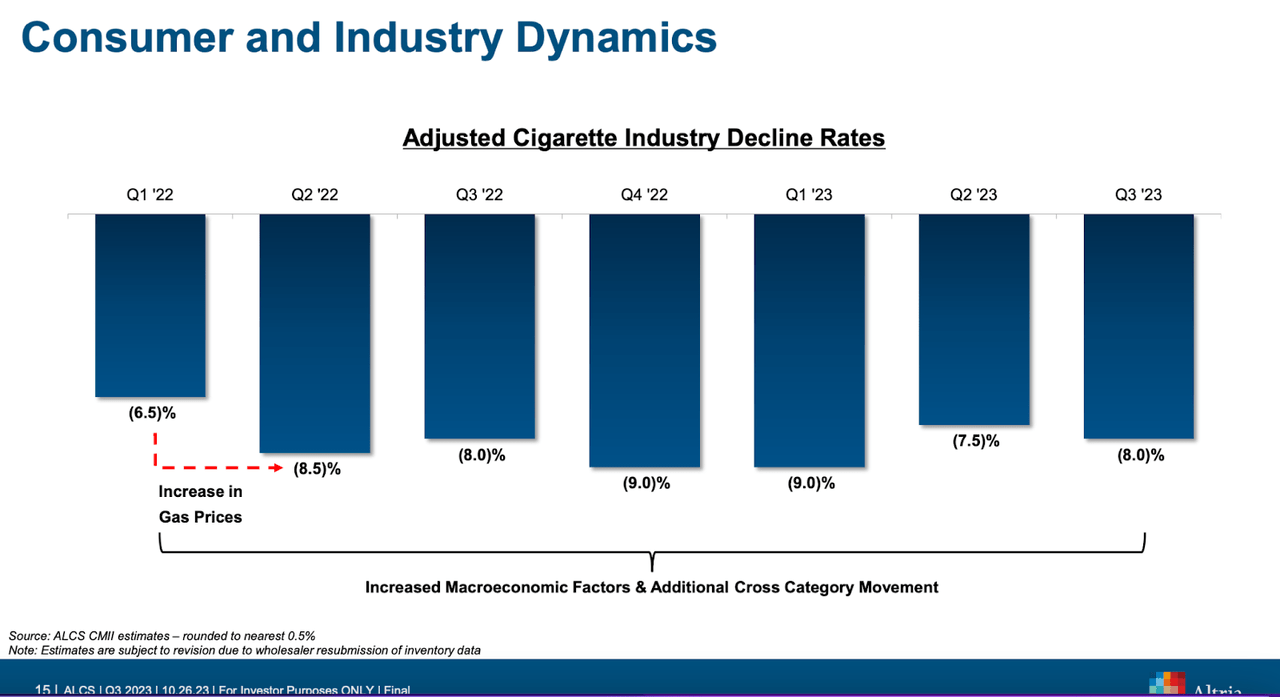

Obviously, there is no denying that the cigarette industry is in decline. That much is obvious, even to management.

Industry Dynamics (Investor Presentation)

With that said, there are still some rays of hope emerging out of the last quarter. Altria will have to pivot away from cigarettes slowly, but I definitely see a market for its newer products moving forward.

Future Outlook

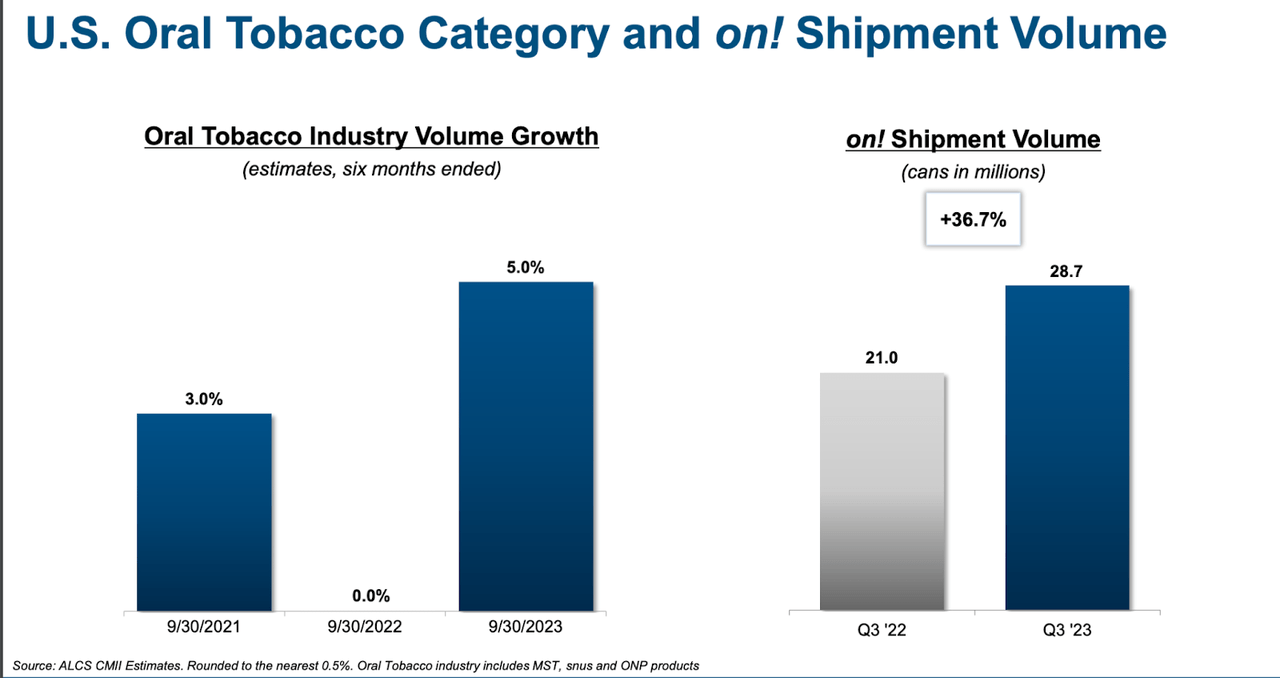

Cigarettes are out of fashion, but that doesn’t mean nicotine and other related products are. MO is seeing significant momentum in its Oral Tobacco shipments.

Oral tobacco performance (Investor Presentation)

on! shipment volumes have increased by a whopping 36.7%. The product seems to be popular, and the company can at least capitalize on the mild growth from oral tobacco moving forward.

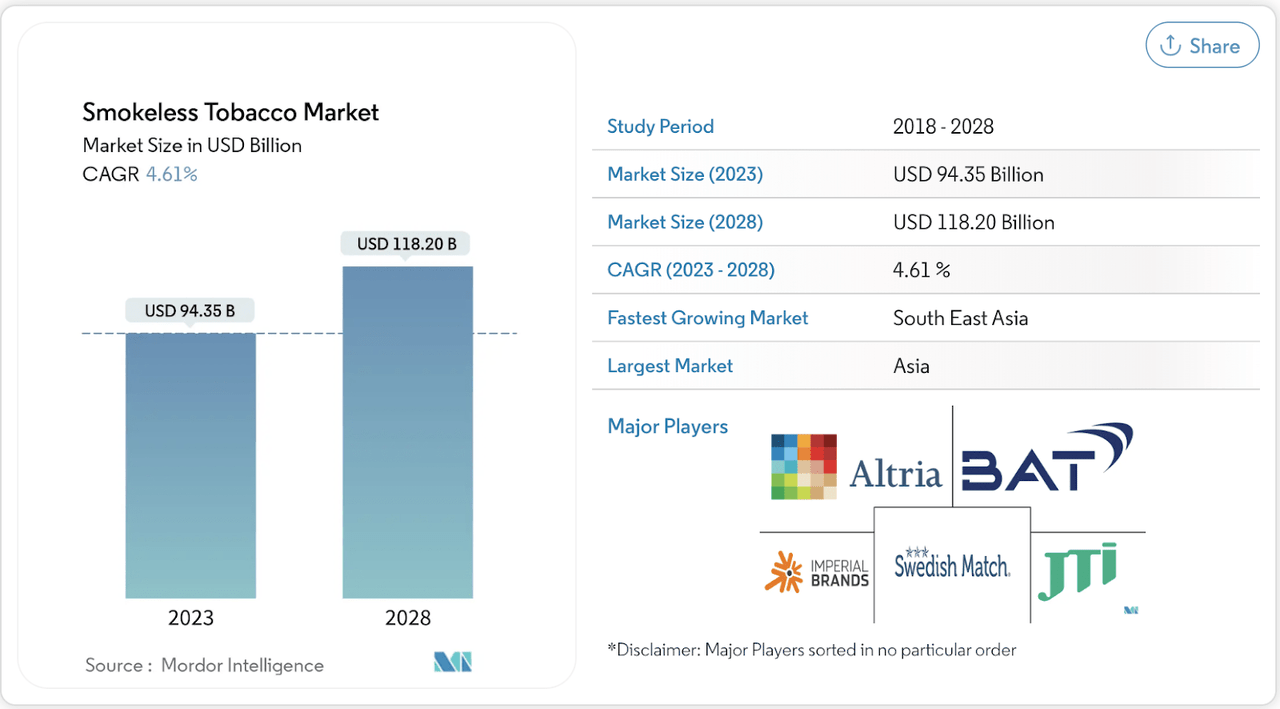

Smokeless tobacco market (Mordor Intelligence)

On the other hand, electronic cigarettes/vapes continue to grow in popularity.

The CDC reported that sales of vapes increased by 46.6% between January 2020 and December 2022.

According to Technavio, the E-cigarette and Vape market will grow at a CAGR of 30.41% from 2022 to 2027.

The Good and The Bad

The two key questions here are the following:

-

Just how fast will the decline in traditional smoking products be?

-

How successful will Altria be in capturing the market from “new” smoking products?

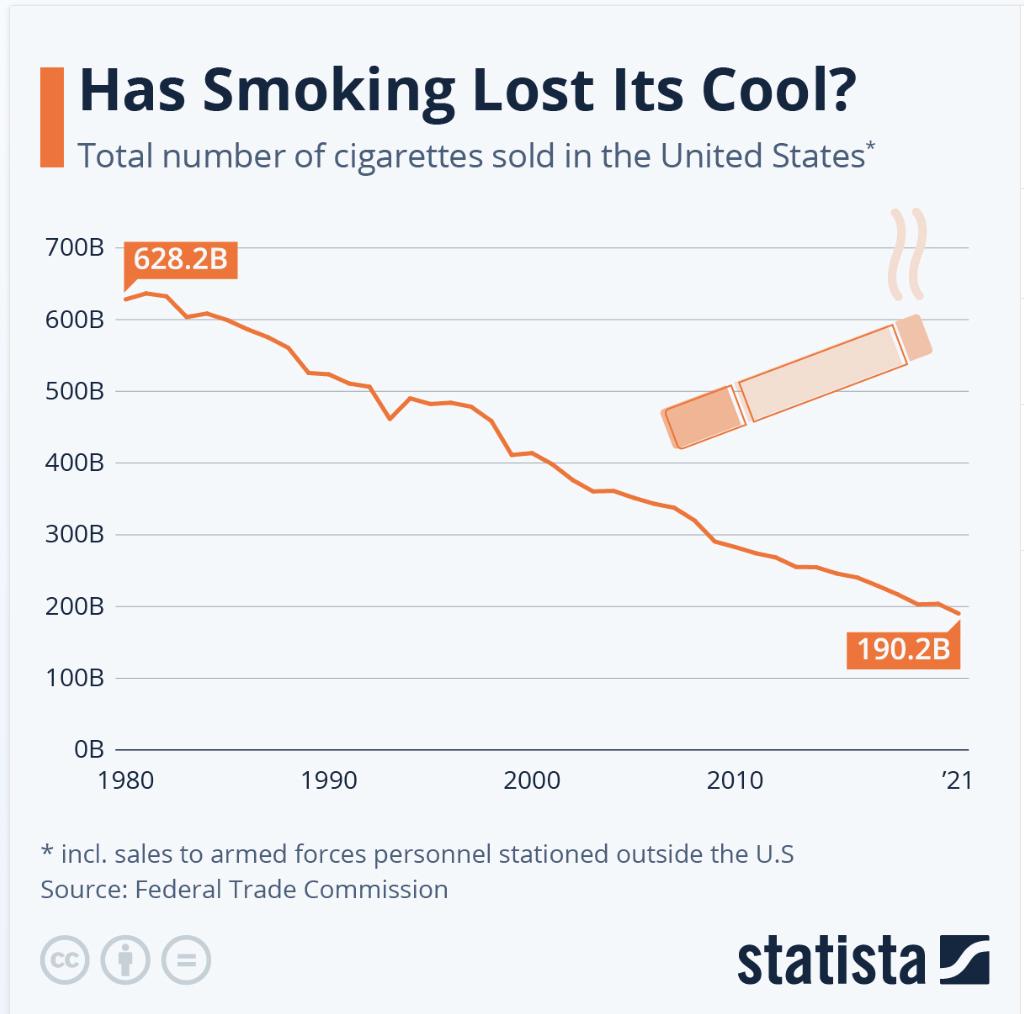

In terms of the first, cigarette sales have been in decline over the last 50 years.

Cigarette sales (Statista)

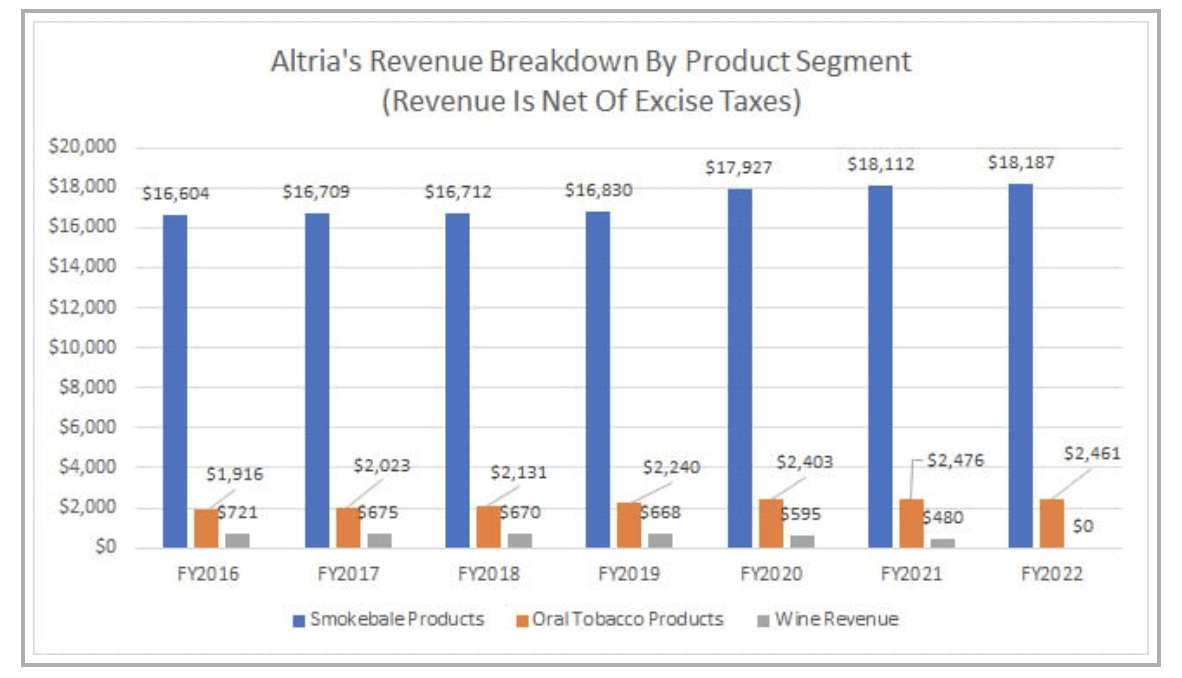

However, the same cannot be said of Altria’s revenues, which have held steady even in the face of a shrinking market.

Altria Revenues (dividendstockscreener)

Smokable product revenues have continued to increase over the last five years, and even though we are in decline, MO’s revenue is holding steady.

Furthermore, EPS continues to grow thanks to increased profitability.

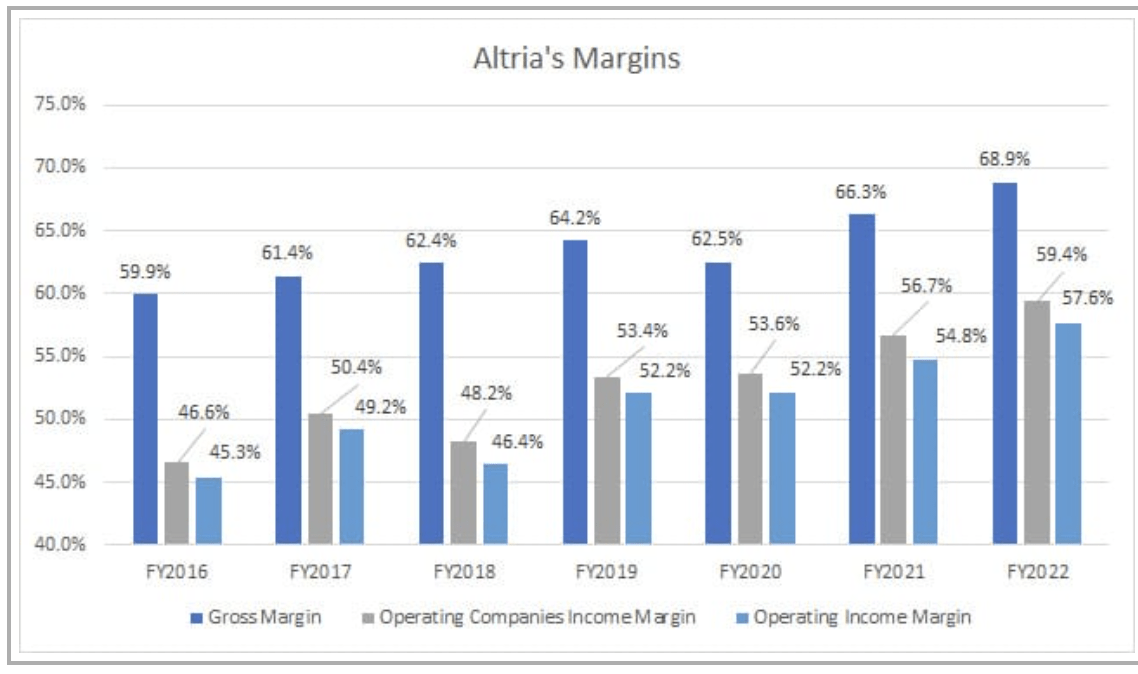

Altria Margins (dividendstockscreener)

To this extent, I do feel that the narrative around the decline of the industry is overblown. At the very least, MO is doing very well to maintain its revenue and EPS. This is thanks to its established brand and market dominance.

With that said, while MO is a household name in the smokeable tobacco segment, I have my doubts about how successful it can be in penetrating new markets.

These doubts, of course, stem from the complete failure of the JUUL acquisition. The company certainly overpaid, and its investment has underdelivered.

No worries, though; the company is trying again, now with the acquisition of NJOY.

NJOY outlook (Investor Presentation)

While I am hopeful about the outlook for NJOY, we will have to wait and see. This time, management must prove to investors that it can actually pull off this kind of acquisition.

Valuation

With that said the silver lining of Altria’s past failures is that it is priced for future failures.

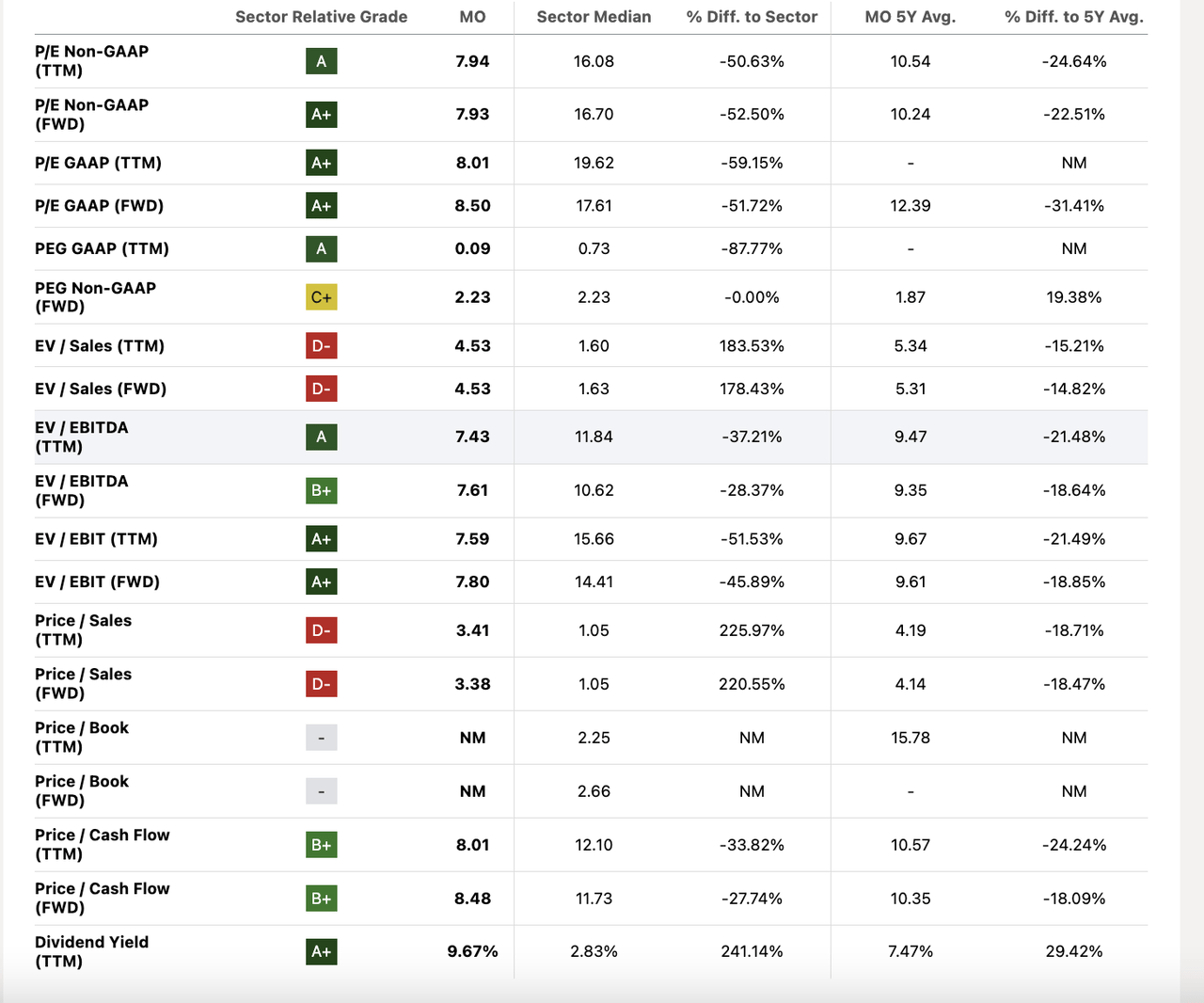

MO Valuation (SA)

Altria trades at a reasonable discount, both compared to the sector and its 5YR average. However, if the NJOY acquisition pays off, we could likely see these metrics pick up.

I believe that a company like MO could trade closer to 10x cash flow, which implies an undervaluation of around 18%.

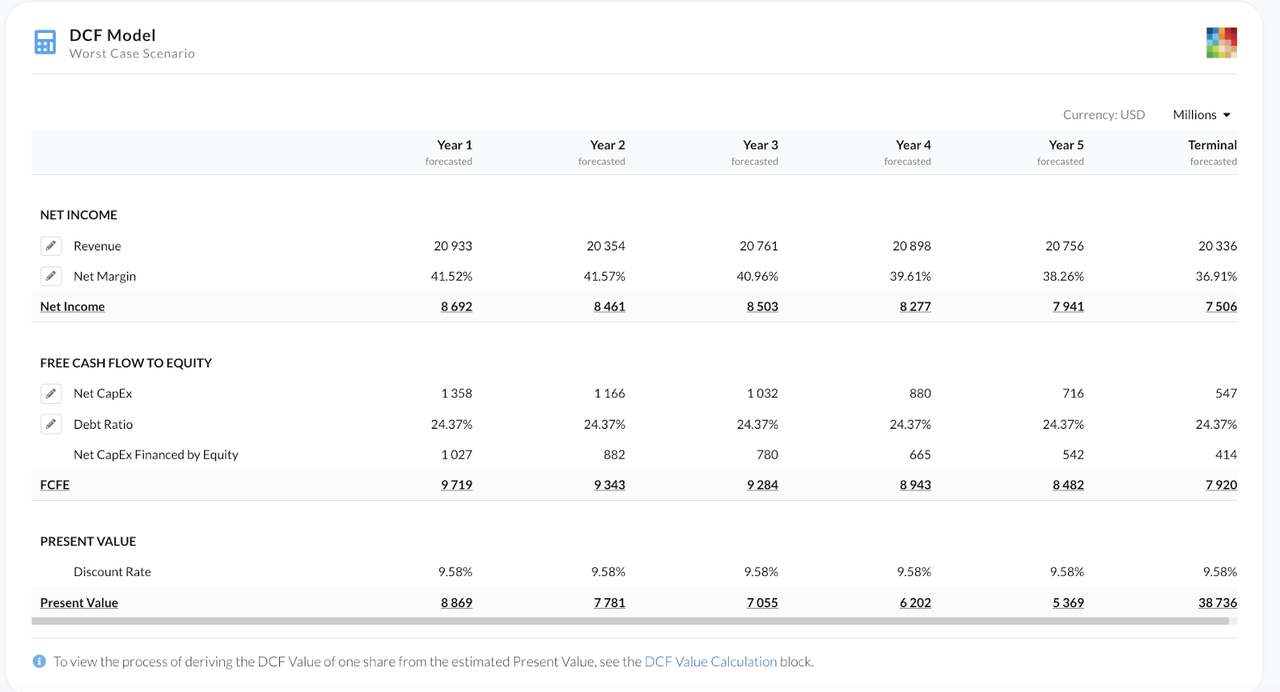

Right now, MO is trading at a “worst-case scenario” valuation in my opinion:

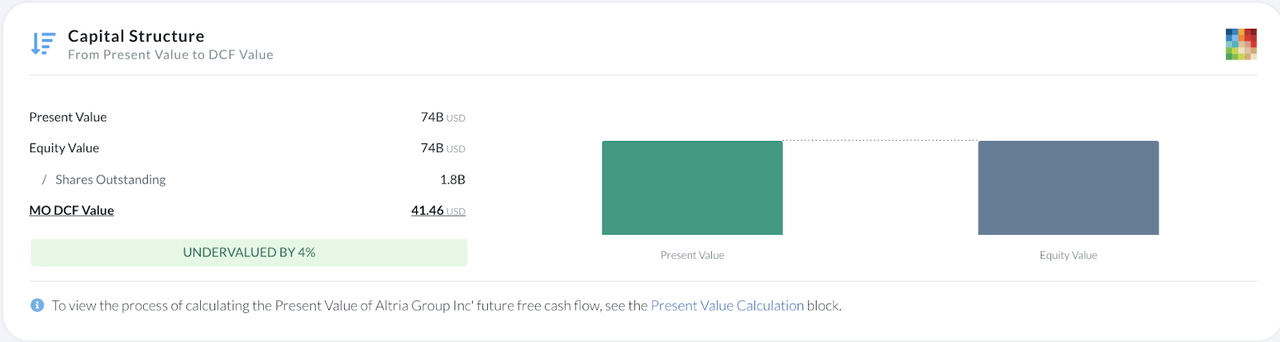

DCF model (Alpha Spread)

DCF valuation (Alpha Spread)

Even assuming revenue declines over the next five years, paired with a decline in profitability and applying a generous 9% discount rate, the stock comes up as 4% undervalued based on my DCF analysis.

Reassessing Previous Claims

In my last review of MO, I boldly claimed the stock could make you a millionaire in the next ten years, but this was under some assumptions.

“With a starting investment of $100,000 and annual contributions of $20,000, you’d have $1,059,570.95 by 2030. This does not take into account the effects of taxation. While this may seem optimistic, it is certainly a possibility.”

Source: Altria Article

Dividend calculator (Altria Article)

This calculation assumed an average yield of 7%, an average dividend growth of 8% and an average stock appreciation of 8%.

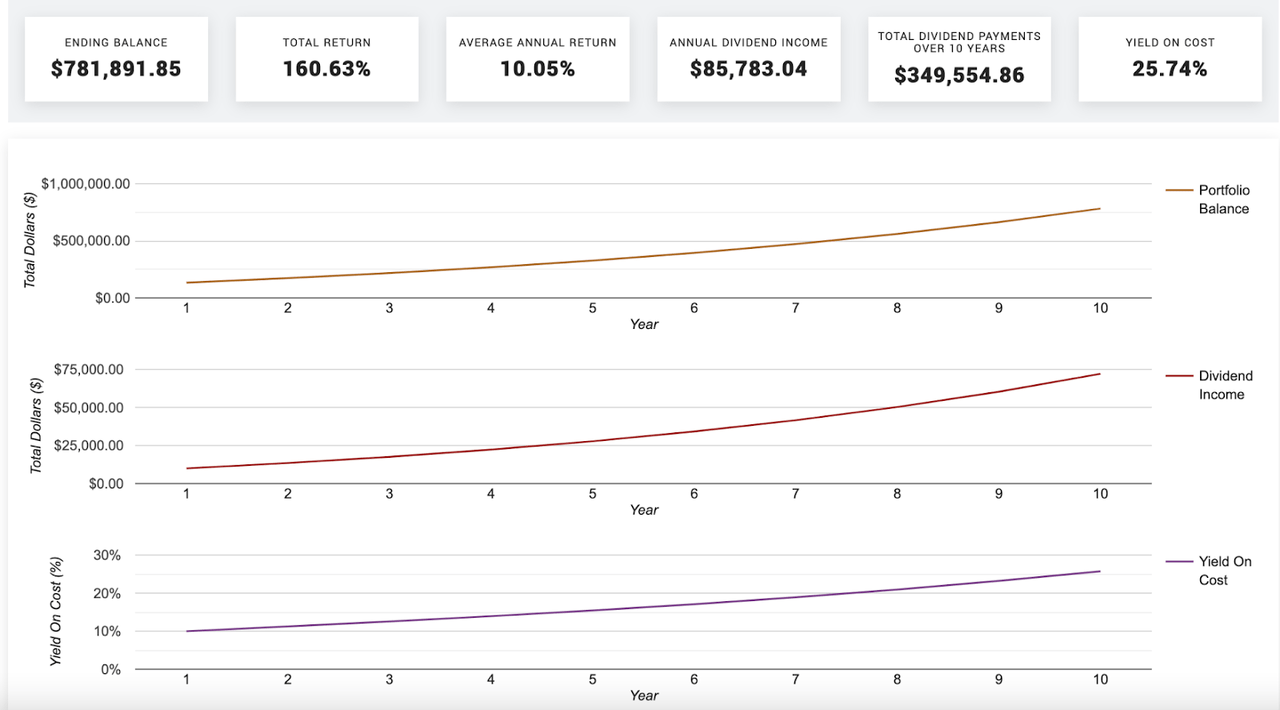

Running these calculations again, I would have to apply a less optimistic outlook. In the following calculations, I have applied a dividend growth of 4%, and an annual stock appreciation of 4%. Once again, we start with an investment of $100,000 and annual contributions of $20,000.

New Dividend forecast (Dividend calculator)

This time, our total ending balance comes out to $781,891, with an average return of 10.05% annually. This would also imply a share price for MO of $59.21.

Overall, I see these as conservative numbers and very much achievable. The bottom line is that even under these harsh assumptions, Altria would still potentially deliver +10% return.

Takeaway

In conclusion, the last couple of years have forced me to become less bullish on Altria, but that doesn’t mean that this is a bad investment by any means.

Following the latest sell-off, the stock offers a compelling dividend yield and margin of safety. The stock is not priced for growth, and while this is a challenging environment, and Altria will have to pivot, there are still plenty of avenues to increase revenues.

The next year will be critical as we will see how the NJOY acquisition pans out.

Read the full article here