Investment Thesis

Advanced Micro Devices, Inc. (NASDAQ:AMD) has positioned itself as a frontrunner in the data center and artificial intelligence (“AI”) markets, showcasing its commitment to delivering tailored computing solutions during the recent AMD Data Center and AI Tech Premiere. With a comprehensive portfolio of CPUs, GPUs, DPUs, and ASICs, AMD has established itself as a major player in the industry, catering to diverse customer requirements and recognizing the need for performance and cost optimization.

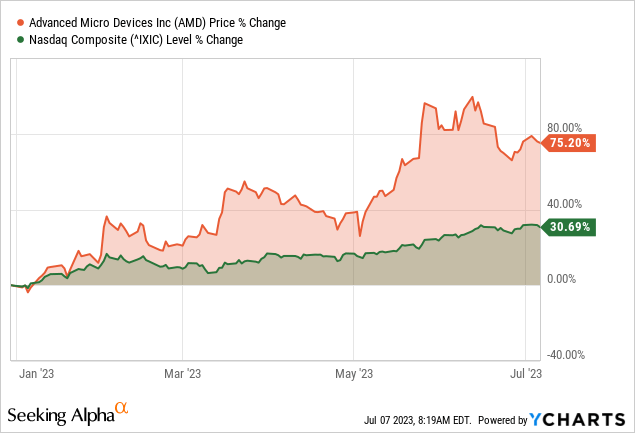

AMD investors have enjoyed strong returns year-to-date, capitalizing on the AI boom. The recent developments and advancements presented at the premiere emphasize AMD’s potential for growth and market leadership in the data center and AI sectors, reaffirming the buy rating for the stock. Even though I booked my AMD profits to rotate gains to new opportunities, AMD remains an attractive long-term investment with a favorable risk/reward profile.

AMD Data Center & AI Tech Premiere

During the recent AMD Data Center and AI Tech Premiere, AMD outlined its long-term vision for the data center and AI markets, providing updates on its product and technology roadmaps and recognizing the increasing complexity of data center computing workloads.

AMD acknowledges that a one-size-fits-all approach is not suitable for meeting customer requirements in terms of performance and total cost of ownership. As a result, the company has built a strong portfolio of data center computing solutions, including CPUs, GPUs, DPUs, and ASICs, to cater to various segments of the data center market, including AI.

Additionally, AMD is focused on executing its server CPU and GPU roadmaps, and with the recent acquisitions of Xilinx (FPGA/adaptive SoCs) and Pensando (DPU), it now possesses a comprehensive range of products suited for different workloads. Lastly, the company aims to address the growing AI accelerator market, projected to be over $30 billion in 2023 and potentially exceed $150 billion in 2027.

MI300X Launched To Capitalize On AI Boom

The event’s most highly anticipated portion was the Instinct MI300 family of products preview. Data Center GPUs present an attractive growth opportunity in the digital semis end market; the story has mostly stayed the same here as the rationale remains that the total addressable market (TAM) is massive and that AMD will get a piece.

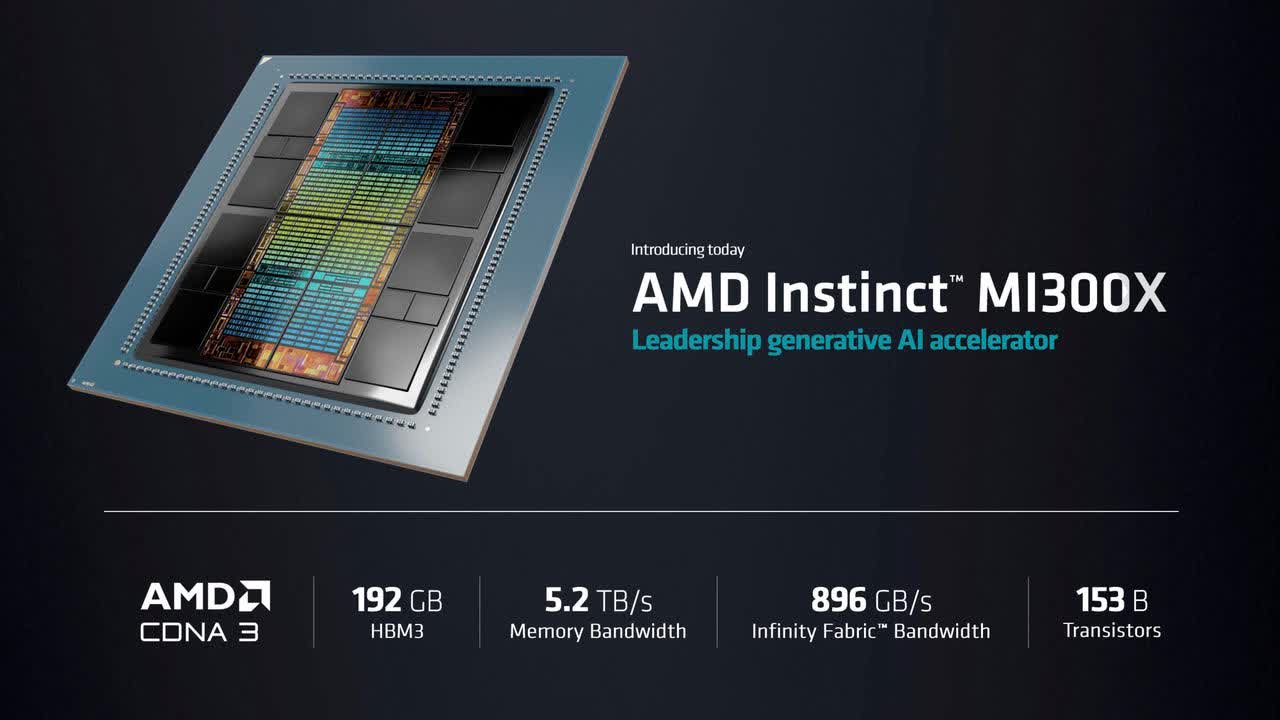

The AMD Premiere was a step in the right direction, launching the MI300X (a GPU-only chip) to compete with Nvidia Corporation’s (NVDA) H100. While yet to be proven in the DC, the MI300X includes 8 GPUs (5nm GPUs with 6nm I/O) with 192GB of HBM3 (vs. NVDA’s 80GB) and 5.2TB/s of memory bandwidth, which should make it a good option for LLMs inference workloads requiring substantial memory. AMD believes this will allow inference workloads to be run using fewer GPUs and, therefore, should improve TCO over the H100.

AMD’s Instinct MI300X GPU

Additionally, through partnerships with PyTorch and HuggingFace, models built to run on NVDA hardware should be relatively easy to get up and running on AMD silicon. However, complete optimization may take more tuning. The MI300X should begin sampling in Q3 and will likely not see meaningful volume until 2024.

Alongside the MI300X, the MI300A APU was also announced (targeting high-performance computing (HPC) workloads) and consisted of 24 CPU cores, a CDNA3 graphics engine, and 128GB of HBM3. This will power the El Capitan supercomputer and likely make up most of the Q4 ramp. I expect AMD to be engaged with multiple hyperscalers on the MI300/ Instinct Platform, with the company highlighting a strong customer interest YTD.

AMD Expands EPYC Server CPU Portfolio

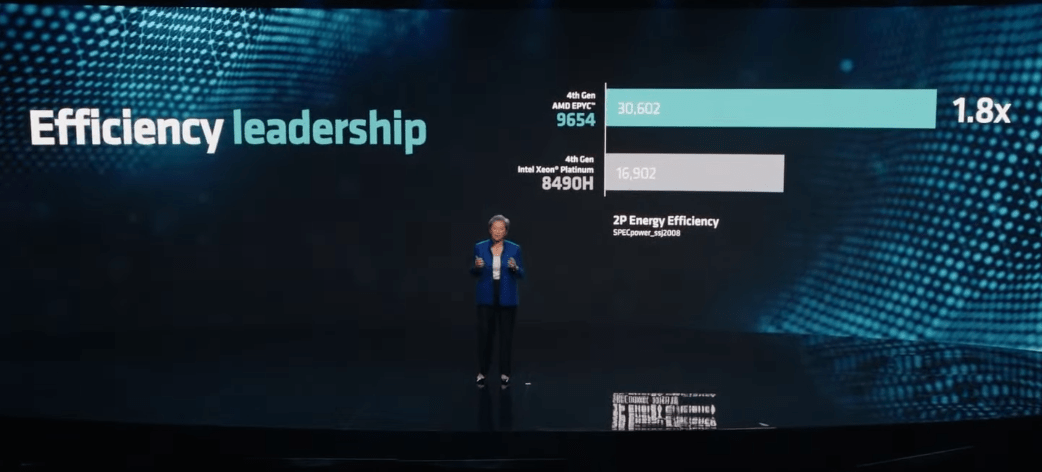

AMD’s outlook for server CPU growth is conservative compared to GPUs, expecting single-digit growth. However, the company believes its Genoa CPU processors outperform competitors in performance and efficiency across most workloads, including AI.

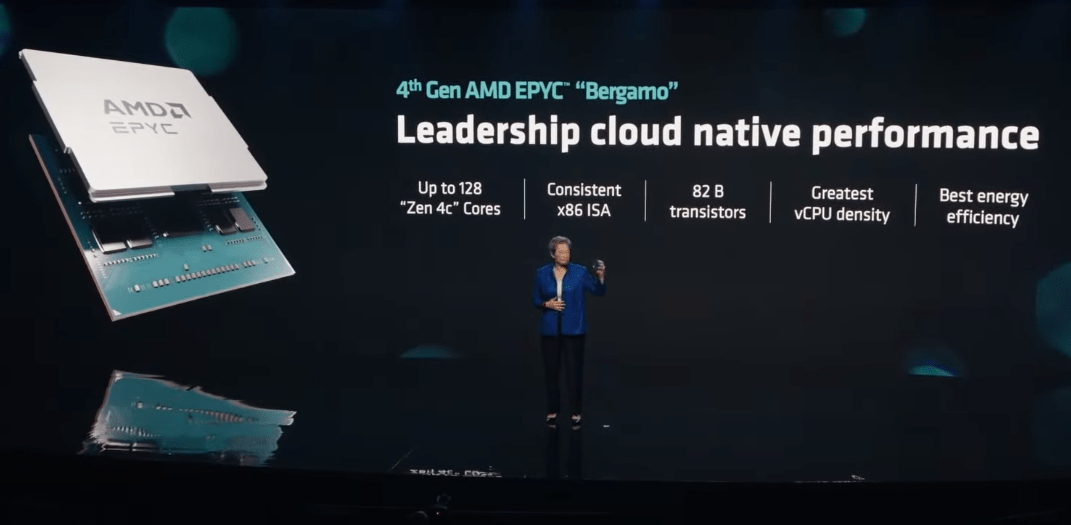

The company claims that Genoa is 1.9 times more efficient than Intel’s Sapphire Rapids CPU for AI tasks. During the event, AMD expanded its EPYC server CPU portfolio by launching the highly anticipated Bergamo EPYC CPUs optimized for cloud environments.

The Bergamo CPUs feature a cloud-optimized design focusing on single-threaded performance and energy efficiency. With the Zen 4c architecture, AMD has doubled the number of cores per Core Complex Die (CCD), going from 8 to 16 cores per CCD compared to Zen 4. The Bergamo CPUs deliver significant performance improvements, offering up to 2.6 times more performance across cloud-native workloads than Intel’s Sapphire Rapids (Xeon Platinum 8490H). They provide over two times better efficiency and can run twice as many containers per server as Intel’s Sapphire Rapids.

Meta Platforms, Inc. (META) has collaborated with AMD to customize the design of the Bergamo server, which will be deployed in their data centers to support web applications such as WhatsApp, Instagram, and Facebook. In order to cater to their specific workloads, Meta had significant input in the design process.

Alexis Black Bjorlin, the vice president of infrastructure at Meta, highlighted the optimizations made by AMD, including dense compute chipsets, favorable core-to-cache ratios, efficient power management, and manufacturing enhancements, all of which enable Meta to maximize server density within a rack. Meta reported seeing 2.5 times greater performance than AMD’s previous generation Milan CPUs and notable improvements in total cost of ownership (TCO).

AMD Bergamo

AMD highlighted that the 128-core Bergamo EPYC CPUs are already being shipped in high volume to hyperscale cloud customers. The Bergamo CPUs offer full software compatibility with previous generations while providing more cores per socket. Compared to the Genoa CPUs, Bergamo includes eight chipsets with 16 cores each, resulting in 128 cores, whereas Genoa has 12 chipsets with eight cores each, totaling 92 cores. The Bergamo CPUs achieve space savings of around 35% and offer two times better performance per watt, especially for Java workloads, resulting in improved TCO for cloud workloads.

In addition to Bergamo, AMD also announced Genoa-X as another workload-optimized alternative to Genoa. Genoa-X utilizes a 3D V-Cache and triple the L3 cache per die, making it faster for general-purpose computing and optimal for technical computing tasks. Microsoft announced the general availability of HBv4 instances using Genoa-X in the Azure cloud. Finally, these HPC instances offer up to 5.7 times performance gains for specific workloads.

Leadership In Data Center Market Driven By Superior Technology

AMD’s EPYC family of server CPUs is gaining market share from Intel thanks to its superior technology and performance. Their upcoming server CPU product, Turin, remains on schedule for a 2024 release and has shown promising initial results. The team maintains a strong leadership in the data center market, leveraging their architecture, design, packaging, IP, and close collaboration with foundry partner TSMC.

The management is confident that their track record of successful execution will continue to drive their leadership in this sector. In the GPU space, AMD is actively investing and focusing on narrowing the software, AI frameworks, and accelerated compute ecosystem development gap. They allocate additional resources to keep up with software deployment and are well-positioned to support customers’ external workloads.

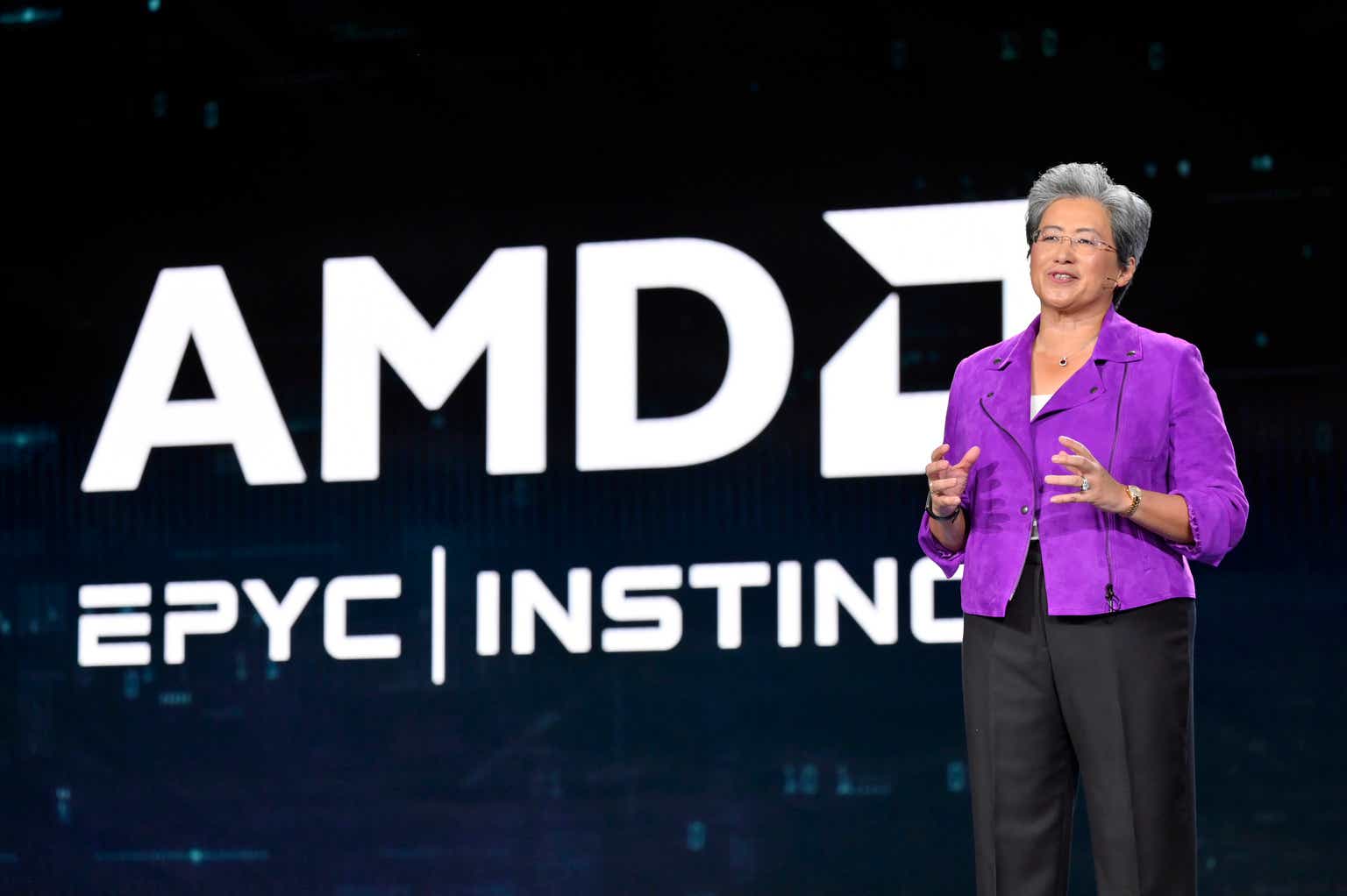

AMD Leadership

Takeaway

AMD’s Data Center and AI Tech Premiere demonstrated its strong position in the data center market, driven by its superior technology and commitment to customer-centric solutions. With a diverse portfolio of computing solutions, AMD aims to address the evolving needs of the data center market, including AI workloads.

The launch of the Instinct MI300X GPU, along with the Bergamo CPUs and other server CPU advancements, underscores AMD’s focus on delivering high-performance, energy-efficient products optimized for specific workloads. Through strategic partnerships and acquisitions, AMD has expanded its capabilities and positioned itself to capitalize on the growing AI accelerator market.

Finally, as the company continues to execute its product and technology roadmaps, AMD remains poised to maintain its leadership in the data center market by delivering superior technology and driving customer success.

Read the full article here