Antero Resources Corporation (NYSE:AR) has performed well since my initial write-up, up nearly 27% since I placed a “Buy” rating on the stock in March versus an 11% gain in the S&P over the same time period. With the Appalachian natural gas E&P reporting its Q3 results, I wanted to catch up on the name.

Q3 Results

For Q3, AR posted revenue of $1.13 billion million, down -45%. That was ahead of the analyst revenue consensus of $1.05 million. Natural gas sales plunged -70% to $516.2 million, while NGL sales sank -22% to $482.6 million. Oil sales slipped -7% to $62.6 million. The company saw a slight $3.4 million hedging gain versus a loss of -$530.5 million a year ago.

AR recorded EPS of 6 cents, which was 4 cents ahead of the analyst consensus.

Net production was 3.5 Bcfe/d, up 3% sequentially and 9% year over year. Natural gas production was up 4% year over year, while ethane production climbed 34%. Other NGL production increased 10%, while oil production rose 147%. Overall liquids production rose 18%.

AR’s average realized price after hedging was $3.30 Mcfe. That was down -46% year over year, but up nearly 14% sequentially.

The company produced operating cash flow of $183.4 million in the quarter, down from $1.09 billion a year ago. Free cash flow was an outflow of -$114.0 million in the quarter, compared to $797.0 million in the prior-year quarter. It spent $242.3 million in drilling and completion capex in the quarter.

AR ended the quarter with $1.61 billion in net debt. Its trailing twelve-month leverage was 1.28x.

AR obviously can’t control the price of natural gas, which rebounded for 1H levels but which was still way below 2022 levels. However, the company did a nice job controlling what it can control, growing production nicely while also lowering most of its costs on a per Mcfe basis.

The company is doing a great job of increasing its completion stages per day, while decreasing its cycle times, which is leading to outpaced production growth. As result, AR was able to increase its production guidance for the second time this year.

Outlook

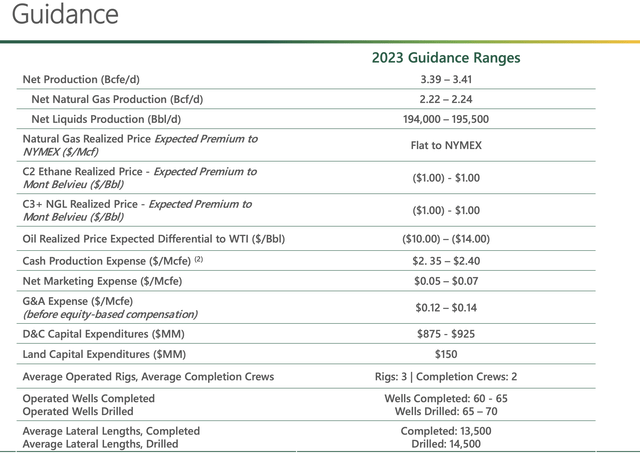

For the full year, AR forecast net production of between 3.39-3.41 Bcfe/d. That’s up from already raised prior guidance of between 3.35-3.4 Bcfe/d and initial guidance of 3.25-3.30 Bcfe/d. It is projecting net liquids production (excluding ethane) of between 114,500-115,000 Bbl/d, up from a previous outlook of 110,000-115,000 Bbl/d and initial guidance of 105,000-110,000 Bbl/d.

It is now looking for ethane production of between 69,000-69,500 Bbl/d, up from an earlier forecast 67,500-72,500 Bbl/d, but down from initial guidance of 70,000-75,000 Bbl/d. Natural gas production is expected to be between 2.22-2.24 Bcf/d, up from its earlier expectation of 2.200-2.225 Bcf/ and an initial projection of 2.10-2.15 Bcf/d. Oil production guidance is for volumes of 10,500-11,000 Bbl/d, compared to 10,500-11,500 Bbl/d previously.

AR is currently operating three rigs and two completion crews. It anticipates drilling 65-70 wells this year and to complete 60-65. That is unchanged versus its previous outlook.

With regard to costs, the company anticipates cash production expenses between $2.35-2.40 Mcfe. That’s down from prior guidance of $2.35-2.40 Mcfe. Yearly drilling and completion capex is projected to be between $875-925 million, with land capex of $150 million, unchanged versus previous expectations. AR also reduced its maintenance capex expectations, which it expects to be between $650-700 million. Maintenance capex is how much it would need to spend to hold production flat.

Company Presentation

AR noted that active rigs are down -21% since the start of 2023. Last quarter it said rigs were down -15%, so the decline only continued despite better energy prices.

On the call SVP of Gas Marketing & Transportation Justin Fowler said:

“We have seen the Appalachia plus Haynesville rig count decline by approximately 50 drilling rigs since the beginning of this year. This compares to the similar rig decline that we experienced back in 2019. It took over 6 months to materialize; however, U.S. natural gas production ultimately declined by as much as 10%. Further, it took almost 2 years to get back to the 2019 highs. Today, we are just about 6 months out from when rigs began to drop in a meaningful and sustained way. An important distinction this time around, however, is that over 70% of the rig declines this cycle have come from the higher decline in Haynesville Basin. A sharp contrast to 2019 when the majority of rig drops came from the lower decline in the Appalachian Basin. In summary, we believe the sharp decline in rigs and completion crews will curb production growth in 2024, helping to balance the U.S. natural gas market. As a reminder, we sell substantially all of our natural gas out of basin, including approximately 75% to the LNG corridor.”

Natural gas prices have seen a big rebound in price over the past month, a more importantly, as I noted in a recent article on Black Stone Minerals, L.P. (BSM) natural gas future prices are much higher today than just a few months ago. Natural gas demand only continues to rise, and now production has come down to help balance the market, leading to stronger prices. As followers of mine know, I’ve been a big natural gas bull this year based on the thesis that prices would rise as the market balances itself out, and this looks to be at the start of this happening.

As for AR, the company just continues to perform with great execution leading to better more productive wells. The company, meanwhile, has great transportation contracts locked that allow it to sell all of its production out of basin at premium prices. With natural gas prices on the rise and the company getting premium pricing, the setup looks good for 2024.

Valuation

AR trades at 11.8x EBITDA based on 2023 analyst estimates of $1.18 billion. Based on the 2024 consensus of $1.91 billion, the stock trades at a 7.3x multiple.

As a reminder, the company also owns a 29% stake in “Buy” rated Antero Midstream Corporation (AM), which is valued at $1.8 billion.

AR trades at a premium to fellow Appalachian E&Ps, with Range Resources Corporation (RRC) trading at 6.9x 2024 EBITDA and EQT Corporation (EQT) at 5.3x. AR, however, owns AM and has more liquids exposure. Strip out its stake in in AM, and AR trades at 6.5x 2024 EBITDA, but it gets better realized pricing due to its firm transport; it has more liquids production, which is more valuable; and it has some of the lowest cost breakevens in the space.

The price of natural gas and NGLs can impact AR’s actual results greatly, and thus its valuation metrics. As such, to be bullish on AR, you need to be bullish on natural gas prices as well. I value the stock around $35 based on current estimates, which is a 7x 2024 multiple plus its AM stake.

Risks

The biggest risk to the stock is lower natural gas and NGL prices. Its hedging is fairly minimal, so natural gas and NGL prices will be the biggest driver of its results.

Natural gas prices could be driven lower by weak demand from the macro environment, or a warm winter. El Nino is likely to lead to some unpredictable weather this winter, so this is a risk to the thesis to watch. NGL prices are starting to be more impacted by the export market, so international demand can have an impact.

Conclusion

I remain bullish on natural gas over the medium term, and think AR should be a strong beneficiary of increased natural gas and NGL prices. Being able to drill either dry gas or wet gas based on prices is a huge differentiator, and the company has smartly locked up firm transportation to important LNG export markets, allowing it to get premium pricing.

Natural gas demand is only increasing, and as more LNG facilities are built and expanded, the more natural gas the U.S. can export to markets that have high prices. At the same time, China continues to increase PDH (propylene) capacity and needs increased amounts of LPG (which contains NGLs), which benefits the liquids-rich AR.

Given all the positives in the market and its strong continued execution, I continue to rate AR a “Buy” despite the stock’s strong performance this year.

Read the full article here